Liquidity conditions and monetary policy operations in the period from 29 January to 5 May 2020

Published as part of the ECB Economic Bulletin, Issue 4/2020.

This box describes the ECB’s monetary policy operations during the first two reserve maintenance periods of 2020, which ran from 29 January to 5 May. As a response to the coronavirus (COVID-19) crisis and in view of heightened financial market volatility, the Eurosystem decided on a set of measures to ease funding conditions and liquidity availability across sectors and jurisdictions during the two maintenance periods under review.

As part of the COVID-19-related policy measures on the liquidity providing side, the Eurosystem announced amendments to the existing targeted longer-term refinancing operations (TLTRO III) and introduced a series of additional tender operations as well as a broad set of collateral easing measures for Eurosystem counterparties. On 12 March the easing of conditions for the TLTRO III and a new series of additional longer-term refinancing operations (additional LTROs) were introduced to provide immediate liquidity support to banks and to safeguard money market conditions. These measures aimed to serve as a backstop facility during the recent turbulence. The additional LTROs are conducted on a weekly basis and will mature on 24 June 2020, effectively bridging the period until the fourth TLTRO III operation is settled.[1]

On the asset purchase side, further to the temporary envelope of €120 billion of net asset purchases under the asset purchase programme (APP) agreed on 12 March, on 18 March the ECB announced a new pandemic emergency purchase programme (PEPP) with a volume of €750 billion to last at least until the end of 2020. These additional purchases are intended to counter the risks to the monetary policy transmission mechanism in the euro area stemming from the COVID-19 crisis. These purchases will be conducted in a flexible manner and can be expanded if the crisis phase extends past the end of the year.[2]

In order to further improve funding conditions in the global US dollar funding market, the Eurosystem, in coordination with the Federal Reserve, Bank of England, Bank of Japan, Bank of Canada and Swiss National Bank, enhanced the provision of US dollar liquidity via the existing US dollar swap lines. Furthermore, the ECB set up euro-providing swap lines with a number of EU central banks. The coordinated action enhancing the existing provision of US dollar liquidity was announced on 15 March, reducing the pricing of US dollar liquidity and introducing an additional US dollar operation with a maturity of 84 days. Furthermore, as of 20 March, the frequency of the seven-day US-dollar-providing operations was increased from weekly to daily. These measures helped to significantly ease funding conditions in the US dollar funding markets.

