Drivers of rising labour force participation – the role of pension reforms

Published as part of the ECB Economic Bulletin, Issue 5/2020.

1 Introduction

Labour supply developments are a major determinant of potential output and are therefore also relevant for monetary policy. Labour supply developments in the euro area are strongly affected by population ageing, among other things.[1] Against this background, it is crucial to have a good understanding of how demographic changes in the various working-age cohorts, together with structural factors such as policy changes, will affect the labour market. Looking ahead, this understanding will be relevant when assessing the potential growth outlook, even though uncertainty has considerably increased recently due to the coronavirus (COVID-19) pandemic.

With the ageing of the baby boom generation, the population share of the older working-age cohort, i.e. those between 55 and 74 years, has been gradually increasing. This would suggest a decline in the overall labour force participation rate, given that the participation rate of these older workers has usually been considerably lower compared to other working-age cohorts.[2] However, this is not what we have observed during the past two decades. Instead, most euro area countries have experienced an increase of labour supply since the early 2000s, largely explained by developments in the labour force participation rate. Moreover, the steepest rise in the labour force participation rate was observed for older workers, following a seminal decline before the turn of the century.[3]

This raises the question: what has been driving this increase in the labour force participation rate of older workers? Deciding on when to exit the labour market and enter retirement is a complex individual choice. Factors that influence this choice include: the relevant labour market situation; the set-up of the national social security system; and each individual’s health status and personal preferences. The net wealth position of older workers, and in this context the increasing role of occupational pensions, is also likely to, at least indirectly, influence their retirement decisions – not least because higher net wealth might help to partly compensate for possibly shrinking pension entitlements. Many of these factors have improved over time. In fact, better health conditions, rising life expectancy, higher educational levels – mainly among women – and rising net wealth reflect long-term trends that had already started well before the turn of the twenty-first century. As such, those factors, though they have likely contributed to the rise in participation, cannot be used to fully explain the particularly sharp rebound in the participation rate of older workers since 2000. This sharp rebound may, in fact, have been supported by more recent policy changes, such as pension reforms, which incentivised older workers to remain in the labour market for longer by postponing retirement. Against this background, the focus of this article will mainly be on the role of pension reforms.

Most euro area countries adopted substantial pension reforms in the last two decades to reduce risks to long-term fiscal sustainability. Pension reforms are essential in view of the challenges that population ageing poses for financial sustainability of the public pension systems, which are predominately pay-as-you-go schemes in the euro area. At the same time, pension payments need to ensure that pension benefits are socially adequate. The adopted pension reforms mainly sought to reduce the generosity of retirement schemes and to limit eligibility criteria, in particular for early retirement; it can be expected that this does encourage older workers to participate in the labour market for a longer period of time. These pension reforms were in some cases complemented by labour market reforms tailored towards older workers – for example, incentivising job searches or supporting the retention of older workers.

However, the COVID-19 shock – if prolonged – may bring into question whether this increase in the labour force participation rate of older workers will continue. Experiences drawn from some earlier shocks suggest that older workers – predominantly those with lower education levels – may be particularly exposed to prolonged negative macroeconomic shocks.[4] When labour demand drops significantly and workers are dismissed they may become discouraged from job searching and withdraw from the labour market. For older people, this withdrawal may not be reversed when the economic conditions improve again, thus, their labour force participation rate may be permanently affected. In the current macroeconomic shock resulting from COVID-19, some factors may amplify this effect. First, the direct health shock related to the rise of fatality rates with age may make older workers less willing to prolong their employment. Second, sectors where older people might have longer careers – for instance, service sectors – are significantly exposed to the shock. However, short-time work schemes implemented across the euro area are contributing to preserve employment relationships and thus are likely to mitigate the possible subsequent discouragement effects.[5] Furthermore, the current crisis may negatively affect disposable income and – through pension funds and other personal investments – worker’s net wealth. This may incentivise older workers to prolong their working careers. This may counterbalance some of the negative impact mentioned above.

The current shock may be unlike the financial crisis. In fact, after 2008, unlike in earlier shocks, the trend increase of the labour force participation rate continued for older workers[6], while today the older workers’ labour market situations, their willingness to work and thus their labour force participation rate might be at greater risk. This may be due to the specificities of the health shock, the differences in sectoral developments, as well as differences in terms of governments’ willingness to carry out further pension reforms. Given that recently older workers provided the largest contribution to the recent labour force participation rate increases, the impact of the macroeconomic shock on their labour market situation may have a large impact on the overall labour force participation rate.

The article is organised as follows. Section 2 gives a broad overview of developments in the labour force participation rate across euro area countries in the past two decades. Section 3 examines indicators of when older workers retire in the euro area. Section 4 discusses various factors that potentially determine the participation rate of older workers from a conceptual point of view, including pension reforms. Box 1 complements the analysis by looking at the role of labour market reforms for older workers, while Box 2 discusses the composition of net wealth of older age cohorts. Section 5 provides an overview of the pension reforms that have been adopted and implemented by euro area countries since the early 2000s and discusses their possible impact on the participation rate of older workers. Finally, Section 6 concludes with a tentative outlook for participation rate developments in euro area countries, examining how this could affect future labour supply and potential growth, also in the light of the COVID-19 shock.

2 Changes in labour force participation rates in the euro area

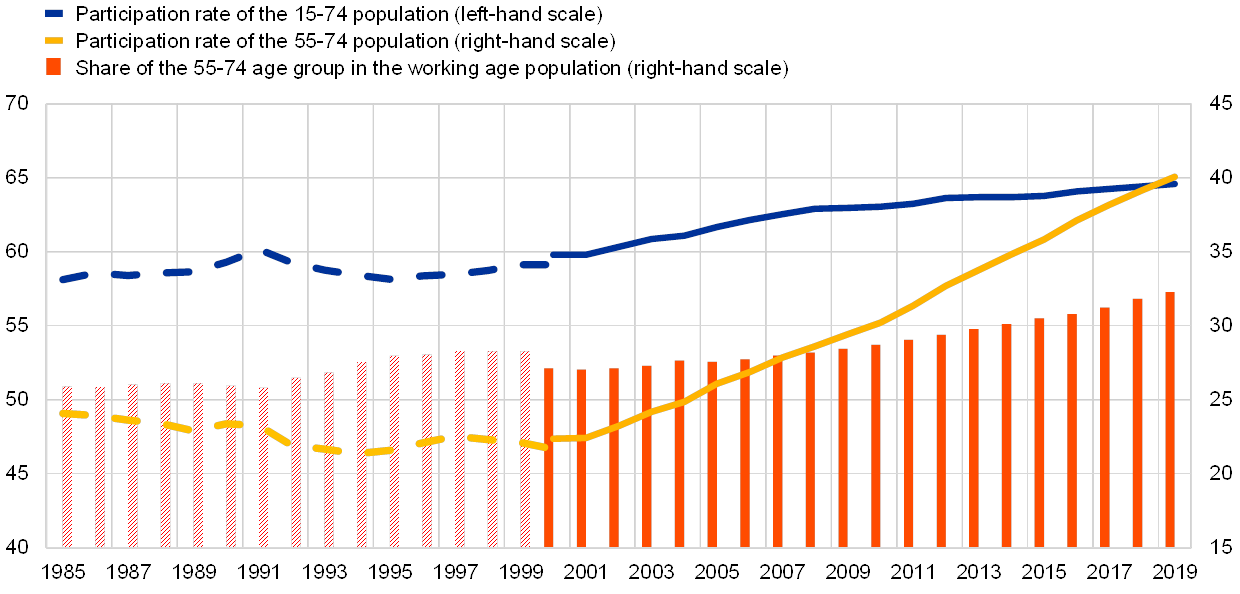

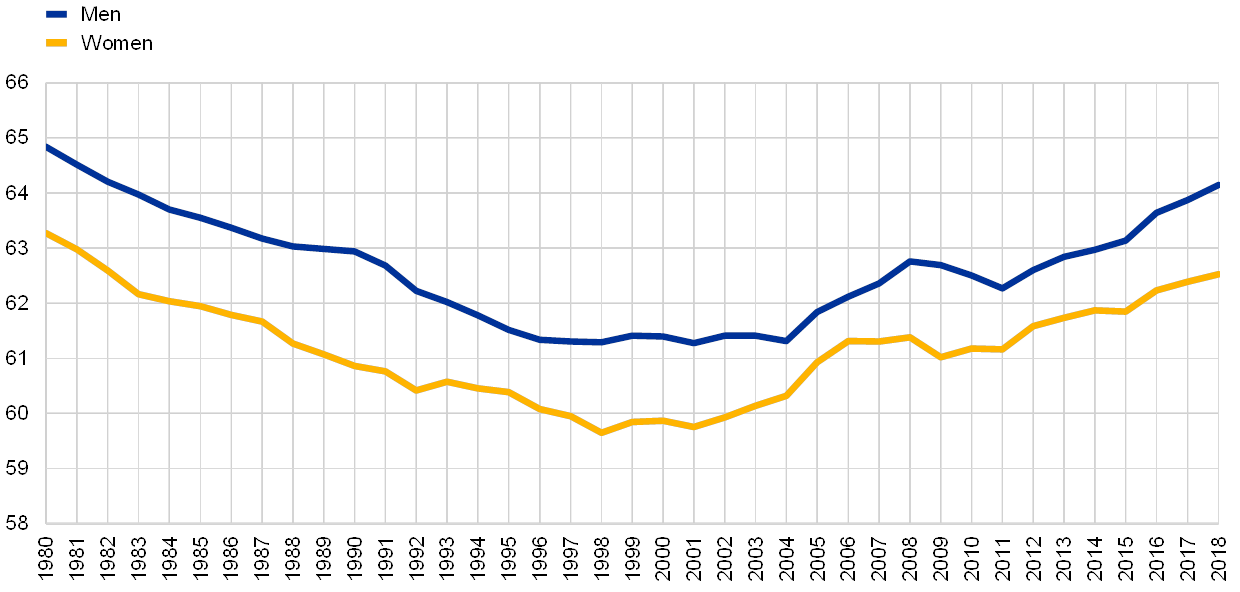

Labour force participation rates increased across euro area countries in the past two decades. In the euro area, the overall labour force participation rate of the working-age population (defined as the population aged between 15 and 74 years) increased by almost 5 percentage points in the last two decades, reaching 64.5% in 2019. This follows an earlier period where the labour force participation rate was flat overall (see Chart 1).[7] Instead, the participation rate of older workers is u-shaped because it declined until 2000 before increasing strongly between 2001 and 2019.

