- 27 MAY 2025 · RESEARCH BULLETIN NO 131

Private safe asset supply and financial instability

This article explores how banks supply safe assets through securitisation and evaluates the consequences for financial stability. As safe assets become scarcer, banks increasingly rely on securitisation to produce safe assets, relaxing screening standards in the process, which lowers loan quality, undermines financial stability and harms real economic activity. Crucially, banks do not internalise how loan quality affects their ability to create safe assets, underscoring the need for policy intervention. The following discusses the effectiveness of various policy tools in addressing this inefficiency.

Safe assets and the role of private supply

There is growing academic and policy interest in safe assets – financial instruments that maintain a stable value even after adverse macroeconomic shocks. These assets are in high demand because they are good stores of financial value, are widely accepted as collateral and help meet mandatory capital and liquidity requirements. Although highly rated government bonds are the quintessential safe assets, evidence suggests that financial intermediaries can produce private alternatives, such as senior tranches of asset-backed securities. However, the private supply of safe assets carries inherent risks that may undermine financial stability.[2] Understanding these risks is essential to design appropriate policy interventions and ensure stability and efficiency in the financial system.

How do banks supply safe assets?

One of the core functions of banks is to provide loans to households and firms, thereby channelling the resources of savers into productive investments in the real economy. However, lending is inherently risky, as loan repayments are uncertain and can fluctuate. At the same time, many savers seek low-risk or safe investment options. To meet this demand, banks structure their liabilities into two main types of financial claims with different levels of risk: riskier equity and safe debt.

When a bank has sufficient equity to absorb potential losses, its debt remains safe. However, when the demand for safe assets is high relative to the demand for risky assets, the safe tranche of loan repayments may not be sufficient to support the issuance of safe debt on the scale needed to meet that demand. As a result, banks may seek ways to enhance the safety of their loan portfolios, to enable them to issue more debt.

One way to achieve this is by diversifying their loan portfolios. Banks often specialise in lending to particular regions or industries, making their loan portfolios more vulnerable to economic distress in one region or industry. To reduce this risk, banks may trade loans with other institutions that specialise in different regions or industries, creating a more diversified and safer asset portfolio. This, in turn, enables them to issue more low-risk debt. Securitisation is central to this diversification process, where banks issue asset-backed securities (ABS) by selling the loans they originate and shifting the associated risks off their balance sheets. In practice, however, it is often other intermediaries who ultimately purchase ABS from various banks in pursuit of diversification.

Despite helping to diversify loan risk, securitisation can be detrimental to loan quality. When banks originate loans with the intention of transferring the associated risks to third parties, they have less incentive to thoroughly screen borrowers, as they will not reap all the benefits of doing so but will still bear all the costs. This can lead to lending to riskier borrowers and the origination of lower quality loans. To mitigate this, banks retain a stake in those loans, keeping some “skin in the game” as an incentive to maintain loan quality and to signal this to outside investors.

Lower loan quality not only undermines financial stability but also affects the amount of safe debt banks can issue. The safe payoffs from the diversified loan portfolio depend on the overall quality of loans in the economy. When the diversified portfolio consists of higher quality loans, its safe payoffs increase, allowing banks to issue more debt backed by this portfolio. The opposite holds as well: lower quality loans reduce safe payoffs, limiting debt issuance. So loan quality – driven by banks’ screening efforts – and the level of diversification jointly determine the aggregate level of safe assets supplied by banks.