Liquidity needs

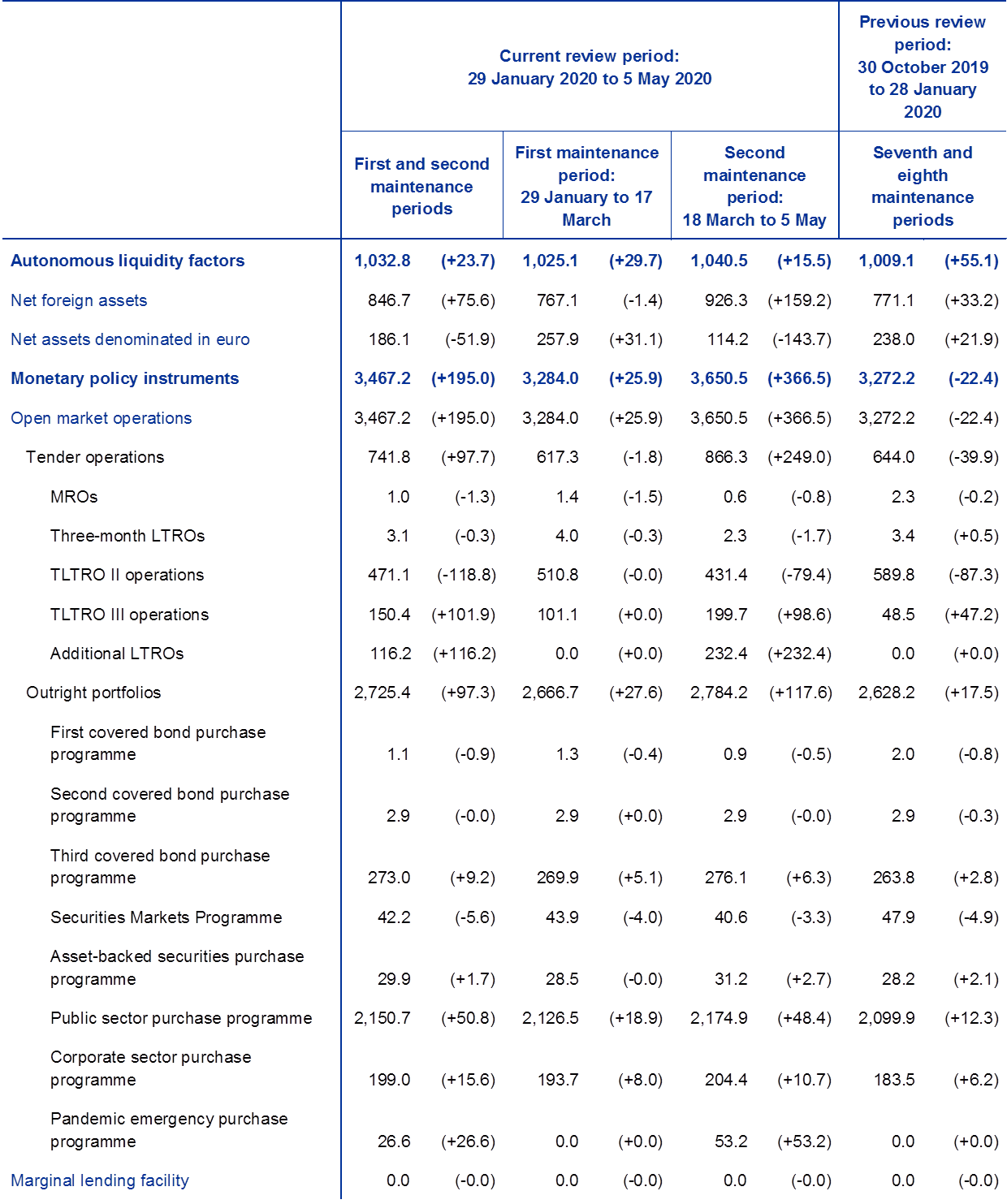

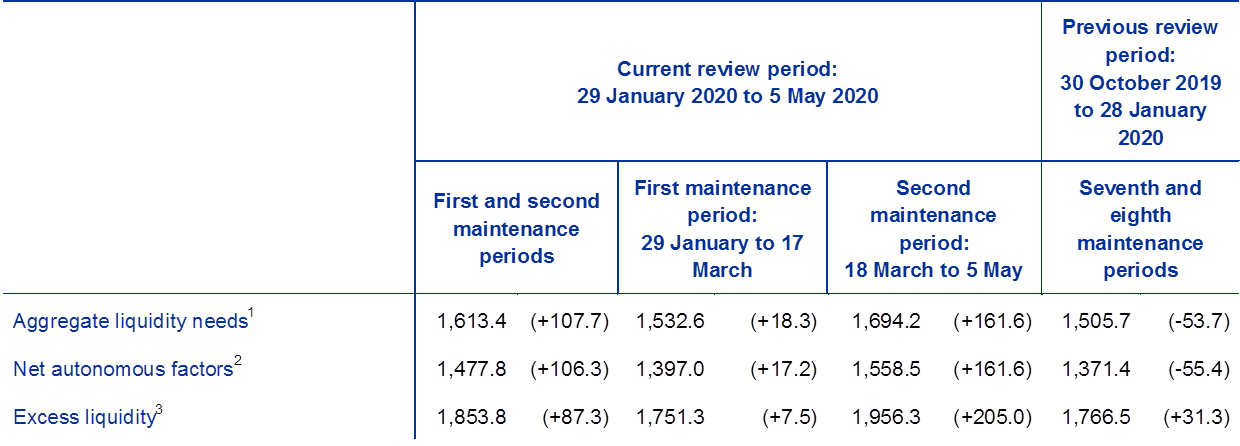

The average daily liquidity needs of the banking system, defined as the sum of net autonomous factors and reserve requirements, stood at €1,613.4 billion in the period under review (see the section of Table A entitled “Other liquidity-based information”). This was €107.7 billion higher than in the previous review period (i.e. the last two maintenance periods of 2019). Net autonomous factors increased by €106.3 billion to €1477.8 billion, while minimum reserve requirements increased by €1.4 billion to €135.7 billion.

The main drivers of liquidity in the first two maintenance periods of 2020 were increasing government deposits, demand for banknotes, asset purchases and the new series of additional LTROs. Liquidity absorption by autonomous factors increased by €106.3 billion, on average, mainly driven by an exceptional increase in government deposits of €101.7 billion due to prudent government cash management in view of COVID-19. Against the same background, a higher demand for banknotes contributed to further liquidity absorption of €27.7 billion, as the post-year-end seasonal decrease in banknote holdings during the first maintenance period was outweighed by the increase in the second maintenance period. The developments in autonomous factors on the asset side, however, with a net increase of €23.7 billion, had a mild counter effect. Net assets denominated in euro decreased by €51.9 billion, whereas net foreign assets increased by €75.6 billion and partially compensated for the liquidity absorption by government deposits and banknotes. The dynamics on the asset side during the second maintenance period were mainly a result of the higher demand in the US-dollar-providing operations, with a total outstanding amount of €142 billion by the end of the second maintenance period of 2020.