Chart 1

Developments of labour force participation and the population share of older workers in the euro area

(labour force participation rate: 55-74 active population as a percentage of the 55-74 population; population share: 55-74 population as a percentage share of the 15-74 population)

Source: Eurostat.

Notes: Eurostat data for the euro area as a whole are available from the year 2000 onward. The longest time series for euro area countries are available for Germany, France and Italy, starting in 1983. We have used the aggregation of data for these three countries for the period between 1983 and 1999. This is indicated by the dashed lines and columns.

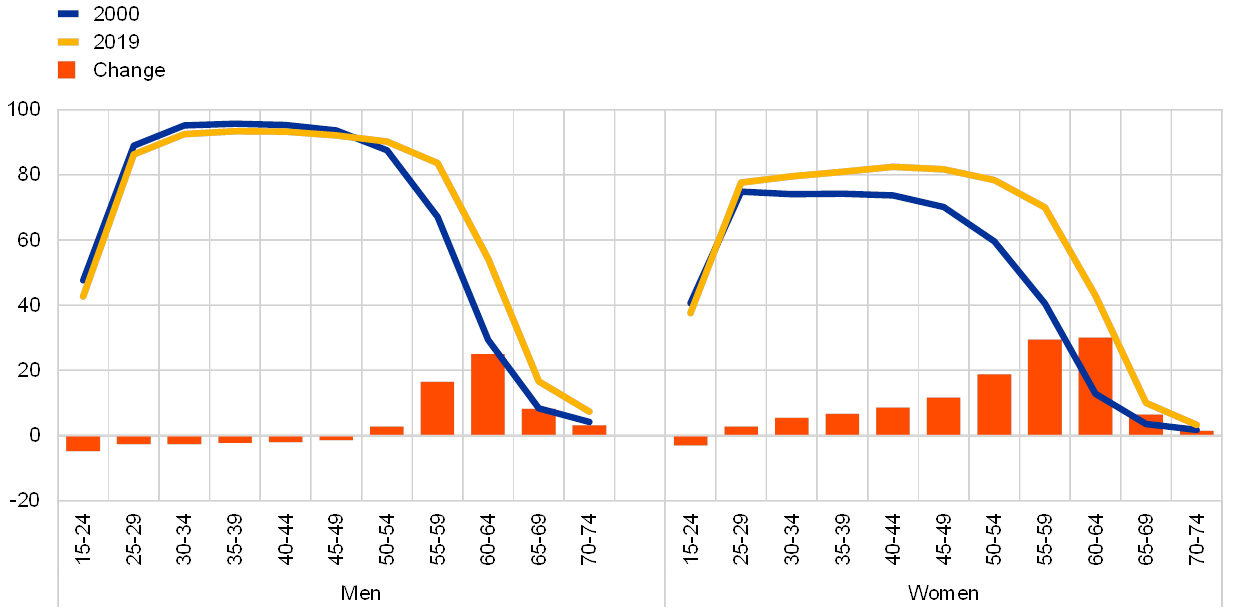

Since 2000, the labour force participation rate of older workers showed the largest increase in the euro area when compared to other age cohorts. The participation rate has been increasing for almost all age groups. In contrast, while it has been rising only modestly for those below the age of 55, and even slightly decreasing for the 15-24 age group, the participation rate has increased since 2000 by around 15 percentage points for those in the euro area aged between 55 and 74. For those aged between 55 and 64 years, the rise has been well over 20 percentage points. In 2019 most labour market withdrawals happened in the 65-69 age group, whereas they occurred in the 60-64 age group in 2000. Two decades ago 20% of the male population withdrew from the labour market when they were between the ages of 55 and 59, while 38% withdrew when aged between 60 and 64. These figures are at 7% and 30% as of 2019, respectively. A similar pattern can be observed in the female population. The participation rates of women aged between 55 and 59 years is now as high as the participation rate of those aged between 45 and 49 years two decades ago (Chart 2). These figures indicate major changes that happened in the older age cohort of the working-age population.

Chart 2

Labour force participation rate by gender and age groups in the euro area

(percentage of the respective population and percentage point changes)

Sources: Eurostat.

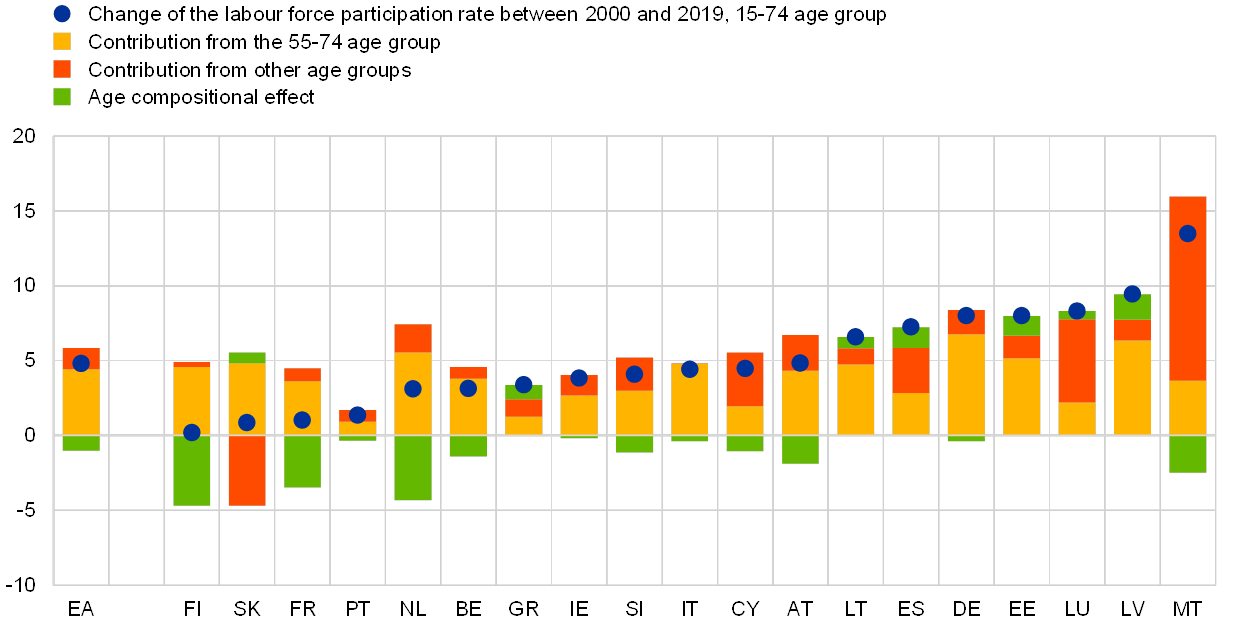

The positive contribution from the rise in the labour force participation rate of the older workers exceeded, by far, the negative impact due to population ageing. The population share of the 55-74 age group increased considerably, from about 27% in the early 1980s to 32% in 2019 (Chart 1). This increase is mainly the consequence of the baby boom generation reaching this age group. Given the generally lower participation rate of older workers compared to prime-age workers (Chart 2), this exerts a negative compositional effect on the overall participation rate. However, this has been more than compensated by the rise in the participation rate of older workers, resulting in a significant net positive overall impact. The age group with the largest increases in its labour force participation rate, i.e. those aged between 55 and 64 years, accounts for 3.8 percentage points of the overall 4.7 percentage point change observable for the entire working-age population (Chart 3).

Chart 3

Change of the overall participation rate between 2000 and 2019, and its decomposition for the euro area and euro area member countries

(percentage points)

Sources: Eurostat, ECB staff calculations.

Notes: The charts refer to the entire working-age population. The compositional effect is calculated as the difference between the actual labour force participation rate of the 15-74 age group in 2019 and the weighted average of the participation rates using the 2000 population shares as weights. Data are available for age groups comprising five-year age ranges (e.g. 25-29, 30-34, 35-39, etc.). Such five-year age groups are used here and only the age composition is taken into consideration for the calculations. The compositional effects are more negative in countries with more significant increases in the population share of the age groups with low participation rates and a larger difference in the labour force participation rate across age groups. Apart from developments in the older age groups, the share of the population weight of the youngest working-age cohorts also has an impact on this decomposition.

This pattern of older workers being the main drivers of labour force participation rate increases is evident across all euro area countries. The overall labour force participation rate has been increasing in all euro area countries in the last two decades, although to varying degrees. In most countries, a major part of the overall increase can be explained by the 55-74 age group remaining active for longer. The contribution of the rest of the working-age population remains more diverse across the euro area countries. For example, it is strongly negative in Slovakia and strongly positive in Malta. The age compositional effect tends to be negative in more than half of the euro area countries, mainly reflecting the ageing of the baby boom generation (Chart 3).

The rise of labour force participation rate of older workers is more pronounced for women. In the euro area, the recent increase in the female participation rate in the 55-74 age group (19 percentage points) exceeded that of men (15 percentage points). Still, women in this age group continue to participate in the labour market less than men (Chart 2). This is true for all euro area countries. Between 2000 and 2019, the difference between the increase in the male participation rate and the female participation rate was particularly pronounced in Latvia, Estonia, Ireland, Slovakia, Cyprus and Spain.

The increase in the participation rate is largely independent of education levels. While participation rates are usually higher for workers with higher education levels compared to low-skilled workers, the steep increase in the participation rates of older workers was observed across all education levels. At the same time, the population share of people with low education is declining (in the 55-64 age group, from 51.9% in 2000 to 33.5% in 2018 for the euro area), which means that the compositional effect according to education level contributes positively to the change in the participation rate. A shift-share analysis suggests that this compositional effect is moderate for older workers (explaining about one-fifth of the change for the 55-64 age group), while the major part of the rise in the participation rate seen in the last two decades would have happened even with unchanged education levels.

