Market reaction to the two-tier system

Published as part of the ECB Economic Bulletin, Issue 8/2019.

On 30 October 2019 the ECB implemented a two-tier system under which a portion of credit institutions’ excess liquidity holdings with the Eurosystem are exempt from remuneration at negative rates. The two-tier system applies to excess liquidity held by banks in current accounts with the Eurosystem and not to holdings with the ECB’s deposit facility.[1] Excess liquidity holdings (i.e. reserve holdings in excess of minimum reserve requirements) that are exempt are remunerated at 0%, instead of at the rate of the deposit facility, currently -0.5%.

The aim of the two-tier system is to support the bank-based transmission of monetary policy in preserving the overall positive contribution of negative rates to the accommodative stance of monetary policy. The Governing Council has set exempt excess liquidity holdings (exemption allowance) at six times an institution’s minimum reserve requirements. The multiplier is the same for all institutions and has been chosen to support the pass-through of the negative deposit facility rate to bank lending rates by offsetting some of the adverse impact of negative rates on bank profitability, while also ensuring that euro short-term money market rates remain close to this policy rate. The multiplier and the remuneration rate on exempt excess liquidity can be changed over time to ensure that banks continue to extend loans to their customers at conditions that fully reflect the desired stance of monetary policy.

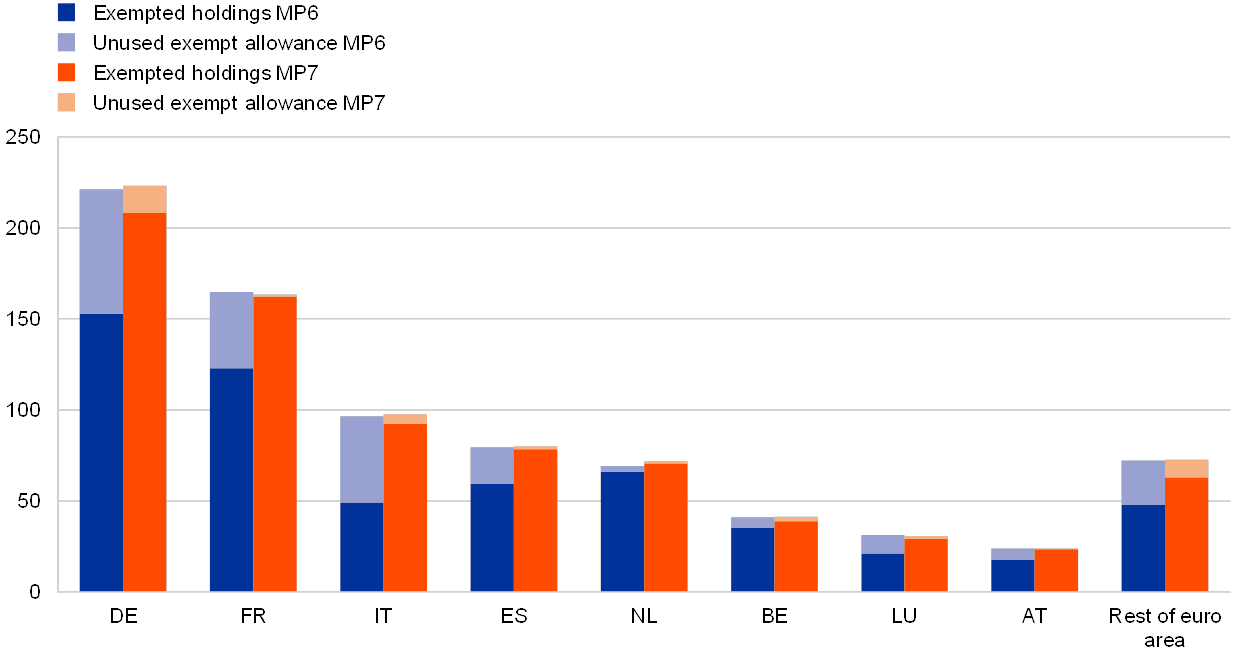

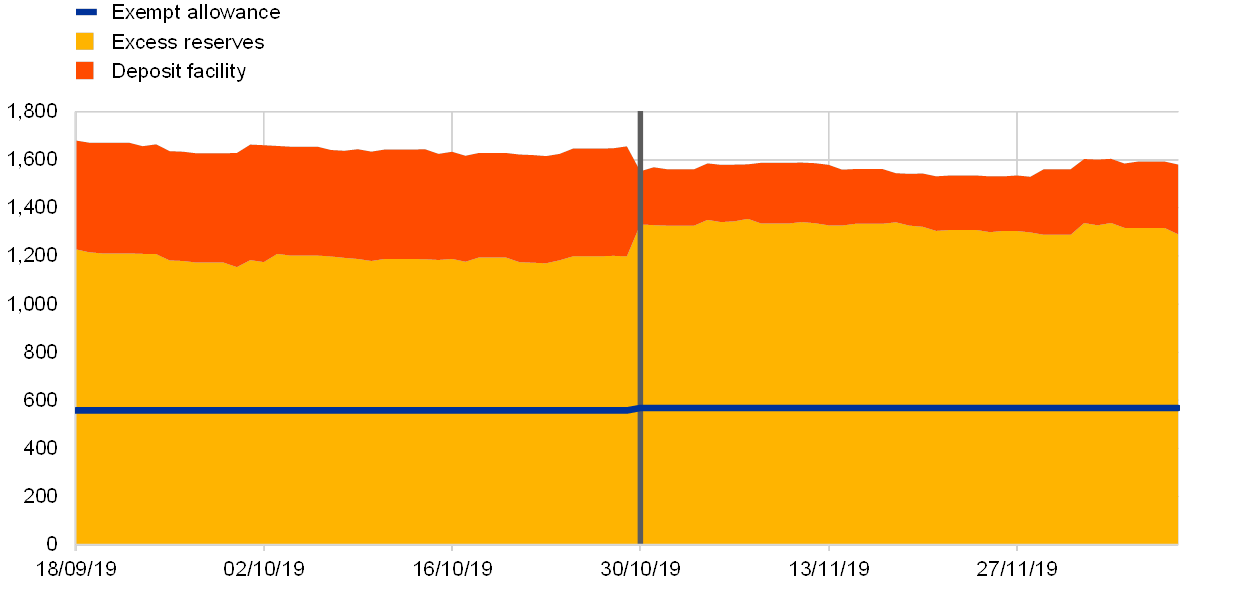

With the introduction of the two-tier system banks holding less excess liquidity than their exemption allowance increased their excess liquidity holdings by borrowing from banks exceeding their exemption allowances. On 30 October 2019, i.e. the day the two-tier system came into effect, banks reduced their unused exemption allowances from 28% to 13% of total exemption allowances. Over the following days banks that had not completely used their exemption allowances continued to gradually increase their excess liquidity holdings until by 11 December less than 5% of exemption allowances were unused (see Chart A). At the same time, excess liquidity held by banks exceeding their exemption allowances declined slightly – indicating a redistribution of excess liquidity through money markets and other channels in line with the incentives laid out by the two-tier system (see Chart B).

Chart A

Exempt excess liquidity holdings and exemption allowances per country

(EUR billions)

Source: ECB.

Notes: Exempted holdings and unused exemption allowances are computed on the basis of individual average excess liquidity holdings (excess reserves plus recourse to the deposit facility) for the sixth maintenance period (MP 6) and on the basis of average excess reserves holdings (until 24 November) for the seventh maintenance period (MP 7).

Latest observations: 11 December 2019.

Chart B