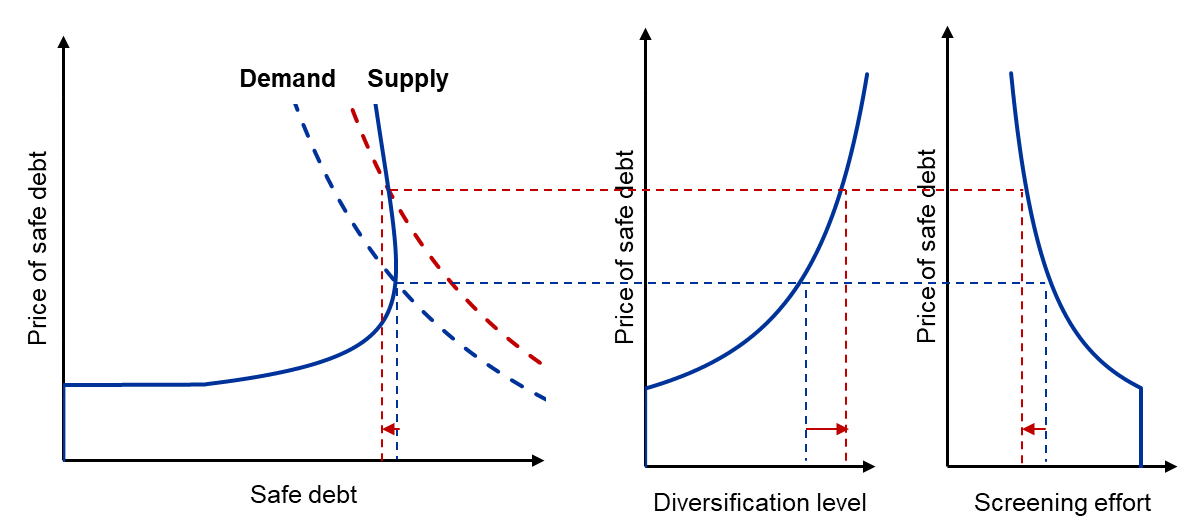

As shown in Chart 1, when savers increase their demand for safe assets, banks carry out more securitisation – this enhances the diversification of banks’ asset portfolios at the cost of reduced screening efforts and loan quality. When the demand for safe assets is low, the increased loan diversification more than compensates for the negative effects of lower loan quality on the creation of safe payoffs, allowing banks to issue more safe debt. However, when the demand for safety is high, the opposite occurs, paradoxically reducing both the safe payoffs and the amount of safe debt that banks can issue. This dynamic gives rise to a backward-bending supply curve for private safe assets: beyond a certain point, an increase in the price of safe assets (or a decrease in the safe rate) leads to a decline in their supply.

Chart 1

Market for safe assets/debt and the consequences of an upward shift in demand

Inefficiency and policy implications

Creating safe assets through securitisation is costly. Less thorough screening of borrowers, when loans are intended for securitisation, contributes to a collective decline in loan quality across the market, which can undermine financial stability and harm real economic activity.[3] Banks’ ability to reduce risk through diversification may be curtailed by lower overall loan quality, making it harder to issue more safe assets. However, banks do not internalise the latter effect due to a free-rider problem: individual bankers have an incentive to free-ride on others’ screening efforts to improve loan quality, benefiting from safer diversified portfolios and increased ability to issue safe debt while avoiding the full costs of enhancing loan quality.

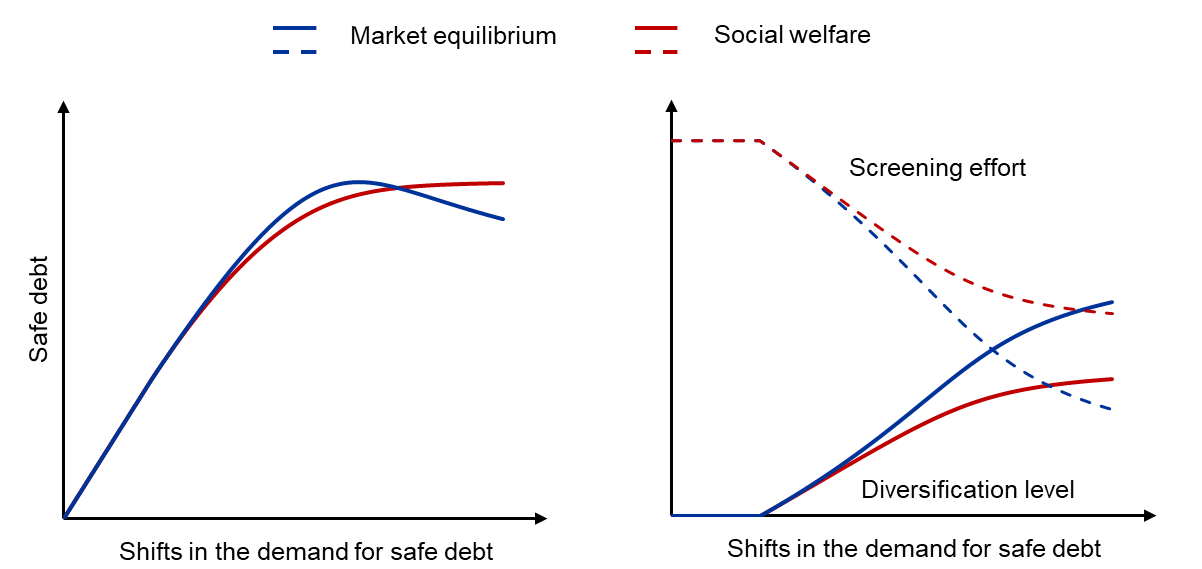

Hence, banks underestimate the benefits of screening and the costs of trading loans for the propose of diversification when screening efforts are reduced. As shown in Chart 2, this leads to an inefficiently high level of securitisation and diversification, and insufficient investment in screening efforts. Whether the amount of safe debt issued by banks is too high or too low from a social standpoint depends on which of the two effects – greater diversification or lower loan quality – dominates, which depends on the demand for safety being high or low.

Chart 2

A comparison between the choices of private banks and socially optimal choices

This inefficiency becomes more acute as the demand for safe assets rises relative to that for risky assets – that is, as safe assets become scarce – highlighting the need for policy intervention.

