- 10 OCTOBER 2023 · RESEARCH BULLETIN NO. 111

The outlook is mixed: the asymmetric effects of weather shocks on inflation

Climate change has implications for price stability and the work of central banks. For instance, it may increase the volatility and heterogeneity of inflation, and hotter summers may lead to more frequent and persistent upward pressures on food and services inflation. Our empirical study provides evidence for the four largest euro area economies and outlines the relationship between temperature and inflation.

What does climate change mean for price stability?

Climate change is increasingly affecting the economy. The global mean temperature has climbed to more than 1.1°C above pre-industrial levels. Extreme weather events have become more widespread and more severe around the world, and adverse impacts have been observed across economies. For example, there is increasing evidence that higher temperatures have a negative impact on economic output, through reduced agricultural output, lower labour productivity, increased energy demand, detrimental impacts on human health and disruption of supply chains (Auffhammer and Mansur, 2014; Auffhammer and Schlenker, 2014; Dell et al., 2012, 2014; among numerous others).

Many central banks have acknowledged the need to understand the macroeconomic consequences of climate change. Yet when it comes to the implications for price stability, the literature is still scarce. The existing evidence establishes a link between weather shocks and the level and volatility of inflation. As a changing climate is accompanied by an increasing frequency and severity of extreme weather, this evidence implies that climate change is also becoming increasingly relevant for the price stability mandate of central banks (Parker, 2018; Faccia et al., 2021a, 2021b; Mukherjee and Ouattara, 2021; Natoli, 2022; Kotz et al., 2023). Similar to the effects of weather shocks on economic output, the effects on inflation are likely non-linear – i.e. the impact of weather shocks is likely compounded by other factors. For example, Faccia et al. (2021a) find evidence that when shocks occur in summer, extreme temperatures have long-lasting effects on inflation. In Ciccarelli et al. (2023), we provide further evidence on the relationship between weather shocks and inflation in the euro area, focusing on the impacts of higher monthly mean temperatures.

How hotter summers affect inflation in euro area countries

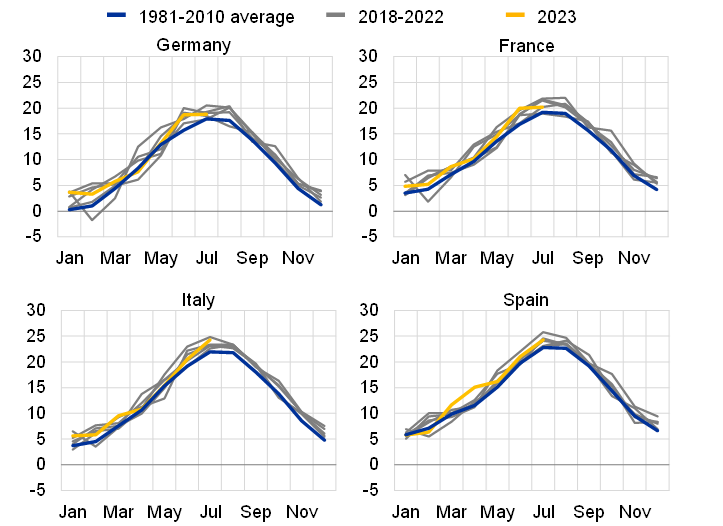

We analyse the impact of temperature shocks on inflation, assessing (i) the four largest euro area economies; (ii) the main inflation aggregates; and (iii) differences across seasons of the year. The temperature shocks are defined as the deviation of monthly mean temperatures from their historical average (as recorded over the period 1981-2010).[2] Notably, the data reveal that in recent years temperatures have often increased above the historical average (Chart 1).

Chart 1

Monthly temperatures in the four largest euro area economies

(Degrees Celsius)

Source: Own calculations based on the ERA5 reanalysis dataset, provided by the Copernicus Climate Change Service.

Notes: The grey lines show the temperature in the individual years between 2018 and 2022. We define a weather shock based on the difference between the grey lines and the blue line (the historical average), for each country. Country averages are calculated as averages across all datapoints within a country, thereby masking variations between different parts of the country.

We set up a Bayesian Vector Autoregression (BVAR) for each of the four largest euro area economies, with weather shocks as exogenous variables. In addition, the effect of the shocks in the model depends on the season of the year, thereby capturing one potential non-linearity in the relationship between temperature and inflation.

