Background

Introduction

The European Central Bank (ECB), with the support of the European System of Central Bank’s (ESCB’s) Statistics Committee, compiles and publishes the balance of payments (b.o.p.) and the international investment position (i.i.p.) of the euro area. These statistics depict the economic relations of the euro area as a whole vis-à-vis the rest of the world and provide important indicators of economic performance. The euro area is therefore considered as a single economic area. The ESCB analyses the euro area b.o.p. and i.i.p. in the context of its tasks, particularly monetary policy, macroprudential analysis and reserve assets management. The individual European Union (EU) Member States’ b.o.p. and i.i.p. statistics also provide crucial indicators of economic performance. These are closely monitored by, for example, the International Monetary Fund (IMF) in Article IV reports, the European Systemic Risk Board (ESRB) in the Risk Dashboard and in the context of the European Commission’s macroeconomic imbalances procedure (MIP).

The euro area b.o.p. and i.i.p. are in general compiled by summing up the individual b.o.p. and i.i.p. statistics of each euro area country vis-à-vis non-euro area countries (with some exceptions, as explained in the compilation methods of the euro area in each chapter). Cross-border transactions/positions of euro area countries vis-à-vis each other are therefore excluded. This publication, commonly referred to as the “B.o.p. and i.i.p. e-book”, aims to provide users with an overview of the main features of the b.o.p. and i.i.p. methodological framework and of the data sources and compilation methods used in the euro area and in the individual EU Member States.

The structure of the e-book is as follows: The background sets out the general principles and definitions of the b.o.p. and i.i.p. statistics from a euro area point of view, followed by a description of the ECB requirements for compiling euro area aggregates and. relevant information on the institutional framework, data availability and dissemination policy and tools for each EU country.

Chapters 1 to 11 describe the main methodological aspects for each b.o.p. and i.i.p. item, drawing on the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6), the worldwide reference for the compilation of b.o.p. and i.i.p. statistics. This latest edition was revised in parallel with the System of National Accounts 2008[1] (2008 SNA) to ensure consistency between external and domestic macroeconomic statistics. Each chapter provides the common methodology, sources and compilation methods, with a particular focus on the special conventions of the euro area. The national country data and their contributions to the euro area external statistics are legally defined in the ECB Guideline (ECB/2011/23)[2] of 9 December 2011 on the statistical reporting requirements of the ECB in the field of external statistics.[3] The chapters also highlight specificities and potential deviations from agreed international statistical standards as well as borderline classification cases that EU countries observed when compiling b.o.p. and i.i.p. data.

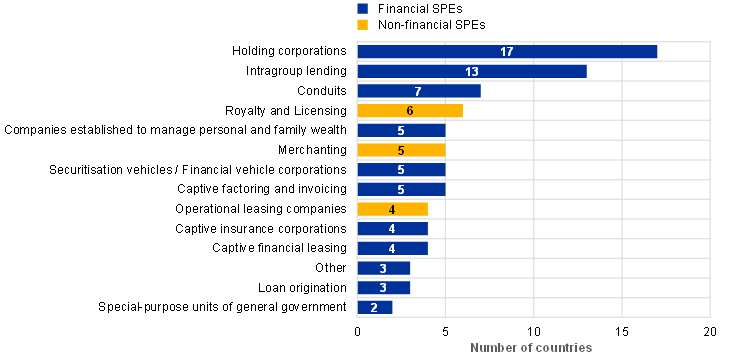

The last chapter describes the special conventions agreed by the Working Group on External Statistics (WG ES) on the operational implementation of the definition of special-purpose entities (SPEs) to facilitate the identification and classification of SPEs in the EU.

General principles of balance of payments and international investment position statistics

Balance of payments

The balance of payments is a statistical statement of the economic transactions between residents and non-residents in an economy over a specific period of time. A transaction is an interaction between two institutional units which occurs by mutual agreement or through the operation of the law and involves an exchange of economic value or a transfer thereof.

Despite its name, which refers to standards applied in the past in accordance with the recommendations of the IMF Manuals up to the fourth edition, the b.o.p. is now less concerned with payments, as that term is generally understood, than with transactions. In fact, international transactions recorded in the b.o.p. may not involve the transfer of money, and some are not paid for in any sense: “change in ownership” is the relevant concept for recording transactions. This development from a financial towards an economic approach was deemed more appropriate to (i) foster a sound economic interpretation of the figures, and (ii) make the b.o.p. concepts compliant with national accounts (the b.o.p. corresponds to the “rest of the world” account).

The b.o.p. is organised in three main accounts:

- current account;

- capital account;

- financial account.

The current account shows transactions in goods, services and income between residents and non-residents. The capital account shows transactions in non-produced, non-financial assets, and capital transfers between residents and non-residents. The financial account shows net acquisitions of financial assets and net incurrences of liabilities between residents and non-residents. The financial account is organised in five functional categories:

- direct investment;

- portfolio investment;

- financial derivatives;

- other investment;

- reserve assets.

The current and capital accounts record gross transactions (or commonly denominated “flows”); the inward flows are classified as credits, whereas the outward flows are classified as debits. By contrast, the financial account records transactions in net terms, separately for each financial asset and liability (i.e. it reflects net changes arising from all credit and debit entries during the accounting period). The net acquisition of financial assets records all acquisitions minus disposals of assets, whereas the net incurrence of liabilities records all incurrences minus redemptions of liabilities.

The sum of the current and capital accounts’ balances corresponds to the net lending (surplus) or net borrowing (deficit) of an economy vis-à-vis the rest of the world. The same concept can be derived from the financial account as the net acquisition of financial assets minus the net incurrence of liabilities. Differences between these two alternative measures of net lending/net borrowing are commonly identified as b.o.p. “net errors and omissions”.

International investment position

The international investment position is a statistical statement that shows, at a specific point in time, the value of the stocks of residents’ financial assets that are non-contingent claims on non-residents in that economy or gold bullion held as reserve assets, and of the non-contingent liabilities of the residents to non-residents in that economy. As with the b.o.p. financial account, financial assets and liabilities are grouped into the same five functional categories (see above).

The difference between the financial assets and liabilities is the net i.i.p. It represents either a net claim on or a net liability to non-residents. Changes in the i.i.p. between consecutive periods can be due to transactions, as recorded in the b.o.p. financial account during that period, or to “other flows” (see below).

Associated with the i.i.p. is the concept of gross external debt, which is the outstanding amount of current, rather than contingent, liabilities that require payment(s) of principal and/or interest by the debtor at some point(s) in the future and that are owed to non-residents by residents of an economy.[4] A net external debt concept can also be derived by subtracting gross external assets in the form of debt instruments from the gross external debt concept. In practice, the concept of “debt” corresponds to debt securities, currency, deposits, loans, insurance technical reserves, trade credits and advances and other accounts receivable/payable.

Reconciliation of positions and flows

Changes in positions between consecutive points in time are explained by the following flows during that period:

- transactions in the b.o.p. financial account;

- revaluations due to changes in the euro exchange rate vis-à-vis the currencies in which the assets/liabilities are denominated;

- revaluation due to price changes of the assets/liabilities;

- other changes in the volume of assets and liabilities (such as reclassifications or write-offs).

The greater the level of detail of the basic information on both stocks and flows – namely currency breakdown, applicable market prices (especially for portfolio investment) and the timing of the transaction (using the price and exchange rate for that date) – the more precise the reconciliation of consecutive positions will be.

For equity shares of unlisted companies, the transactions recorded in the b.o.p. financial account may differ from the change in the own funds at book value (OFBV) recorded in the i.i.p. Such differences are recorded as revaluations due to price changes.

For non-negotiable instruments, namely loans, deposits and other accounts receivable/payable, financial account transactions, which are valued at market prices, will differ from the change in the nominal values recorded in the i.i.p. Such differences are recorded as other price changes during the period in which the transaction occurs.

