The distribution of interest rate risk in the euro area

Published as part of the Financial Stability Review May 2018.

This special feature analyses the distribution of interest rate risk in the euro area economy using balance sheet data and information on derivatives positions from significant credit institutions. On aggregate, banks’ interest rate risk exposure is small relative to their loss absorption capacity, but exposure varies across institutions. This variation is driven by loan rate fixation practices at country level. Banks use derivatives for hedging, but retain residual interest rate risk exposures. In fixed-rate countries the main vulnerability to rising interest rates lies with the banks that have the greatest interest rate risk, while households would be directly affected in countries with predominantly variable-rate loans. In the latter case, increased loan servicing costs due to rising interest rates could affect banks through lower asset quality.

1 Introduction

The distribution of interest rate risk in the economy is important from a financial stability perspective. The extent to which banks, households and non-financial corporations (NFCs) are exposed to interest rate risk is a priori ambiguous. Loans, for example, can be granted at fixed or variable interest rates, giving rise to different interest rate sensitivities for instruments with similar maturities. Depending on banks’ market power, sight deposits can be relatively insensitive to changes in interest rates, despite having a zero maturity. In addition, banks can use derivatives to offset the impact of existing maturity mismatches on their balance sheets. From a financial stability perspective, it is important to understand which entities bear interest rate risk and whether they are able to absorb the impact of changes in interest rates. Financial stability could be affected if specific entities or sectors with limited loss absorption capacity have a large exposure to interest rate risk.