Excess liquidity developments of banks exceeding their exemption allowances

(EUR billions)

Source: ECB.

Notes: Excess reserves and recourse to the deposit facility of banks exceeding their exemption allowances in the sixth maintenance period (MP 6) and the start of the seventh maintenance period (MP 7).The grey line marks the start of the seventh reserve maintenance period (30/10/2019).

Latest observations: 11 December 2019.

The bulk of banks’ increased borrowing in the money market occurred via secured transactions. Transaction data for a subset of banks with unused exemption allowances show that on the first days following the implementation of the two-tier system they increased their average daily secured borrowing by about €15 billion, while keeping their unsecured borrowing broadly unchanged (see Chart C). However, the reliance on the money market to fill unused exemption allowances declined thereafter. Banks can adopt other strategies beyond the money market to fill allowances, such as asset sales and attracting other forms of funding.

Chart C

Short-term secured and unsecured cash borrowing volumes of banks with unused exemption allowances

(EUR billions)

Sources: ECB, MMSR.

Notes: Cash borrowing in the secured and unsecured segment on transactions with the shortest tenors (ON, TN and SN) for MMSR banks with unused exemption allowances computed on the basis of their excess liquidity in the sixth reserve maintenance period. Red lines mark the start of the sixth reserve maintenance period (18/09/2019) and seventh reserve maintenance period (30/10/2019).

Latest observations: 11 December 2019.

Although the increase in trading activity temporarily coincided with higher money market rates, experience with the two-tier system over its first six weeks shows that money market rates were only marginally affected and remain well aligned with the policy rate. After the implementation of the two-tier system, €STR, the unsecured overnight wholesale borrowing rate, remained close to its average level calculated over the period from 1 to 29 October. Secured rates temporarily increased by up to 6 basis points in the largest euro area countries, but have since reverted back to levels within the range of volatility seen before the start of two-tier system (see Chart D).

Chart D

Unsecured and secured money market rates

(%)

Sources: ECB, MTS, NEX.

Notes: GC repo rates are volume weighted average rates for German, French, Spanish and Italian collateral, and transactions with O/N, T/N, S/N maturities with the same transaction date. Grey lines mark the September Governing Council (12/09/2019), the start of the sixth reserve maintenance period (18/09/2019) when the rate cut of 10 basis points to the deposit facility rate took effect, and the start of the seventh reserve maintenance period (30/10/2019) when the two-tier system took effect. Pre-€STR until 30 September, €STR from 1 October onwards.

Latest observations: 11 December 2019.

- The ECB also published additional information on the two-tier system for remunerating excess reserve holdings.