Other changes in the volume of assets and liabilities are recorded when new assets that were not in the beginning-of-period balance sheet appear in the end-of-period balance sheet, or when existing assets that were in the beginning-of-period balance sheet disappear from the end-of-period balance sheet, and these appearances/disappearances are not the result of transactions and/or revaluations. These include write-offs of claims by creditors, statistical reclassifications (of instruments, sectors, country of residency, etc.), and monetisation and demonetisation of gold bullion.

When writing off financial instruments that are valued at nominal values, the value recorded in the other changes in volume should correspond to their nominal value prior to being written off. For reclassifications (e.g. a sector reclassification), the values of both the new and the old instruments should be in general identical.

The main accounting principles for transactions and positions

Quadruple-entry system

The accounting system for national and international accounts relies on quadruple-entry bookkeeping, which results from the simultaneous application of both vertical and horizontal double-entry bookkeeping.

Vertical double-entry bookkeeping implies that each transaction is recorded with two entries in the books of the respective unit, one credit and one debit. In the current and capital accounts, a credit corresponds to exports, primary income receivable, transfers receivable, or disposals of non-produced, non-financial assets; a debit corresponds to imports, primary income payable, transfers payable, or acquisitions of non-produced, non-financial assets. In the financial account, transactions are recorded separately for assets and liabilities on a net basis, i.e. all credits minus all debits during the accounting period, and are therefore classified as net acquisition of financial assets and net incurrence of liabilities respectively. This means that, in principle, the total for all credit entries is equal to the total for all debit entries, which allows the “vertical” consistency of the accounts for a single resident unit to be checked.

Horizontal double-entry bookkeeping ensures recoding consistency between resident units and their (non-resident) counterparts. For example, an export recorded by a resident unit should be recorded as an import by a non-resident unit. This is useful for compiling accounts that consistently reflect the mutual economic relationships between different institutional units.

The quadruple-entry system deals in a coherent manner with multiple transactors or groups of transactors, each of which practises vertical double-entry bookkeeping. A single transaction between two counterparties thus gives rise to four entries, as a liability of one unit is mirrored by a financial asset of another unit.

Although the total of all the credit entries and all the debit entries should, in principle, be equal, imbalances occur in practice due to imperfections in source data and compilation systems. This imbalance is known as “net errors and omissions”. A positive value for net errors and omissions indicates that the total value of debits is higher than the total value of credits recorded in the current and capital accounts of the b.o.p., and/or the value of net increases in assets in the financial account is too high, and/or the value of net increases in liabilities in the financial account is too low. Negative net errors and omissions indicate the opposite.

Following a careful review of the euro area net errors and omissions, the ECB introduced an updated statistical methodology for the correction of these errors and omissions in 2020. The current balancing mechanism is applied jointly to the euro area b.o.p. and the “rest of the world” sector in euro area accounts (EAA) statistics, and it considers a comprehensive information set, comprising the various EAA building blocks as well as “unadjusted” euro area b.o.p. data, which primarily consist of the national contributions to the euro area aggregate. The adjustment mechanism aims to keep absolute net errors and omissions in the euro area b.o.p. and “vertical discrepancies” in EAA statistics below a threshold which is currently set at €30 billion, broadly corresponding to 1% of euro area quarterly GDP.

Time of recording of transactions

In line with the BPM6, the ECB requires, as a general principle, that flows be recorded on an accrual basis, meaning that flows are recorded when economic value is created, transformed, exchanged, transferred or extinguished. Flows that imply a change of economic ownership are recorded when ownership passes, and services are recorded when provided.

However, it is not mandatory to report the monthly b.o.p. on a full accrual basis, due to the short time frame for the collection and reporting of monthly data. In agreement with the ECB, national central banks (NCBs) and other national compilers may provide monthly b.o.p. statistics that are partially based on other recording principles, such as cash basis (flows are recorded when the respective payment/receipt occurs). However, national compilers are invited to review these data once quarterly data are available on a full accrual basis.

Geographical allocation principle for change of ownership

In order to achieve a more precise geographical allocation from a risk analysis perspective, the BPM6 requires the application of the debtor/creditor principle. This principle is also fundamental for ensuring bilateral symmetry in the transmission of country contributions to euro area aggregates. According to this principle, transactions/positions in a country’s financial assets are assigned to the country that incurs the liability (the debtor) and transactions/positions in a country’s financial liabilities are assigned to the country of residence of the creditor.

Aggregation and netting

Aggregations or combinations in which all elementary items are shown for their full values are called gross recordings (e.g. all interest credits are aggregated separately from all interest debits). The international accounts show the gross recording in their current and capital accounts.

The international accounts show the net recording in their financial account and other respective changes, meaning aggregations or combinations that show net changes (increases minus reductions) in a particular financial asset or liability. In general, the net recording of flows in financial assets and liabilities is recommended in the international accounts from both an analytical and a pragmatic perspective. Net acquisition of external financial assets and net incurrence of external liabilities are generally of more analytical interest than gross flows. Moreover, gross reporting of data may not be possible for different classes of units and for some financial instruments. Furthermore, net transactions in some financial assets and liabilities often have to be derived from balance sheet data because gross transactions are not available.

Euro area residency

In general, the term resident means having one’s centre of predominant economic interest in the economic territory of a country.

For the euro area, the economic territory comprises (i) the economic territory of those EU Member States whose currency is the euro (the euro area countries); and (ii) the ECB, the European Stability Mechanism (ESM) and the European Financial Stability Facility (EFSF), which are regarded as resident units of the euro area. The b.o.p. of the euro area is therefore the statistical statement of the economic transactions between residents in the euro area (seen as one economic territory) and residents outside the euro area. Similarly, the i.i.p. of the euro area is the statistical statement of the positions in financial assets and liabilities of the residents in the euro area vis-à-vis residents outside the euro area.

The rest of the world (RoW) comprises all third countries and international organisations, including those physically located within the euro area (except the ECB, ESM and EFSF). Consequently, all transactions of euro area countries vis-à-vis EU institutions are classified as vis-à-vis non-euro area residents and hence included in the euro area b.o.p. and i.i.p. statistics.

Some territories belonging to, or associated with, euro area countries might give rise to difficulties in the statistical classification. These can be divided into the following groups:

Territories which are part of the euro area:

- Helgoland: Germany;

- Canary Islands, Ceuta and Melilla, Balearic Islands: Spain;

- Monaco, French overseas departments (French Guiana, Guadeloupe, Martinique, Réunion, Mayotte), Saint Pierre and Miquelon, Saint Barthélemy, Saint Martin: France;

- Madeira, the Azores: Portugal;

- the Åland Islands: Finland.

Territories associated with euro area countries which are to be included in the RoW:

- Büsingen: not Germany;

- Andorra: neither Spain nor France;

- Aruba, Bonaire, Sint Eustatius and Saba, Curaçao, Sint Maarten: not the Netherlands;

- French overseas territories (French Polynesia, New Caledonia, and Wallis and Futuna): not France;

- San Marino, Vatican City: not Italy.

A centre of economic interest exists when a unit engages and intends to continue engaging, either indefinitely or over a finite but long period of time, in economic activities and transactions on a significant scale in or from a location, dwelling, place of production or other premises within a territory. For practical reasons, actual or intended location for one year or more is used as an operational threshold. However, the following are examples of borderline cases in the determination of residency.

- Students who go abroad to study full-time generally continue to be resident in the territory in which they were resident prior to studying abroad. This treatment is adopted even though their course of study may exceed a year.

- Patients who go abroad for medical treatment maintain their predominant centre of interest in the territory in which they were resident before they received the treatment, even if the treatment lasts one year or more.

- Crews of ships, aircraft, oil rigs, space stations or other similar equipment which operate outside a territory or across several territories are treated as being resident in their home country.