Table A

Eurosystem liquidity conditions

Liabilities

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of the revaluation accounts, other claims and liabilities of euro area residents, capital and reserves.

Assets

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

Other liquidity-based information

(averages; EUR billions)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the sum of net autonomous factors and minimum reserve requirements.

2) Computed as the difference between autonomous liquidity factors on the liability side and autonomous liquidity factors on the asset side. For the purpose of this table, items in course of settlement are also added to net autonomous factors.

3) Computed as the sum of current accounts above minimum reserve requirements and the recourse to the deposit facility minus the recourse to the marginal lending facility.

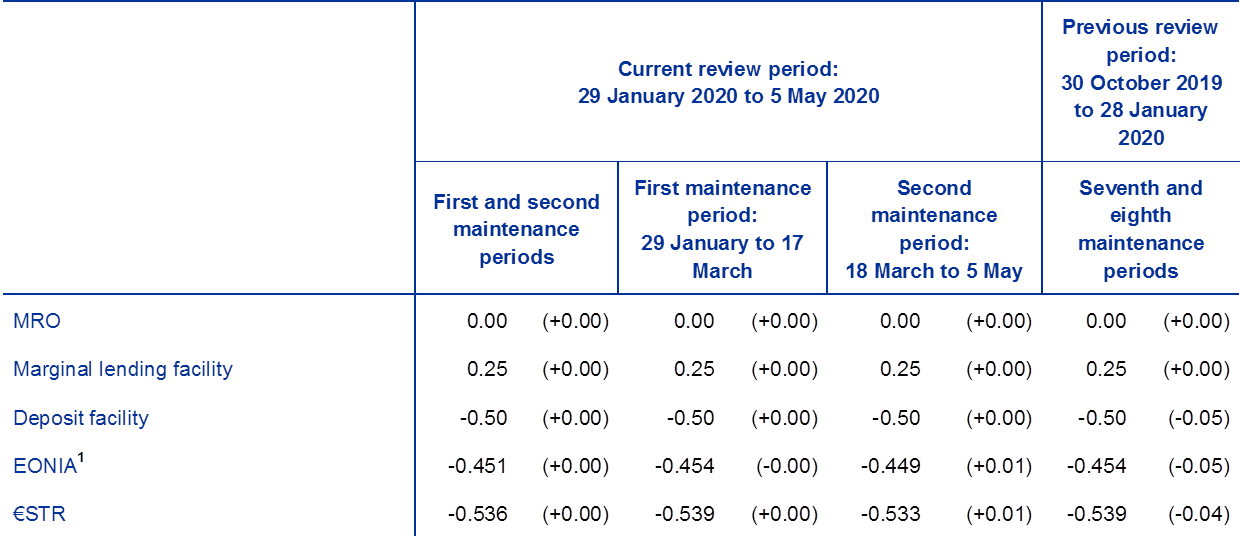

Interest rate developments

(averages; percentages)

Source: ECB.

Notes: All figures in the table are rounded to the nearest €0.1 billion. Figures in brackets denote the change from the previous review or maintenance period.

1) Computed as the euro short-term rate (€STR) plus 8.5 basis points from 1 October 2019. Differences in the changes shown for the euro overnight index average (EONIA) and the €STR are due to rounding.