Risk retention as an effective policy

One effective policy is to impose a loan risk retention requirement, to increase bankers’ skin in the game and curb excessive securitisation and diversification. However, when securitisation is driven by the demand for safety, this percentage should be sensitive to aspects such as the scarcity of safe assets. It should be adjusted in response to the convenience yield – the premium that investors are willing to pay for holding safe assets.

Capital regulation

Capital requirements are often seen as a way to enhance bankers’ skin in the game. However, they do not effectively address the inefficiency discussed here, which arises from banks’ decisions on securitisation or diversification, rather than from the capital level itself. In fact, the capital ratio is sometimes inefficiently high (see Chart 2).

Public supply of safe assets

The public supply of safe assets, such as government bonds, reduces the scarcity of safe assets and can partially alleviate the inefficiency. However, it does not fully solve the problem. Specifically, the public supply of the same assets creates two counteracting effects: it discourages securitisation and diversification (a “crowding-out” of private safe debt) and encourages greater screening (a “crowding-in” of private safe debt). The net impact on the private issuance of safe debt depends on whether the benefits from improved screening outweigh the costs of reduced diversification.

Conclusions

This article and the related policy discussion provide valuable insights into recent initiatives targeting securitisation within the broader framework of the capital markets union (CMU). It emphasises that securitisation can play a crucial role in the creation of privately produced safe assets – an especially relevant function amid the growing scarcity of such assets in the euro area. Reinvigorating securitisation, however, is not without cost – and policymakers should take measures to safeguard financial stability.

A key point raised is the importance of risk retention requirements, which align with recent regulatory initiatives under the CMU that mandate loan originators to retain a material net economic interest of no less than 5% in the securitisation. However, this requirement should be flexible. In an environment characterised by an acute shortage of safe assets, the threshold should be set lower than it would be otherwise, in order to encourage private sector production – especially when public supply is insufficient.

The discussion also underscores the need for policy to adapt to the availability of publicly supplied safe assets, such as highly rated sovereign bonds, EU supranational bonds and potential Eurobonds.[4] Expanding the public supply can help mitigate market inefficiencies and reduce the pressure on the private sector to fill the gap through potentially lower quality securitisation.

In addition, monetary policy also plays a role in shaping the supply of safe assets. The size and composition of central bank balance sheets – as well as collateral policies – can influence the safe asset market (see Vissing-Jorgensen, 2023), and significantly affect the private sector’s incentives to produce them. The latter is an important effect that should be accounted for in the policy discussion, but is often overlooked.

References

Breckenfelder, J., De Falco, V. and Hoerova, M. (2023), “Investing in Safety”, available at SSRN 4982446.

Bletzinger, T., Greif, W. and Schwaab, B. (2022), “Can EU bonds serve as euro-denominated safe assets?” Journal of Risk and Financial Management, Vol. 15 No 11, pp. 530.

Diamond, W. (2020), “Safety transformation and the structure of the financial system”, The Journal of Finance, Vol. 75, No 6, pp. 2973-3012.

Castells-Jauregui, M., Kuvshinov, D., Richter, B. and Vanasco, V. “Who Supplies and Demands Safe Assets – and Why It Matters”, VoxEU, 21 April 2025.

Gorton, G. and Ordoñez, G. (2022), “The supply and demand for safe assets”, Journal of Monetary Economics, Vol. 125, pp. 132-147.

Krishnamurthy, A. and Vissing-Jorgensen, A. (2015), “The impact of treasury supply on financial sector lending and stability”, Journal of Financial Economics, Vol. 118, No 3, pp. 571-600.

Segura, A. and Villacorta, A. (2023), “The paradox of safe asset creation”, Journal of Economic Theory, 210, 105640.

Vissing-Jorgensen, A. (2023), “Balance Sheet Policy Above the Effective Lower Bound”, ECB Forum on Central Banking.

This article was written by Madalen Castells-Jauregui (Directorate General Research, European Central Bank). The author gratefully acknowledges the comments of Vladimir Asriyan, Fernando Broner, Xavier Freixas, Alberto Martin, Edouard Schaal, Anatoli Segura, Zoë Sprokel, Alex Popov, Victoria Vanasco and Jaume Ventura. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank or the Eurosystem.

Krishnamurthy and Vissing-Jorgensen, 2015 show that financial intermediaries create private substitutes for public safe assets, but this response can undermine financial stability (Diamond, 2020, Gorton and Ordoñez, 2022, Segura and Villacorta, 2023).

In the recent VoxEU article "Who Supplies and Demands Safe Assets – and Why It Matters", we find supporting evidence for the negative financial and real effects of the private supply of safe assets by financial intermediaries.

See Bletzinger, Greif and Schwaab, 2022 and Breckenfelder, De Falco and Hoerova, 2023.