- National diplomats, peacekeeping and other military personnel, and other civil servants employed abroad in government enclaves, as well as members of their households, are considered to be residents of the economic territory of the employing government.

- Staff of international organisations, including those with diplomatic status and military personnel, are resident in the territory of their principal dwelling.

- Border workers, seasonal workers and other short-term workers who cross borders for a short period to undertake a job are considered residents in the economic territory in which they maintain a dwelling used by members of the household as their principal dwelling.

When undertaking international transactions in land and/or buildings (e.g. holiday homes), property owners are treated as if they have transferred their ownership to a notional institutional unit resident in the country where the property is located. The notional unit is treated as being owned and controlled by the non-resident owner.

A legal entity is resident in the economic territory under whose laws the entity is incorporated or registered. This applies also to legal entities with little or no physical presence, e.g. investment funds (as distinct from their managers), securitisation vehicles, and some SPEs. If the entity is not incorporated, it is considered to be resident in the country whose legal system governs the creation and continued existence of the entity.

Subsidiaries are separate institutional units with independent legal status, either wholly owned or with majority ownership held by another entity (the parent institution). Branches are entities without independent legal status (they are wholly owned by the parent). However, when branches are located in a country other than the one in which the company controlling them is located, they are deemed to be separate institutional units.

Allocation to institutional sectors

The sector breakdowns of the euro area b.o.p. and i.i.p. are consistent with the European System of Accounts (ESA) 2010. Monthly b.o.p. data are required using the following sector breakdown of the resident units:

- central banks;

- other monetary financial institutions (MFIs):

- deposit-taking corporations except the central bank;

- money market funds.

- general government;

- other sectors.

For the quarterly b.o.p. and i.i.p. data, the ECB requests that the “other sectors” category be further broken down into:

- non-money market investment funds;

- insurance corporations and pension funds;

- other financial institutions;

- non-financial corporations;

- households and non-profit institutions serving households (NPISHs).

The central banks sector of the euro area b.o.p. and i.i.p. consists of the Eurosystem, i.e. the ECB and the NCBs of euro area countries.

The other MFIs sector identified in the euro area b.o.p. and i.i.p. coincides with the other MFIs sector for money and banking statistics, i.e. it comprises deposit-taking corporations except the central bank and money market funds, as defined in Regulation (EU) No 1071/2013[5] of the ECB of 24 September 2013 concerning the balance sheet of the monetary financial institutions sector (ECB/2013/33).

The ECB maintains a list of MFIs based on information provided regularly by all members of the ESCB, which can be downloaded from the ECB’s website.

Transactions and positions in external financial assets are assigned to the institutional sector to which the resident creditor (owner of the asset) belongs. Transactions and positions in external financial liabilities are assigned to the institutional sector to which the resident issuer of the liability belongs.

With regard to other investment flows and stocks, the following should also be noted.

- Government-guaranteed and/or bank-insured trade credits should be treated as private operations rather than as government or bank lending and should therefore be included under “other sectors”. In these cases, the debtors have incurred liabilities but have not as yet failed to discharge them; liability for such loans would not be transferred to the government or bank that guaranteed them until the loan recipient defaulted in payment. Guarantees and financial intermediation in which the intermediary is not in fact the legal creditor or debtor should not be taken into account in statistical reporting (see also standardised guarantee changes in Chapter 3.10.1).

- Loans and deposits connected to repo-type agreements must be classified under the institutional sector to which the resident that extends or receives the financing belongs, regardless of the nature of the issuer of the securities acting as collateral. The residence of the borrower and lender is the decisive factor, not the residence of the issuer of the collateral.

In addition to classifying transactions and positions in financial assets/liabilities by sector of the resident creditor/debtor, the ECB requires euro area countries to classify quarterly flows and positions in portfolio investment assets by the sector of the counterpart issuer. The same principles of sector classification apply.

Compilation of euro area balance of payments and international investment position statistics

Statistical reporting requirements for national compilers

In the field of b.o.p. and i.i.p. statistics, the ECB requires that NCBs report data on international transactions and international reserve assets (including revaluations) at monthly frequency. Reports on more detailed international transactions, on international positions and on respective revaluations are due on a quarterly basis.

From a euro area perspective, international transactions encompass all transactions that create or redeem, in full or in part, claims or debts, or any transaction that implies the transfer of a right over an object between residents of a euro area country or institution and non-residents of the euro area. International positions are the stocks of financial assets and liabilities of euro area residents towards non-residents of the euro area.

Revaluations are (realised and unrealised) holding gains and losses on international positions arising from changes in the exchange rate and/or in asset prices.

Monthly requirements

Monthly b.o.p.

The ECB requires NCBs to provide, on a monthly basis, a selection of the main items of the b.o.p., as well as data on the revaluations of euro area reserve assets. These data are made available to the ECB within 44 calendar days of the end of the month to which they relate. The collection of data from reporting agents is organised by the national authorities, who take this deadline into account, thereby striking a balance between accuracy and the reporting burden. Owing to the nature of the data and to this short reporting period, it is therefore common practice to use time series modelling or indirect estimation methods in the compilation of some components of the monthly b.o.p.[6]

The aim of the monthly b.o.p. is to provide an overall picture of major developments quickly enough to be of use for monetary policy decisions. This is notably reflected in the monetary presentation of the b.o.p., which is aimed at linking developments in euro area broad money (M3) with the cross-border transactions of non-MFIs resident in the euro area.

As shown in the table below, transactions in the net external assets of the MFIs sector can be presented as the mirror image of non-MFIs’ b.o.p. transactions with non-euro area residents.

Monetary presentation of the euro area balance of payments |

+ Current account |

+ Capital account |

+ Balance of financial transactions by the non-MFIs sector (assets minus liabilities) |

+ Errors and omissions |

= Balance of payments of the non-MFIs sector |

= Balance of payments of the MFIs sector |

= Transactions in the net external assets of the MFIs sector |

Hence, changes in the monetary aggregate M3 can be presented as the arithmetic result of changes in its counterparts, namely (i) credit to euro area residents, (ii) net external assets of euro area MFIs, (iii) long-term financial liabilities, and (iv) other counterparts (residual).

Template on international reserve assets and foreign currency liquidity

The ECB requires NCBs to report monthly data to compile the stock of international reserves held by the Eurosystem (the ECB and the NCBs of the euro area countries). The reserve assets of the Eurosystem are the financial assets held and effectively controlled by the ECB and the euro area NCBs, which are issued by residents outside the euro area and denominated in currencies other than the euro. This definition, approved by the ECB’s Governing Council in March 1999, conforms to the BPM6 (Appendix 3 on regional arrangements, paragraph A3.29).

In addition to the BPM6 standard components, (i) the foreign currency-denominated claims (i.e. claims denominated in any currency other than the euro) not included under official reserve assets, mainly claims on euro area residents held by the Eurosystem; and (ii) the predetermined net drains are shown as memorandum items in the ECB’s Statistics Bulletin. The purpose of this approach is to support an analysis for monetary purposes as well as to permit the reconciliation of the Eurosystem’s international reserves with its foreign currency liquidity position.

In addition to the information provided in the ECB’s Statistics Bulletin, the ECB publishes Eurosystem and ECB data on its website in line with the Template on International Reserves and Foreign Currency Liquidity, set out in early 2000 in the context of the IMF’s Special Data Dissemination Standard (SDDS). This information covers not only data on reserve assets included in the euro area b.o.p. and i.i.p., but also data on other foreign currency assets not included as official reserve assets and the reserve-related liabilities of the Eurosystem.[7]

Quarterly requirements

The quarterly requirements are the ECB’s main statistical product in the field of b.o.p. and i.i.p. statistics. With the introduction of the BPM6, these requirements are comprehensive and detailed, covering to a large extent the standard components of the b.o.p. and i.i.p., as specified in Annex 9 of the BPM6.