Liquidity provided through monetary policy instruments

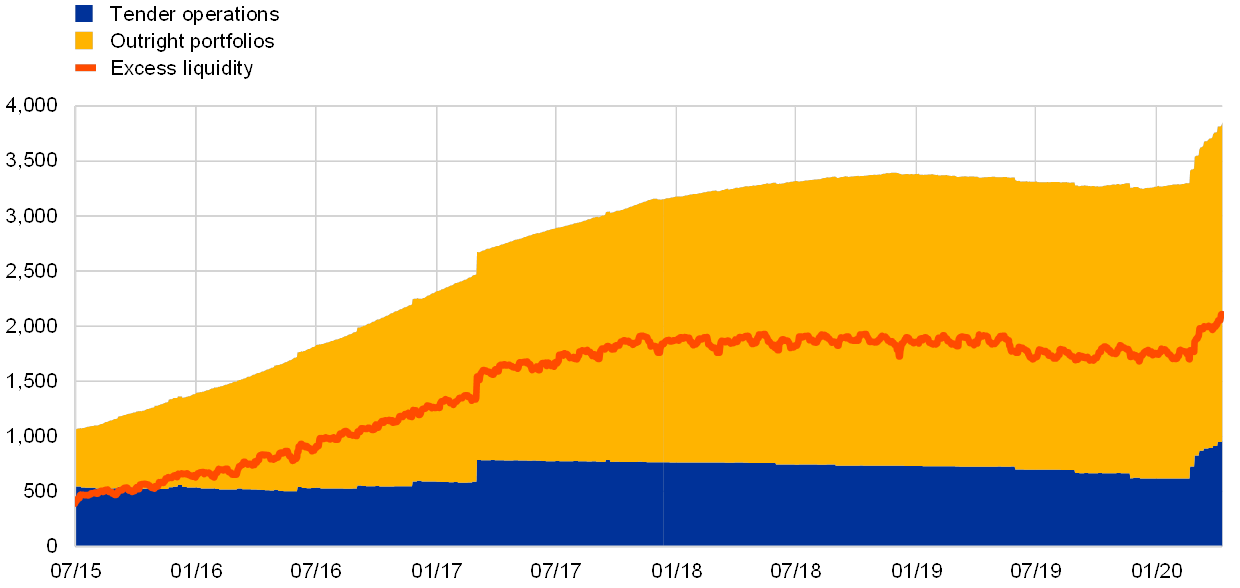

The average amount of liquidity provided through open market operations – including both tender operations and monetary policy portfolios – increased by €195 billion to €3467.2 billion (see Chart A). The overall reported increase in excess liquidity in the first two maintenance periods of 2020 was driven in similar amounts by tender operations and the outright purchases of the Eurosystem. The main sources of this additional liquidity were the additional LTROs as well as asset purchases under the public sector purchase programme (PSPP) and the new PEPP.

Chart A

Evolution of liquidity provided through open market operations and excess liquidity

(EUR billions)

Source: ECB.

Note: The latest observation is for 5 May 2020.

The average amount of liquidity provided through tender operations increased by €97.7 billion relative to the previous review period. While it remained almost unchanged in the first maintenance period of 2020 (-€1.8 billion), it increased by €249.0 billion in the second maintenance period. This was mainly driven by the uptake of €232.4 billion in the newly introduced LTROs. In addition, the TLTRO II repayments of €93 billion and TLTRO III uptake of €115 billion were settled on 25 March, leading to a net liquidity injection of on average €19.2 billion in the second maintenance period. Liquidity provision via the main refinancing operations (MROs) decreased by €1.3 billion relative to the previous review period. This is mostly due to the elevated MRO volumes during the previous maintenance period covering the year-end and is broadly in line with last year’s changes. The outstanding amount of three-month LTROs decreased slightly, by €0.3 billion.

At the same time, outright portfolios increased by €97.3 billion, from €2,628.2 billion to €2,725.4 billion, owing to the resumption of augmented net purchases under the APP following the agreed additional €120 billion envelope until end of 2020 and the start of the purchases under the new PEPP. Average holdings increased by €50.8 billion to €2,150.7 billion in the public sector purchase programme (PSPP) and by €15.6 billion to €199.0 billion in the corporate sector purchase programme (CSPP) – in line with announced purchase amounts. In addition, on 26 March the Eurosystem started its purchases under the new PEPP. By the end of the second maintenance period, the liquidity provision under the PEPP amounted to €53.2 billion on average over the maintenance period – equivalent to nearly €18 billion of weekly purchases.

Excess liquidity

Average excess liquidity increased by €87.3 billion, from €1,766.5 billion to €1,853.8 billion (see Chart A). This is a result of increasing liquidity provision via monetary policy operations including outright portfolios (€195.0 billion), while autonomous factors absorbed liquidity (€106.3 billion) in the euro area.

In addition, although the excess liquidity held in the Eurosystem’s deposit facility increased, its relative share declined further owing to the two-tier system for remunerating excess liquidity holdings. Since only balances held in financial institutions’ current accounts up to their maximum allowance are exempt from negative remuneration at the rate applicable to the deposit facility, financial institutions continue storing funds in their current accounts, which increased by €85.5 billion, rather than the deposit facility, which increased only marginally by €1.8 billion.

Interest rate developments

The €STR remained broadly unchanged during the first two maintenance periods. The ECB’s deposit facility rate as well as the main refinancing operations and marginal lending facility rates were left unchanged by the Governing Council during this period. Consequently, the €STR remained stable at a level of -53.6 basis points (+0.3 basis points compared with the previous review period). The EONIA, which as of October 2019 is calculated as the €STR plus a fixed spread, moved in parallel with the €STR.

- Subsequently, on 30 April, additional recalibrations of the targeted longer-term refinancing operations (TLTRO III) and new pandemic emergency longer-term refinancing operations (PELTROs) were introduced to further support the real economy and smooth money market conditions. Both measures will only affect liquidity provision as of the third maintenance period of 2020.

- In fact, the ECB Governing Council decided on 4 June to expand the size of the PEPP by €600 billion, and to extend the horizon until at least the end of June 2021.