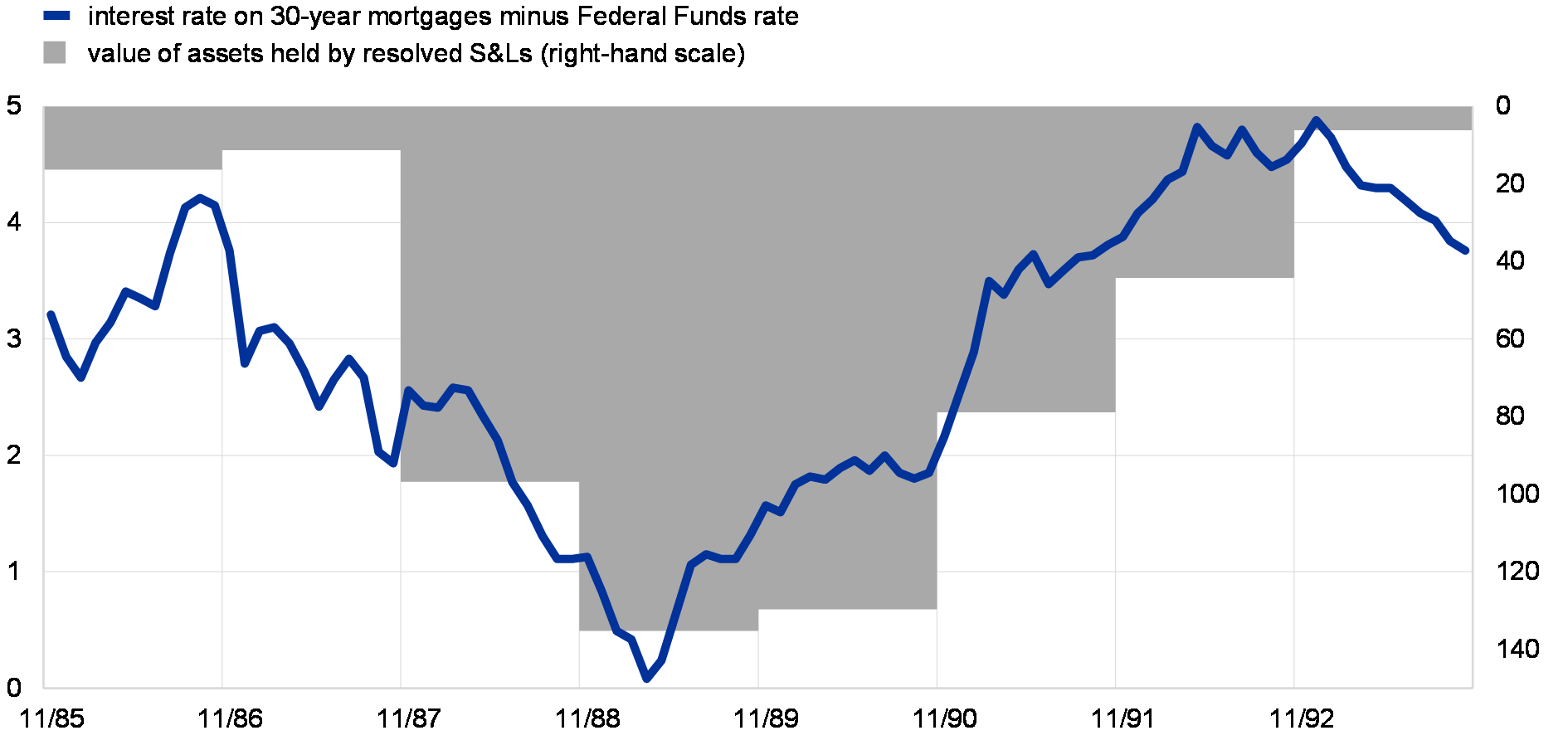

Past experience motivates an in-depth analysis of the distribution of interest rate risk in the euro area. One episode that illustrates the perils of concentrated interest rate risk is the savings and loans crisis in the United States in the 1980s. After funding long-term mortgages with short-term liabilities, savings and loans institutions incurred losses following sharp, unexpected increases in interest rates. This is illustrated in Chart C.1, which shows the erosion of banks’ net interest margin over the period 1986-89 and the contemporaneous increase in assets held by savings and loan institutions under resolution.[1]

Savings and loans institutions in the United States were vulnerable to increases in interest rates in the 1980s

Interest rate margin and assets held by resolved savings and loans institutions

(1985-1993; percentage points (left-hand scale), USD billions (right-hand scale))

Sources: Federal Reserve System and Federal Deposit Insurance Corporation (FDIC).

As the macroeconomic recovery strengthens in the euro area and price pressures gradually build up, financial market participants are likely to bring forward their expectations of higher interest rates. Accordingly, the exposure of different sectors of the economy to interest rate risk justifies a detailed analysis of the associated financial stability risks.[2] While banks are naturally centre stage owing to their role in maturity transformation, interest rate risk can also be borne by other sectors. Insofar as those sectors are leveraged, their exposure to interest rate risk can lead to credit risk for banks and other lenders.

This special feature investigates the distribution of interest rate risk across euro area banks, households and NFCs.[3] Two measures of interest rate risk – net worth sensitivity and income sensitivity – are defined and calculated for a sample of 104 euro area significant institutions. While the aggregate exposure is small, there is significant variation across banks, in large part due to cross-country differences in interest rate fixation practices. There is evidence that banks hedge their interest rate risk in the derivatives market, but hedging is incomplete, and banks retain residual exposures. The analysis is then broadened to include the risk exposures of other sectors, which vary across countries according to the characteristics of loan contracts offered by banks. In a scenario of rising interest rates, banks tend to be more adversely affected in fixed-rate countries, while households are more vulnerable to interest rate increases in countries with predominantly variable rates. Households with already stretched balance sheets are particularly vulnerable to rate increases, which could in turn affect the asset quality of banks.

2 Interest rate risk in banks

The analysis is based on two measures of interest rate risk that are commonly used by practitioners, supervisors and academics. The first measures the sensitivity of bank net worth (defined as the present value of assets minus liabilities) to an increase in interest rates. For a given balance sheet, it is computed as the change in net worth following an upward shift in the yield curve by one basis point.[4] The second measure, called the income gap, is defined as the difference between assets and liabilities with a duration of less than one year, multiplied by an increase in interest rates of one basis point. In broad terms, the income gap quantifies how much a bank’s interest income is expected to change over one year in response to changes in interest rates. These two measures are closely related. For example, a bank with a positive duration gap (i.e. the duration of its assets is higher than the duration of its liabilities) will typically exhibit a negative change in net worth following an increase in interest rates because the present value of assets will decrease relative to liabilities. The income gap will typically also be negative, as short-term liabilities re-price before longer-term assets.[5] For comparability across institutions, both measures are expressed relative to a bank’s total assets.[6]