The ECB requires quarterly data on b.o.p., i.i.p., and revaluations to be reported within 82 calendar days after the end of the reference quarter.

In terms of breakdowns, the structure of the i.i.p. is broadly equivalent to the structure of the b.o.p. financial account.

A detailed geographical breakdown of the euro area b.o.p. and i.i.p. is available for some items vis-à-vis main partner countries, such as non-euro area EU countries, Canada, China, Japan, Norway, the Russian Federation, Saudi Arabia, Switzerland, the United Kingdom and the United States, and counterpart groupings (namely offshore financial centres, EU institutions and other international organisations).

A detailed currency of denomination breakdown (euro, US dollar, Japanese yen and other currencies) is reported for some items of the i.i.p.

The ECB’s contribution to the euro area aggregates

The ECB’s own transactions and positions vis-à-vis non-euro area counterparts are also reflected in the external statistics of the euro area.

In practice, the ECB’s main contributions to the euro area b.o.p. and i.i.p. are related to the following items.

- Reserve assets: reserve assets of the ECB are claims on non-residents of the euro area pooled in accordance with Article 30 of the Statute of the ESCB and thus under the direct and effective control of the ECB. As long as no further transfer of ownership takes place, in accordance with Article 30.4, external assets retained by the NCBs are under their direct and effective control and are treated as reserve assets of each individual NCB.

- Other investment: transactions between the ECB and the NCBs of EU Member States not participating in the euro area related to the operation of the T2 system; repo transactions with non-residents of the euro area in euro or in foreign currency (the latter only refers to liabilities, because reverse repos are included in reserve assets); non-euro area participations in the ECB’s capital; deposits taken from other NCBs outside the euro area.

- Portfolio investment: debt securities denominated in euro and issued by non-residents of the euro area (the ECB’s holdings of debt securities denominated in foreign currency, which were issued by non-euro area residents, are included in the ECB’s reserve assets).

- Income on portfolio investment, other investment and reserve assets: income received (paid) by the ECB from (on) the above-mentioned investment assets (liabilities).

- Financial derivatives: transactions and positions in financial derivatives, e.g. from foreign exchange interventions or foreign currency providing liquidity programs.

Professional independence

The independence of national central banks in their capacity as members of the European System of Central Banks (ESCB) is reflected in national law in accordance with Article 130 of the EU Treaty and Article 7 of the Statute of the ESCB and of the ECB, which stipulates that “when exercising the powers and carrying out the tasks and duties conferred upon them…, neither the ECB, nor a national central bank, nor any member of their decision-making bodies shall seek or take instructions from Community institutions or bodies, from any government of a Member State or from any other body. The Community institutions and bodies and the governments of the Member States undertake to respect this principle and not to seek to influence the members of the decision-making bodies of the ECB or of the national central banks in the performance of their tasks.”

The following table summarises the relationship between each country’s public bodies and their respective national central bank (NCB) and national statistical institute (NSI). When available to the public, the relevant statistical work programme is also included.

Specific features

Professional independence | Statistical work programme | |

|---|---|---|

EA | See Article 130 of the EU Treaty and Article 7 of the Statute of the ESCB and of the ECB. | See “Work programmes” on the ECB’s website. |

BE | The independence of the Nationale Bank van België/Banque Nationale de Belgique with regard to the Belgian State is guaranteed in the Law of 22 February concerning the Nationale Bank van België/Banque Nationale de Belgique. This independence comprises several aspects, namely institutional independence (no instructions in the execution of its tasks), operational independence (principal objective of price stability), personal independence (protection against dismissal and minimum term of directors) and financial independence. The Belgian Statistics Act of 22 March 2006 establishes the professional independence of Statistics Belgium. | The statistical work programme of the Nationale Bank van België/Banque Nationale de Belgique has not been made public. |

BG | The national statistical system (NSS) of Bulgaria carries out activities related to collecting, processing, analysing and storing/archiving statistical data, as well as to the provision and dissemination of official statistics. The NSS consists of the NSI, bodies of statistics and Българска народна банка (Bulgarian National Bank). The professional independence of the NSS from political and external interference in developing, producing and disseminating official statistics is guaranteed by the Statistics Act. The Bulgarian National Bank is financially independent and maintains the necessary resources to meet its statistical obligations. | In accordance with the Statistics Act, National Statistical Programme and strategy for the development of the National Statistical Programme of the Republic of Bulgaria 2021-2027, a five-year work programme is coordinated and implemented by the National Statistical Council. The Council is a consultative body consisting of representatives of the NSI, bodies of statistics, the Bulgarian National Bank, academic society and various groups of respondents and users. The Bulgarian National Bank has an annual statistical work programme, which has not been made public. In the respective chapter on statistics, the central bank’s semi-annual and annual reports contain information on progress made. |

CZ | Article 9 (“Relationship to the government and to other bodies”) of Act No 6/1993 Coll. on Česká národní banka (as amended) states that, when exercising its powers and carrying out its tasks, the central bank is not to “seek or take instructions from the President of the Republic, from Parliament, from the Government, from administrative authorities of the Czech Republic, from the bodies, institutions or other entities of the European Union, from governments of Member States of the European Union or from any other body”. The independence of the NSI is based on Act No 89/1995 Sb on the State Statistical Service. | Česká národní banka has both annual and medium-term statistical work programmes, which are not available to the public. Nevertheless, essential statistical activities are described in the central bank’s Annual Report in the chapter dedicated to statistics. |

DK | The Act on Danmarks Statistik, Section 2, states that Danmarks Statistik is an independent institution. Danmarks Nationalbank is an independent institution, pursuant to the National Bank of Denmark Act, Sections 3-6, and By-laws of the Nationalbank of Denmark (see Articles 23 and 25). | The statistical work programme is available only as an internal central bank document. The focus of Danmarks Nationalbank in 2023 is the consolidation of a new IT system that was implemented in autumn 2022, as well as new data for the money market (daily basis) and preparations for its main revision in 2024. |

DE | Article 12 of the Deutsche Bundesbank Act states that “in exercising [its] powers …, the Deutsche Bundesbank shall be independent of and not subject to instructions from the Federal Government. As far as is possible without prejudice to its tasks as part of the European System of Central Banks, it shall support the general economic policy of the Federal Government”. The neutrality, objectivity and professional independence of all federal statistics are established in paragraph 1 of the Act on Statistics for Federal Purposes. | The Deutsche Bundesbank has a statistical work programme, which has not been made public. In 2017 the federal statistical office published plans outlining its strategy and work programme for a five-year period up to 2021. |

EE | According to Section 8(3) of the Official Statistics Act, “the producers of official statistics [Statistics Estonia and Eesti Pank] shall be independent in their choice of statistical methodology”. Upon performance of its duties, “Statistics Estonia shall be professionally independent within the meaning of Regulation (EC) No 223/2009 of the European Parliament and of the Council”, as stated in Section 9(3) of the Act. | Eesti Pank develops annual statistical programmes pursuant to the Official Statistics Act (Chapter 3). The list of statistical actions conducted by Eesti Pank is established for five years by Governor’s decree. The list of statistical activities to be performed by Statistics Estonia is to be approved by order of the Government of the Republic. |

IE | The independence of the Central Bank of Ireland is provided for by its founding law and established pursuant to Part II of the Central Bank Act 1942. Article 13 of the Statistics Act states that the Director General of the Central Statistics Office (CSO) “shall have the sole responsibility for and be independent in the exercise of the functions of deciding – (a) the statistical methodology and professional statistical standards used by the Office; (b) the content of statistical releases and publications issued by the Office; and (c) the timing and methods of dissemination of statistics compiled by the Office”. See also: Statistics Act, 1993 | The Central Bank of Ireland does not publish the statistical work programme. The annual statistical work programme represents a list of statistical products created and disseminated by the CSO. Annual reports have been compiled since 2016 |

