- STATISTICAL RELEASE

Euro area securities issues statistics: October 2020

10 December 2020

- The annual growth rate of the outstanding amount of debt securities issued by euro area residents increased from 8.0% in September 2020 to 8.3% in October

- For the outstanding amount of listed shares issued by euro area residents, the annual growth rate increased from 0.6% in September 2020 to 1.0% in October

Debt securities

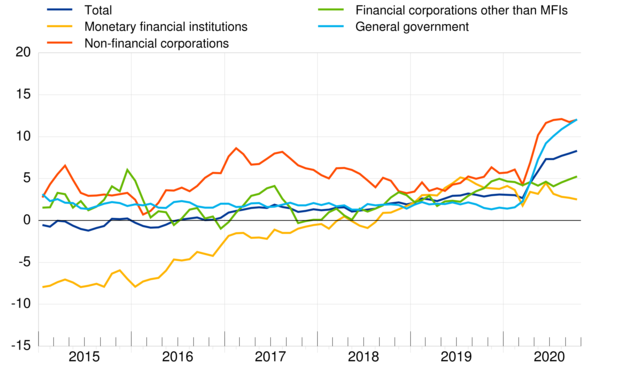

New issuance of debt securities by euro area residents totalled EUR 677.5 billion in October 2020. Redemptions amounted to EUR 690.9 billion and net redemptions to EUR 13.4 billion. The annual growth rate of outstanding debt securities issued by euro area residents increased from 8.0% in September 2020 to 8.3% in October.

Data for debt securitiesChart 1

Debt securities issued by euro area residents

(annual growth rates)

Breakdown by maturity

The annual growth rate of outstanding short-term debt securities increased from 20.1% in September 2020 to 20.7% in October. For long-term debt securities, the annual growth rate increased from 6.9% in September 2020 to 7.3% in October. The annual growth rate of outstanding fixed rate long-term debt securities increased from 7.6% in September 2020 to 8.0% in October. The annual rate of change of outstanding variable rate long-term debt securities decreased from 0.3% in September 2020 to -0.1% in October.

Data for breakdown by maturityBreakdown by sector

As regards the sectoral breakdown, the annual growth rate of outstanding debt securities issued by non-financial corporations increased from 11.7% in September 2020 to 12.0% in October. For the monetary financial institutions (MFIs) sector, this growth rate was 2.5% in October 2020, compared with 2.7% in September. The annual growth rate of outstanding debt securities issued by financial corporations other than MFIs increased from 4.9% in September 2020 to 5.2% in October. For the general government, this growth rate increased from 11.5% in September 2020 to 12.1% in October.

The annual rate of change of outstanding short-term debt securities issued by MFIs was -11.4% in October 2020, compared with -12.6% in September. The annual growth rate of outstanding long-term debt securities issued by MFIs decreased from 5.1% in September 2020 to 4.6% in October.

Data for breakdown by sectorBreakdown by currency

Concerning the currency breakdown, the annual growth rate of outstanding euro-denominated debt securities was 9.6% in October 2020, compared with 9.4% in September. For debt securities in other currencies, this rate of change increased from -0.2% in September 2020 to 0.6% in October.

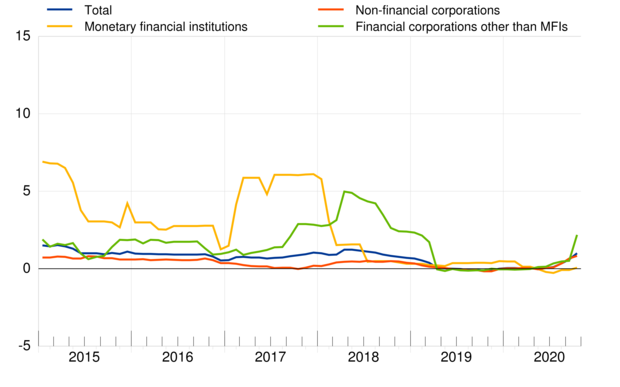

Data for breakdown by currencyListed shares

New issuance of listed shares by euro area residents totalled EUR 29.9 billion in October 2020. Redemptions amounted to EUR 0.5 billion and net issues to EUR 29.4 billion. The annual growth rate of the outstanding amount of listed shares issued by euro area residents (excluding valuation changes) increased from 0.6% in September 2020 to 1.0% in October. The annual growth rate of listed shares issued by non-financial corporations was 0.8% in October 2020, compared with 0.7% in September. For MFIs, the corresponding rate of change was 0.1% in October 2020, compared with -0.1% in September. For financial corporations other than MFIs, this growth rate increased from 0.5% in September 2020 to 2.2% in October.

Chart 2

Listed shares issued by euro area residents

(annual growth rates)

The market value of the outstanding amount of listed shares issued by euro area residents totalled EUR 7,230.6 billion at the end of October 2020. Compared with EUR 8,257.8 billion at the end of October 2019, this represents an annual decrease of -12.4% in the value of the stock of listed shares in October 2020, down from -7.9% in September.

Data for listed shares

For queries, please use the Statistical information request form.

Notes:

- Unless otherwise indicated, data relate to non-seasonally adjusted statistics. In addition to the developments for October 2020, this statistical release incorporates minor revisions to the data for previous periods. The annual growth rates are based on financial transactions that occur when an institutional unit incurs or redeems liabilities, they are not affected by the impact of any other changes which do not arise from transactions.

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex tables are a snapshot of the data as at the time of the current release.

- The next statistical release on euro area securities issues will be published on 13 January 2021.

- 10 December 2020

- 10 December 2020