- PRESS RELEASE

October 2023 euro area bank lending survey

24 October 2023

- Credit standards tightened further, and more than expected by banks, across all loan categories

- The demand for loans by firms and households continued to decrease strongly

- Ongoing central bank balance sheet reduction contributing to tighter lending conditions

- Positive impact of policy rate hikes on net interest margins expected to gradually abate

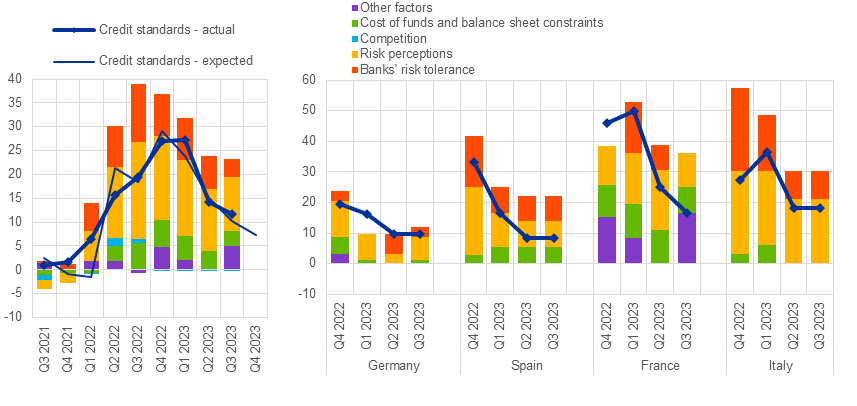

According to the October 2023 euro area bank lending survey (BLS), credit standards – i.e. internal guidelines or loan approval criteria of banks – for loans or credit lines to enterprises tightened further in the third quarter of 2023 (net percentage of banks of 12%, after 14% in Q2 2023; Chart 1). Cumulative net tightening since 2022 has been substantial, which is consistent with the ongoing significant weakening in lending dynamics. The net percentage of banks reporting a tightening moderated slightly compared with the previous quarter but was slightly higher than banks had expected in the previous quarter. Banks also reported a further net tightening of their credit standards for loans to households for house purchase and consumer credit and other lending to households (net percentages of 11% and 16% respectively). In both cases this strongly exceeded previous expectations. The pace of net tightening for housing loans even picked up compared with the second quarter, while it moderated slightly for consumer credit and other lending. Higher risk perceptions related to the economic outlook and borrower-specific situation, lower risk tolerance and lower liquidity positions of banks contributed to the tightening. For the fourth quarter of 2023, euro area banks expect a further, albeit more moderate, net tightening of credit standards on loans to firms, and broadly unchanged credit standards on loans to households for house purchase. For consumer credit, euro area banks expect a further significant net tightening.

The overall terms and conditions applied by banks – i.e. the actual terms and conditions agreed in loan contracts – tightened further for all loan categories in the third quarter of 2023. Widening loan margins were the main driver of the net tightening, reflecting the ongoing pass-through of higher market rates to lending rates for firms and households.

Banks again reported a substantial net decrease in demand from firms for loans or drawing of credit lines in the third quarter of 2023 (Chart 2), as well as a decrease in demand for housing loans and demand for consumer credit and other lending to households. Similar to recent quarters, the decline in net demand was significantly stronger than banks had expected, driven mainly by higher interest rates as well as lower fixed investment for firms and lower consumer confidence and deteriorating housing market prospects for households. The net percentage of banks reporting a decrease in demand was more contained than in recent quarters, which had marked all-time lows since the survey began in 2003. For the fourth quarter of 2023, banks expect a further net decline in demand across all loan categories, albeit less pronounced than in the third quarter.

According to the banks surveyed, access to funding deteriorated in all market segments in the third quarter of 2023, especially for access to retail funding. The pronounced deterioration in access to retail funding − especially short-term funding – reflects increasing competition for liquidity stemming from other banks and alternative investment opportunities offering higher remuneration.

Regarding the balance sheet reduction, banks reported that the ECB reducing its monetary policy asset portfolio – including by discontinuing reinvestments of proceeds from maturing securities purchased under the ECB’s asset purchase programme (APP) – contributed to a deterioration in market financing conditions and liquidity positions for euro area banks over the past six months. This contributed to tighter lending conditions, with a net tightening impact on terms and conditions and a negative impact on bank lending volumes across all lending categories. These effects are expected to strengthen over the next six months.

Euro area banks indicated that the phasing-out of the third series of targeted longer-term refinancing operations (TLTRO III), with funds having fallen due or been voluntarily repaid early, has had a negative impact on their liquidity positions and funding conditions over the past six months. This led to a mild tightening effect on the terms and conditions applied by banks and downward pressure on lending volumes. This downward pressure is expected to intensify in the coming six months.

Euro area banks reported that the key ECB interest rates have had a further markedly positive impact on their net interest margins over the past six months, although this impact is expected to gradually abate in the coming six months. While banks reported a positive effect on their overall profitability, there was a substantial increase in the share of banks reporting a negative impact of ECB interest rate decisions on lending volumes, consistent with the significant weakening in lending dynamics. Moreover, banks reported a further negative impact via higher provisioning needs and impairments.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the October 2023 survey relate to changes observed in the third quarter of 2023 and expected changes in the fourth quarter of 2023, unless otherwise indicated. The October 2023 survey round was conducted between 15 September and 2 October 2023. A total of 157 banks were surveyed in this round, with a response rate of 100%.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for “other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found here too.

- The euro area and national data series are available on the ECB’s website via the ECB Data Portal. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the BLS, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016; and Burlon, L., Dimou, M., Drahonsky, A. and Köhler-Ulbrich, P., “What does the bank lending survey tell us about credit conditions for euro area firms?”, Economic Bulletin, Issue 8, ECB, December 2019.

Evropska centralna banka

Generalni direktorat Stiki z javnostjo

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Nemčija

- +49 69 1344 7455

- media@ecb.europa.eu

Razmnoževanje je dovoljeno pod pogojem, da je naveden vir.

Kontakti za medije