- PRESS RELEASE

Survey on the Access to Finance of Enterprises: continued tightening in reported financing conditions

28 November 2023

- Euro area firms signalled a continued increase in turnover, while higher labour, production and interest costs weighed on their profitability. Firms expect their turnover to increase further over the next six months.

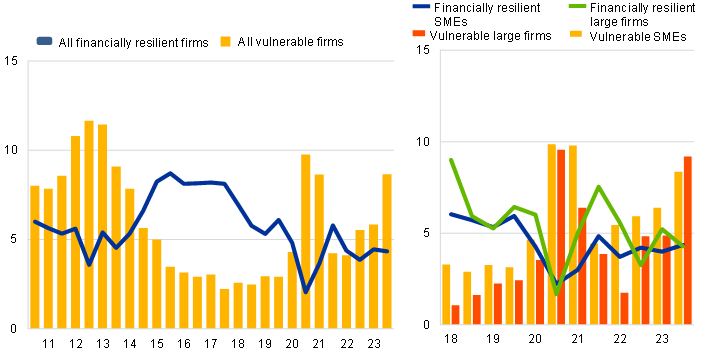

- The share of financially vulnerable firms increased almost to the level seen during the coronavirus (COVID-19) pandemic.

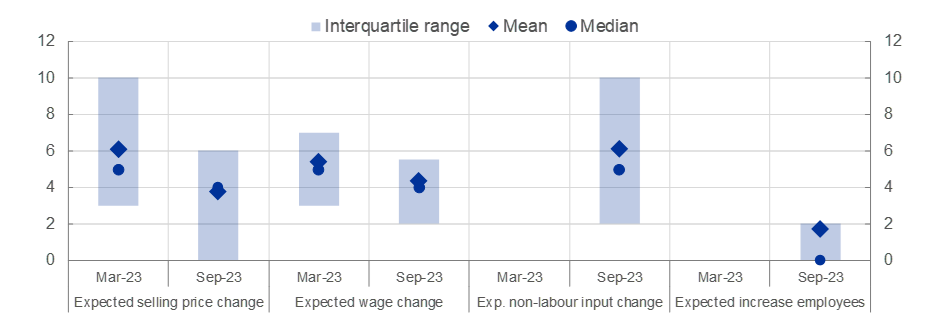

- Compared with the last survey, firms expect a noticeably smaller increase in their average selling prices (3.7%, down from 6.1%) and wages (4.3%, down from 5.4%) over the next year.

- Firms reported a modest increase in their need for external funds, while availability deteriorated further, reflecting the transmission of monetary policy. As a result, the financing gap continued to increase at a moderate pace.

- A large net share of firms reported stricter price terms and conditions for bank loans. Despite tighter financing conditions, few firms reported obstacles to obtaining a bank loan.

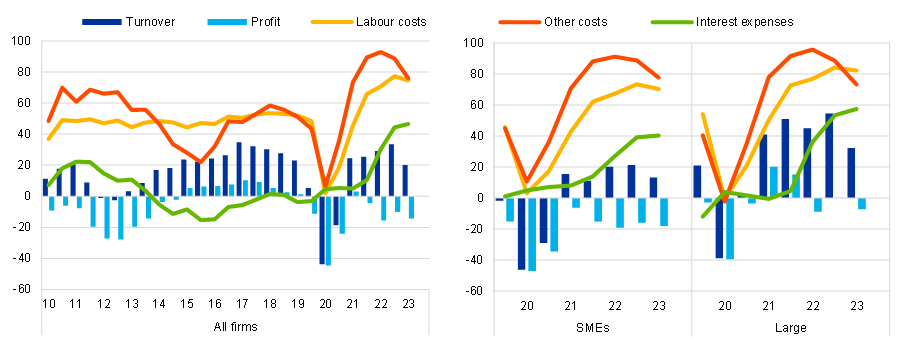

In the latest round of the twice-yearly Survey on the Access to Finance of Enterprises (SAFE) in the euro area, covering the period from April to September 2023, firms reported an increase in turnover, although the net percentage was lower than in the previous survey round (Chart 1).

More firms saw a deterioration in their profits than in the previous survey round (net -14%). The decline in profits once again reflects a sharp rise in labour costs and other costs related to materials and energy, although cost pressures seem to have eased. Increasing interest expenses are a further drag on profitability. Firms’ investment and employment growth has broadly held up, albeit with fewer firms reporting increases.

The financial vulnerability indicator, which provides a comprehensive picture of firms’ financial situation, suggests that 9% of euro area enterprises encountered major difficulties in running their business and servicing their debts over the past six months (Chart 2).

Firms reported on average that they expect their selling prices to increase by 3.7% over the next 12 months (down from 6.1% in the previous survey round) and their non-labour input costs to increase by 6.1% (Chart 3). They expect their employees’ wages to rise by 4.3% (down from 5.4%), with an increase in average employment of 1.7% over the year ahead.

The net share of firms reporting an increase in their need for bank loans was modest (5%, compared to 4% in the last survey round). At the same time, the availability of bank loans declined, with 10% of firms indicating a deterioration. The financing gap thus continued to widen at a moderate pace.

Firms continued to report a widespread increase in bank interest rates and other price and non-price costs of bank financing (net 86%), reflecting the transmission of past monetary policy tightening to firms’ financing costs.

Despite tighter financing conditions, the financing obstacles indicator for all firms remained at a similar level compared with the previous round (6%, down from 7%). Among firms applying for a bank loan (27% of firms), 10% reported obstacles to obtaining a loan, which was also similar to the previous round.

Looking ahead, firms expect a decline in the availability of all external financing sources, and especially bank loans. This suggests that part of the transmission of monetary policy to firms’ financing conditions is still in the pipeline.

The report published today presents the main results of the 29th round of the SAFE in the euro area, conducted between 4 September and 18 October 2023 and covering the period from April to September 2023. The sample comprised 11,523 enterprises, of which 10,499 (92%) are small and medium-sized enterprises (SMEs) (i.e. firms with fewer than 250 employees).

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes:

- The report on this SAFE survey round, together with the questionnaire and methodological information, is available on the ECB’s website.

- Detailed data series for the individual euro area countries and aggregate euro area results are available on the ECB Data Portal.

Chart 1

Changes in the income situation of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 3 to 29 of the survey (March 2010-September 2010 to April 2023-September 2023) for all firms and to rounds 21 to 29 (April 2019-September 2019 to April 2023-September 2023) for SMEs and large firms.

Notes: Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease. The data included in the chart refer to Question 2 of the survey.

Chart 2

Vulnerable and financially resilient enterprises in the euro area

(percentages of respondents)

Base: All enterprises. The figures refer to rounds 3 to 29 of the survey (March 2010-September 2010 to April 2023-September 2023) for all firms and to rounds 18 to 29 (October 2017-March 2018 to April 2023-September 2023) for SMEs and large firms.

Notes: Vulnerable firms are defined as firms that simultaneously report lower turnover, decreasing profits, higher interest expenses and a higher or unchanged debt-to-assets ratio, while financially resilient firms are those that simultaneously report higher turnover and profits, lower or no interest expenses and a lower or no debt-to-assets ratio. The data included in the chart refer to Question 2 of the survey.

Chart 3

Expectations of selling prices, wages, input costs and employment one year ahead

(weighted percentages)

Base: All enterprises. The figures refer to rounds 28 and 29 of the survey (October 2022-March 2023 and April 2023-September 2023).

Notes: Mean and median euro area firm expectations of changes in selling prices, wages of current employees, non-labour input costs and number of employees for the next 12 months, along with interquartile ranges, using survey weights. The statistics are computed after trimming the data at the country-specific 1st and 99th percentiles. The data included in the chart refer to Question 34 of the survey. Questions on non-labour input costs and employees were not available in round 28.

Europos Centrinis Bankas

Komunikacijos generalinis direktoratas

- Sonnemannstrasse 20

- 60314 Frankfurtas prie Maino, Vokietija

- +49 69 1344 7455

- media@ecb.europa.eu

Leidžiama perspausdinti, jei nurodomas šaltinis.

Kontaktai žiniasklaidai