Two datasets are combined to measure interest rate risk. The analysis is restricted to exposures in the banking book denominated in euro.[7] On-balance sheet exposures are obtained from supervisory filings of euro area significant institutions. These data provide an extensive overview of the maturity and repricing frequency of banks’ assets and liabilities. Each balance sheet item (e.g. loans or term deposits) is broken down into 14 maturity buckets, which allows precise measurement of the duration of each instrument class. For fixed-rate instruments, data correspond to the residual maturity; for variable-rate instruments, data correspond to the next repricing date. Off-balance sheet exposures are measured using transaction-level data on banks’ outstanding interest rate swaps.[8] These data are available to the ECB under the European Market Infrastructure Regulation (EMIR).[9] For each contract, the dataset includes information on the identity of the counterparties involved, the residual maturity of the contract, the underlying benchmark rate (e.g. 6-month EURIBOR), and the fixed rate agreed upon at trade execution.

Since both data sources were created recently, historical information is limited and the cross-sectional dimension provides the main informational content. The primary reference period for the analysis is the end of 2015, but the findings are qualitatively robust to different sample periods. After merging the two datasets, the sample covers 104 euro area significant institutions. The total assets of these banks amount to €21.3 trillion, representing 97% of the total assets of all significant institutions directly supervised by the ECB. These banks were engaged in around 595,000 interest rate swap (IRS) contracts as at 31 December 2015, representing a gross notional value of close to €32.5 trillion. This amounts to over 40% of the global market for euro-denominated IRS contracts.

The behaviour of sight deposits is calibrated using stress test data. While sight deposits have a contractual maturity of zero, they behave differently in practice. This is particularly true for retail deposits, which tend to be less sensitive to interest rates than other liabilities. To account for this effect, the behaviour of sight deposits is modelled on the basis of bank-level supervisory information. In the case of retail loans, it is assumed that 5% are subject to early repayment each year.[10]

Banks’ aggregate exposure to interest rate risk is small. Chart C.2 depicts the cross-sectional distributions of the two measures of interest rate risk for the 104 institutions. The average change in bank net worth is -0.09 basis points relative to total assets. Given an average ratio of book equity to assets of around 7%, an interest rate increase of 200 basis points – a standard reference magnitude used by supervisors – would lead to a decline in bank capital of 2.57%. The income gap averages -0.002 basis points, which is much smaller in magnitude than the net worth sensitivity, given that this measure only captures the impact over one year.

There is substantial heterogeneity in banks’ exposure to interest rate risk. While the average bank has a small exposure, certain institutions bear significant interest rate risk, as indicated by the pronounced tails of both distributions in Chart C.2. Whereas some institutions benefit from higher interest rates (both in terms of net worth and income), others lose. Accordingly, the near-zero aggregate effect is a result of substantial individual exposures cancelling each other out at the level of the banking sector.

On average, euro area banks bear little interest rate risk based on net worth and income gap sensitivity

Cross-sectional distribution of the change in bank net worth (left panel) and in the income gap (right panel) following a one basis point increase in interest rates

(Q4 2015; x-axis: basis points; y-axis: probability density)

Source: Hoffmann, Langfield, Pierobon and Vuillemey (forthcoming).Notes: This figure plots a kernel density estimate (with optimal bandwidth) of the cross-sectional distribution of banks’ net worth sensitivity (left panel) and income gap sensitivity (right panel) for 104 euro area significant institutions. Left panel: the change in bank net worth (expressed in basis points as a fraction of a bank’s total assets) is based on a one basis point parallel increase in interest rates. Right panel: the income gap is defined as the net position (assets minus liabilities) with a re-pricing maturity of less than one year times 1/10,000 (expressed in basis points as a fraction of a bank’s total assets).

Loan-rate fixation practices are a significant driver of heterogeneity in bank-level exposures. Importantly, the type of interest rate fixation in loan contracts (i.e. fixed versus variable rates) varies significantly across jurisdictions.[11] These practices affect the interest rate risk borne by banks. Chart C.3 (left panel) plots the cross-sectional distribution of the change in bank net worth for two groups of banks, depending on whether they are domiciled in a fixed-rate country or a variable-rate country. Chart C.3 (right panel) plots the corresponding distributions for the income gap. These charts illustrate a close connection between loan rate fixation and the direction of banks’ interest rate risk exposure. Banks in fixed-rate countries are more likely to hold long-duration assets (i.e. fixed-rate mortgages), which leads to greater maturity mismatch. Accordingly, the net worth and income of these banks is hurt by an increase in interest rates. The opposite is true for banks in variable-rate countries, as the relatively short duration of loans means that their assets tend to re-price before their liabilities, such that higher interest rates translate into higher income and higher net worth.