The rise of the participation rate of older workers has been a major driver of the increasing labour supply. Recent labour supply developments have been dominated by older workers: between 2000 and 2019, 98% of the increase in the overall labour supply came from those aged between 55 and 74. This mainly reflects the increasing participation rate (explaining about two-thirds of the rising labour supply of older workers) and, to a smaller degree, the rising population of this age group.[8]

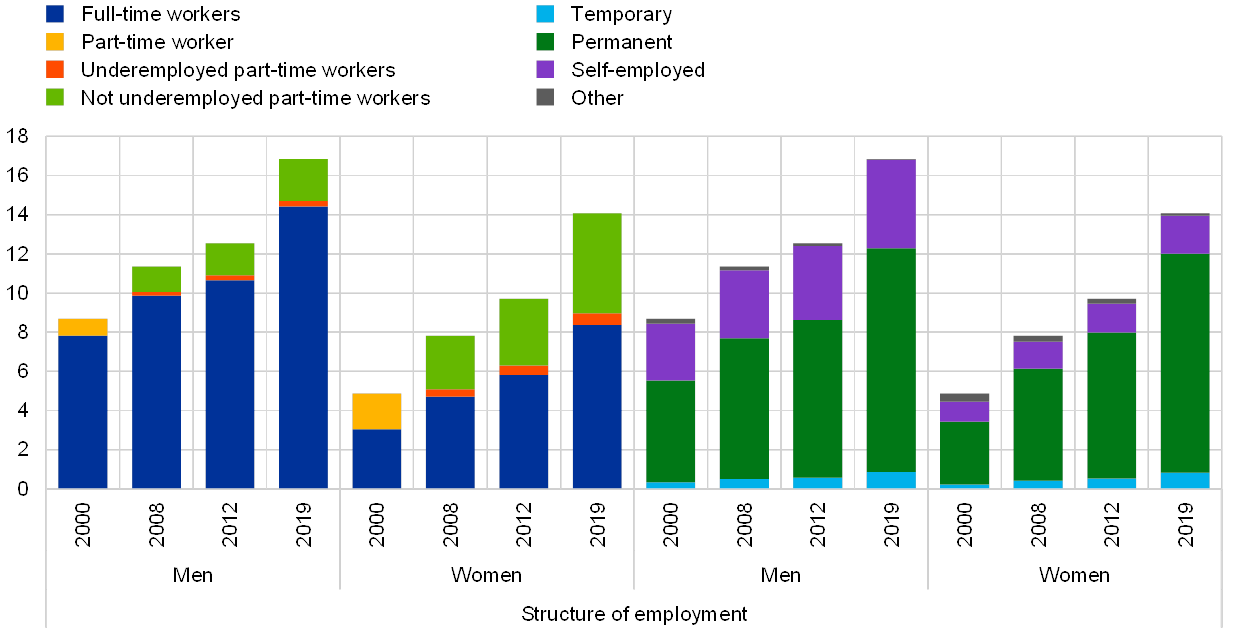

In the last two decades the rising labour force of older workers combined with a strong increase in their employment, while unemployment remained moderate. The rise of the labour force participation rate of older workers transformed almost entirely to a higher employment share (increasing by around 15 and 19 percentage points for men and women, respectively), while the number of unemployed changed only a little. Older workers are generally characterised by a lower unemployment rate than the younger cohorts, partly reflecting that often they move to inactivity in case of a loss of job.[9] However, the moderate change of the unemployment rate of older workers following the strong increases in the labour force participation rate is remarkable. This, in turn, reflects that the 55-74 age group was the main contributor to employment growth in the period examined. This does not seem to have been accompanied by a rise of potentially precarious contracts (such as temporary contracts, underemployed part-time workers, self-employed) in this age group. Indeed, most of the increase of the employment of older workers was due to permanent, full-time positions (Chart 4). Part-time employment has also increased somewhat, mainly for women, mostly in line with the preferences of older workers.

Chart 4

The number of people aged 55-74 in employment according to contract types

(millions)

Sources: Eurostat, ECB staff calculations.

Notes: In the European Union Labour Force Survey, it is possible to distinguish between part-time workers who are seeking to work more hours and those who are not. The former group is referred to as “underemployed” and the latter is referred to as “not underemployed”. The decomposition of part-time workers according to underemployed and not underemployed is not available for the period before 2008. Disaggregation of employment is available either by full-time/part-time or by permanent/temporary, but not in combination.

3 When do older workers retire?

When do older workers actually retire in the euro area? The timing of older workers exiting the labour market does not necessarily fully align with their entry into retirement. While comparable data on the actual average retirement age is not publicly available for all countries, several indicators could serve as proxy. One of them is referred to as “effective retirement age”, which corresponds to the age at which people withdraw from the labour market. It is defined by the Organisation for Economic Co-operation and Development (OECD) “as the average age of exit from the labour force during a five-year period for workers initially aged 40 and over”. The effective retirement age may well differ from the statutory retirement age, which defines the age at which people become eligible for a full pension.[10]

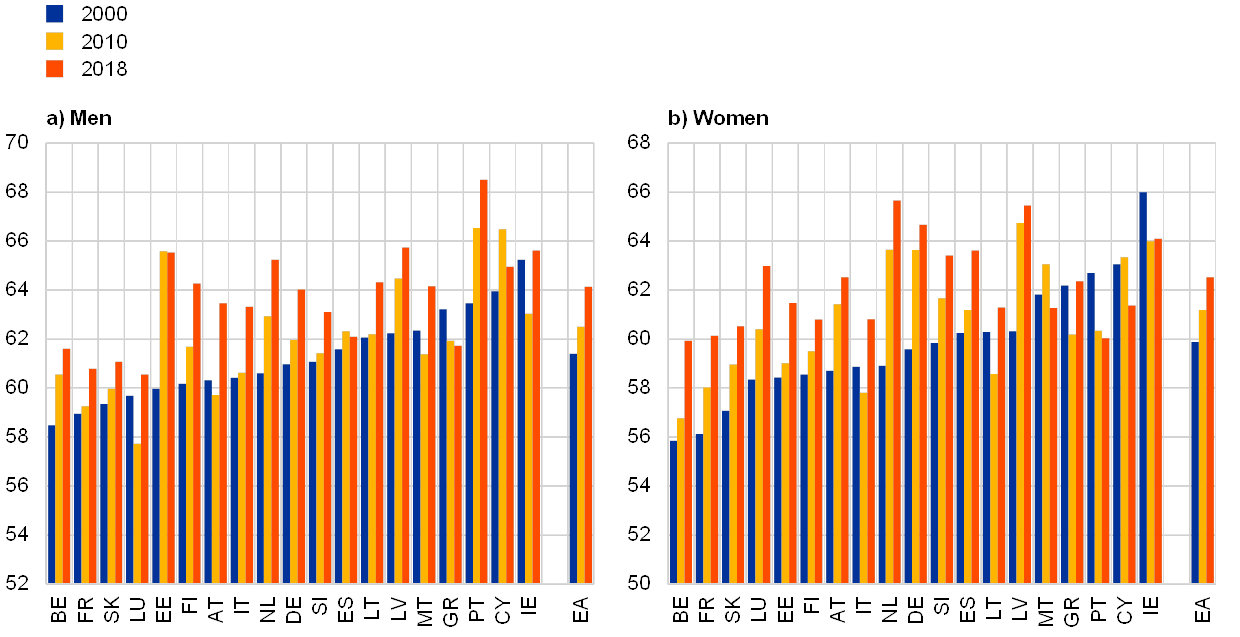

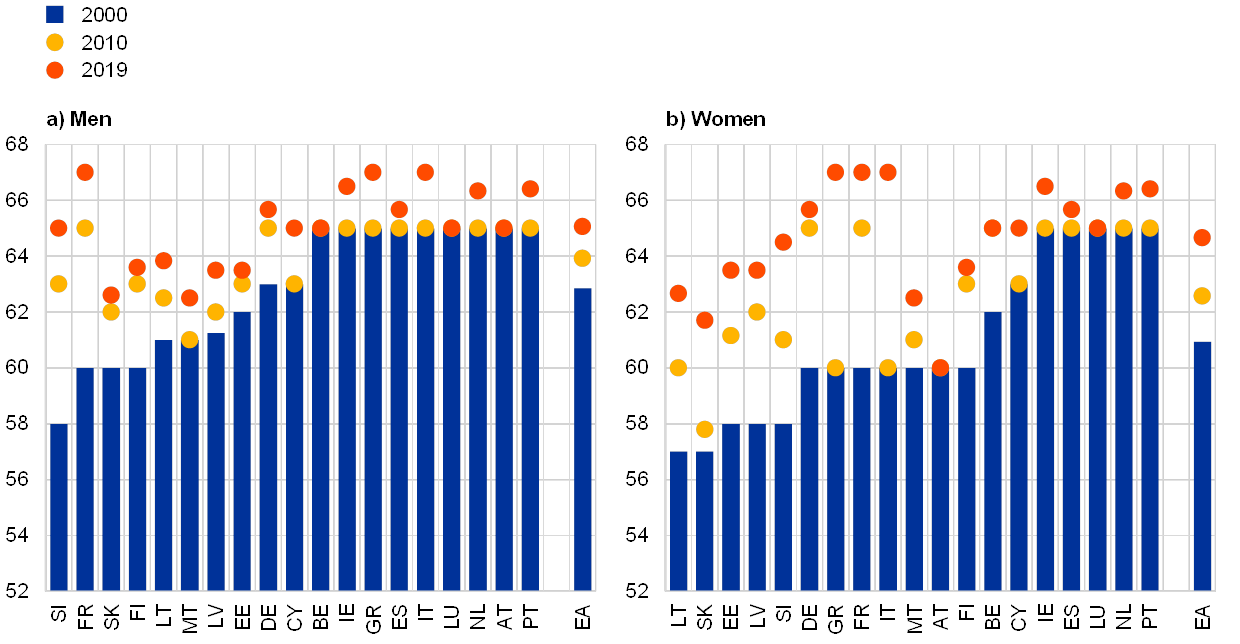

The effective retirement age has changed considerably over time and across countries – broadly in line with the dynamics of the participation rate of older workers, as shown in Chart 1. The average effective retirement age within the euro area constantly declined towards the end of the last century to a level of as low as 61 years for men and below 60 years for women (Chart 5). From 2000 onwards, the effective retirement age started to rise, even though the recovery was briefly interrupted during the financial crisis. By 2018, the effective retirement age for men stood at more than 64 years and for women at almost 63 years, which corresponds to an increase by 3 years since 2000.[11] Despite the wide-spread improvement in the effective retirement age since 2000, the changes and the current levels differ across countries (Chart 6). The highest effective retirement ages are currently seen in Estonia, Latvia, the Netherlands (only men) and Portugal. These countries also observed the strongest increases in the effective retirement age since 2000. In a few countries, however, the effective retirement age declined, partly reflecting the (lagged) impact of the financial crisis as well as in anticipation of substantial changes to (early) retirement schemes, as discussed in Section 5.

Chart 5

Effective retirement age of men and women in the euro area

(age)

Sources: OECD

Chart 6

Effective retirement age across countries

(age)

Source: OECD.

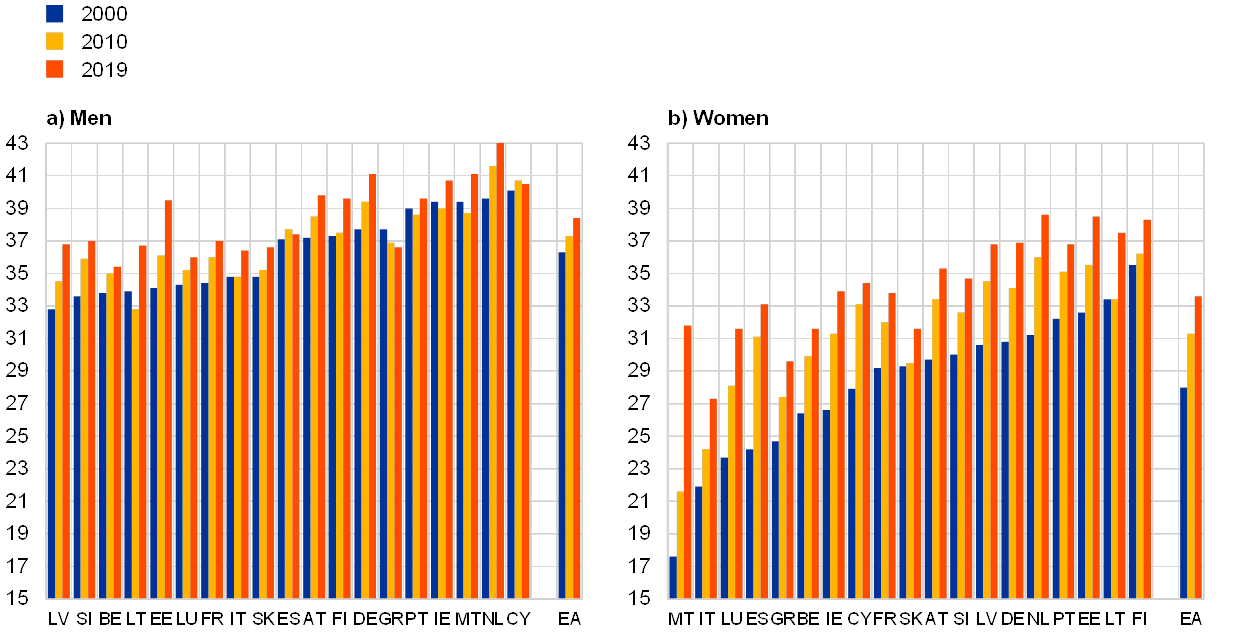

Analogous developments were observed for the duration of working careers, in particular among women. The length of working careers is another indicator for the actual retirement age. Since 2000, the duration of working life increased for men by 2 years and for women by almost 6 years, standing at almost 39 years and 33 ½ years in 2019, respectively (Charts 7). This has to be seen in the context of rising education levels, particularly for women. Women work longest in Estonia, Lithuania, the Netherlands and Finland, while the most substantial improvements since 2000 were achieved in Spain, Luxembourg and Malta. Overall, the rising duration of working careers seem to broadly coincide with the sharp rise of the participation rate of older workers.

Chart 7

Duration of working life

(years)

Source: Eurostat

4 Why do older workers remain in the labour market for a longer period of time?

From a conceptual point of view, there are many possible reasons for older workers to postpone retirement and remain in the labour market for a longer period of time. Entering retirement is a complex individual decision, influenced by many factors including the attributes of relevant labour markets, the set-up of national social security systems, peoples’ net wealth, their health status and their individual preferences. While most of these factors have changed considerably in the past two decades, the extent to which they serve to explain the steep increase in the labour force participation rate of older workers can be expected to differ.

Healthy ageing is likely to encourage longer working lives. Healthy ageing not only implies an increase in life expectancy, but also better health conditions of older cohorts, both reflecting long-term trends. Since 2000, life expectancy at age 65 in the euro area increased on average by 2 ½ years, reaching almost 21 years in 2018, with a stronger improvement for men compared to women.[12] The number of healthy years expected at older ages has also improved in many countries. Several factors might have positively affected the health of individuals, and a person’s health is an important prerequisite for older workers to stay longer in the labour force. Healthy ageing might be positively influenced by higher educational levels, as life expectancy is found to be higher for people with higher education.[13]

Structural changes of labour markets, labour market policies and cyclical labour demand have supported the improvement of the labour market situation for older workers. While labour demand has likely contributed to the improvement seen before the financial crisis and during the euro area recovery (between early 2013 and end-2019), the increase in the participation rate of older workers does not seem to have been strongly distorted by cyclical developments. At the same time, structural changes in the labour markets – for example a rising share of jobs in the service sector – has likely supported longer working careers due to higher overall labour demand and by offering physically less demanding working conditions than manufacturing and construction. In addition, several labour market reforms have influenced the labour market for older workers – these are summarised in Box 1.

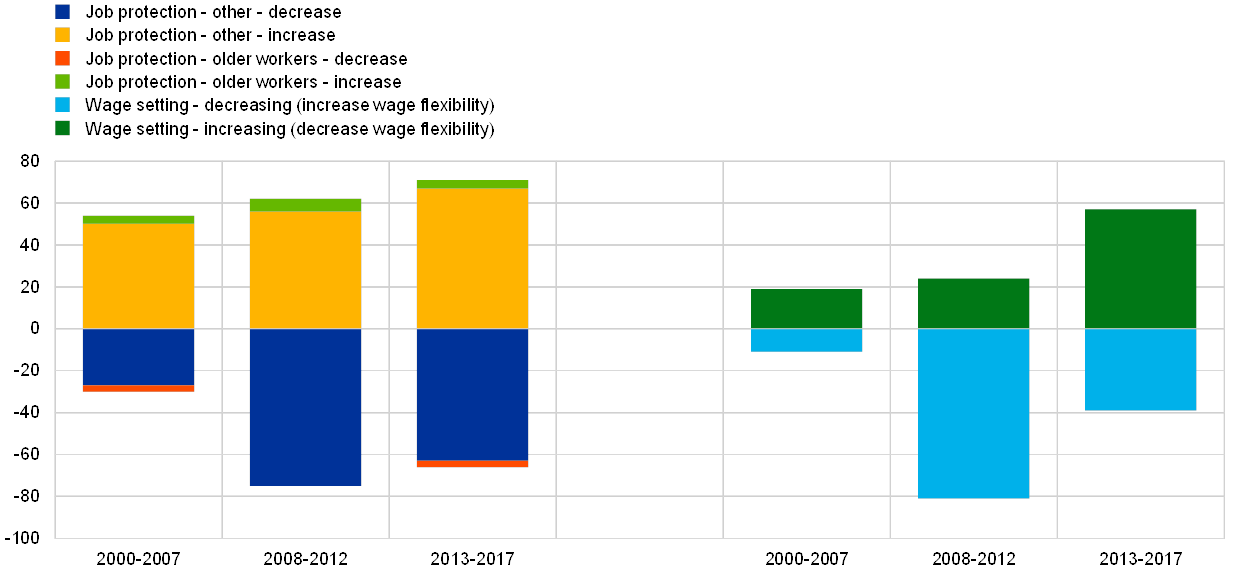

Box 1 Labour market reforms and their impact on older workers

Apart from pension reforms, labour market reforms can influence the labour market for older workers. Some of these reforms are specifically tailored towards older workers. Others affect all workers but may have a higher impact on those that are less strongly attached to the labour market in terms of their labour force participation rate, including older workers. This box gives an overview of labour market reforms that have likely affected the labour market for older workers in the euro area during the last two decades.

The position of older workers in the labour market is characterised by an important duality. On the one hand, the share of older workers who hold permanent positions is higher than that of younger workers, thus older workers are more protected once in employment. On the other hand, older workers may be in less favourable positions than younger workers when searching for a job, due to, among other things, age discrimination. The latter feature may also reflect a lower educational level on average for older workers compared to younger workers.[14] With this in mind, ensuring the employability of older workers is an important labour market policy objective.

Reforms affecting alternative pathways to retirement

Conditions of alternative pathways to early retirement, such as unemployment or disability benefits, are likely to affect the labour supply of older people. Several European countries introduced specific conditions for unemployment benefits for older workers in the 1980s, for example by providing a longer duration of unemployment benefits or by removing the requirement that recipients look for a job while receiving unemployment benefits. These changes contributed to the rise of long-term unemployment for older workers (or, in cases where those out of work were not searching for a job, a rise in “inactivity” as defined in the International Labour Organisation’s labour market statistics). [15] In the late 1990s until the early 2000s, these schemes were tightened in several countries.[16] In terms of reducing long-term unemployment among older people, Germany stands out: the long-term unemployment rate of the 55-64 age group declined from almost 9% in 2006 to 1% in 2019. This decline followed the Hartz reforms, which included a large set of reform measures, including tightening unemployment benefits for older workers, but also other reforms supporting retention and job searches. Finland also seems to have been successful in decreasing the long-term unemployment rate of older workers, following the tightening of the unemployment benefit criteria for older workers in 1997.[17]

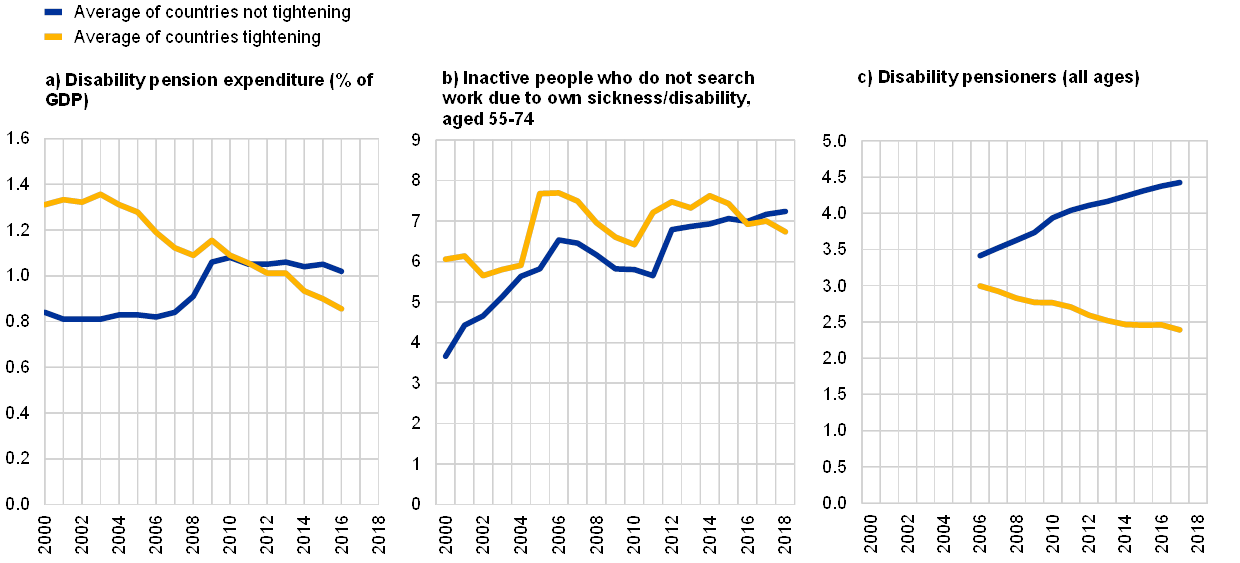

Social safety nets provide insurance against the risk of becoming disabled and support those people whose working capacity becomes limited. However, these schemes may serve as alternative pathways to retirement, even for those whose working capacity is not entirely damaged. In the euro area, disability pension schemes were tightened between 2000 and 2018 in about half of the euro area countries (Chart A).[18] This was implemented either by tightening the eligibility criteria for obtaining a disability pension or by decreasing the generosity of their disability pension system. The number of disability pensioners (of all ages) declined in the countries that tightened their disability schemes, as can be seen in Chart A, panel c. However, in the 55-74 age group, the population share of those who are inactive due to their own sickness or disability has not declined (see Chart A, panel b), suggesting that the tightening of disability schemes could have affected other generations than those in the above 55 year age bracket.