GR | In performing its tasks, the Bank of Greece enjoys institutional, personal and operational independence and is accountable to the Greek parliament. The regime that governs the operation of the Bank of Greece is laid down in its statute. Section VIII of the Statute of the Bank of Greece (as amended) on the relations with the State specifies the ways by which the Central Bank’s independence is ensured. | The statistical work programme of the Bank of Greece has not been made public. The Hellenic Statistical Authority (ELSTAT) does not play an active role in compiling and disseminating b.o.p statistics. |

ES | The activity of the Banco de España is regulated by its Law of Autonomy (Law No 13/1994). Article 1 (on the nature and specific provisions of the Bank and its legal status) establishes that the central bank “shall pursue its activities and fulfil its objectives with autonomy from the administration”, while Article 25 (on the renewal and dismissal of governing bodies) also aims at reinforcing the institution’s autonomy. | There is an internal multi-annual statistical work programme at the Banco de España which closely follows the workflows established in the ESCB work programmes. The Banco de España’s Institutional Report devotes a section to its activity in economic analysis, research and statistics, which includes reports on its statistical function, as well as focusing on new plans and progress made on existing projects. The National Statistics Plan is drawn up every four years, approved by Royal Decree and published in the Official State Gazette. The latest National Statistics Plan for 2021-2024 is available in Spanish. |

FR | The independence of the Banque de France in exercising its powers is guaranteed by French law (Code monétaire et financier) in Article L141-1 (only in French), which states that, in carrying out the missions it performs on account of its participation in the ESCB, the Banque de France may neither solicit nor accept instructions from the Government or from any person. | The annual statistical work programme of the Banque de France is communicated to the Conseil national de l’information statistique (PARIS, le 28 février 2006 – n°30/D130), the national institutional body that ensures dialogue between users and producers of public statistics, examines new projects and monitors the quality of existing surveys and data collections. |

HR | Professional independence of Hrvatska narodna banka is guaranteed by Article 2 of the Act on the Croatian National Bank, in which Hrvatska narodna banka establishes its independence in achieving its objective and carrying out its tasks, as well as ensuring the absence of interference with respect to the compilation and dissemination of statistical information. | The annual statistical work programme is coordinated between the Croatian Bureau of Statistics and Hrvatska narodna banka and published in the Official Gazette (only in Croatian). |

IT | Article 1 of Banca d’Italia’s Statute states that, in performing its functions, the central bank “shall act autonomously and independently in observance of the principle of transparency and shall not seek or accept instructions from other public or private-sector entities”. The independence of national central banks in their capacity as members of the ESCB is further emphasised in Article 130 of the EU Treaty and Article 7 of the Statute of the ESCB and of the ECB. The independence, as well as ethical and professional principles, of the Italian national institute of statistics is stated in Article 3(3) of its Statute. | The Banca d’Italia has a statistical work programme for internal use, with stated objectives, timing and responsibilities which is approved by a high-level internal committee and which has not been made public. The Italian National Institute of Statistics has a work programme, which has been made public. |

CY | The Central Bank of Cyprus is governed by the Central Bank of Cyprus Laws 2002-2017. It ensures the independence of the central bank. When carrying out all of the tasks required to achieve its objectives, neither the central bank nor any member of its decision-making bodies is to seek, or take instructions from, the Community institutions or bodies, from the Government, from any government of an EU Member State or from any other body (Section 7 of the Central Bank of Cyprus Laws). Activities of the Statistical Service of Cyprus (CYSTAT) are regulated by the Official Statistics Law of 2021, which provides the legal basis for the development, production and dissemination of official statistics in Cyprus. | The Central Bank of Cyprus has an internal statistical work programme, which has not been made public. CYSTAT, in accordance with the provisions of Article 8 of the Official Statistics Law of 2021 (Law No 25(I)/2021), prepares a multi-annual programme of activities, which includes surveys or other work to be carried out during the reporting period. Moreover, an annual programme of statistical activities has been prepared, which includes surveys or other work mentioned in the multi-annual programme and which is carried out during the corresponding year. In the context of adopting European best practices, CYSTAT additionally evaluates the degree of implementation of the programme of statistical surveys and activities and prepares an annual evaluation report. |

LV | Professional independence, as well as the tasks of collecting, processing and disseminating statistics, is prescribed in the Law on Latvijas Banka, adopted on 23 September 2021, and in the legal acts of the European Union. | Latvijas Banka has a statistical work programme. |

LT | The independence of Lietuvos bankas is emphasised in Article 3 of the Law on the Bank of Lithuania, which states that the “Government of the Republic of Lithuania and State institutions must respect the independence of the Bank of Lithuania and must not seek to influence the Bank of Lithuania and its staff in discharge of their duties”. The activities of Statistics Lithuania are regulated by the Law on Official Statistics (in Lithuanian only), which refers to the principle of independence, consolidates the general principles of the organisation thereof and stipulates the rights and duties of respondents, as well as defines the tasks, rights and duties of institutions managing official statistics and their liability for breaching the law. | All statistical works carried out by Lietuvos bankas, Statistics Lithuania and other national authorities are reflected in the official statistics work programme, a compilation of which is coordinated by the statistical office and made public on its webpage (in Lithuanian only). |

LU | The Law of 10 July 2011 on the organisation of the National Institute for Statistics and Economic Studies (STATEC) specifies in Article 11 that, in carrying out its remit, “STATEC is endowed with scientific and professional independence”. The Banque centrale du Luxembourg is currently governed by its Organic Law of 23 December 1998 (as amended). | The Committee on Public Statistics (established by the Minister of Economic Affairs) coordinates the statistical programmes and monitors their progress. STATEC’s statistical activity report is published online (available only in French). The Banque centrale du Luxembourg’s annual reports include a chapter on the activity of the Banque centrale du Luxembourg’s statistics department. |

HU | The independence of the Magyar Nemzeti Bank in exercising its powers is guaranteed by Hungarian law. The independence of the NSI is established by Act CLV of 2016 on Official Statistics (available only in Hungarian). | The central bank has a statistical work programme, which is not made public. The NSI has an annual national statistical data collection programme, which includes formal cooperation agreements with various institutions such as the NCB (only in Hungarian). |

MT | The independence of the Central Bank of Malta is laid down in the Central Bank of Malta Act (Chapter 204), Part 2, Article 5(2). The Malta Statistics Authority (MSA) Act (XXIV), provides the NSO with autonomy and professional independence in carrying out its statistical functions. Article 10 of the MSA Act states that the NSO is to supply, and make accessible to the public, the methods used for the production of statistics and the principles under which these statistics are compiled. | The statistical work programme of the NSO has not been made public. |

NL | With respect to the tasks to be carried out through the ESCB, the independence of De Nederlandsche Bank is laid down in Section 3 of the Bank Act 1998. Accordingly, when De Nederlandsche Bank assists the ECB in collecting data within the scope of Article 5 of the Statute of the ESCB, it is operating in a professionally independent manner. The Statistics Netherlands Act constitutes the legal basis for Statistics Netherlands (CBS). Statistics Netherlands is governed by a director general, who in this role determines the statistical methods to be used, as well as methods of dissemination (Statistics Netherlands Act, Article 18). | The statistical work programme of De Nederlandsche Bank has not been made public. |

AT | Citing Article 14(3) of the Statute of the ESCB and of the ECB, Article 1, Section 2(5) of the 1984 Nationalbankgesetz (Central Bank Act) establishes the independence of the Oesterreichische Nationalbank from other government authorities in exercising certain powers, thereby guaranteeing, among other things, absence of interference in compiling statistical information. The Bundesstatistikgesetz establishes the objectivity and impartiality of Statistics Austria in producing statistics. | The statistical work programme of the Oesterreichische Nationalbank has not been made public. The work programme of Statistics Austria is available only in German. |