Exposures are heterogeneous, with loan-rate fixation practices playing a major role

Cross-sectional distribution of the change in bank net worth (left panel) and in the income gap (right panel) following a one basis point increase in interest rates – for fixed and variable-rate countries

(Q4 2015; x-axis: basis points; y-axis: probability density)

Source: Hoffmann, Langfield, Pierobon and Vuillemey (forthcoming).Notes: This figure plots a kernel density estimate (with optimal bandwidth) of the cross-sectional distribution of banks’ net worth sensitivity (left panel) and income gap sensitivity (right panel) for 104 euro area significant institutions, separated into two groups of countries. Left panel: the change in bank net worth (expressed in basis points as a fraction of a bank’s total assets) is based on a one basis point parallel increase in interest rates. Right panel: the income gap is defined as the net position (assets minus liabilities) with a re-pricing maturity of less than one year times 1/10,000 (expressed in basis points as a fraction of a bank’s total assets). Fixed-rate countries include Belgium, Germany, France, the Netherlands and Slovakia, while in all other countries variable rates predominate.

Similar conclusions are obtained when considering a steepening of the yield curve. Such a scenario is modelled by assuming an increase in interest rates of one basis point only for maturities of more than five years. In this scenario, the two main conclusions – limited exposures for the aggregate banking sector and significant heterogeneity owing to loan-rate fixation conventions – continue to hold. Higher long-term interest rates have a negative effect on the net worth of banks in fixed-rate countries, as they hold a large share of long-term assets, the present value of which decreases in such a scenario. In contrast, banks in variable-rate countries hold assets with much shorter durations, making their net worth less vulnerable to higher interest rates.

Banks’ positions in interest rate swaps are used to hedge their interest rate exposures. To illustrate the effects of risk management via derivatives, the change in bank net worth can be decomposed into two components, one arising from on-balance sheet exposures (loans and securities held on the asset side, and deposits and securities issued on the liability side) and one due to interest rate swap positions. The effect of interest rate swaps can then be assessed by contrasting banks’ exposure to interest rate risk before and after hedging. Chart C.4 (left panel) reveals that banks’ use of interest rate swaps leads to a reduction in interest rate risk. In particular, the left tail of the distribution is curtailed after accounting for interest rate swaps. This indicates that swaps are used for hedging, particularly by banks with large exposures to interest rate risk. Banks use interest rate swaps to hedge irrespective of the sign of their balance sheet exposure, with the result that the cross-sectional distribution narrows towards zero from both sides.

Euro area banks engage in mutual risk-sharing in the interest rate swap market, reducing on-balance sheet exposures by one quarter on average

Cross-sectional distribution of net worth sensitivities before and after accounting for hedging with interest rate swaps (left panel) and value transfers across sectors following a one basis point increase in interest rates (right panel)

(Q4 2015; left panel: x-axis: basis points; y-axis: probability density; right panel: € millions)

Source: Hoffmann, Langfield, Pierobon and Vuillemey (forthcoming).Notes: Left panel: this figure plots a kernel density estimate (with optimal bandwidth) of the cross-sectional distribution of banks’ net worth sensitivity before and after accounting for positions in interest rate swaps. The sample comprises 104 euro area significant institutions. Right panel: this figure plots the value transfers across sectors based on outstanding euro-denominated interest rate swap contracts as at the end of 2015. The 104 euro area significant institutions (SIs) are split into three groups: 22 dealer SIs, 43 SIs with a positive on-balance sheet exposure, and 39 SIs with a negative on-balance sheet exposure.

Heterogeneous on-balance sheet exposures facilitate risk-sharing through derivatives markets. Institutions with exposures of opposite signs can enter into contracts that reduce interest rate risk for both counterparties. This is shown in Chart C.4 (right panel), which indicates the value transfers owing to interest rate swaps arising from a one basis point upward shift in the yield curve. Banks with on-balance-sheet positions that benefit from an increase in interest rates (i.e. a positive change in net worth) share risk with banks with the opposite configuration (i.e. a negative change in net worth). While some of this risk sharing occurs through bilateral contracts, most is intermediated by a subset of banks that act as dealers in derivatives markets.