Chart A

Disability pensioners, aged 55-74, who are inactive due to own sickness/disability, according to the tightening of the disability schemes

Source: Eurostat, own computations

Notes: When grouping the countries, the change in disability pension as a percentage of GDP between 2000 and 2016 was taken into account. If, instead, averages from 2012-2016 and 2000-2004 are used for the calculation of the change, the classification remains unchanged. Tightening countries are: Germany, Cyprus, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia and Finland.

Policies directly supporting the employment of older workers

Measures that affect retention on the one hand and promote the employability and productivity of older workers on the other hand are also important in boosting the participation rate. Such reforms may include wage subsidies for older workers, stronger job protection and more flexible working times, which are complemented by information measures targeted at employers (such as campaigns to increase awareness about the benefits of age diversification and campaigns against the discrimination towards older workers).[19] For example, in Germany, wage subsidies in the form of in-work benefits and temporary wage subsidies have been paid since 2003 for older workers. In Luxembourg, a 2014 reform made it possible for workers over the age of 50 to go part-time and for the employers to ask for subsidies in case another worker is hired to make up for the missing hours.

Impact of general labour market reforms on older workers

Recent reforms in euro area countries point to somewhat less stringent employment protection legislation (EPL) and more wage flexibility for the labour markets as a whole. Higher EPL tends to support the employment ratio of older workers.[20] While overall decreasing employment protection may have been unfavourable for older workers, data from the Labour Market Reform (LABREF) database suggests that the overall change of EPL may have been less tilted to flexibility for older workers than for others (see Chart B, left panel). The role of wage flexibility may be less clear-cut. Wage rigidity influences the degree to which employment reacts to macroeconomic shocks. Most of the recent labour market reforms aimed at increasing overall wage flexibility in euro area countries have primarily affected incumbents, thus implicitly having a potentially larger impact on older workers than younger ones (see Chart B, right panel). This may have contributed to increased hiring of older workers, or to keeping them in employment. However, the exact role of increasing wage flexibility in the context of older workers’ employment remains unclear.

Chart B

Labour market reforms affecting the level of employment protection and wage setting in the euro area countries

(number of reform measures per year)

Source: European Commission, LABREF database

Reforms of different forms of non-standard employment may also affect the labour market for older workers more than for other groups. For example, the Hartz reforms introduced subsidised “marginal” jobs (“mini” and “midi”-jobs) in Germany, increasing work incentives for those in early retirement.[21] Furthermore, labour market reforms tailored towards self-employed people (for example in Italy) may affect older people to a larger extent than younger people because the share of self-employment in total employment increases with age.

Overall, several labour market reforms, both those tailored towards older people and more general ones, affected the labour market for older workers in the euro area. With the ageing of the working-age population, reforms that support the labour supply, labour demand, employability and productivity of older workers will remain important on the reform agenda of euro area countries.

The characteristics of pension schemes are important determinants of the retirement behaviour of older workers. Pension schemes provide for a range of circumstances, from old-age pensions to disability pensions, and can be designed in different ways, from public pensions to occupational pensions, and from pay-as-you-go systems to fully funded private systems. With respect to old-age pensions, including early retirement schemes, age eligibility parameters for pensions are a decisive factor in determining the participation rate of older workers. Statutory and early pension ages may serve either as constraints, after which working is not possible,[22] or at least as an indicator of when to retire. Moreover, incentives to stay in the labour market for a longer period are seen to be negatively correlated with the generosity of pension payments. In case pension entitlements are cut, for example by raising the malus applied in case of early retirement, this is likely to encourage prolonged working lives. This also has to be seen against comfortable net wealth positions of households in retirement on average (see Box 2). In addition, moving to actuarially fairer adjustments for delayed retirement, for example in the form of a bonus, can be expected to have a positive impact on the duration of working lives. Furthermore, more flexible pension arrangements which allow combining work and retirement are expected to positively affect the decision to postpone retirement. In case of more restricted access to programmes that offer alternative pathways out of the labour market, such as disability pensions (see Box 1), this might also encourage old-age workers to retire later.

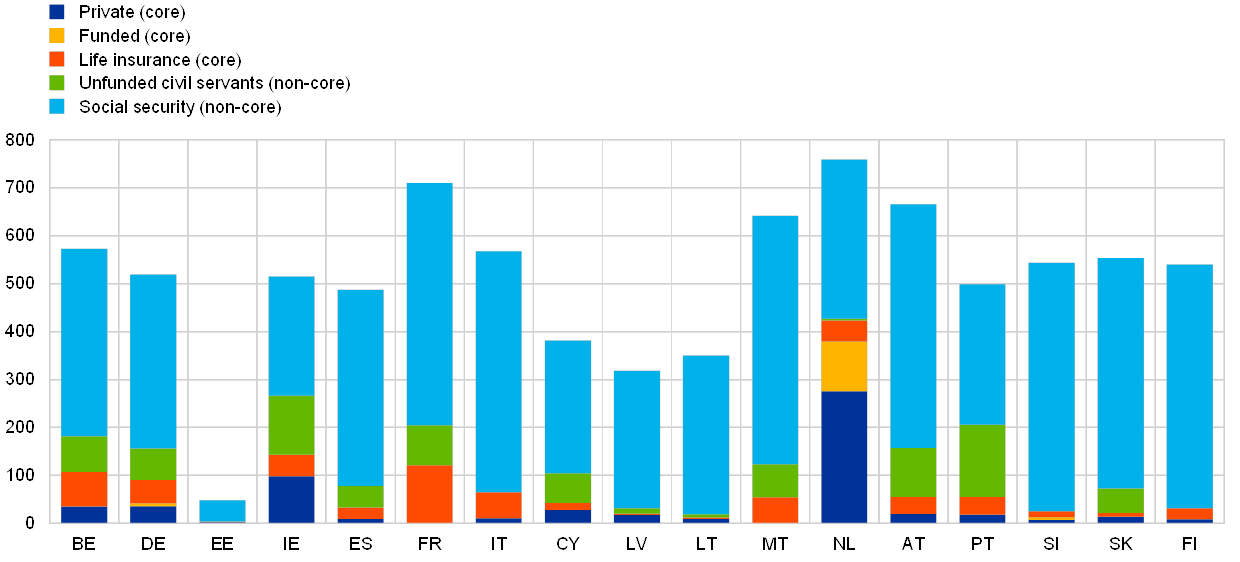

Box 2 Net wealth of households in retirement in the euro area

This box reviews the concept of net wealth of households in the euro area, with a focus on pension-related wealth at retirement age. Individual retirement decisions are partly based on expectations of welfare levels in retirement. Wealth accumulation[23] is an important factor for mitigating any potential decrease in labour and pension income at a later stage in life (e.g. as a consequence of future pension reforms).

Household “net” wealth is the value of wealth (total assets broken down by financial and non-financial) held by households netted out by the value of outstanding debt liabilities. Overall, the average stock of household net wealth increased notably at the euro area level from around 550% of annual household gross disposable income (GDI) in 2002 to around 710% in 2019.[24] The net wealth trajectories are heterogeneous across countries reflecting different starting positions, societal preferences, and tax and savings policies.[25] Based on sectoral accounts, household wealth by end-2019 was broadly composed of housing wealth (around 460% of GDI), financial wealth (350%) and, with opposite sign, debt liabilities (100%). The main financial assets held by households are liquid assets (currency and deposits) and voluntary pension and life insurance, followed by debt securities and equity.

Pension entitlements add to financial wealth but the way they are recorded deserves particular attention because future pension entitlements are difficult to capture statistically yet they represent a major source of financial wealth. Chart A provides an indication of the maximum potential household pension wealth. This combines all pension assets recorded in the financial wealth as above (core national accounts) and the contingent pension entitlements of households vis-à-vis governments (non-core).[26] This augmented concept of household pension wealth leads to larger estimates of pension wealth, at approximately three to six times of annual household GDI for most euro area countries. This augmented concept captures the substantial additional pension wealth in the countries where pension schemes are predominantly organised as social security pensions, such as in Belgium, Germany, Spain, France, Italy or Finland. It is also particularly relevant in countries with a predominance of unfunded (defined benefit) schemes, such as in Portugal, or Malta, which are managed by the Government but recorded outside the core government sector accounts. By contrast, funded employment-related pension schemes (whether managed privately or by the Government), which are very important, e.g. in the Netherlands, they are already reflected in the core accounts. Voluntary pension assets tend to be important in countries where the Government encourages such saving schemes, such as in France, Malta, Italy, Ireland, Germany or Belgium.

Chart A

Augmented household pension wealth in euro area countries

(percentage of household Gross Disposable Income, 2015 data)

Sources: ECB and Eurostat. Accrued-to-date pension entitlements data for Greece and Luxembourg have not yet been published.

Notes: The household financial wealth calculations (in the core national accounts) recognise all employment-related pension schemes to households, whether funded or not, plus the voluntary life insurance (in the graph this is represented by red+yellow+green). It includes both privately managed schemes (including pension funds and insurers) and the funded schemes operated by the Government as an employer. The contingent pension entitlements that are not included in the core national accounts, but are included in the augmented household pension wealth in this Chart, are the social security pension schemes (dark blue) and the unfunded government (defined benefit) schemes for government employees (light blue).