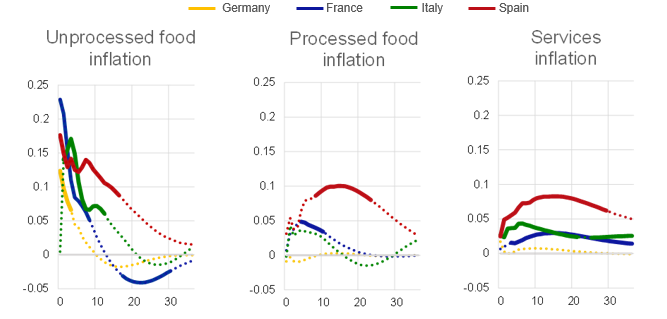

We find that when the shock occurs in the summer, temperature increases lead to significant upward impacts on unprocessed food inflation in all four economies. When the monthly mean temperature increases by 1°C, unprocessed food inflation rises by around 0.1-0.2 percentage points within the first year after the shock hits (Chart 2). The effects are larger and more persistent in France, Italy, and Spain than in Germany. Potential channels for these impacts include decreases in agricultural productivity, labour productivity and the supply of fresh food. The response to a shock that occurs in winter or spring is less significant and can conversely lead to a fall in inflation, though the effect is usually less persistent than when the shock occurs in summer. Higher summer temperatures also result in an increase in processed food inflation in France and Spain, though with some lag. This may reflect a delayed pass-through of a rise in food commodity prices to processed food prices.

Chart 2

Responses of different inflation aggregates to an increase in summer temperatures

(x-axis: months after the shock; y-axis: percentage points)

Notes: The panels show the responses of year-on-year inflation rates up to three years after a 1°C deviation of the monthly mean temperature from its historical average for the period 1981-2010. The continuous segments of the lines represent a significant response based on the 68% credibility bands. The dotted segments represent non-significant responses.

Hotter summers also have implications for core inflation (i.e. headline inflation excluding the food and energy components). We find a persistent upward response of services inflation to an increase in summer temperatures (Chart 2), but the response is smaller than for unprocessed food inflation. The increase in services inflation might be due to a change in food (commodity) prices, which, in turn, affects the prices of food services (e.g. restaurants, cafes, canteens and fast food). The tourism and recreation services sectors could be similarly vulnerable to temperature shocks, since they are labour-intensive sectors and it is well-documented in the literature that when temperatures exceed a critical threshold, there are negative effects on labour supply and productivity (Dasgupta et al., 2021).

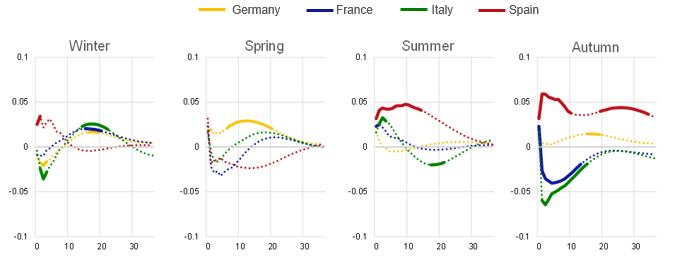

How euro area headline inflation responds to temperature shocks in individual countries

In line with the response of disaggregated inflation rates, we observe asymmetric and heterogeneous changes in euro area headline inflation as a result of weather shocks in individual countries. In summer, inflation consistently responds to temperature shocks by rising in the first few months after the shock, and the response is significant when the shocks occur in Italy and Spain (Chart 3). However, euro area headline inflation may conversely decrease when temperature shocks materialise in other seasons of the year, depending on where and when the shock occurs.

Chart 3

Response of euro area headline inflation to country-specific temperature shocks

(x-axis: months after the shock; y-axis: percentage points)

Notes: The panels show the responses of euro area headline year-on-year inflation up to three years after a 1°C deviation of the monthly mean temperature from its historical average for the period 1981-2010 in different countries. The colours represents the country where the shock occurs. The continuous segments of the lines represent a significant response based on the 68% credibility bands. The dotted segments represent non-significant responses.