3 Interest rate risk in the non-financial private sector

Banks’ balance sheets also reveal information about the interest rate risk exposures of other sectors of the economy. Assets held by banks constitute the liabilities of other agents, and vice versa. For example, a mortgage loan is a liability for households. Accordingly, decomposing bank balance sheets at the sector level allows the computation of exposures for households and NFCs. Chart C.5 (left panel) depicts the distribution of the net worth sensitivities of households and NFCs based on their financial contracting with 104 credit institutions.

The household sector is vulnerable to increases in interest rates, particularly in countries with predominantly floating-rate mortgages

Distribution of the net worth sensitivity following a one basis point increase in interest rates for households and NFCs (left panel) and for households in fixed and variable-rate countries (right panel)

(Q4 2015; x-axis: basis points; y-axis: probability density)

Source: Hoffmann, Langfield, Pierobon and Vuillemey (forthcoming).Notes: Left panel: this figure plots a kernel density estimate of the cross-sectional distribution of net worth sensitivities for households and NFCs based on their financial contracting with 104 euro area significant institutions. Numbers are expressed in basis points and relative to total bank assets. Right panel: this figure plots a kernel density estimate of the cross-sectional distribution of net worth sensitivities for households from two groups of countries, based on their financial contracting with 104 euro area significant institutions. Numbers are expressed in basis points and relative to total bank assets. Fixed-rate countries include Belgium, Germany, France, the Netherlands and Slovakia, while in all other countries variable rates predominate.

The household sector appears more vulnerable to interest rate increases than the corporate sector. The exposure arises because a considerable portion of household liabilities is indexed to short-term interest rates, while deposits are relatively insensitive to changes in the yield curve owing to banks’ market power. In contrast, NFCs have exposures with the opposite sign and a somewhat lower magnitude. However, this aggregate picture masks heterogeneity with respect to firm size. For example, there is evidence that smaller firms tend to hedge less, leading to greater interest rate risk exposures for such firms.[12]