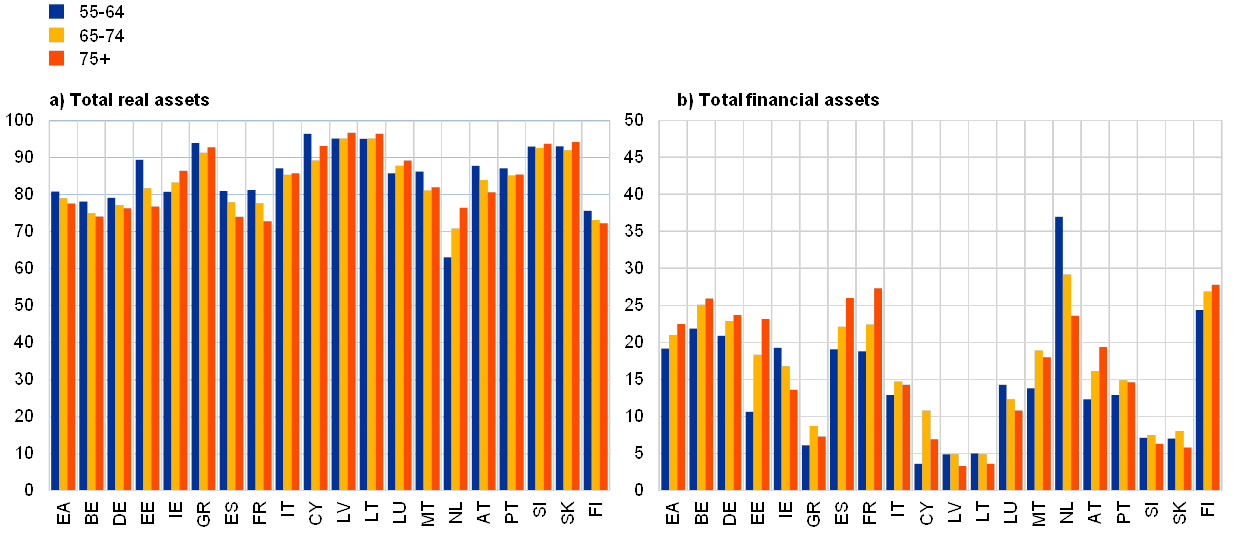

The composition of household net wealth also varies significantly as a function of the household age according to survey data.[27] Regarding housing wealth, Chart B shows that households tend to disinvest at 75 years and above (left). By contrast, the picture for financial wealth (right) indicates the opposite trend, with older households continuing to accumulate financial assets into old age. The main exceptions are Ireland and the Netherlands where households invest more in real assets when ageing.

Chart B

Household holding of total assets by country, breakdown by household total real assets (left) and total financial assets (right)

(percentage of households by age range, 2017 data)

Sources: HFCS (2020) and author calculations. The sum of total real assets (left) and total financial assets (right) equals total assets (100%).

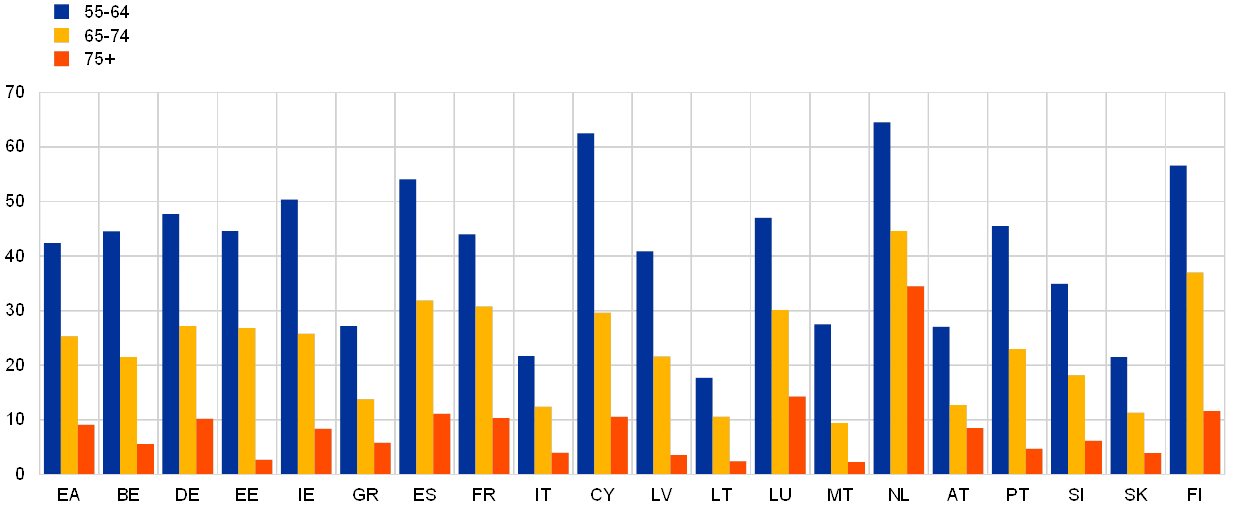

Finally, regarding the debt dimension of the net wealth concept, Chart C, below, shows the household participation rates in total debt. There is a strongly negative relationship between age and the percentage of indebted households, as older households tend to clearly reduce their mortgage debt. Also the dynamics of the median debt-to-asset ratio in the euro area shows that it decreases for those households during retirement age (from 8.5% for those aged 65-74 to 5.6% for those aged 75 and older).

Chart C

Household holding of total debt liabilities by country

(percentage of households by age range, 2017 data)

Sources: HFCS (2020) and author calculations.

Against this background, pension reforms can be expected to play a key role in the changes in the participation rate of older workers. While better health conditions, rising education, and more favourable labour market conditions are expected to support a higher labour participation rate of older workers, these common long-term trend factors alone are not able to explain the recent increase in the participation rate and its large variation across countries. This shifts the focus on to how pension reforms might have affected the old-age participation rate.

5 Recent pension reforms across euro area countries and their labour market impact

While all euro area countries adopted pension reform measures during the past two decades, they varied across countries in terms of intensity and frequency. The pension reforms comprised in particular increases in the statutory retirement age, more flexible retirement arrangements to combine work and retirement, financial incentives for prolonging working lives beyond the statutory retirement age, less generous (early) retirement schemes and stricter eligibility criteria for early retirement for instance due to more required contributory years.[28] The pension reforms implemented in the last decade were particularly substantial in countries subject to adjustment programmes, such as Greece, Spain, Cyprus and Portugal.

Pension reforms are important not only for fiscal sustainability but also for labour supply. Population ageing is placing upward pressure on mostly already elevated levels of age-related public spending, including old-age pension expenditures.[29] The recently adopted pension reforms have helped to strengthen the robustness of the countries’ public pension systems in view of population ageing and to contain long-term fiscal sustainability risks.[30] Moreover, pension reforms are seen as an important factor of prolonged working lives.

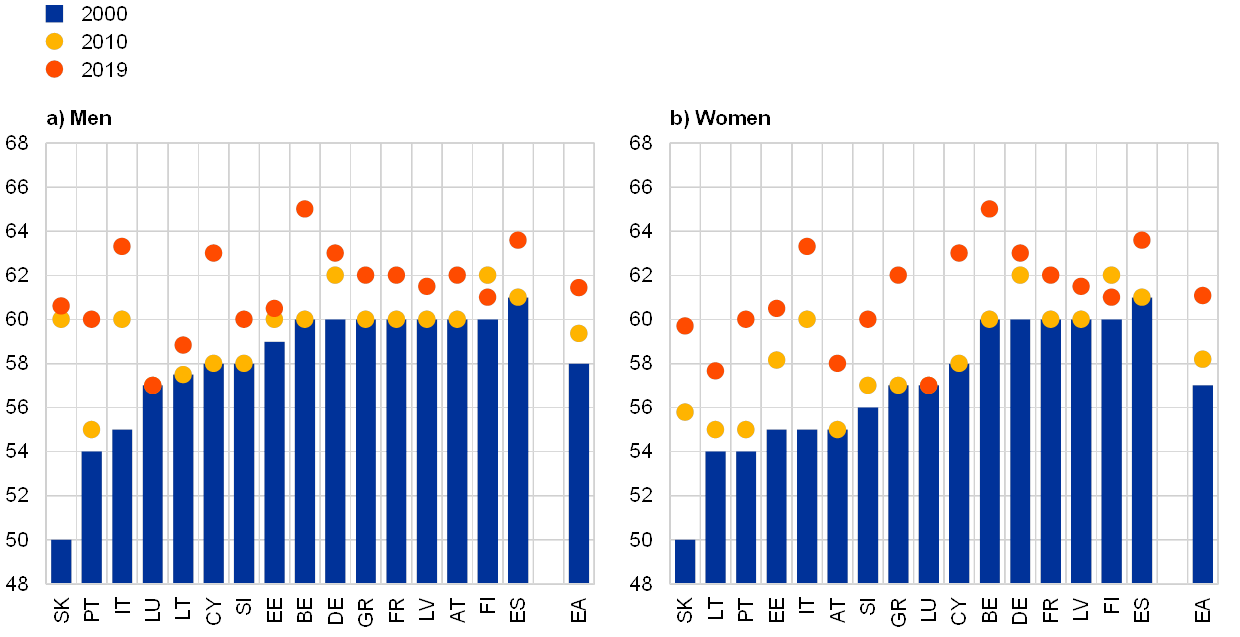

Statutory retirement ages have been raised in almost all euro area countries. Since 2000, the age limits for receiving a full pension increased by on average more than two years for men and almost four years for women in the euro area countries (Chart 8). Increases of 5 years or more were implemented in two countries, France and Slovenia, both for men and women, and in six countries, namely Germany, Estonia, Italy, Greece, Latvia and Lithuania, only for women. The generally more pronounced increase of eligibility ages for women reflects a common trend in Europe towards equalising the retirement ages of men and women. Only a few countries, namely Belgium (only men), Luxembourg and Austria, left the eligibility age unchanged during the past two decades. Most countries have also restricted access to old-age pension payments by making them contingent on a higher number of contribution years, which is particularly relevant for the sustainability of predominately defined benefit schemes. The trend of rising statutory retirement ages is expected to continue, as several countries decided to automatically link the retirement age to changes in life expectancy.

Chart 8

Statutory retirement age

(age year)

Source: National sources and own calculations.