PL | Narodowy Bank Polski’s tasks and independence are stipulated in Article 227 of the Constitution of the Republic of Poland and in Article 18 of the Act on Narodowy Bank Polski of 29 August 1997. Articles 1 and 25a of the Law of 29 June 1995 on Official Statistics set forth the independence of Statistics Poland. | The “Narodowy Bank Polski Plan of Activity for 2023-2025” specifies important statistical activities of Narodowy Bank Polski. |

PT | The Banco de Portugal is governed by its Organic Law, which states in Article 27 that “the Governor and the other members of the Board of Directors shall be independent”. The Law for the National Statistical System (Law No 22/2008 of 13 May 2008) states in Article 5 that “official statistics shall be produced with technical independence”, i.e. the Statistical Office is to have “the sole responsibility for defining statistical methods, standards and procedures, as well as the content, type and timing of data releases”, “without prejudice to compliance with the rules laid down by the National Statistical System or the European Statistical System”. | The Banco de Portugal has a statistical work programme, which is published on its website (available only in Portuguese). Statistics Portugal also publishes on its website annual work programmes and activity reports. |

RO | Article 3 (“Co-operation with other authorities”), paragraph (1) of Law No 312/28.06.2004 on the Statute of the National Bank of Romania establishes that “when carrying out their tasks, Banca Naţională a României and the members of its decision-making bodies shall not seek or take instructions from public authorities or from any other institution or authority”. Article 6 of Law No 226/2009 (only in Romanian) stipulates that Banca Naţională a României is an independent producer of official statistics, and Article 5(a) establishes the independence of the national institute of statistics. | Banca Naţională a României has a statistical work programme, which has not been made public. Statistical work conducted jointly with the NSI (mainly involving surveys) is outlined in the multi-annual national statistical programme_2022-2024 (in Romanian only), which includes the NSI’s work programme. |

SI | The independence of Banka Slovenije in exercising its powers is guaranteed by Article 2 of the Bank of Slovenia Act, Official Gazette of the Republic of Slovenia, No 72/06 (official consolidated version), which states that “Banka Slovenije and members of its decision-making bodies shall be independent, and in performing the tasks pursuant to this Act shall not be bound by any decisions, positions or instructions issued by the State or any other authorities, nor shall they seek any instructions or guidelines from them”. The statistical office of Slovenia operates as a professionally independent government office, as set forth in Article 11 of the National Statistics Act, Official Gazette of the Republic of Slovenia, Nos 45/95 and 9/01. | Medium-term and annual statistical work programmes are available on the statistical office’s website (annual programme in Slovenian only). Essential statistical activities are also described in the central bank’s Annual Report in the chapter on statistics. |

SK | The independence of Národná banka Slovenska is guaranteed both in Article 12 (on the relationship with the government) of the National Bank of Slovakia Act, No 566/1992 (as amended), which states that “Národná banka Slovenska shall fulfil its tasks independently of instructions from state authorities, self-government bodies, any other public bodies and from legal entities and natural persons” and in Article 56 of the Constitution of the Slovak Republic: “The National Bank of Slovakia is the independent central bank of the Slovak Republic. As part of its scope of authority, the National Bank of Slovakia may issue generally binding legislation, where empowered to do so by law”. | The statistical work programme for Národná banka Slovenska has not been made public. |

FI | The independence of Statistics Finland is laid down in the Statistics Act, Section 2. According to that section, “statistical authorities and other authorities that compile statistics are professionally independent when performing tasks directly connected to developing, producing and disseminating statistics”. The independence of Suomen Pankki – Finlands Bank is laid down in the Act on the Bank of Finland, Section 1, according to which the “Bank of Finland is the central bank of Finland. It is an independent institution governed by public law.” | The strategy document and performance agreement between the Ministry of Finance and Statistics Finland stipulate the objectives, projects and resources for the planning period. Suomen Pankki – Finlands Bank lists its tasks and strategic priorities on its website. |

SE | The independence of Statistics Sweden from political and other external interference in collecting, producing and disseminating official statistics is guaranteed by law. See Chapter 1(9). The Instrument of Government, Chapter 9, Article 13, establishes that Sveriges Riksbank is an independent central bank under the Riksdag. | The annual statistical work programme of Statistics Sweden is found on the latter’s website. |

Mandate for data collection and compilation

The development, production and dissemination of statistics by each country’s national central bank (NCB) are governed by Article 5 of the Statute of the ESCB and of the ECB, as well as Regulation (EC) No 2533/98, whereas the national statistical institutes (NSIs) is governed by the statistical principles laid down in Article 2 of Regulation (EC) No 223/2009. Furthermore, each NCB (as member of the ESCB) conducts quality assurance and disseminates statistics in conformity with the principles of the ESCB’s Public Commitment on European statistics.

The members of the ESCB and the European Statistical System (ESS) cooperate closely to maximise synergies, minimise the reporting burden and ensure the production of complete and coherent European statistics. The two statistical pillars also cooperate closely through the Committee on Monetary, Financial and Balance of Payments Statistics (CMFB), as well as through the European Statistical Forum. The CMFB, composed of senior representatives of NCBs, NSIs, the ECB and the European Commission (Eurostat), was set up by the Council of the European Union in 1991 and provides a platform to support operational cooperation between the two statistical pillars, particularly in statistical areas, such as the production of national accounts and balance of payment statistics, for which they share responsibility.

The following table summarises the national legal frameworks as well as the institutional cooperation that enable each country to compile and disseminate b.o.p. and i.i.p. statistics in the European Union (EU) context.

Legal framework | Institutional cooperation | |

|---|---|---|

EA | The production of European statistics is organised around two separate pillars, the ESCB and the ESS, each with separate legal frameworks and governance structures. The ESCB is a system enshrined in the Treaty on the Functioning of the European Union (TFEU). It is composed of the ECB and NCBs, and the ECB’s Governing Council is its highest decision-making body. The ECB, assisted by the NCBs, collects either from the competent national authorities or directly from economic agents the statistics necessary to undertake the ESCB’s tasks, including safeguarding monetary policy and ensuring financial stability. B.o.p. and i.i.p. statistics are included in those statistics. More specifically, Article 2 of Council Regulation (EC) No 2533/98 empowers the ECB to collect information from legal and natural persons residing in a Member State to the extent that they hold cross-border positions or have carried out cross-border transactions relevant for producing balance of payments statistics. The statistical requirements of the ECB in the fields of external statistics (b.o.p. and i.i.p.), international reserves template and cross-border shipments of euro banknotes) are defined in Guideline ECB/2011/23 of 9 December 2011 (as amended). Recommendation ECB/2011/24 of 9 December 2011 (as amended) complements Guideline ECB/2011/23 by addressing other competent national authorities that are entrusted with the collection and/or compilation of external statistics in their respective countries. | Close collaboration between the European Commission and the ECB in the field of statistics is not only a Treaty obligation but is also key to ensuring that the quality of European statistics serves EU objectives and policies, such as the single monetary policy or Macroeconomic Imbalance Procedure (MIP). Since the indicators used for the MIP are provided by Eurostat using statistics compiled in Member States (either by NSIs or NCBs), close cooperation is necessary to ensure the highest quality standards for producing accurate and reliable statistics underlying these indicators. To this end, the ECB Governing Council has agreed to a Memorandum of Understanding (MoU) that mutually recognises the respective quality assurance standards for European statistics and lays down working arrangements and procedures to ensure the quality of European statistics underlying the MIP indicators. The provisions of the MoU cover the b.o.p. and i.i.p. statistics which support the MIP. |