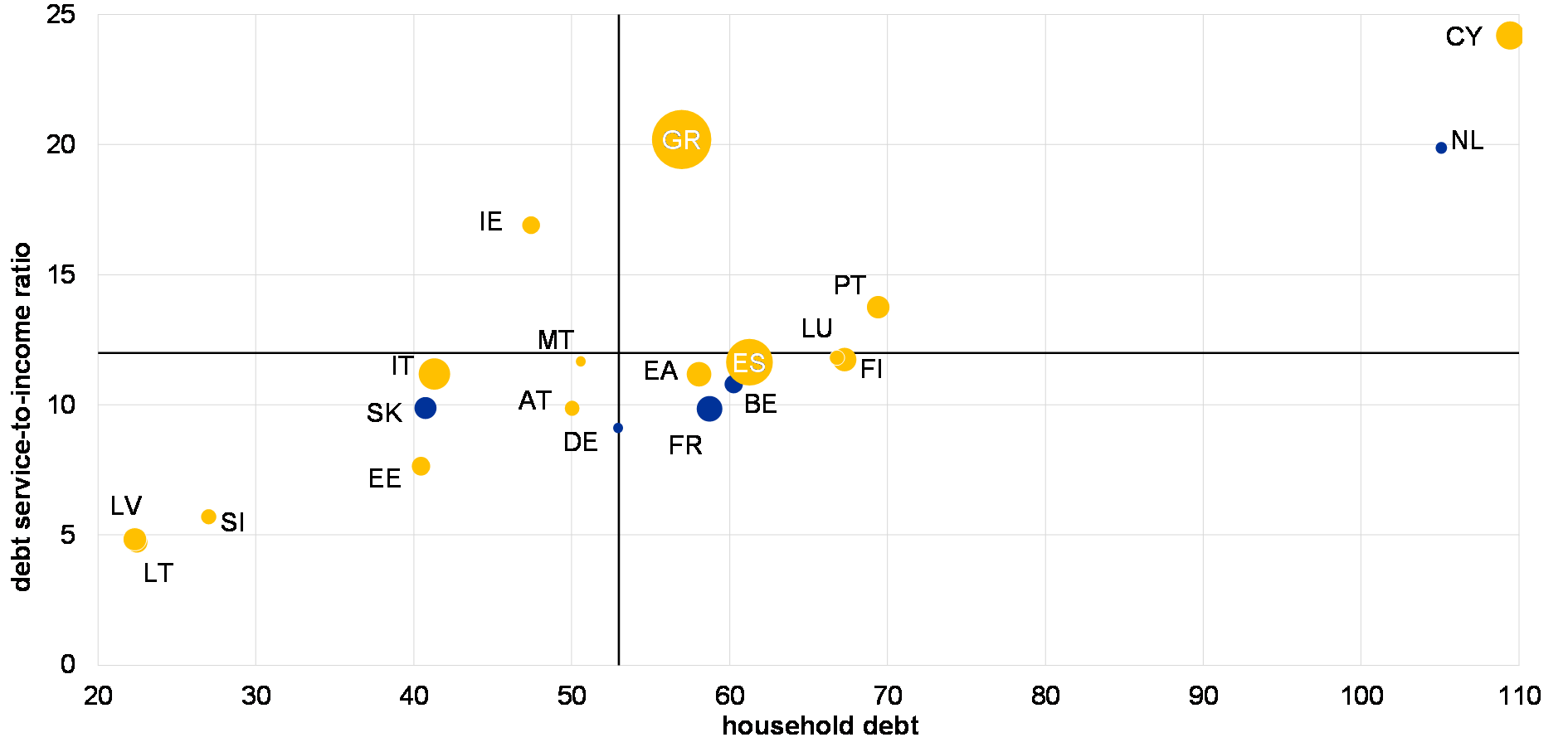

In the household sector, vulnerabilities to interest rate increases are concentrated in variable-rate countries. This is shown in Chart C.5 (right panel), which separates households’ exposures into two groups based on the location of the lending bank. In line with the results in the previous section, the liabilities of households in variable-rate countries have a significantly shorter duration, thus pushing their overall exposure into negative territory. In some of the countries with predominantly variable interest rates, households exhibit high levels of indebtedness and high debt service-to-income ratios (see Chart C.6), rendering those households more vulnerable to negative shocks to their net worth. In contrast, households in fixed-rate countries tend to have lower levels of indebtedness and debt servicing burdens, with the exception of the Netherlands.

The combination of stretched balance sheets and variable interest rates makes some households vulnerable to rising rates

Indebtedness and debt service-to-income ratios of euro area households

(Q4 2017; percentages of GDP and percentages)

Sources: ECB and ECB calculations.Notes: Countries with predominantly variable interest rates are highlighted in yellow. The size of the bubble represents the unemployment rate. The vertical line represents the estimated macroeconomic imbalance procedure (MIP) benchmark of 53% of GDP for household debt. The 133% of GDP MIP limit for fully consolidated non-financial private sector debt is split between firms and households based on their average past shares in the stock of non-financial private sector debt. The debt service-to-income (DSTI) ratio is equal to the fixed debt service costs of an instalment loan divided by income. Fixed debt service costs assume identical repayment of the principal during the average maturity of the debt and an average interest rate, and are a factor of outstanding debt. The threshold for the DSTI ratio is obtained from a univariate signalling model such that values exceeding the threshold have been associated with the onset of systemic financial crises in the following 5 to 12 quarters. Data on these threshold values are taken from “A new database for financial crises in European countries – ECB/ESRB EU crises database”, Occasional Paper Series, No 13, European Systemic Risk Board, July 2017.

Including items from household balance sheets that do not arise from their financial contracting with banks would change the measurement of their interest rate risk exposure. On the liability side these non-bank items are small, but on the asset side many households have assets other than deposits with banks (e.g. other financial assets and real estate). These assets typically have long duration, so including them would make the sensitivity of household net worth to higher interest rates more negative. While the magnitude of this effect would differ across households, home ownership rates tend to be higher in variable-rate countries, suggesting that the inclusion of non-bank assets would amplify cross-country heterogeneity.

4 Conclusion

While the interest rate risk exposure of euro area banks is limited on aggregate, banks operating in countries with predominantly fixed-rate loans would be more adversely affected by rising rates. The fact that aggregate exposures are small does not imply that there are no implications for financial stability. Some banks bear significant interest rate risk, although the direction of that exposure varies across banks. While this implies that the banking sector as a whole is diversified, sharp and unexpected increases in interest rates could nevertheless generate financial instability by depleting a large share of equity for a subset of banks.