Stricter eligibility criteria for statutory pensions were often complemented by restrictions on early retirement. All euro area countries, except Ireland and the Netherlands, have early retirement schemes in place.[31] Some countries even operate several early retirement schemes in parallel which target specific groups of workers. Most early retirement schemes entail deductions to allow for more actuarial fairness. Since 2000, the early retirement age limit was raised on average by 3 ½ years for men and by more than 4 years for women, reaching around 61 years for both men and women in 2019 (Chart 9). Some countries, mainly those that implemented an automatic link between retirement age and changes in life expectancy, also broadened this instrument to their early retirement schemes. In addition, six euro area countries (Belgium, Germany, Greece, Spain, France and Austria) allow receipt of full pension without any deductions before reaching the statutory retirement age. However, entitlements are usually made conditional on specific criteria, such as long working careers. Since 2000, these requirements were significantly increased to currently around 40 contributory years or more. By requiring very long working careers, such early retirement schemes have implicitly become predominantly tailored towards workers with earlier career starts and lower educational levels.

Chart 9

Early retirement age

(age year)

Source: National sources and own calculations.

Notes: Ireland and the Netherlands do not have an early retirement scheme. No data available for Malta. While some countries have several early retirement schemes in place, only one scheme is shown here.

Most countries have embedded in their pension schemes some (financial) incentives for older workers to prolong their working careers. To incentivise older workers to stay in the labour market for a longer period, sometimes even beyond the statutory retirement age, several countries tuned their pension systems in the past two decades by more strongly rewarding delayed retirement or by allowing retirees to continue working (Chart 10). However, the concrete set-up of these measures is very country-specific. Financial incentives are mostly provided in the form of a pension bonus for delayed retirement and through age-dependent tax credits for older workers. Some countries allow older workers to claim pension payments while working up to a certain age limit, while others do not set any upper boundary. Against the background of generally rising statutory retirement ages, these measures have also been increasingly affecting the participation rate of age cohorts beyond 65 years.

Chart 10

Different incentivising policies to prolong working careers

(number of countries)

Sources: National sources and own calculations.

Notes: The Chart shows the number of countries with incentivising policies in place in 2000, 2010 and 2019. The bar on “flexibility” subsumes the number of euro area countries that have policies in place that allow combining work and retirement, while “bonus” refers to the number of countries that pay a pension bonus for delayed retirement.

Reducing the generosity of pension benefits can be expected to encourage older workers to retire later. Many euro area countries reduced the generosity of their public pension systems mainly with the aim of improving the financial sustainability of their pension schemes. Older workers might postpone their retirement date to compensate for the pension shortfall, which might have a positive side effect on the participation rate. In the euro area, pension entitlements were cut through various means, such as by lowering the accrual rate by which pensionable earnings are transferred into pension entitlements; by calculating the reference wage for pension payments on the basis of a full career rather than a subset of best years which usually imply higher salaries; and by strengthening the indexation of pensions to inflation developments rather than wage developments.[32] Moreover, several countries raised the pension tax rates and made early retirement financially less attractive by increasing penalties for early retirement.

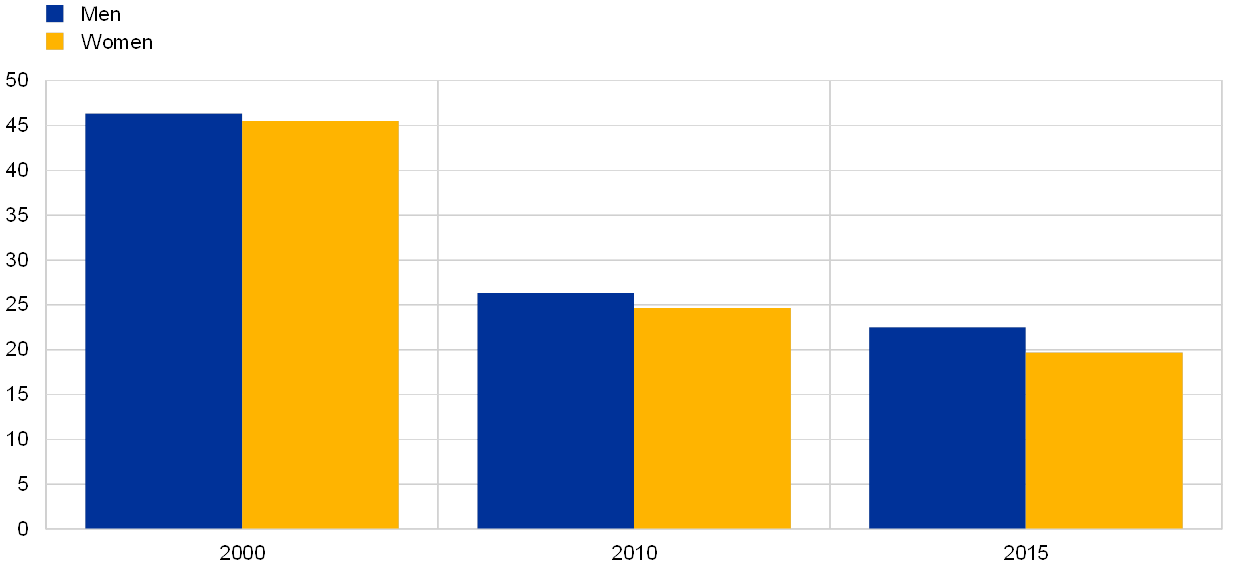

All these pension reforms can be expected to incentivise older workers to delay their retirement decision. The reform impact can be captured by the implicit tax rate of working one year longer, which reflects the changes in the present value of the future stream of pension benefits of a standardised worker in comparison to the additional earnings gained by working one year longer.[33] A high positive value of the implicit tax rate for working longer reveals incentives for retiring earlier, while a negative value can be considered to be a kind of subsidy for working longer – this is because the additional earnings from working one year longer exceed the shortfall in the present value of pension benefits. The value of the implicit tax rate depends on the underlying parameters of the respective pension scheme and therefore varies across country, age cohort and time. For example, in the case of an early retirement scheme, the implicit tax rate tends to increase in the year before reaching the earliest age at which one is eligible for early retirement, while flattening somewhat thereafter. Pension reforms that affect the generosity of the pension system and postpone the retirement age are expected to result in a lower implicit tax rate. The few available studies on euro area countries suggest an overall decline of the implicit tax rate for both men and women. In fact, a recent study shows that the implicit tax rate for workers at age 62 more than halved for a group of euro area countries, from above 45% on average in 2000 to around 20% in 2015, notwithstanding large cross-country differences.[34]

Chart 11

Implicit tax rate of prolonging working life

(percentage points)

Sources: Börsch-Supan and Coile (2020), own calculations.

Notes: The data shown represents the implicit tax rate for working longer for an average worker at the age of 62 years, as calculated in Börsch-Supan and Coile (2020). It is the unweighted average of the six euro area countries, for which data are available, which comprise Belgium, Germany, Spain, France, Italy and the Netherlands.

The implicit tax rate for working longer seems to be negatively correlated with the participation rate of older workers, as also confirmed in the literature. A decline in the implicit tax rate as a result of pension reforms can be seen as an indication that older workers postpone their entry into retirement. The positive effect of pension reforms on incentives to participate in the labour market for longer has been broadly confirmed in several studies. They find evidence that people react to changes in financial incentives (such as early retirement deductions, but also lifetime income and wealth effects) as well as to changes in the statutory pension age.[35] Moreover, recent research has shown a statistically significant negative correlation between the implicit tax rate and the employment rate across several advanced countries, including six euro area countries.[36] Pension reforms, in particular those restricting access to early retirement schemes, are found to have played a major role in driving up the employment rate of older people. In fact, based on pooled panel regressions, the results suggest an increase in the employment rate of older workers (at an average early retirement age of 62 years) by 6.7 percentage points for men and 4.6 percentage points for women in the case of a decline in the implicit tax rate (from 100% to zero). At the statutory retirement age, the positive impact on the employment rate is estimated to stand at 1.8 percentage points. These findings are broadly in line with other studies.[37]

At the same time, disentangling the impact of pension reforms on the labour force participation rate across countries is far from trivial. First, pension schemes and the amount and scope of pension reforms differ considerably across countries, while the specific features of reforms are important with respect to their concrete impact on labour supply. Second, considerable variation exists with respect to the date pension reforms were adopted and the time period between announcement and implementation of reforms. In particular, long implementation delays have been found to have macroeconomic effects, not at least as people try to advance retirement to still benefit from the old regime.[38] Third, the pace of reform implementation varied across countries. In some countries, such as Germany, certain pension reform elements were implemented very gradually, while in others, such as Italy, the increase in the statutory retirement age was implemented rather abruptly. This has implications for when the participation rate of older workers will be affected.

Furthermore, pension reform reversals may have adverse implications for labour supply. More recently, several countries are contemplating whether to reverse previously adopted pension reforms, in view of rising political pressure. In a few countries, such steps have indeed already been decided. However, as recent research has shown, undoing past pension reforms would not only pose challenges for fiscal sustainability, but would also generate substantial adverse macroeconomic costs, including for the labour supply.[39] Thus, if this trend of reform reversals continues, it is likely to result in a declining participation rate of older workers.

6 Conclusions

This article argues that several factors played a role in the considerable increase in the labour force participation rate of older workers during the past two decades. The participation rate of older workers increased particularly strongly among women, although they were starting from a lower level than men. Various factors can determine the participation rate of older workers. Deciding on when to enter retirement is a complex choice, influenced by many factors, including: the labour market situation; the set-up of the social security systems; a person’s health status; their net wealth and its expected evolution; and their individual preferences. While many of these factors have changed considerably over time, most of them are long-term trends, such as better health conditions, rising life expectancy and higher educational levels, and therefore cannot explain the steep increase in the participation rate since 2000. In turn, pension reforms seem to have played a decisive role in driving the participation rate up. They comprise increases in the statutory retirement age, more flexible retirement arrangements to combine work and retirement, financial incentives for prolonging working lives beyond the statutory retirement age, less generous (early) retirement schemes and stricter eligibility criteria for retiring earlier, for instance due to an increase in the contributory years required.

Looking ahead, various factors will play a role in driving the labour force participation rate of older workers in future years, with the overall impact being unclear. First, the latest population projections suggest that the relative share of the cohort of older workers will shrink somewhat, once the baby boom generation has entered retirement. This would drive the overall participation rate up by itself, all other things being equal. Moreover, to further contain fiscal sustainability risks related to population ageing, governments would need to pursue further pension reforms with a potentially positive impact on the labour force participation rate of older workers. However, if the recent trend of pension reform reversals were to continue, this is likely to have an adverse impact on the labour force participation rate of older workers. Finally, in the shorter term all these effects are likely to be dominated by the impact of the COVID-19 pandemic and the severe macroeconomic implications, including on the labour market. The experience from past severe macroeconomic shocks suggests that the labour force participation rate of older workers is likely to be negatively affected, unless mitigated by policy intervention.

