- PRESS RELEASE

Survey on the Access to Finance of Enterprises: availability of finance improved amid increase in turnover

24 November 2021

- Improvement in availability of external finance and banks’ willingness to provide credit

- Increase in turnover but also higher production costs, particularly for materials and energy

- Macroeconomic environment no longer perceived by firms as an impediment to accessing external finance

For the period from April to September 2021, small and medium-sized enterprises (SMEs) in the euro area reported an increase in turnover in net terms, reflecting the rebound in economic activity since the start of the coronavirus (COVID-19) pandemic (Chart 1).[1] On balance, they nonetheless continued to report lower profits as a result of increases in other costs (materials and energy) and labour costs. In net terms, 71% of euro area SMEs reported a rise in the cost of materials and energy, which is the highest percentage since the start of the survey in 2009. At the same time, 43% indicated that labour costs had gone up, which is still a smaller percentage than in the period just before the pandemic. In this survey round, SMEs signalled a net increase (11%) in their fixed investment across all countries and size classes. In the coming months, they expect the economic recovery to continue. In net terms, 36% foresee an increase in turnover over the next six months, which is a higher percentage than in the last survey round.

As in the past, the main concern for SMEs in terms of their business activity was the difficulty in finding skilled labour, followed by the difficulty in finding customers. Concerns about access to finance declined further in the euro area as a whole (7%), with SMEs signalling further improvements in the availability of bank loans. SMEs’ external financing gap – the difference between the change in demand for and the change in the availability of external financing – fell into negative territory, as it was before the pandemic, both for the euro area as a whole (-2%, down from 4%) and for most euro area countries. The percentage of SMEs expecting an improvement in the availability of most external financing sources in the coming months was similar to that in 2019.

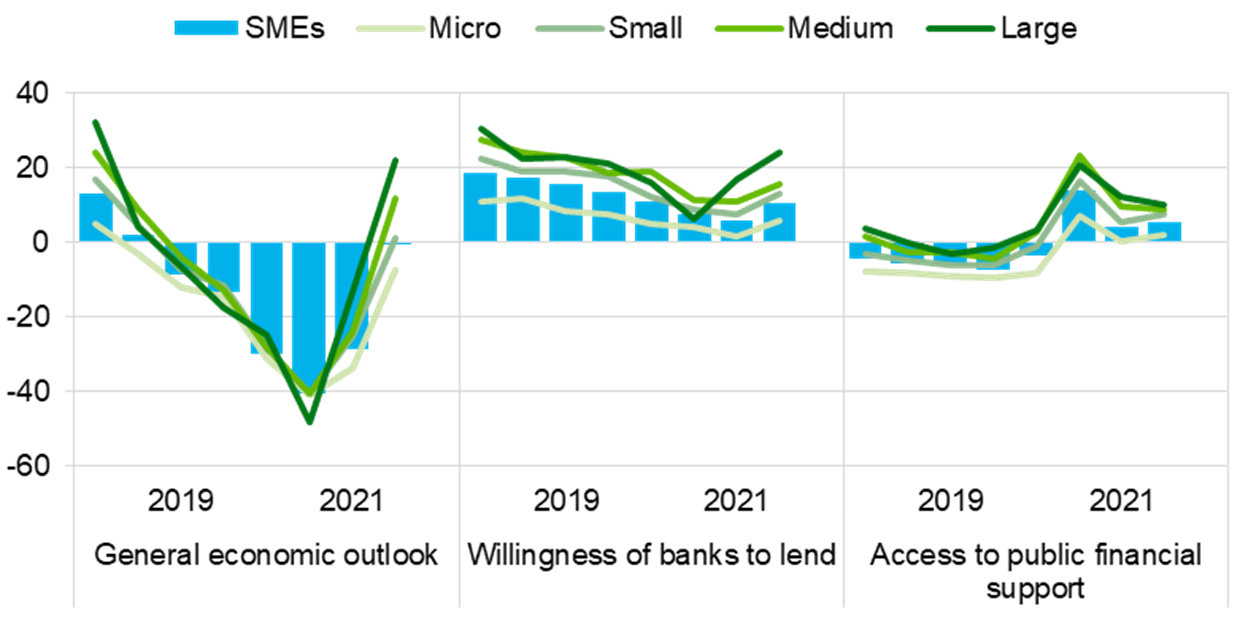

In this survey round, a larger net percentage of SMEs perceived an improvement in banks’ willingness to provide credit (11%). The improvements were reported across most countries and all size classes. In addition, euro area SMEs no longer perceived the general economic outlook as an impediment to their access to finance (0%) (Chart 2). Finally, they continued to see public financial support as a factor making a moderate contribution to their access to finance, with higher percentages among micro and small firms.

This report presents the main results of the 25th round of the Survey on the Access to Finance of Enterprises (SAFE) in the euro area, which was conducted between 6 September and 15 October 2021 and covered the period from April to September 2021. The sample comprised 10,493 enterprises in the euro area, of which 9,554 (91%) were SMEs (i.e. firms with fewer than 250 employees).

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- A report on this survey round, together with the questionnaire and methodological information about the SAFE, is available on the ECB’s website.

- Detailed data series for the individual euro area countries and aggregate euro area results are available from the ECB’s Statistical Data Warehouse.

Chart 1

Changes in the income situation of euro area SMEs

(net percentages of respondents)

Base: All SMEs.

Note: The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Chart 2

Changes in factors that have an impact on the availability of external financing to euro area enterprises

(net percentages of respondents)

Base: All enterprises.

Notes: The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

- Net percentages are defined here as the difference between the percentage of enterprises reporting that something has increased and the percentage reporting that it has declined.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts