- 8 DECEMBER 2021

- RESEARCH BULLETIN NO. 90

Benefits of macroprudential policy in low interest rate environments

The natural rate of interest is the equilibrium real interest rate that is consistent with inflation on target and production at full capacity. This article argues that in economies with low natural rates, such as the euro area today, macroprudential policy can have benefits for the effectiveness of conventional monetary policy, in addition to safeguarding financial stability. Notably, macroprudential policies that curb leverage of financial intermediaries during upturns can also help stimulate aggregate demand during downturns. One way they do so is by containing systemic risk in financial markets. As a by-product of the systemic risk reduction, intermediary financing and aggregate output also become more stable. This additional reduction in risk boosts the natural rate and thus reduces the likelihood of hitting the effective lower bound (ELB) on policy rates. In numerical simulations conducted for the euro area, the positive effect of macroprudential policy on the average natural rate is estimated to be around 0.7%, while the probability of hitting the ELB declines by around 8%, relative to a benchmark scenario without macroprudential policy.

Low interest rate environments: implications for the effectiveness of conventional monetary policy

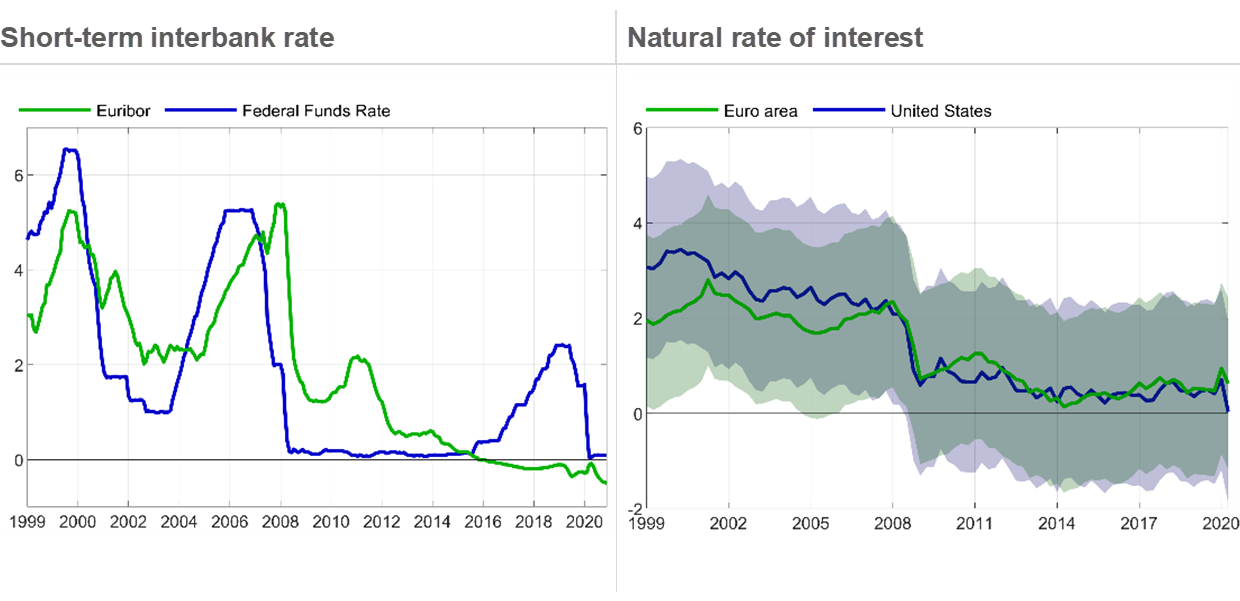

Short-term interest rates in general, and the natural rate in particular, have been in steady decline in the euro area and the United States for the last thirty years or so (Chart 1). This decline has been primarily driven by changes in fundamental aspects of the global economy, such as the integration of Asian countries in global financial markets (Bernanke, 2005 and Caballero et al., 2008) or the ageing of the population across the globe (Krueger and Ludwig, 2007). The decline has accelerated in the aftermath of the global financial crisis of 2008-09 (Summers, 2014) and many expect it to continue and further accelerate going forward (Blanchard, 2020 and Jorda et al., 2020, among others). The expected decline is in part the consequence of the ongoing coronavirus (COVID-19) pandemic and the lockdown measures that have been implemented so far. Both are generating unprecedentedly high economic uncertainty (Baker et al., 2020), which is expected to hinder economic growth and increase aversion to risk, at least over the medium term.

Chart 1

Short-term interest rates in the euro area and the United States

Notes: Benchmark short-term nominal interest rate (panel A) and natural rate of return (panel B) for the euro area and the United States. Natural rates are estimated according to methodology in Laubach and Williams (2003) and Holston et al. (2017). Bands reflect filter and parameter uncertainty. Date sources: ECB Statistical Data Warehouse (SDW) and Federal Reserve Economic Data (FRED).

Low levels of the natural rate for protracted periods of time pose challenges for the conduct of conventional monetary policy. These challenges are particularly acute during downturns, when the natural rate is cyclically lower. In such a situation, conventional monetary policy on its own may fail to stimulate aggregate demand sufficiently, to keep inflation on target and production at full capacity. This can happen because the ELB on nominal interest rates precludes the policy rate from tracking the natural rate if the latter falls below the bound. In the absence of any complementary policy intervention, the consequences are real interest rates that are too high, subdued aggregate demand, low inflation below target, and underutilisation of production capacity. These additional inefficiencies deepen the contraction and hamper the recovery from the downturn.

Benefits of macroprudential policy when natural rates are low

In economies with low natural rates, such as the euro area today, macroprudential policy can have benefits for the effectiveness of conventional monetary policy, in addition to safeguarding financial stability. Naturally, effective macroprudential intervention in financial markets reduces the likelihood and intensity of systemic financial distress. With more stability in those markets, intermediary financing to nonfinancial firms is more stable as well, as is aggregate output. This additional reduction in risk lowers the price of risk-free assets relative to risky assets and, consequently, increases their relative yields. The natural rate – which is a risk-free, short-term real interest rate – therefore increases as well. In turn, a higher natural rate gives the central bank more room for stimulating aggregate demand, especially during downturns, when the natural rate is cyclically lower.

This benefit is inherent to any macroprudential tool that curbs risk-taking in financial markets during upturns. A notable example is the counter-cyclical bank capital requirement. This tool reduces concentration of risk in the balance sheets of banks during the build-up of financial crises. As a result, the tool mitigates amplification effects of disturbances to bank net worth, and it also mitigates fluctuations in aggregate financing to nonfinancial firms.

Using a general equilibrium economy with endogenous systemic risk – in the spirit of Brunnermeier and Sannikov (2014) and Van der Ghote (2021) – this research finds that a bank capital requirement that is imposed purely for reasons of financial stability boosts the average natural rate by around 0.7% in the euro area relative to a benchmark scenario without the capital requirement. The likelihood of hitting the ELB falls by 8% relative to the same benchmark.

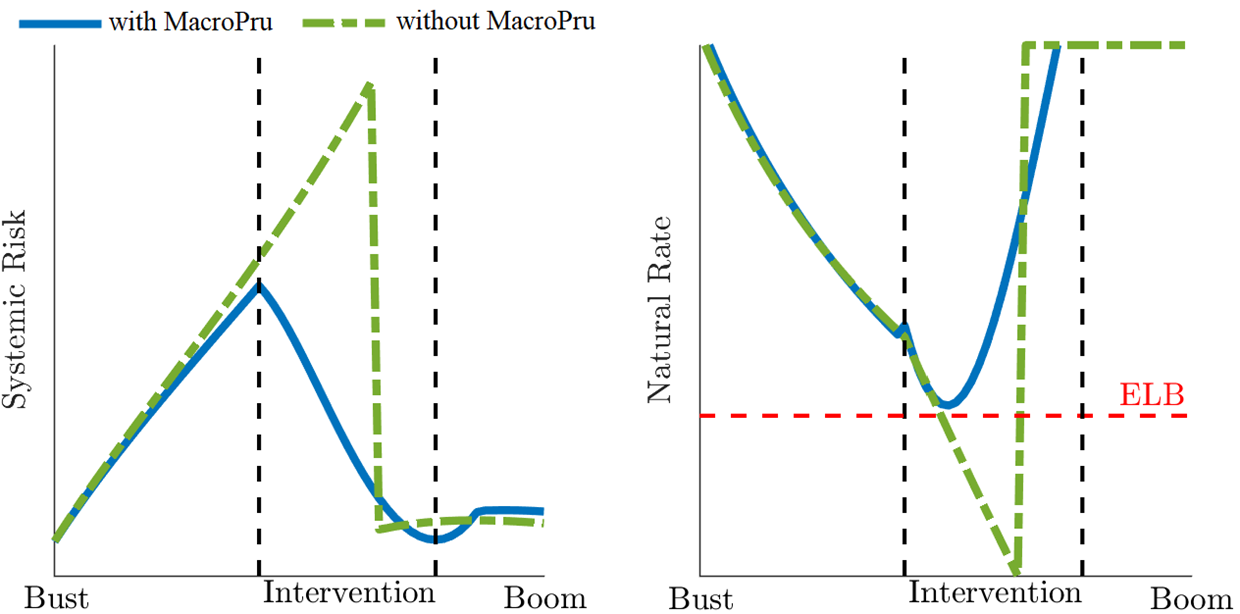

Chart 2

Schematic representation of systemic risk and the natural rate of interest in Van der Ghote (2020)

Notes: The representation is based on the model economy in Van der Ghote (2020). Solid blue lines plot variables in a version of the economy with a macroprudential policy that is only concerned with financial stability (i.e. with MacroPru), while dashed green lines do so in a version of the economy without macroprudential policy (i.e. without MacroPru). Dashed black lines enclose the phases of the cycle in which macroprudential policy is active. The dashed red line indicates the effective lower bound (ELB) on nominal interest rates.

Complementarity between macroprudential policy and conventional monetary policy

The above benefit points to a novel complementarity between macroprudential policy and conventional monetary policy, which takes place only in environments with low interest rates.[2] A “divine coincidence” between these two policies exists if the following two conditions are met: (i) the natural rate in an economy without macroprudential policy falls below the ELB at least occasionally over the cycle; and (ii) the natural rate in an economy with a macroprudential policy that is only concerned with financial stability instead lies above the bound throughout (see Chart 2 for an illustration). If these conditions hold, macroprudential policy boosts the natural rate above the ELB, and it does so unintentionally, simply as a by-product of safeguarding financial stability. Put simply, macroprudential policy is essential for output gap stabilisation as well. If the second condition does not hold, complementarity still exists, but it is not sufficiently strong to generate the coincidence. That is, macroprudential policy still improves the effectiveness of conventional monetary policy, but it does not allow the policy rate to accommodate aggregate demand appropriately without hitting the ELB.

Conclusion

In economies with low natural rates, macroprudential policy can have benefits for the effectiveness of conventional monetary policy, in addition to safeguarding financial stability. These benefits arise because macroprudential policy boosts the natural rate – simply as a by-product of containing systemic risk in financial markets – which gives the central bank more room for stimulating aggregate demand, especially during downturns. Whether this positive side effect prevails for overall macroeconomic stabilisation is yet to be explored in future research. This will crucially depend on the strength of the effect of the higher natural rate on fiscal stabilisation policies, which are not considered in this research.

References

Altavilla, C., Laeven, L. and Peydró, J. (2020), “Monetary and macroprudential policy complementarities: evidence from European credit registers”, ECB Working Paper Series, No 2504.

Baker, S., Bloom, N., Davis, S. and Terry, S. (2020), “COVID-Induced Economic Uncertainty and its Consequences”, VoxEU.org.

Bernanke, B. (2005), “The global saving glut and the US current account deficit”, Board of Governors of the Federal Reserve System (US), No 77.

Blanchard, O. (2020), “Is There Deflation or Inflation in our Future?”, VoxEU.org.

Brunnermeier, M. and Sannikov, S. (2014), “A Macroeconomic Model with a Financial Sector”, American Economic Review, 104, 379-421.

Caballero, R., Farhi, E. and Gourinchas, P. (2008), “An equilibrium model of "global imbalances" and low interest rates”, American Economic Review, 98(1), 358-93.

Holston, K., Laubach, T. and Williams, J. (2017), “Measuring the Natural Rate of Interest: International Trends and Determinants”, Journal of International Economics, 108, supplement 1 (May): S39–S75.

Jorda, O., Singh, S. and Taylor, A. (2020), “Longer-Run Economic Consequences of Pandemics”, NBER working papers, No w26934.

Krueger, D. and Ludwig, A. (2007), “On the consequences of demographic change for rates of returns to capital, and the distribution of wealth and welfare”, Journal of Monetary Economics, 54(1), 49-87.

Laubach, T. and Williams, J. (2003), “Measuring the Natural Rate of Interest”, Review of Economics and Statistics, Vol. 85, No 4 (November): 1063-70.

Summers, L. (2014), “US Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound”, Business Economics, 49(2), 65-73.

Van der Ghote, A. (2020), “Benefits of Macro-Prudential Policy in Low Interest Rate Environments”, ECB Working Paper Series, No 2498.

Van der Ghote, A. (2021), “Interactions and Coordination between Monetary and Macro-Prudential Policies”, American Economic Journal: Macroeconomics, 13.1: 1-34.

- Disclaimer: The article was written by Alejandro Van der Ghote (Senior Economist, Directorate General Research, European Central Bank). The author thanks Michael Ehrmann, Alexander Popov and Louise Sagar. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank and the Eurosystem.

- See Altavilla et al., (2020) for another type of complementarity between macroprudential and monetary policy. In that paper, easy monetary policy leads to more bank risk-taking when macroprudential policy is more accommodative, and tighter macroprudential policy ameliorates the effect of monetary easing on risk-taking.