- For more details, see the article entitled “The economic impact of population ageing and pension reforms”, Economic Bulletin, Issue 2, ECB, 2018, and the article entitled “Labour supply and employment growth”, Economic Bulletin, Issue 1, ECB, 2018.

- In 2019, the labour force participation rate of the 15-54 age group stood at around 76%, compared to around 40% for those aged 55-74.

- See the box entitled “Recent developments in euro area labour supply”, Economic Bulletin, Issue 6, ECB, 2017.

- See “All in it together? The experience of different labour market groups following the crisis”, in OECD Employment Outlook, OECD Publishing, 2013, pp. 19-63.

- See the Box "A preliminary assessment of the COVID-19 pandemic on the euro area labour market" in this issue

- See “Comparisons and contrasts of the impact of the crisis on euro area labour markets”, Occasional Paper Series, No 159, ECB, 2015.

- Source: OECD statistics.

- The labour force of older workers has also increased in the United States (driven by demographic developments) while the participation rate of the older age group has been relatively stable, following a rise until 2008. In Japan, the labour force of those above the age of 55 has also been increasing. This reflects both the rising population of this age group and the rise of the labour force participation rate. In 2019 the labour force participation rate of the 55-64 age group was 65% in the United States and 78% in Japan, which compares to 63.6% in the euro area. Source: Eurostat, Haver, U.S. Bureau of Labor Statistics.

- Due to this difference, the rising population share of older workers exerted a downward compositional impact on the unemployment rate. Without this negative compositional effect between 2000 and 2019, the unemployment rate of the 15-74 age group would have been 0.6 percentage points higher in 2019 (using the composition of the labour force and unemployment rates by five-year age group and gender). This calculation is based on taking the age-specific unemployment rates as given. However, due to the endogeneity between labour demand and labour supply, the age-specific unemployment rates would be different at a different labour supply path. Without the aging of the baby boom generation, labour demand would have likely developed differently during this period. For age-specific unemployment rates, see “Labour supply and employment growth” op. cit.

- The effective retirement age has some drawbacks as an indicator. It is a lagged indicator, based on a five-year period. As it is partly driven by cyclical developments, its usefulness is limited for countries particularly strongly affected by the financial crisis, such as Greece and Spain. Moreover, the indicator does not enable differentiating between whether an exit from the labour market is due to entry into retirement and other reasons (such as a disability pension or caring for family members). Furthermore it does not capture part-time working arrangements among older workers.

- This compares to the significantly higher effective retirement ages of men and women in 2018 in the United States (of almost 68 and 66.5 years, respectively) and in Japan (of almost 71 and 69 years, respectively).

- The data are based on Eurostat statistics and calculated as a weighted average of the euro area countries, using total population as weights.

- See, for example Blundell, R. et al., “Chapter 8 – Retirement Incentives and Labour Supply” in Piggott, J. and Woodland, A. (eds.), Handbook of the Economics of Population Aging, Vol. 1B, Elsevier, 2016, pp. 457-566., and Murtin, F., Mackenbach, J., Jasilionis, D. and d’Ercole, M. M. (2017), "Inequalities in longevity by education in OECD countries: Insights from new OECD estimates", OECD Statistics Working Papers, No 2017/2, OECD Publishing, 2017.

- There is also some evidence of larger wage flexibility of older workers compared to younger ones – possibly because the cost of losing a job is higher for older people. For more details, see Du Caju, P., Fuss, C. and Wintr, L., “Sectoral differences in downward real wage rigidity: workforce composition, institutions, technology and competition”, Journal for Labour Market Research, Vol. 45, No 1, 2012, pp. 7-22

- According to the International Labour Organisation’s classification, “persons in unemployment are defined as all those of working age who were not in employment, carried out activities to seek employment during a specified recent period and were currently available to take up employment given a job opportunity”. People who do not carry out activities to seek employment are considered as inactive even when they receive unemployment benefits.

- See Wise, David A., (ed.) “Social Security Programs and Retirement around the World: Historical Trends in Mortality and Health, Employment, and Disability Insurance Participation and Reforms”, University of Chicago Press, Chicago, 2012, Geyer, J. and Welteke, C. “Closing Routes to Retirement: How Do People Respond?”, Discussion Paper Series, DP No 10681, IZA Institute of Labor Economics, March 2017, and Steiner, V., “The labor market for older workers in Germany, Journal for Labour Market Research, Vol 50, No 1, pp. 1-14, 2017.

- Kyyrä, Tomi and Wilke, Ralf A., “Reduction in the Long-Term Unemployment of the Elderly: A Success Story from Finland” Journal of the European Economic Association, Vol. 5, No 1, March 2007, pp. 154- 182.

- Source: Eurostat

- See “Working Better with Age”, Ageing and Employment Policies Series, OECD Publishing, Paris, 2019.

- Gal, P. and Theising, A., “The macroeconomic impact of structural policies on labour market outcomes in OECD countries: A reassessment” , OECD Economics Department Working Papers, No 1271, OECD Publishing, Paris, 2015.

- Steiner, V., “The labor market for older workers in Germany”, op. cit.

- See Blanchet, D., Bozio, A., Rabaté, S. and Roger, M. “Workers’ employment rates and pension reforms in France: the role of implicit labor taxation”, NBER Working Paper Series, Working Paper 25733, NBER, April 2019.

- Households accumulate wealth by saving income and through private transfers (gifts and bequests).

- The increase in net wealth in the euro area is mainly attributable to valuation gains on households’ real estate holdings due to the robust housing market dynamics in the recent years. For more details, see the article entitled “Household wealth and consumption in the euro area”, Economic Bulletin, Issue 1, ECB, Frankfurt am Main, 2020.

- Countries use two types of financial incentives to encourage individuals to save for retirement, tax incentives and non-tax incentives. For more information, see the report entitled “Financial incentives for funded private pension plans”, OECD, November 2019.

- Eurostat publishes a new comprehensive and harmonised collection of a supplementary data on pension entitlements in social insurance, i.e. ESA 2010 transmission programme Table 29. The reference date is 2015, but data are broadly expected to be stable over time. For more details, see article entitled “Social spending, a euro area cross-country comparison”, Economic Bulletin, Issue 5, ECB, Frankfurt am Main, 2019. At the euro area level, a re-calculated “net” wealth ratio, including the augmented pension wealth concept, would sum up to around 1000% of GDI, i.e. 290 percentage points of GDI higher than the latest value at end-2019.

- The data refer to the third wave of the “Eurosystem’s Household Finance and Consumption Survey”, HFCS (March, 2020). The results from the third wave (reference year 2017) are stable in comparison to the second wave (reference year 2014).

- See Carone, G. et al., “Pension Reforms in the EU since the Early 2000's: Achievements and Challenges Ahead”, European Commission Discussion Papers, No 42, 2016.

- See “The economic impact of population ageing and pension reforms”, op. cit.

- Successive vintages of the European Commission’s Ageing Report project a decline in the level of public pension expenditure in 2050 from 13.3% of GDP in the 2001 report to 11.7% of GDP in the 2018 report. However, these figures need to be interpreted with care, as neither the forecasting horizon nor the country composition are fully comparable across vintages and the starting level has also changed over time.

- Early retirement schemes are specific schemes that allow people to enter retirement before reaching the statutory retirement age, mostly contingent on long working careers and implying an adjustment of pension entitlements. Besides specific early retirement schemes, an early exit from the labour market was also encouraged through the use of unemployment, sickness or disability insurance schemes for older workers. Most of these schemes were introduced in the 1970s in response to rising unemployment – see Carone, G. et al., op. cit.

- For an overview see, for example, Carone, G. et al., op. cit.

- The calculation of the implicit tax rate of working longer requires detailed, country-specific information. This explains why only very few cross-country studies use the concept of the implicit tax rate. See for example Duval, R., The Retirement Effects of Old-Age Pension and Early Retirement Schemes in OECD Countries, OECD Economics Department Working Papers No. 370, and OECD, Economic Policy Reforms – going for growth, various editions. More recently, a cross-country analysis was conducted for 12 advanced economies. See Börsch-Supan, A. and Coile, C. (eds.), Social Security Programs and Retirement around the World: Reforms and Retirement Incentives, NBER Book Series – International Social Security, University of Chicago Press, Chicago, 2020.

- See Börsch-Supan, A. and Coile, C. op. cit. This study contains country-specific analyses, including for six euro area countries (i.e. Belgium, Germany, Spain, France, Italy and the Netherlands). Compared to the group of euro area countries, the 2015 level of the implicit tax rate is considerably higher in Japan (around 45%), although it has halved since 2000, and much lower in the United States (at a stable level around 10%). The analysis covers several types of recipients, for whom the social security benefit is calculated for every year from 1980 to 2015 for every possible retirement age (between 55 and 69 years), and for every pathway to retirement (such as old-age public pension, early retirement pension, disability pensions, etc.) available for the typical individuals.

- See, for example, Blundell et al., op. cit.

- See Börsch-Supan, A. and Coile, C. op. cit.

- See, for example, Geppert, C., Guillemette, Y., Morgavi, H. and Turner, D., “Labour supply of older people in advanced economies: the impact of changes to statutory retirement ages”, OECD Economics Department Working Papers, No 1554, OECD Publishing, Paris, 2019; Grigoli, F., Koczan, Z. and Topalova, P., “A Cohort-Based Analysis of Labor Force Participation for Advanced Economies”, Cohort-Based Analysis of Labor Force Participation for Advanced Economies, United States, IMF, 2018; and De Philippis, M., “The dynamics of the Italian labour force participation rate: determinants and implications for the employment and unemployment rate”, Banca d’Italia Occasional Papers, No 396, Banca d’Italia, 2017.

- See, for example, Bi, H., Hunt, K. and Zubairy, S. “Implementation delays in pension retrenchment reforms”, Economic Review, Vol. 104, No 2, Federal Reserve Bank of Kansas City, Second Quarter 2019, pp. 53-70.

- For an analysis of the macroeconomic and fiscal costs of pension reform reversals, see Baksa, D., Munkacsi, Z. and Nerlich, C., “A framework for assessing the costs of pension reform reversals”, Working Paper Series, No 2396, ECB, April 2020. A study on the impact of the 2014 pension reform reversal in Germany that allows workers with a particularly long working history of 45 years to retire earlier at the age of 63 years at a full pension, finds that the probability of retiring earlier is indeed 10 percentage points higher for eligible persons for early retirement than for those who face penalties. For more information, see Krolage, C. and Dolls, M., “The effects of early retirement incentives on retirement decisions”, ifo Working Papers, No 291, ifo Institute, Munich, 2019, pp. 1-31.