BE | Until December 2001, the Belgian-Luxembourg Exchange Institute was in charge of collecting data from the Belgian-Luxembourg Economic Union (BLEU) based on the intergovernmental agreement dated 23 November 1998 between Belgium and Luxembourg. The Nationale Bank van België/Banque Nationale de Belgique was responsible for compiling the BLEU b.o.p. and i.i.p. statistics covering data until 2001 and has been responsible for data collection, compilation and dissemination of Belgium’s b.o.p. and i.i.p. statistics since January 2002 under the Law regarding the b.o.p./i.i.p., international trade in services and foreign direct investments of Belgium dated 28 February 2002 (as amended). Solely the Nationale Bank van België/Banque Nationale de Belgique collects data for the b.o.p. and i.i.p. | The Nationale Bank van België/Banque Nationale de Belgique compiles the b.o.p. and national accounts. |

BG | Statistical activity in Bulgaria is regulated by the Statistics Act, Article 42 of the Law on the Bulgarian National Bank, Foreign Exchange Act, Law for Protection of Personal Data, Electronic Government Act and a significant number of EC and ECB regulations in the field of statistics. Under Article 42 of the Law on the Bulgarian National Bank, Българска народна банка (Bulgarian National Bank)is responsible for compiling Bulgaria’s b.o.p. statistics. This Law stipulates that all government and municipal authorities, as well as legal entities and physical persons, are to provide information in accordance with a procedure established by the central bank. Articles 7 to10 of the Foreign Exchange Act and Ordinance No 27 of the central bank on the Balance of Payments, International Investment Position and Securities Statistics complete the legal framework for collecting data from reporters, including sanctions for failing to comply with reporting requirements. | In order to achieve greater consistency of activities and deadlines for providing statistical information while also reducing respondents’ reporting burden, Българска народна банка (Bulgarian National Bank) has agreements with the NSI, Ministry of Finance and other State institutions. For purposes of compiling the b.o.p. and i.i.p. statistics, a stable and regular data exchange takes place between the Bulgarian National Bank and the NSI; the Bulgarian National Bank obtains monthly data on foreign trade and number of travellers, quarterly data on illegal activities, financial intermediation services indirectly measured (FISIM), insurance services, non-life insurance premiums and claims, and annual data on resident non-financial foreign direct enterprises. All methodological and data quality issues are discussed at regularly scheduled meetings organised upon demand of one of the institutions. The NSI is responsible for compiling the national accounts (quarterly and annual non-financial accounts, and annual financial accounts) and government finance statistics, while the Bulgarian National Bank compiles quarterly financial account statistics. |

CZ | Česká národní banka is responsible for collecting, processing and disseminating the Czech Republic’s b.o.p. statistics as stipulated in Articles 41 and 42 of Act No 6/1993 Coll. on Česká národní banka. Decree No 215/2014 Coll., amending Decree No 314/2013 Coll. (only in Czech) on data reporting by entities that belong to the financial institutions sector, and Decree No 235/2013 Coll. (only in Czech) on the submission of data by statistically significant reporting entities for the purposes of b.o.p. and i.i.p. and debt statistics specify in detail the reporting requirements that form the core of the b.o.p. data collection system. Additional information used for b.o.p. statistics is collected under Article 8a of Act No 15/1998 Coll. on Supervision in the Capital Market Area (as amended) and Article 15 of Act No 277/2013 Coll. (only in Czech) and Decree No 315/2013 Coll. on bureau-de-change activity. | A general agreement on cooperation in statistics, including b.o.p. statistics (specifying data-sharing and data exchange), has been signed with the Czech Statistical Office. Česká národní banka is responsible for the final compilation and dissemination of b.o.p. statistics. The Czech Statistical Office is involved in primary data collection on cross-border trade in goods and services, including estimates for seasonal workers’ income and expenditure. The Czech Statistical Office is responsible for compiling national accounts statistics. A high-level meeting is arranged annually to evaluate activities conducted in the preceding year and to set up the main mutual-interest goals for the subsequent period. |

DK | Section 14a of the National Bank of Denmark Act gives Danmarks Nationalbank the legal right to collect and disseminate data for the financial account. It also gives the NCB the right to collect and disseminate data for all other financial statistical domains. The Act on Danmarks Statistik (Section 3a) mandates that Danmarks Statistik is obliged to collect information for European statistics. | The framework agreement between Danmarks Nationalbank and Statistics Denmark is available only in Danish. There are regularly scheduled meetings for various sub-groups (international cooperations, globalisation, financial statistics, business statistics and dissemination). The NCB is responsible for financial statistics, including the b.o.p. financial account, i.i.p. and quarterly financial accounts (national accounts). The NSI is responsible for annual financial accounts (national accounts), as well as the current account and complete b.o.p. (error/omission derivations). |

DE | Since 1954, responsibility for collecting, processing and disseminating German b.o.p. statistics has been assigned to the Deutsche Bundesbank by an agreement between the Federal Ministry of Economics, the Federal Ministry of Economic Cooperation, the Federal Ministry of Transportation, the Federal Statistical Office and the predecessor of the Bundesbank (Bank Deutscher Länder). Likewise, the Bundesbank is responsible for compiling other external statistics such as the German i.i.p. and foreign direct investment statistics, both introduced in the 1970s. Section 11(2) of the Foreign Trade and Payments Act enables the government to enact reporting regulations for specific purposes, including compiling Germany’s b.o.p.. The Foreign Trade and Payments Ordinance details these reporting requirements, which form the core of the b.o.p. data collection system. The ordinance also identifies the Bundesbank as the authority responsible for data collection. Although the responsibility for disseminating b.o.p. statistics is not defined in the Foreign Trade and Payments Act, Bundesbank Act or Federal Statistics Act, the Bundesbank has assumed primary responsibility for this task. | The Deutsche Bundesbank and Federal Statistical Office signed a Memorandum of Understanding (MoU) in 2014 laying down the framework for cooperation aimed at producing and disseminating official statistics at the national level, thus anchoring their long-standing cooperation. Section 1 of the MoU specifies the scope of cooperation between both institutions, identifying several statistical areas where forms of cooperation are in place for balance-of-payment statistics, national accounts and foreign trade statistics, among others. According to provisions of the MoU, the Bundesbank and federal statistical office are to hold joint annual meetings at management level. At the working level, relevant information is to be shared on an ongoing basis. |

EE | According to the Official Statistics Act (see Section 8), the producers of official statistics are Statistics Estonia and Eesti Pank to the extent acknowledged in subsection 34(1) of the Bank of Estonia Act. According to the parliamentary law, Eesti Pank is responsible for compiling and publishing Estonia’s national b.o.p., as well as collecting and disclosing statistics necessary to perform its functions (see Section 2). Pursuant to Section 34, Eesti Pank is entitled to obtain, free of charge, information necessary to draw up the nation’s b.o.p. from all agencies of the government and of local authorities, as well as any person who conducts cross-border economic transactions in the territory of Estonia. | In 2017 Eesti Pank and Statistics Estonia signed a coproduction agreement that allocates tasks, defines a common revision policy and formalises cooperation to optimise the workload and data collection. Under the agreement, Eesti Pank is responsible for the annual review of the financial accounts and for quarterly accounts statistics. In 2018 Statistics Estonia took over responsibility for economic statistics on foreign subsidiary companies; since 2021, it has also been responsible for the foreign trade statistics on business services. Eesti Pank is in charge of disseminating b.o.p. and i.i.p. components to Statistics Estonia for national accounts purposes. Technical meetings are held on a quarterly basis to validate the quarterly financial accounts. Common methodological issues are discussed in statistical working groups once a year. |