Conclusions

Our findings have implications for price stability and the work of central banks: as climate change brings more frequent and more severe weather shocks, the volatility and heterogeneity of inflation may increase and hotter summers may result in more frequent and persistent upward pressures on inflation. An increase in inflation volatility is supported by our findings of asymmetric and heterogeneous responses of inflation rates across the euro area to temperature shocks. As climate change progresses, such effects are expected to happen more often in the future. More heterogeneous developments across countries could result from the non-linearities in the relationship between temperature and inflation that are documented in our work. Persistent upward pressures on inflation from hotter summers are in line with our findings on the inflationary impacts of temperature shocks in summer consistently across countries and inflation components. With very hot summers set to become more frequent and more severe, stronger inflationary impacts may be expected in the future.

Our work also opens avenues for future research. These include the impact of other types of extreme weather events (e.g. droughts, torrential rain and floods), the analysis of more granular consumer prices, as well as producer and import prices, the impact of non-euro area weather shocks on euro area inflation, spillovers of weather shocks between countries, a changing response to shocks while the climate changes and while adapting to it, and the interaction of weather shocks with other shocks to the economy. This interaction of shocks is likely to be especially important in an environment of large global shocks, where an extreme weather event – or a series of such events – may amplify existing vulnerabilities.

References

Auffhammer, M. and Mansur, E.T. (2014), “Measuring climatic impacts on energy consumption: A review of the empirical literature”, Energy Economics, Vol. 46.

Auffhammer, M. and Schlenker, W. (2014), “Empirical studies on agricultural impacts and adaptation”, Energy Economics, Vol. 46.

Ciccarelli, M., Kuik, F. and Martínez Hernández, C. (2023), “The asymmetric effects of weather shocks on euro area inflation”, Working Paper Series, No 2798, ECB, March.

Dasgupta, S., van Maanen, N., Gosling, S. N., Piontek, F., Otto, C. and Schleussner, C.-F. (2021), “Effects of climate change on combined labour productivity and supply: an empirical, multi-model study”, The Lancet Planetary Health, Vol. 5(7).

Dell, M., Jones, B.F. and Olken, B.A. (2012), “Temperature shocks and economic growth: Evidence from the last half century”, American Economic Journal: Macroeconomics, Vol. 4(3).

Dell, M., Jones, B.F. and Olken, B.A. (2014), “What Do We Learn from the Weather? The New Climate-Economy Literature”, Journal of Economic Literature, Vol. 52(3).

Faccia, D., Parker, M. and Stracca, L. (2021a), “Feeling the heat: extreme temperatures and price stability”, Working Paper Series, No 2626, ECB, December.

Faccia, D., Parker, M., & Stracca, L. (2021b). What we know about climate change and inflation. VoxEU. Org.

IPCC (2023), AR6 Synthesis Report: Climate Change 2023.

Kotz, M., Kuik, F., Lis, E. and Nickel. C. (2023), “The impact of global warming on inflation: averages, seasonality and extremes”, Working Paper Series, No 2821, ECB, May.

Mukherjee, K. and Ouattara, B. (2021), “Climate and monetary policy: do temperature shocks lead to inflationary pressures?”, Climatic Change, Vol. 167(3).

Natoli, F. (2022), “Temperature surprise shocks”, MPRA Paper, No 112568.

Parker, M. (2018), “The impact of disasters on inflation”, Economics of Disasters and Climate Change, Vol. 2(1).

Vidal-Quadras Costa, I., Kuik, F. and Osbat, C. (forthcoming), “Forecasting food inflation with climate and commodities data using a nonlinear model”, Working Paper Series, ECB.

The article was written by Matteo Ciccarelli (Head of Division, Directorate General Economics, Forecasting and Policy Modelling Division), Friderike Kuik (Economist, Directorate General Economics, Prices and Costs Division) and Catalina Martínez Hernández (Economist, Directorate General Economics, Prices and Costs Division). It is based on the paper entitled “The asymmetric effects of weather shocks on euro area inflation”, by the same authors, which is published in the ECB Working Paper Series. The authors would like to thank Sarah Holton for her comments. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The construction of different weather and climate indicators used in the paper is described in a forthcoming ECB Working Paper by Vidal-Quadras Costa et al.