The assumptions underlying banks’ models for sight deposits can have a sizeable impact on their interest rate risk. One potential concern relates to the accuracy of banks’ models regarding the stability of their deposit funding. Sight deposits are a source of profits for banks because they are less interest rate sensitive than their contractual maturity suggests – a phenomenon usually attributed to household inertia. To maximise profits, banks typically model the behaviour of these liabilities on the basis of past data and choose the maturity structure of their assets accordingly. However, given that interest rates have been low for a prolonged period of time, there could be uncertainty about whether models would capture the adjustment to higher interest rates satisfactorily.[13]

Regarding the non-financial private sector, households appear to be more vulnerable to rising interest rates in countries with variable rates. Higher interest rates could translate into debt servicing difficulties for some households, particularly those that are heavily indebted. This might in turn have adverse consequences for the asset quality of financial institutions, some of which are already managing high levels of non-performing loans. While non-financial corporations might have a higher share of variable rate loans, in particular the large corporations could alleviate their interest rate risk through hedging.

- [1]In the period 1986-89, the Federal Reserve System increased its benchmark policy rate by approximately 400 basis points. Consequently, the cost of deposit funding increased, while income from fixed-rate mortgages remained constant. In combination with low levels of capitalisation, these interest rate changes triggered widespread insolvencies. Resolution authorities in the United States subsequently resolved more than 1,000 savings and loans institutions, causing the industry to shrink by approximately one-third.

- [2]The ECB recently published the findings of a supervisory exercise in which it assumed six hypothetical scenarios for the future path of interest rates. See “Sensitivity Analysis of IRRBB – Stress test 2017 – Final results”, European Central Bank, October 2017, available on the ECB’s banking supervision website.

- [3]The analysis is based on Hoffmann, P., Langfield, S., Pierobon, F. and Vuillemey, G., “Who bears interest rate risk?”, Working Paper Series, ECB, forthcoming (currently available at SSRN).

- [4]This measure is sometimes referred to as the “change in the economic value of equity” (ΔEVE), “duration gap”, or DV01. In the analysis, a perfect pass-through of risk-free rates to other interest rates is assumed.

- [5]Bank supervisors look at both present-value and income-related measures. While present-value-based measures, such as the change in net worth, capture the entire balance sheet, they do not account for the fact that only a subset of items in the banking book are marked to market. On the other hand, income-based measures, such as the income gap, capture only a fraction of the balance sheet.

- [6]Alternative measures of interest rate risk focus on the sensitivity of certain components of net worth. For example, the banking literature has assessed the interest rate sensitivity of stock market capitalisation. This is qualitatively similar to an analysis focused on economic value, but has the disadvantage that stock market data are not available for unlisted banks.

- [7]This choice is supported by additional analyses that reveal that exposures to interest rate risk from the trading book are quantitatively small. In addition, only a few euro area banks have significant exposures to interest rate risk in other currencies.

- [8]Attention is restricted to interest rate swaps referencing the euro overnight index average (EONIA) or the euro interbank offered rate (EURIBOR), as these constitute the vast majority of derivatives used to manage interest rate risk relating to the euro yield curve. See “Shedding light on dark markets: First insights from the new EU-wide OTC derivatives dataset”, Occasional Paper Series, No 11, European Systemic Risk Board, September 2016.

- [9]These data are obtained from two trade repositories, DTCC-DDRL and Regis-TR, which cover the vast majority of trades in interest rate swaps by entities resident in the euro area.

- [10]This is broadly in line with information from the ECB’s recent stress test, which found an average prepayment rate of 7% for all modelled loans (not only retail loans). More generally, the empirical relevance of this assumption is secondary to that for sight deposits.

- [11]For further details, see Hoffmann, Langfield, Pierobon and Vuillemey, op. cit.

- [12]See, for example, Guay, W. and Kothari, S., “How much do firms hedge with derivatives?”, Journal of Financial Economics, Vol. 70, 2003, pp. 423-461.

- [13]This uncertainty could work in either direction. On one hand, models that have been calibrated on the basis of a prolonged period of low interest rates might underestimate sensitivities in a scenario of rising rates. On the other hand, models might overestimate sensitivities insofar as banks have absorbed part of the decline in market rates via lower margins owing to the effective zero lower bound on retail deposit rates. This could imply more inertia when interest rates are raised from negative territory, as banks first restore their interest rate margins.