IE | The Statistics Act 1993 provides a modern legislative basis for compiling and disseminating official statistics. The Act came into force on 1 November 1994, incorporating inter alia the following provision: the appointment on a formal basis of the Director General of the Central Statistics Office (CSO), who, in addition to being responsible for managing the CSO, is also independent on statistical matters (i.e. sole responsibility for the statistical methodologies and professional standards that are followed, content of statistical releases/publications and the timing and methods of disseminating the statistics compiled). The mandate of the CSO is to collect, compile, extract and disseminate, for statistical purposes, information relating to economic, social and general activities and conditions in the State. The law supporting the CSO’s collection of data is the Statistics Act 1993: According to Section 24 of the Act, the CSO has the right to invite any person or undertaking to provide information on a voluntary basis. Under Section 26 of the Act, the CSO has the right to require persons and undertakings to provide information on a statutory basis once an associated Order has been prescribed by the Taoiseach under Section 25 of the Act. Failure to provide information requested on a statutory basis may result in fines and criminal prosecution under Sections 36 and 44 of the Act. Orders have been prescribed for providing quarterly and monthly b.o.p. data: Section 5A(1)(h) of the Central Bank Act 1942 (as revised) specifies that the function of the Central Bank of Ireland is “to provide advice and assistance to the Central Statistics Office about the collection, compilation, analysis and interpretation of statistics relating to the balance of payments, national accounts and other financial statistics and, where appropriate, to collect data for that purpose”. | A formal written agreement, namely the Economic Statistics MoU, exists between the Central Bank of Ireland and the CSO, signed by the governor of the Central Bank and director general of the CSO. The MoU outlines the set of principles governing the relationship between the Central Bank of Ireland and CSO. The MoU sets out work arrangements and facilitates the exchange of relevant data and metadata between the Central Bank of Ireland and the CSO. Under this agreement, the CSO is the official compiler of b.o.p. and i.i.p. statistics for Ireland, and the central bank collects and compiles most of the primary financial sector statistics, with all other data collected directly by the National Statistics Institute. The central bank is the competent authority for compiling and publishing the international reserves template and official external reserves. The CSO currently disseminates data to the ECB through the Central Bank of Ireland. Working arrangements as outlined in the Economic Statistics MoU are overseen by a centralised coordination group (CCG). The head of statistics at the Central Bank of Ireland and the Director of Macroeconomic Statistics at the CSO act as “sponsors” of the CCG. The sponsors appoint members, support proposals and guide the general direction of the CCG. The CCG is jointly chaired by a b.o.p. senior statistician from the CSO, as well as the head of macro and non-bank statistics (Central Bank of Ireland) and meets quarterly (or if required by either party, with sufficient notice), agreeing and monitoring progress on joint work plans and priorities, areas for enhanced cooperation and coordination with European committees. |

GR | The Bank of Greece has been responsible for compiling and disseminating Greek b.o.p. statistics since 1929. The legal basis for collecting and compiling b.o.p. transactions is established in the Statute of the Bank of Greece (Article 55C). The legislation foresees sanctions in the event of a failure to report b.o.p. data correctly. B.o.p. and i.i.p. data are disseminated by the Bank of Greece as a service to the public. | Although the exchange of statistical data related to the balance of payments between the Bank of Greece and Hellenic statistical authority occurs on a regular basis, it has not yet been laid down in a Memorandum of Understanding. The Hellenic statistical authority supplies trade data and other variables to the Central Bank, which are used either to compile the goods account or else for cross-checking purposes (e.g. government current transfers). The Bank of Greece supplies balance-of-payment data to the national statistical institute. The data are used to compile the national accounts and, more particularly, rest-of-the-world account. Data on the number of traveller arrivals/departures at all types of frontier stations (e.g. airports/seaports) are provided directly to the Bank of Greece by the relevant Greek authorities (civil aviation authority, port authorities, etc.). The Bank of Greece also cooperates with the Hellenic Stock Exchange on a regular monthly basis. The Hellenic Stock Exchange provides statistical information on the activity of the ATHEX securities market and, more particularly, ISIN by ISIN (International Securities Identification Number) information on foreign investor participation in equities as negotiated on ATHEX. |

ES | The Banco de España is responsible for processing and disseminating balance of payment statistics compiled by directly collecting the required information or using other sources. This responsibility is supported by

Data collection by the Banco de España for balance of payments is covered by Law 19/2003 on transactions with the foreign sector; Royal Decree 1360/2011 on reporting obligations to the Banco de España; and Banco de España’s Circulars 1/2012, 4/2012, 3/2013 and 4/2017. Nevertheless, data collection is not always undertaken directly by the bank. Particularly in the context of current and capital accounts (with the exception of investment income), data collection is mainly the responsibility of the instituto nacional de estadística (INE) and the customs department (see “institutional cooperation” box). | The compilation of current and capital accounts is prepared in close cooperation with the Instituto nacional de estadística (INE), which is responsible for compiling national accounts (non-financial). The INE is also responsible for preparing primary statistics on travel and international trade in services, as well as providing input data to the Central Bank. The INE’s survey on international trade in services also covers other international transactions of the current and capital accounts. There is also close cooperation with the following institutions:

Other general government units, mainly the Ministry of Ecological Transition and Demographic Challenge, Ministry of Inclusion, Social Security and Migrations and national audit office. |

FR | Banque de France is responsible for compiling b.o.p. and i.i.p. statistics for France, as established by Article L141-6 of the Code Monétaire et Financier (only in French), which gives the Central Bank the power to collect data needed to fulfil its fundamental missions. | The NSI is responsible for compiling national accounts (non-financial portion). The financial part is prepared by the Banque de France. Information and data are exchanged on a regular basis for the applicable current production. |

HR | According to the Foreign Exchange Act (Article 49), Hrvatska narodna banka is responsible for compiling the balance of payments and international investment position. Articles 66, 86 and 89 of the Act of the Croatian National Bank mandate that the Central Bank collect and process statistical data. | The NSI has no active role in compiling b.o.p. and i.i.p. statistics but acts as a source of data for b.o.p. compilation. The NSI is responsible for compiling national accounts. The exchange of data between Hrvatska narodna banka and the NSI is regulated by the agreement of confidential data exchange. Regularly scheduled meetings are organised to ensure consistency between balance of payments and national accounts. |

IT | Article 11 of the Legislative decree of 19 November 2008, No 195 assigns to the Banca d’Italia the responsibility of compiling and publishing b.o.p. and i.i.p. statistics, as well as collecting the necessary information for their compilation. | Institutional relations between the Banca d’Italia and Italian National Institute of Statistics are managed by a Coordination Committee, which was established in March 2011 within the framework of a Memorandum of Understanding between the two institutions and which provides for cooperation in the field of research and exchange of statistical information. The Committee identifies and enforces actions that are needed for the purpose of fostering cooperation; it also discusses methodological issues of common interest, in addition to overseeing the exchange of statistical data. Interinstitutional working groups are formed within the Committee to discuss high-priority issues such as ensuring consistency between balance of payments and national accounts, as well as between balance of payments and business statistics. |

CY | At the national level, the legal basis for the statistical functions of the Central Bank is provided by Sections 6(2)(h), 63 and 64 of the Central Bank of Cyprus Laws. Under section 6(2)(h) of the Law, the collection, compilation and distribution of statistical data, including data required to fulfil the tasks of the Bank as an integral part of the ESCB, are assigned to the Central Bank of Cyprus. Lastly, Section 64 of the Law includes specific provisions for collecting and compiling b.o.p. and i.i.p. statistics of the Republic, as well as financial accounts of individual sectors of the economy, including a strict confidentiality regime (link: The Central Bank of Cyprus Laws of 2002 to 2007). | The implementation of new statistical standards in the field of external statistics and national accounts, together with the need to enhance consistency and ensure data comparability between the two domains of statistics, has led to deeper cooperation (laid out in a Memorandum of Understanding between the Central Bank of Cyprus, Ministry of Finance and statistical service of Cyprus). These authorities have agreed to exchange statistical data and other information in the following contexts: