Money market trends as observed through MMSR data*

Overview

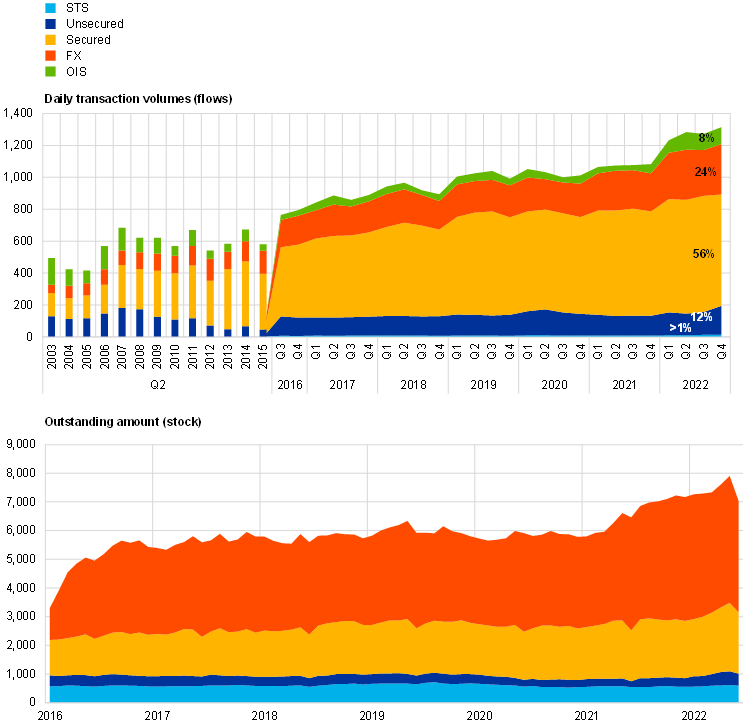

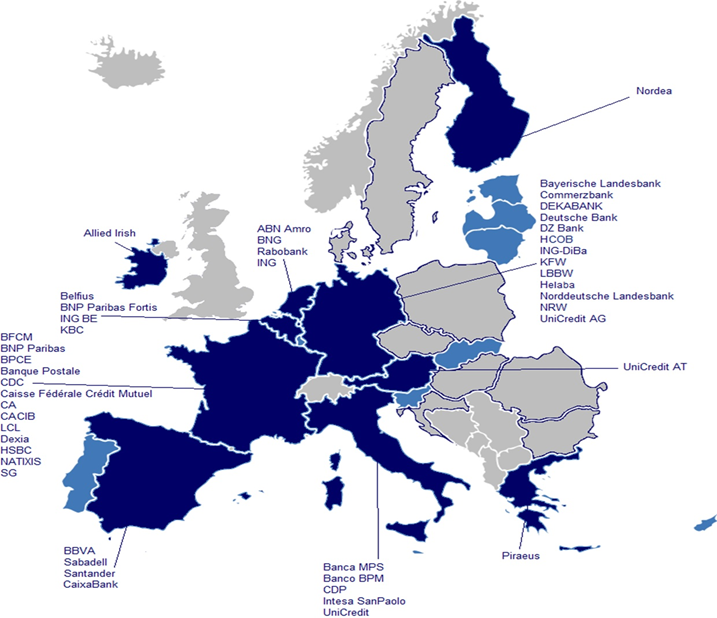

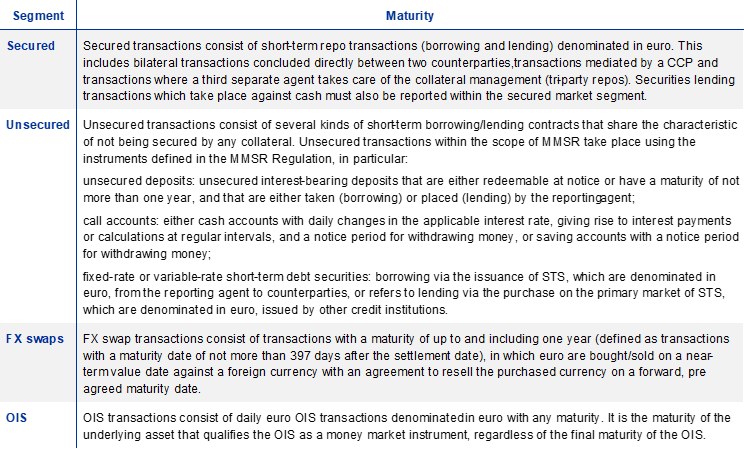

The 2022 Euro money market study is a comprehensive analysis of euro money markets using a unique, transactions-based dataset. The study covers five segments of the euro money markets: (i) secured transactions – repos and reverse repos, (ii) unsecured cash transactions, (iii) the issuance of short-term securities (STS), (iv) foreign exchange (FX) swaps, and (v) overnight index swaps (OIS). The study describes developments in these segments between January 2021 and December 2022 based on actual daily money market transactions executed by the 47 largest euro area banks and reported to the European Central Bank (ECB) through the Eurosystem’s money market statistical reporting (MMSR) dataset.

During 2021 and 2022 activity in the euro money market took place amid inflationary pressures. The inflationary outlook changed towards the end of 2021. Mismatches between buoyant aggregate demand and overall constrained supply resulted in inflationary pressures after a prolonged period of very low inflation, which intensified in 2022 owing to the adverse supply shock on energy and agricultural commodities following the Russian invasion of Ukraine.

Along with other major global central banks, the ECB withdrew monetary policy accommodation to curb these inflationary pressures. This withdrawal was brought about via: (i) four policy rate hikes with an accumulated value of 250 basis points on the key ECB interest rates over the second half of 2022 and the consequent suspension of the two-tier system that was applicable during negative rates, (ii) the discontinuation of net asset purchases under the pandemic emergency purchase programme (PEPP) and the asset purchase programme (APP) as of 1 April 2022 and 1 July 2022 respectively, and (iii) the recalibration of the interest rate on all remaining targeted longer-term refinancing operations (TLTRO III) as of 23 November 2022.

The withdrawal of ECB monetary policy accommodation was accompanied by measures aimed at supporting monetary policy transmission and the orderly functioning of markets. The measures supporting monetary transmission and market functioning included (i) the temporary suspension in September 2022 of the zero interest rate ceiling for remunerating government and foreign central bank deposits until April 2023; (ii) the increase in the aggregate limit for securities lending against cash to €150 billion in November 2021, and to €250 billion in November 2022; and (iii) the extension of the Eurosystem repo facility (EUREP) for non-euro area central banks and of temporary swap and repo lines until January 2024. Furthermore, the Governing Council decided to adjust the remuneration of minimum reserves to the deposit facility rate (DFR) as of 21 December 2022, in order to align remuneration with the marginal cost and return of liquidity in the current abundant liquidity environment.

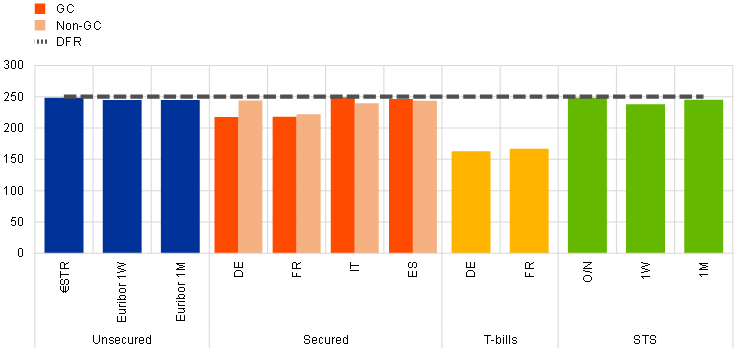

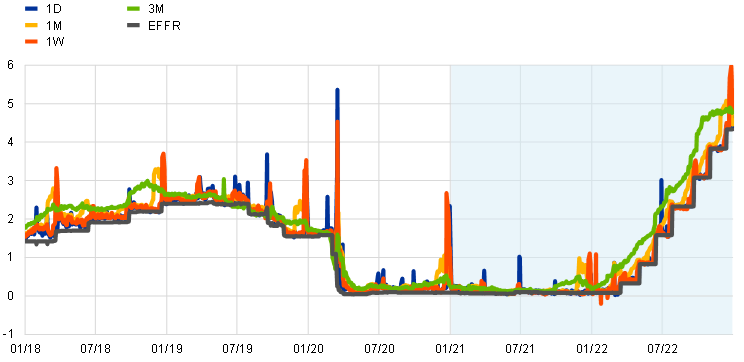

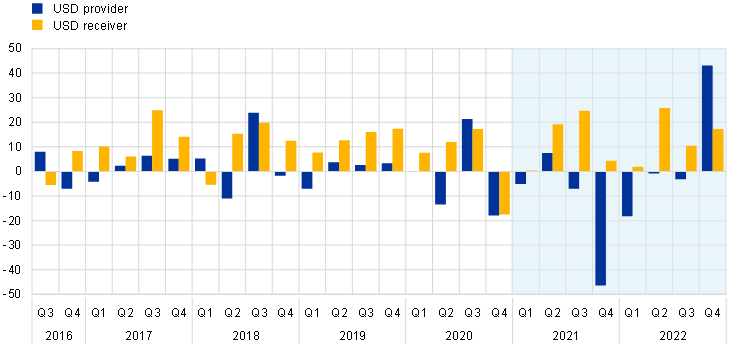

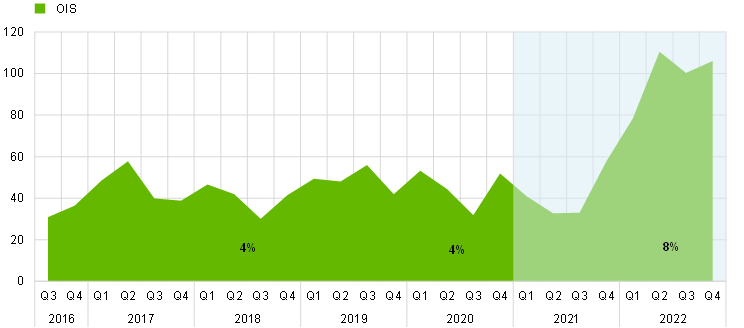

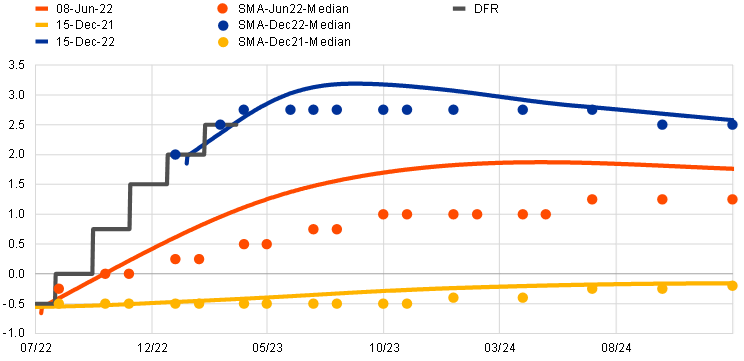

Given the primary role the euro money market plays in the transmission of monetary policy, the most salient result of the study is that policy rates hikes were transmitted to money market rates. The Governing Council raised the DFR from -0.5% to +2.0% in four consecutive meetings during the second half of 2022, terminating the policy cycle of negative rates that was introduced in June 2014. The pass-through to the unsecured segment was immediate, with overnight unsecured rates reflecting 99% of the policy rate changes within two days. Moreover, OIS rates swiftly reacted to the signals on monetary tightening provided by the Governing Council and hence the expectations embedded in OIS rates have largely reflected the policy rate changes that materialised in the second half of 2022.

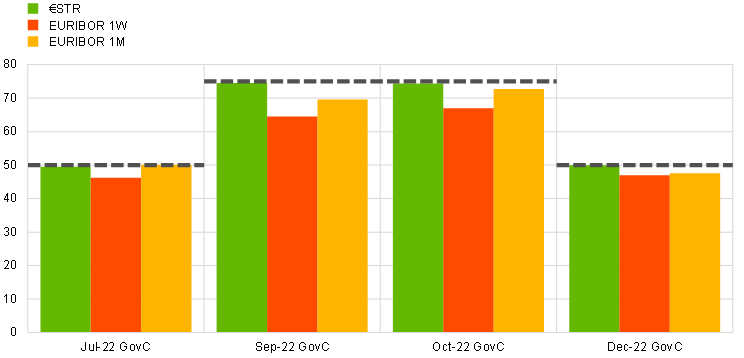

Figure A

Cumulative rate hike transmission to money markets in the second half of 2022

(basis points)

Source: BrokerTec and MTS, Bloomberg, ECB and STEP.

Note: Unsecured, secured and T-bills vertical bars compare the rate of trades with settlement on 22 December 2022 (2nd day of the maintenance period after the December 2022 rate hike) with the rate of transactions settled on the last day of the maintenance period before the July 2022 hike (1 week and 1 month before the last day of the maintenance period for EURIBOR and T-bill trades). Owing to the low STS issuance volume, the pass-through includes a longer settlement period (from 21 December 2022 to 6 January 2023) to achieve a better representativeness of the rate comparison.

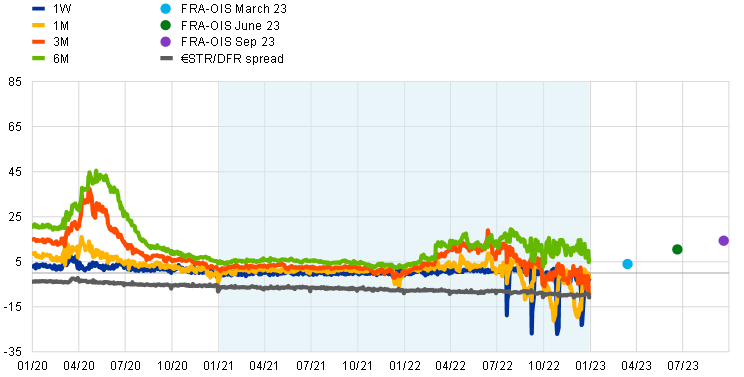

Unsecured borrowing rates remained anchored to the DFR, only marginally drifting away when investors preferred short-term investment in a context of very ample excess liquidity. Overnight unsecured borrowing rates remained anchored to the DFR during the whole period under review, almost perfectly mirroring the official interest rate hikes. Still, the €STR-DFR spread had widened slightly to 10 basis points by the end of 2022, compared with 6 basis points at the beginning of 2021. This can be partly explained by the further increase in excess liquidity during the same period. The widening of the €STR-DFR spread – and the negative one-month EURIBOR-OIS spread – came from an imbalance between demand and supply for cash in the money market. On the supply side, depositors holding excess liquidity favoured investments in short maturities as they offered positive returns in an environment still dominated by high uncertainty surrounding the terminal rate and the policy rate path thereafter. On the demand side, euro area banks discouraged short-term cash inflows, as they weigh on the banks’ regulatory ratios. Forward spreads (i.e. FRA-OIS spreads) remained positive, suggesting that the negative EURIBOR-OIS spreads were expected to be temporary and outweighed in future by lower levels of excess liquidity.

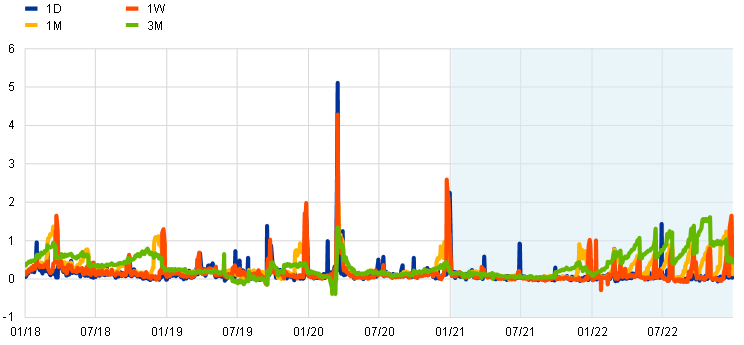

Figure B

EURIBOR versus OIS spread developments

(basis points)

Sources: Bloomberg, ECB.

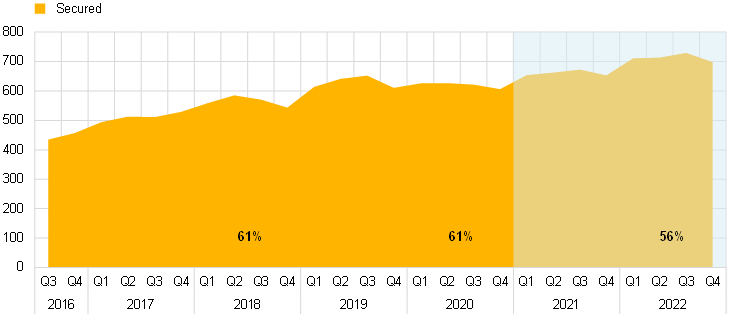

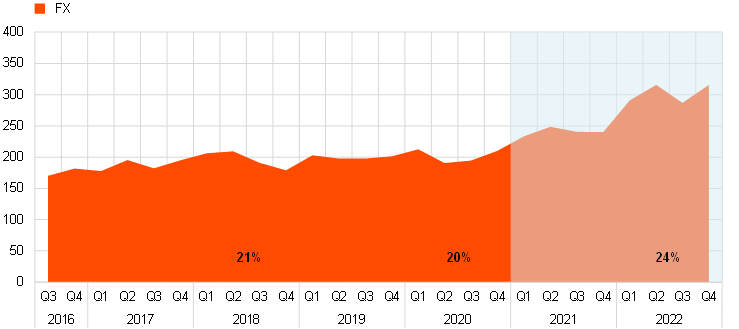

Another salient feature of the study is that turnover continued to be dominated by the secured segment, with national government debt collateralising secured trades. The secured segment is the largest segment of the euro money market, accounting in 2022 on average for 56% of the total €1.3 trillion in daily transactions and 30% of the total €7.0 trillion in outstanding amounts. The secured segment has become more attractive than the unsecured segment, with the latter accounting for 12% of the market share. This can be explained by (i) the mitigation of counterparty risk via collateral transfer, (ii) the favourable regulatory treatment, and (iii) the fact that cleared repos are an efficient vehicle for sourcing specific securities. Given the sheer size of the secured segment, repo rate developments have become increasingly important for assessing overall financing conditions and thus for monetary policy implementation.

Figure C

Overview of the size of the euro money market (daily turnover)

(EUR billions)

Sources: CSDB for the STS segment. Euro money market survey until 2015, and MMSR from 2016 onwards, for the other four segments.

Notes: From 2016 onwards, the series include MMSR transactions with all counterparties, excluding novated trades for the OIS segment. Until 2015 the series include euro money market survey data for 38 overlapping reporting agents and retropolated data for the 14 MMSR reporting agents not covered in the survey. The performed retropolation applies the growth rates of the overlapping sample series to the missing data backwards in time, starting from the first available observation in 2016 Q3. Two Confidential datapoints have been interpolated. For STS, we are considering only the borrowing side (issuance). For FX swap, we are considering swaps of euro against all currencies.

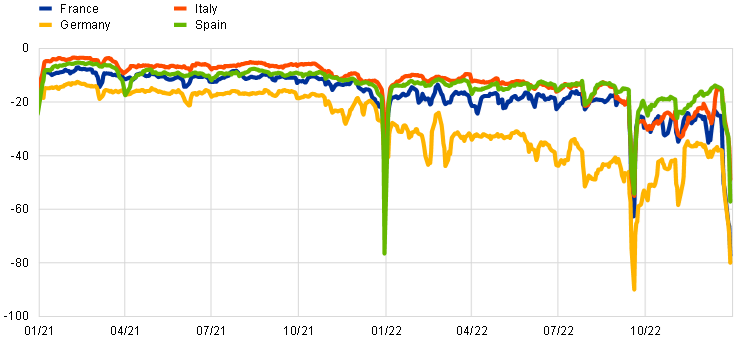

The scarcity of certain government securities exerted downward pressure on secured rates. During the severe phase of the COVID-19 pandemic in 2020, repo rates remained well anchored to the DFR and rather homogeneous across jurisdictions. However, repo rates gradually drifted below the DFR and became more dispersed across Member States in the period under review. As most secured trades were backed by sovereign debt, scarcity of government bonds – particularly severe for certain German issuances – caused a larger share of bonds to trade at very low repo rates and a greater segmentation of repo rates across jurisdictions. The scarcity worsened in autumn 2022 owing to a higher preference for less risky short-term investments and higher margin requirements. This resulted in more demand for collateral as its value declined, thus underpinning further downward pressures on repo rates. Repo price developments reverberate in the financial conditions in government and corporate debt markets via asset swaps.

The pass-through to repo rates of the four ECB policy rate hikes in 2022 was not as orderly as for unsecured rates. The pass-through to repo rates was uneven across jurisdictions and partially lagged. In two hikes (July and October 2022) the pass-through was 90% complete within two days for cash-driven repos based on general collateral, while it took about one week for securities-driven repos, especially for those using scarce German or French government securities. The pass-through of the September hike was even more sluggish with most repo rates remaining negative for some time after the DFR had been lifted from 0% to 0.75%. This lagged pass-through was largely triggered by a return of investors who had been absent from the money market during the negative interest rate policy cycle, including governments and foreign central banks moving sizeable funds from deposits in the Eurosystem into the repo market. A quicker and more complete pass-through across jurisdictions in response to the December rate hike was ensured, among other things, by (i) the temporary suspension of the 0% remuneration applied by the ECB to non-monetary policy deposits, (ii) the increase in the aggregate limit for securities lending against cash, (iii) the early repayments from TLTRO III, and (iv) the Deutsche Finanzagentur making more German bonds available to the market.

Figure D

Difference between the repo rate and the DFR by collateral issuer jurisdiction

(basis points)

Source: MMSR (end of the quarter dates excluded).

Note: The rates consider both general collateral (GC) and non-GC trades aggregated.

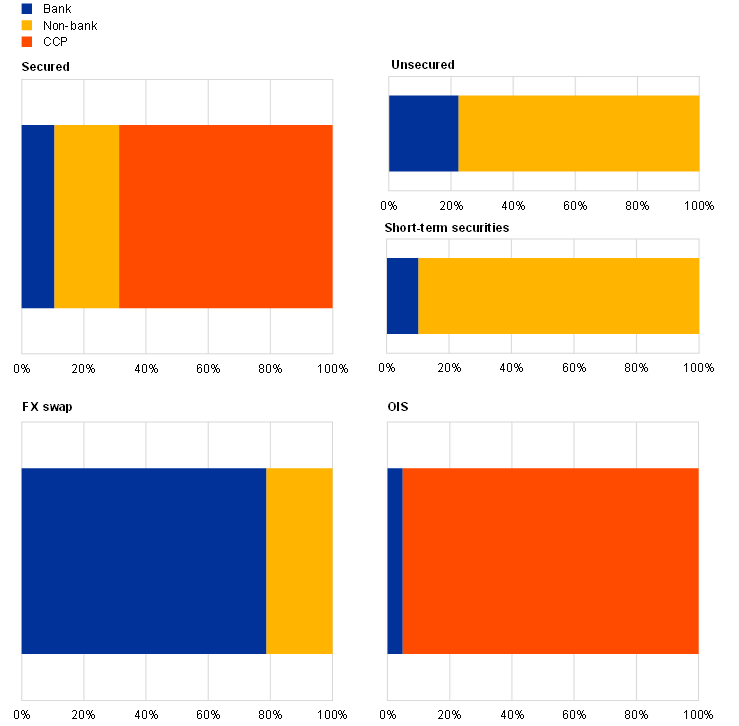

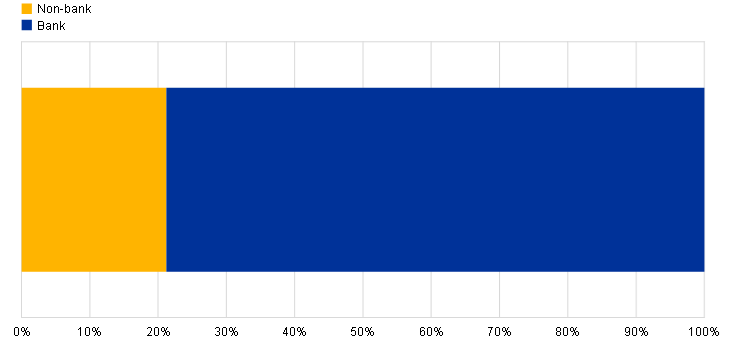

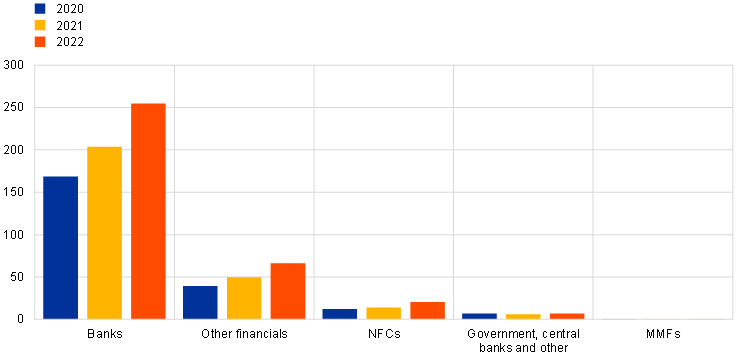

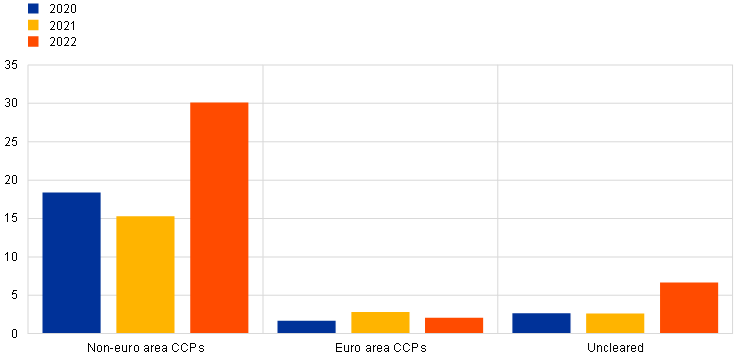

Finally, activity in the euro money market remained driven by non-banks, with money market funds (MMFs) and other investment funds (IFs) making up a growing share of the market. MMSR data collect information on transactions executed by the largest banks in the euro area in a context of excess liquidity. This implies that a bank is always on one side of the MMSR transaction. The counterparty breakdown displayed in Figure E refers to the other side of the MMSR transaction. Non-banks[1] dominated transactions in the unsecured segment, while interbank trades represented the largest share of the activity in the FX swap market. On the other hand, CCPs[2] were involved in 70% of secured trades, and around 90% of overnight index swap trades. On closer examination of the trades with non-banks, MMFs accounted for 28% of unsecured trades in 2022 and held 73% of total banks’ issuance of short-term securities. There was a relevant increase in MMF participation in the unsecured segment (19% in 2020 and 7% in 2018). However, for uncleared secured trades, IFs were a more important counterparty than MMFs, accounting for over 30% of bilateral secured trades in 2022 – twice as much as in 2018.

Figure E

Breakdown of daily average amounts (flows) per counterparty type

(percentages)

Sources: MMSR for secured, unsecured, FX swap, CSDB and ECB (Securities holdings statistics database – SHS) for STS. Some of the CCPs also have a banking licence. However, CCPs are displayed as a third category in this chart, separate from banks and non-banks.

1 The secured segment

The secured market has become the largest segment of the euro money market, accounting for 56% of total daily turnover in 2022. The mitigation of counterparty risk inherent to secured trades and the more favourable regulatory conditions were key to the secured segment becoming more attractive than the unsecured segment over the past decade. Moreover, repurchase agreements (repos) are an efficient vehicle for sourcing securities.

During 2021 and 2022 secured rates gradually drifted below the DFR and became more dispersed than in 2020. Scarcity of government bonds, particularly severe for certain issuances, caused downward pressure on rates and resulted in a larger share of trades well below the DFR. The structural scarcity of some government bonds was aggravated in autumn 2022 by a higher demand for short-term safe assets and an increase in short positions in the bond cash market, underpinning further stress in repo rates.

The pass-through to repo rates of the four ECB policy rate hikes in 2022 was not as orderly as for unsecured rates. The response of repo rates to each of the four policy rate hikes was heterogeneous, with rates collateralised by bonds with a structurally higher demand experiencing a more volatile pass-through. In September 2022, policy rates returned to positive territory and uncertainty surrounded the remuneration applicable to certain non-monetary policy deposits. This led to the expectation of large amounts of funds looking to be placed in the market, which resulted in a large drop in repo rates on the first days of the new maintenance period. The Eurosystem suspended the zero interest rate ceiling on certain non-monetary policy deposits until April 2023 and increased the limits of the securities lending facilities against cash from €150 billion to €250 billion. Moreover, the Deutsche Finanzagentur released €54 billion in German bonds to be used in the most expensive repo trades in order to alleviate collateral scarcity. These measures helped to stabilise rates closer to the DFR on the repo market and lay the foundations for a smooth end-of-year 2022 transition.

Both overnight volumes and repo rates exhibited seasonality at balance sheet reporting dates and most prominently at the end of the year. At the year end, borrowing cash was becoming less popular as it increases the size of the balance sheet, causing overnight transactions and rates to decline. The effect on repo rates was exacerbated in 2021 and to a lesser extent in 2022, declining by more than 200 basis points on both year-ends compared with less than 100 basis points on previous years.

Central counterparties cleared around two-thirds of total activity in the repo market. LCH SA, located in France, cleared more than half of the total trades, with EuroNext Clearing (formerly CC&G) and EUREX, located in Italy and Germany respectively, clearing the rest. Non-cleared trades were conducted by banks and mutual funds. While banks borrow and lend in repo, MMFs tend to be net cash lenders and investment funds are generally net cash borrowers.

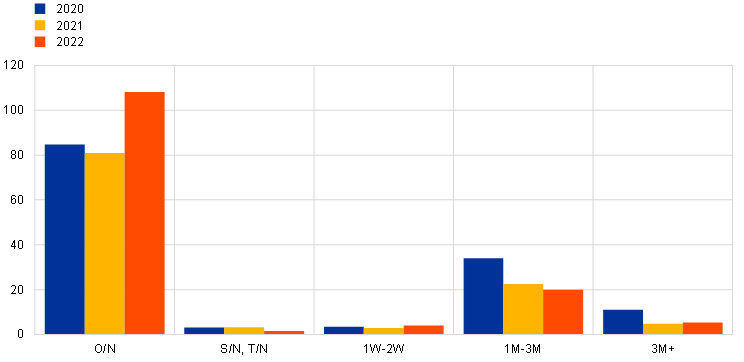

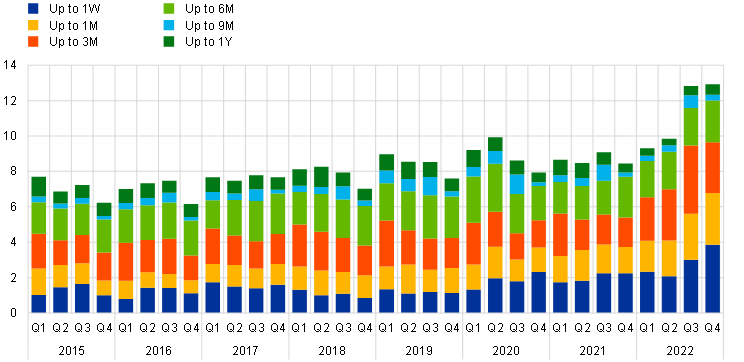

1.1 Volumes

1.1.1 Flows

With an average daily trading volume of approximately €698 billion, the secured segment is the largest segment of the euro money market (Chart 1.1.1). Daily turnover in the secured segment – traded among banks and CCPs – has more than doubled over the last decade, while during the same period the interbank unsecured segment shrank to one tenth. As a result, the euro area repo market has become the predominant form of short-term trading, representing almost 56% of total money market turnover.

Chart 1.1.1

Market size per segment – average daily transaction volumes

(EUR billions)

Source: MMSR.

Note: The percentages refer to the weight of the secured segment on the total of the euro money market for 2018, 2020 and 2022.

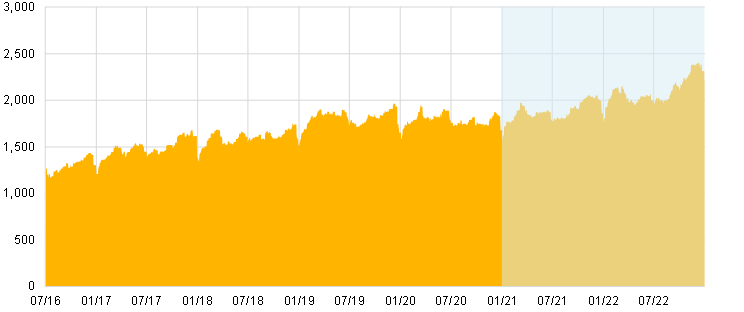

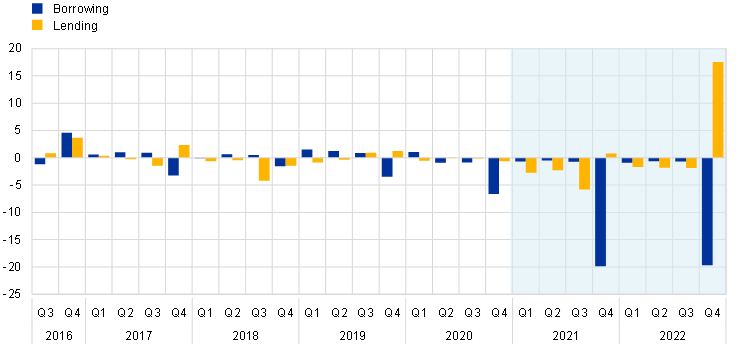

1.1.2 Stock

Outstanding amounts reached a new record high of €2.15 trillion in November 2022 (Chart 1.1.2). Over the last two years, the secured segment has played a key role in facilitating the exchange of both securities and cash in the financial system. Repo trades (49%) largely become a platform for seeking certain securities. Reverse repos (51%) are used to place cash buffers with euro area banks that have access to the ECB deposit facility. Such a trend has been reinforced with the return to positive rates.

Chart 1.1.2

Borrowing and lending secured trading volumes, daily values

(EUR billions)

Notes: Outstanding amounts are adjusted for open repo transactions without fixed maturity at origination. These transactions are outstanding for the entire period between origination and termination date. Confidential points are hidden.

1.1.3 Drivers of volume

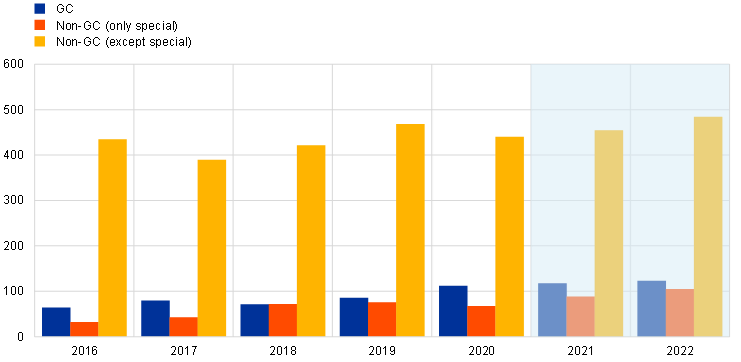

Dominance of non-general collateral trades

Activity in the repo market was largely driven by collateral exchange rather than cash management purposes (Chart 1.1.3). Repo transactions classified as non-general collateral (non-GC) accounted for about 83% of the daily volumes in MMSR. Non-GC covers transactions in which counterparties agree to use a specific security as collateral rather than a general basket of collateral. The scarcer this specific security is in the market, the more expensive it is to borrow it in a non-GC repo transaction. For certain securities with no supply shortages, non-GC and GC repo rates were roughly equivalent. When a security is very expensive – i.e. its repo rate is well below GC repo rates – it is called “special” repo. “Special” repo deals represented on average about 20% of all non-GC repo transactions, while occasionally reaching higher levels. This reflects the increasing scarcity for some securities that has been observed in the repo market.

Chart 1.1.3

Daily average of secured transactions by collateral type

(EUR billions)

Source: MMSR.

Note: Non-general collateral repo refers to secured transactions collateralised using specific securities (international securities identification number (ISIN) codes) and trades with undefined collateral. Given that reporting special collateral is voluntary in the MMSR, the volumes may be under-represented.

Regulation fosters the demand for high quality securities

Prudential regulatory measures that address excessive leverage and unstable funding structures have an impact on the secured money market. The Basel Committee on Banking Supervision has developed a regulatory minimum leverage ratio (LR) to address the potential build-up of excessive leverage, a net stable funding ratio (NSFR) introducing a stable funding requirement for short-dated financing transactions, and a liquidity coverage ratio (LCR) to ensure that banks can withstand short-term liquidity dry-ups. Furthermore, the Financial Stability Board has developed a minimum haircut framework for a subset of securities financing transactions aimed at constraining the build-up of procyclical leverage outside the banking system.

Regulatory ratios alter banks’ incentives to enter repo activity. Repo trades may worsen the LR as the cash received increases the assets side of the balance sheet and, at the same time, the security deployed as collateral is not derecognised from the balance sheet. Regarding the NSFR, short-term repos are not recognised as stable funding and hence this reduces the incentives to engage in such short-term funding transactions. As regards the LCR, the impact on a repo transaction depends on several factors, such as the nature of the collateral used, the counterparty involved and the haircuts applied.

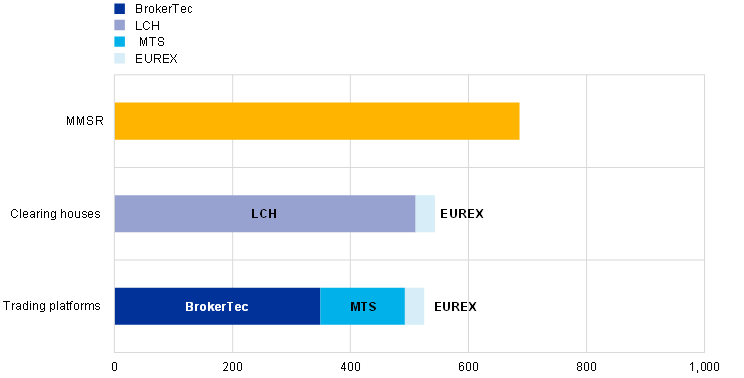

Regulatory measures created to limit banks’ balance sheet capacity and increase efficiency in securities management have contributed to a shift to centrally cleared transactions in the repo market (Chart 1.1.4). The LR framework contributed to the increasing role of central counterparties in the repo market, as it allows for the netting of repos and reverse repos with the same counterparty. Information from complementary data sources on the volume in the repo segment shows that the bulk of transactions in the euro repo market is conducted through clearing houses: LCH, EuroNext Clearing (formerly CC&G) and EUREX Clearing. Transaction-level data gathered from LCH and EUREX datasets cover around 70% of the MMSR volume. Most CCP-cleared repo transactions are negotiated on trading platforms: BrokerTec, MTS Repo platform and EUREX Repo.

Chart 1.1.4

Repo market size decomposition – average daily transaction volumes

(EUR billions)

Sources: MMSR (total repo volume, lending and borrowing), LCH (nominal amounts for RepoClear Ltd and RepoClear SA), EUREX Repo, BrokerTec and MTS. The data from EuroNext Clearing are not reported in the chart because they are not publicly available.

Increase in hedging needs and margin requirements

The need to hedge against interest rate uncertainty, meet margin calls and support fixed-income market making in the derivatives markets gave investors an incentive to source securities via the repo market. The increase in demand for securities has been also largely fuelled by the requirements of the European Market Infrastructure Regulation (EMIR). According to EMIR, over-the-counter (OTC) interest rate derivatives should be cleared via CCPs, hence the need for collateral to meet margin calls. Moreover, the demand for repo transactions has also been stimulated by the need to cover short positions and to support market making on secondary markets for fixed-income derivatives.

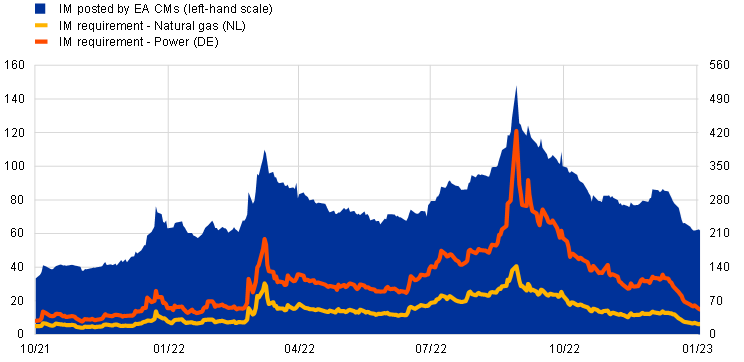

The increase in margin requirements stemmed from the high volatility faced by markets in 2022 as well as from the increased calls per unit of hedging activity and created additional demand for collateral (Chart 1.1.5). As energy prices rose and the ECB embarked on a cycle of rapid and sizeable tightening of financing conditions, margin requirements from clearing houses on futures and swap contracts increased almost twofold. This led clearing houses’ clients to source additional collateral to meet their margin requirements. The requirement to centrally clear these types of derivatives increased liquidity risk, as margin calls must be met with high quality liquid assets in the form of cash or securities. The increased usage of the latter exacerbated the collateral scarcity and further exerted downward pressure on repo rates.

Chart 1.1.5

Initial margin (IM) posted by euro area entities

(left y-axis: EUR billions; right y-axis: EUR/MWh)

Source: ECB calculations.

1.2 Rates

1.2.1 2021-2022 trends

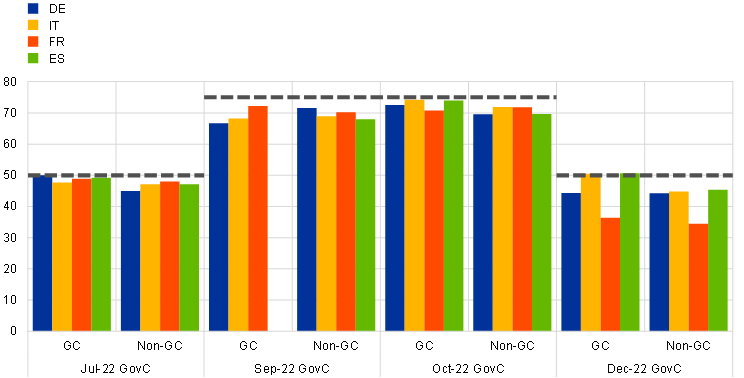

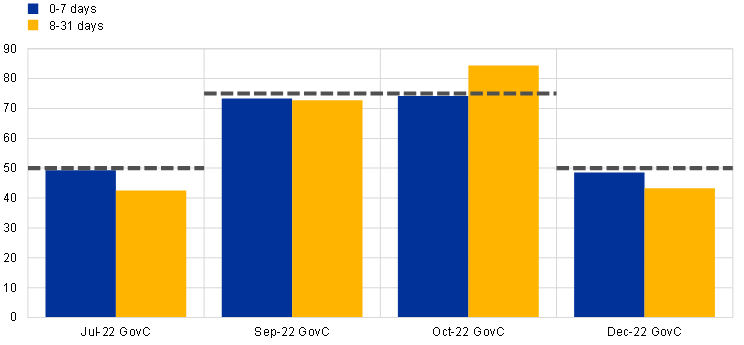

The response of repo rates to the ECB’s key policy rate hikes in 2022 was sluggish (Chart 1.2.1). Following the July, September and October 2022 rate hikes, the pass-through to non-GC repo rates was weaker than to rates for GC repo transactions. This contributed to an increase in the spread of repo transactions backed by special bonds to the DFR. The weaker pass-through to non-GC repo rates, in particular for German collateral, might have been due to frictions resulting from the bargaining power of the lenders of these scarce bonds. The pass-through of the September hike was even more sluggish than July with most repo rates remaining negative for some time after the DFR had been lifted from 0% to 0.75%. This lagged pass-through was largely triggered by the return of investors who had been absent from the money market during the negative interest rate policy cycle, including governments and foreign central banks moving sizeable funds from deposits in the Eurosystem into the repo market. A quicker and more complete pass-through across jurisdictions in response to the October rate hike was aided by (i) the temporary suspension of the 0% remuneration applied by the ECB to non-monetary policy deposits, (ii) the increase of the aggregate limit for securities lending against cash, (iii) the early repayments from TLTRO III, and (iv) the Deutsche Finanzagentur making more German bonds available to the market. Finally, the persistently weak pass-through of the December 2022 hike to repo rates was likely anticipating the seasonal decrease in rates around year-end due to the lower market liquidity.

Chart 1.2.1

Transmission of ECB rate hikes until the second day of the MP

(basis points)

Sources: BrokerTec, MTS.

Notes: Basis points difference of the volume-weighted average rates of the overnight (O/N), spot/next (S/N) and tomorrow/next (T/N) trades from the day of the Governing Council decision until the last day of the maintenance period (MP) and that settle either on the first or second day of the new MP, and the trades from the day of the Governing Council decision until the last day of the MP and that settle before the new MP. For Spain, there were no transactions with GC that met these date requirements for the September hike.

Secured rates stood below the unsecured money market rates and the spread between GC and non-GC repo rates widened (Chart 1.2.2). GC repo rates continued the progressive downward trend that followed the ECB’s large liquidity injection in response to the coronavirus (COVID-19) crisis. As a result, GC repo rates traded below the DFR over the entire review period, with the negative spread between policy rates and GC rates growing over time to record levels. The drift of GC repo rates below the policy rate and below the euro short-term rate (€STR) reflects a widespread collateral scarcity – in contrast to the ample availability of cash – affecting the entire universe of government bonds. Simultaneously, non-GC rates declined more strongly than GC rates, and this decline became more pronounced after the second half of 2021. The GC/non-GC spread reflects the premium that investors are willing to pay to source a specific bond in a repo transaction. In specific collateral repos, rates are mainly determined by the supply and demand of the individual bond issued as collateral. Over the review period, the availability of bonds in repo markets decreased owing to central bank asset purchases, which withdrew collateral from the system, leading to an all-time low free float for many government bonds. Moreover, there was a pick-up in the demand for specific collateral driven by short selling and market making activity in the bond market and by the pre-positioning for seasonality-driven spikes in the demand for collateral. The interaction between these factors led to an increase in the premium for borrowing specific collateral, resulting in wider GC/non-GC spreads.

Chart 1.2.2

Government repo rates by collateral type

(left-y-axis: percentages; right y-axis: basis points)

Sources: BrokerTec, MTS.

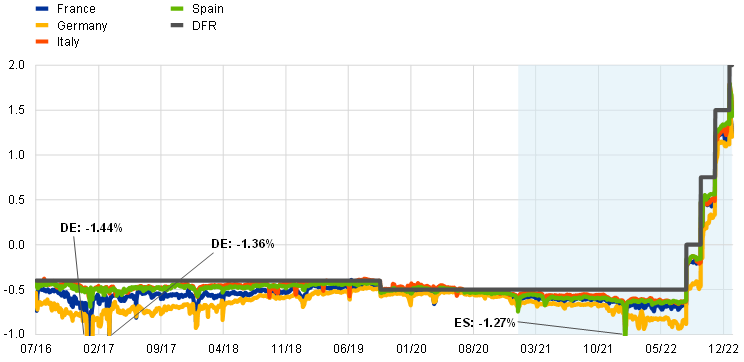

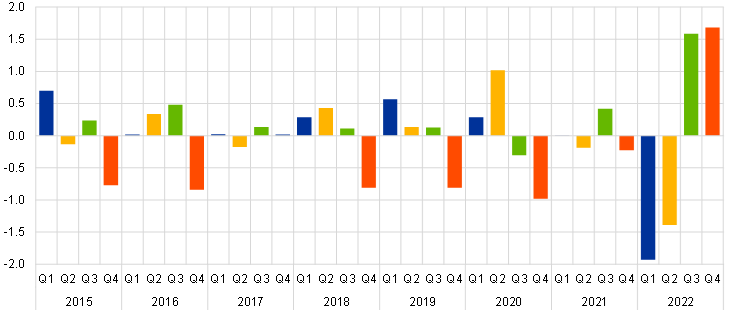

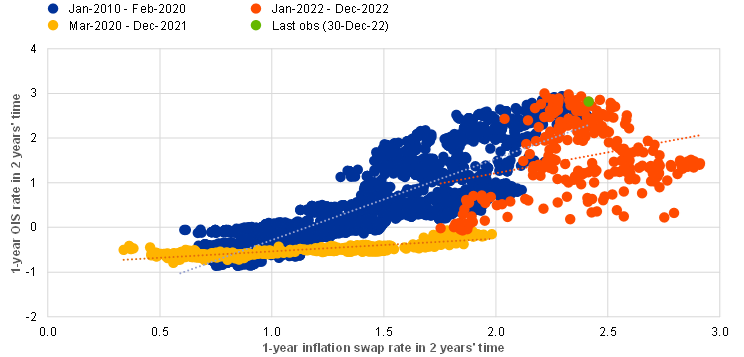

The spread between repo rates and the DFR widened significantly for collateral across all jurisdictions and the heterogeneity across jurisdictions increased (Chart 1.2.3, panel a). For most of 2021 the repo rates for all jurisdictions moved together, while the gap between rates for repo transactions with collateral from core and non-core jurisdictions increased towards the end of 2021 and remained sizeable during 2022. Repo rates for German collateral were subject to additional downward pressures by the end of 2021 amid concerns of a severe shortage of collateral ahead of the year-end. Owing to economic and geopolitical uncertainty, the German collateral repo rates continued to drift further below the DFR during 2022 in the context of additional demand for safe assets.

Policy measures in the second half of 2022 have eased collateral scarcity and alleviated the severe collateral shortage (Chart 1.2.3, panel b). As mentioned earlier, in October 2022, the Deutsche Finanzagentur put €54 billion of own-held German bonds on the market, helping to smooth over German repo rates. Moreover, the temporary suspension of the 0% remuneration applied by the ECB to non-monetary policy deposits, together with the increase of the aggregate limit for securities lending against cash and the early repayments from the TLTRO III programme, served to alleviate tensions in the availability of collateral.

Chart 1.2.3

Government repo rates by collateral issuer jurisdiction

a) Repo rates by jurisdiction

(panel a: percentages; panel b: basis points)

b) Repo rates’ difference to DFR by jurisdiction (Jan-21 to Dec-22)

(panel a: percentages; panel b: basis points)

Sources: MMSR and ECB.

Note: The quarter-end dates were excluded.

1.2.2 Drivers of rates

Low repo rates result from the interaction between the supply and demand for collateral and cash seeking for short-term safe instruments. This equilibrium between cash and securities can be influenced by conjunctural and structural factors. Among the conjunctural factors, the most important drivers of swings in rates are seasonal patterns (such as reporting dates of regulatory ratios and futures delivery dates), idiosyncratic demand for specific securities and flight-to-quality episodes, e.g. owing to COVID-19 and the war in Ukraine. The structural factors, on the other hand, are the ample availability of reserves and the lower free float of collateral.[3] The latter factors were caused by the implementation of asset purchase programmes and the conduct of credit operations, which led to central banks having a large footprint in financial markets.

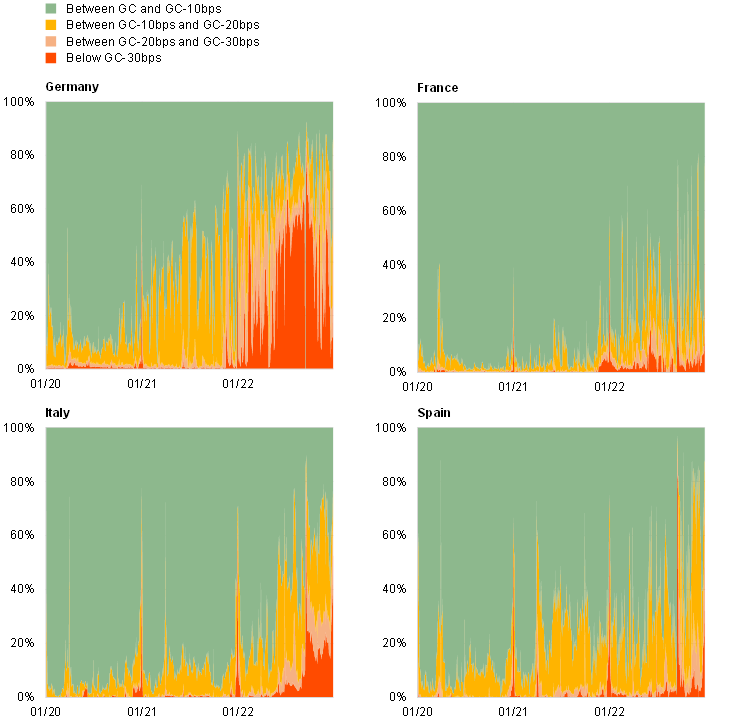

Collateral scarcity

The severe collateral scarcity for certain high credit quality bonds was the decisive factor in the strong downward pressure on repo rates observed in autumn 2022 (Chart 1.2.4). Scarcity of government bonds, particularly severe for some specific issuances, caused downward pressures on rates and resulted in a larger share of trades well below the DFR. The structural scarcity of some government bonds was aggravated in autumn 2022 by a higher demand for short-term safe assets and by an increase in short positions in the cash market, thus underpinning further stress in repo rates.

Chart 1.2.4

Specialness in the German, French, Italian and Spanish repo markets: share of repo volume trading below the GC rate by spread band (%)

(percentages)

Sources: MMSR, BrokerTec and MTS.

Note: Confidential points are hidden. Given that the reporting of special collateral is voluntary in MMSR, this chart aims to estimate the volume of non-GC special repo by looking at the most expensive transactions. The areas highlighted in red show the transactions that are more expensive compared with GC repo rate (a difference of 30 basis points or more).

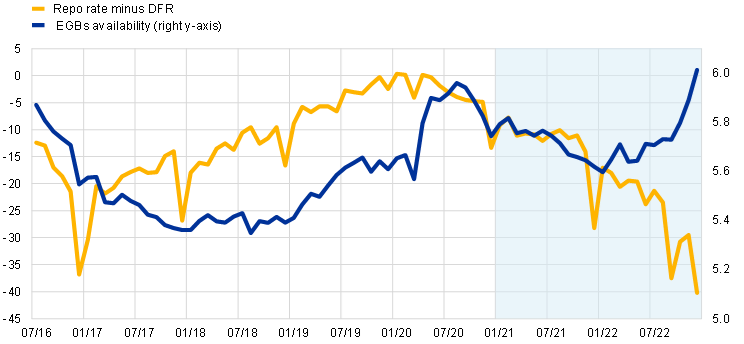

Central bank footprint

The increasing presence of the Eurosystem in the market for euro area government bonds has contributed to a lower availability of collateral (Chart 1.2.5). The sizeable amount of net asset purchases conducted during 2021 and in the first half of 2022, as well as the full reinvestment of maturing holdings thereafter further increased the Eurosystem’s share in the European sovereign debt market and contributed to lower repo rates. As the central bank behaves as a buy-and-hold investor, its asset purchases limit the free-floating availability of government bonds in the system. This stock effect diminishes the supply of bonds and thus increases the relative value of collateral, leading to lower repo rates. While GC repo is affected by asset scarcity – as the overall supply of collateral is diminished – non-GC repo has a higher sensitivity to a lower free float, because investors face greater difficulties finding specific collateral the scarcer it is.

Chart 1.2.5

Relationship between repo rates (GC and non-GC) and availability of securities in the Eurosystem

(left-hand side: basis points; right-hand side: EUR trillions)

Sources: Eurosystem, BrokerTec and MTS.

Note: The DFR was subtracted from the repo rates and is represented as a daily monthly average. The availability of European government bond (EGB) is calculated by subtracting the Eurosystem footprint on government bonds from the total issuance of euro area government bonds. The Eurosystem footprint is the monetary policy government bond portfolios, plus pledged government bonds as collateral for the Eurosystem lending operations, minus government bonds lent by the Eurosystem through the securities lending facility.

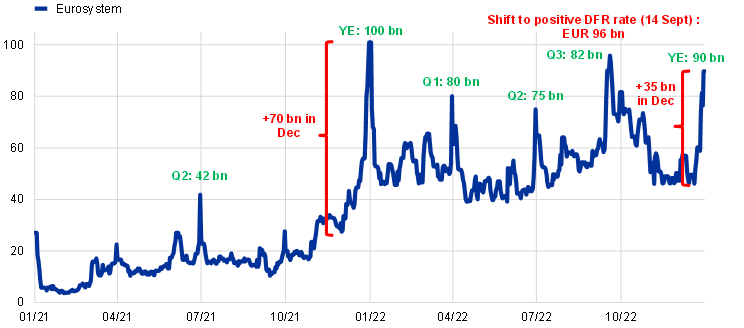

To attenuate the impact of its larger footprint, the Eurosystem has activated the securities lending facilities (Chart 1.2.6). The securities lending framework aims to support the functioning of bond and repo markets by lending back the market bonds bought under the APP and the PEPP. Moreover, the Deutsche Finanzagentur issued €54 billion to alleviate collateral scarcity of the German bonds used in the most expensive repo trades.[4] Both measures contributed to stabilise rates closer to the DFR on the repo market.

Chart 1.2.6

Usage of the Eurosystem securities lending facilities against cash collateral

(EUR billions)

Source: Eurosystem.

Note: YE refers to “year end”.

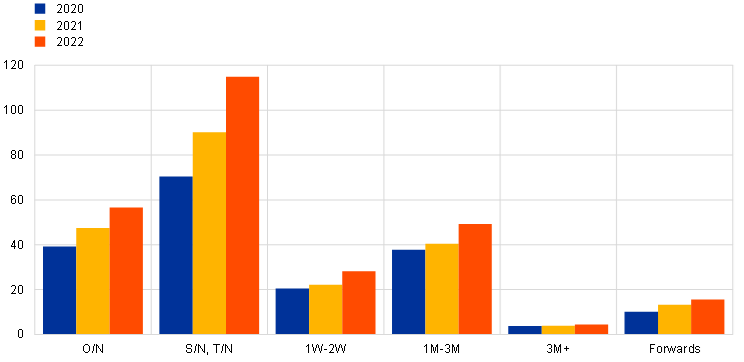

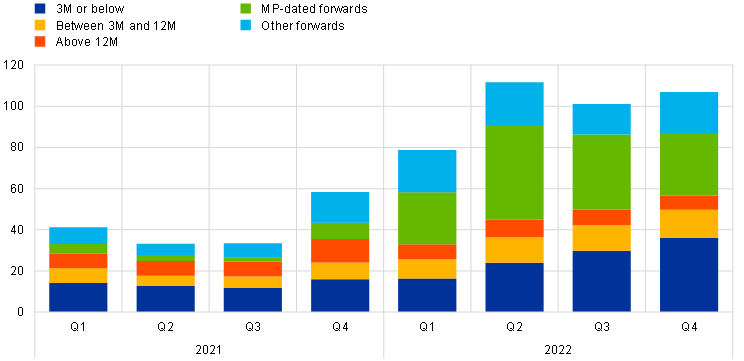

1.3 Maturities and calendar effects

1.3.1 Flows

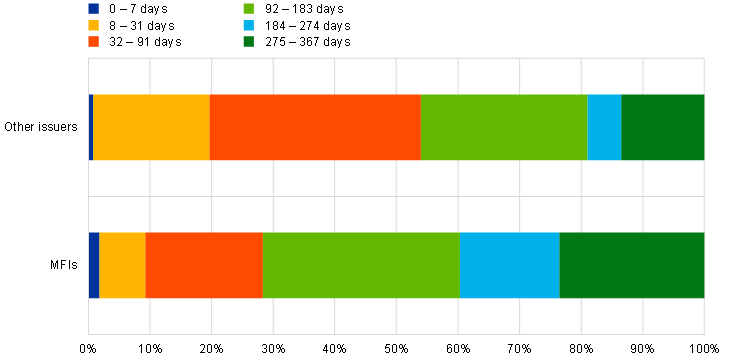

The repo market is mainly a short-term market, with most transactions taking place in the one-day maturity bucket (Chart 1.3.1). One-day maturity transactions, mainly concentrated in spot/next (S/N) and tomorrow/next (T/N), accounted for about 90% of the total repo turnover in 2022. Given that (specific) collateral-driven secured transactions are typically executed at the S/N tenor, this increase in S/N transactions reflects the growing importance of specific secured transactions.

Chart 1.3.1

Daily average volumes by maturity bucket over time

(EUR billions)

Source: MMSR.

Note: O/N – overnight; S/N – spot/next; T/N – tomorrow/next.

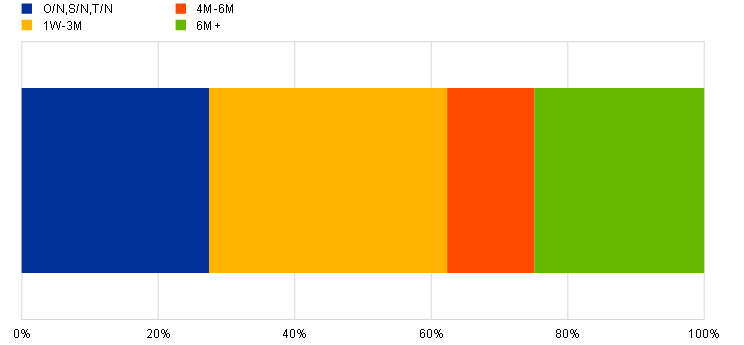

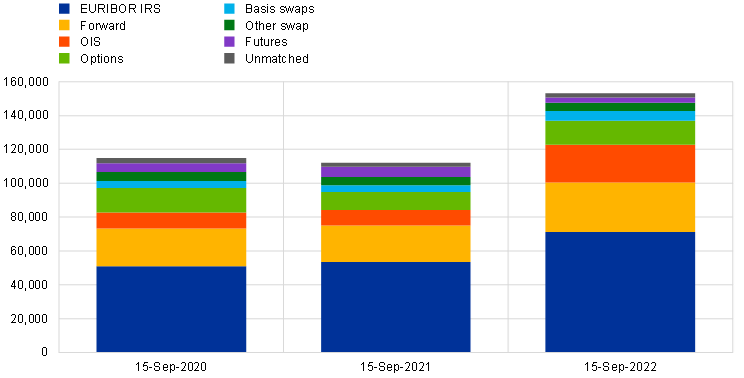

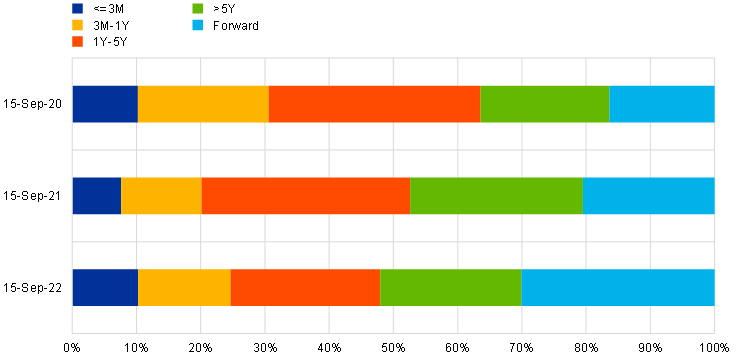

1.3.2 Stock

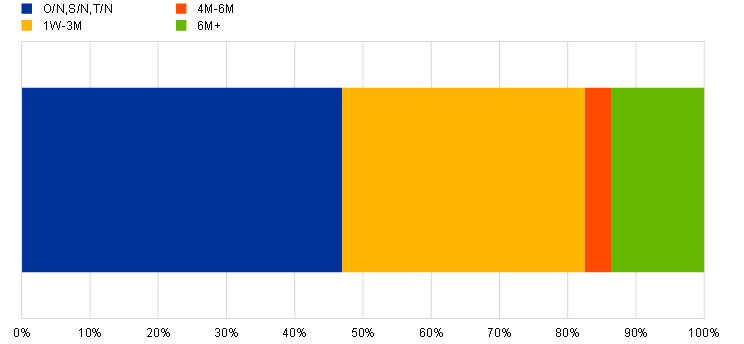

Roughly 85% of the total outstanding secured transactions are concentrated below the three-month maturity bucket (Chart 1.3.2). The larger share of the outstanding amount for term transactions relative to their daily turnover responds to the fact that these are not rolled over daily. The outstanding volumes on shorter maturities mainly involve borrowing transactions, with a total share of about 45% (compared with about 39% of the stock of volume in lending transactions). The stock of repos traded on longer maturities is higher for lending transactions, as repos are used as a source of liquidity provision when taking a position in longer maturities.

Chart 1.3.2

Share of total outstanding amount at 15 September 2022 by original maturity

(percentages)

Source: MMSR.

Note: The outstanding amount is a snapshot taken on 15 September 2022 in order to avoid reporting dates. The outstanding amount transforms the daily transaction volumes (flows) into a stock variable based on maturity dates. Outstanding amounts are adjusted for open repo transactions without fixed maturity at origination. These transactions are outstanding for the entire period between origination and termination date. Both borrowing and lending sides have been considered.

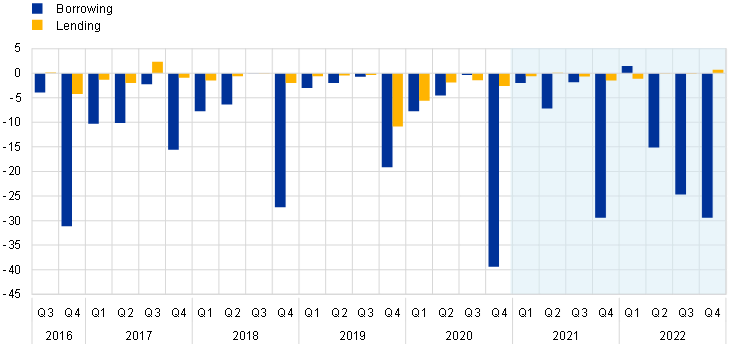

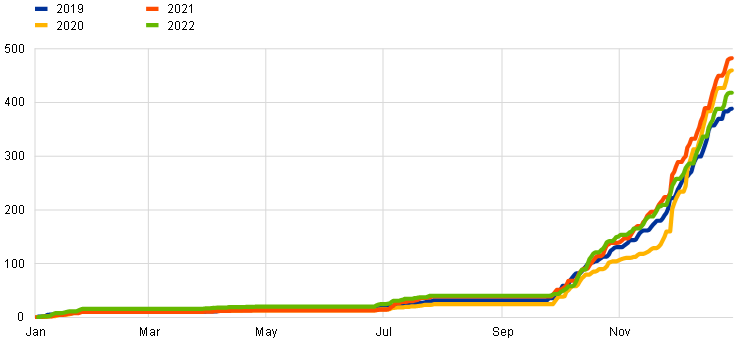

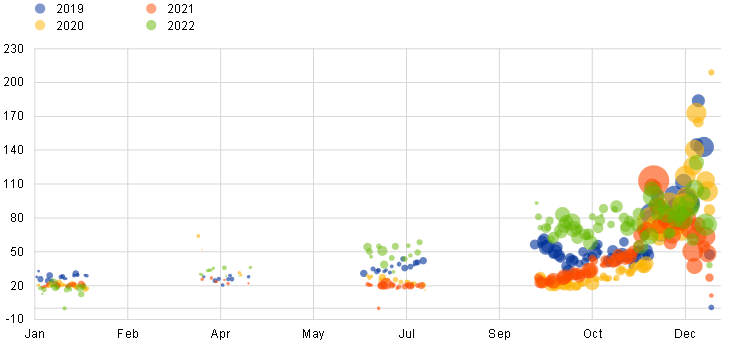

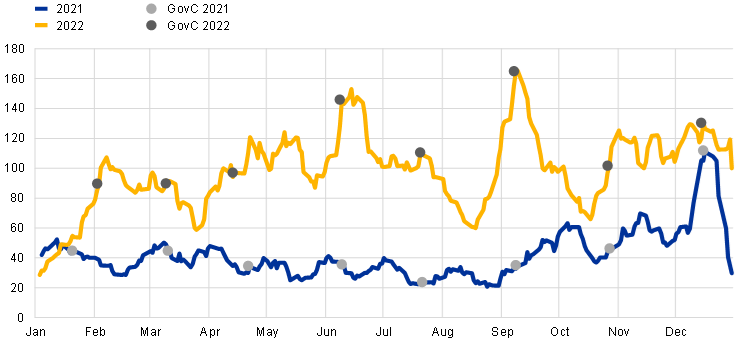

1.3.3 Calendar effects

In recent years, there has been a significant decline in repo rates at quarter- and year-ends (Chart 1.3.3). Banks have an incentive to reduce the size of their balance sheets at regulatory reporting dates, especially at year-end, in order to improve their supervisory ratios. This leads to a reduction in their intermediation capacity, and ultimately in repo activity, which is particularly balance-sheet intensive around these periods. As a result, investors willing to borrow collateral are charged a premium for this balance sheet cost, which has increased over the past years due to the imbalance between the amount of cash and the availability of securities in the system.

Chart 1.3.3

Effect of reporting dates on repo rates

(basis points)

Source: MMSR.

Note: Rate difference between the last business day of the quarter and the first business day of following quarter.

Volumes declined at the end of each quarter owing to counterparties’ balance sheet constraints (Chart 1.3.4). In an environment of high excess liquidity, repo transactions predominantly serve collateral management purposes. Compared with the average volume traded during the quarter, borrowing activity on the last day of each quarter has gradually decreased, as banks are less willing to borrow liquidity and lend collateral to control their balance sheet size. The decline of volumes and the lower repo rates at these dates have generated (i) difficulties in hedging short positions in the repo market; (ii) an increase in settlement failures; (iii) difficulties for non-bank counterparties in depositing liquidity and, consequently, increased exposure to unexpected losses owing to particularly punitive rates; and (iv) volatility and uncertainty regarding one-day rates.

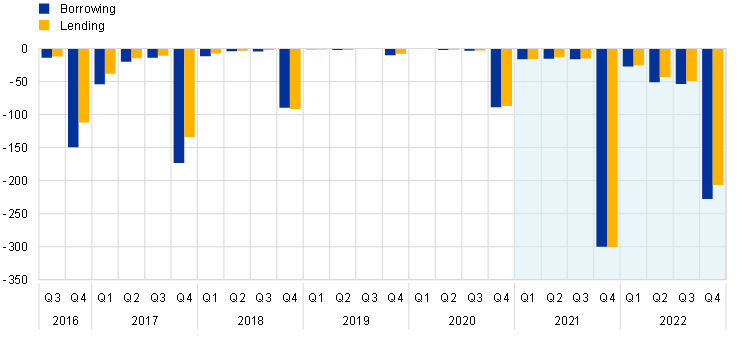

Chart 1.3.4

Volume effect of reporting dates (quarter-end and year-end)

(EUR billions)

Source: MMSR

Note: Volume difference between the last business day of the quarter and the first business day of following quarter.

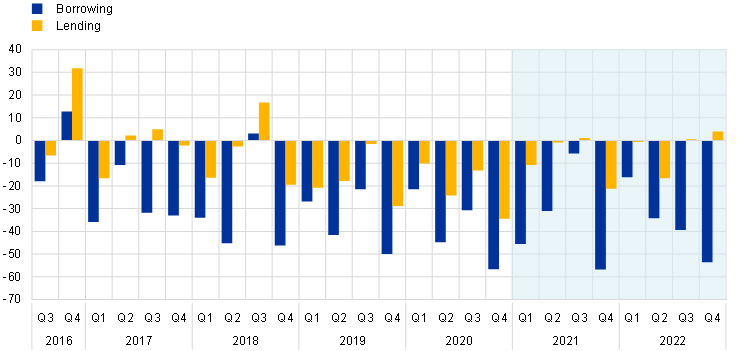

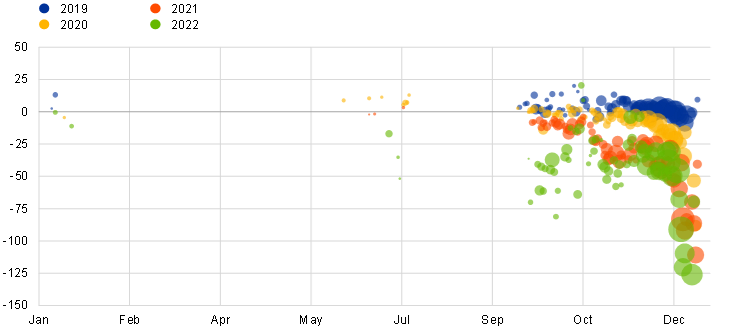

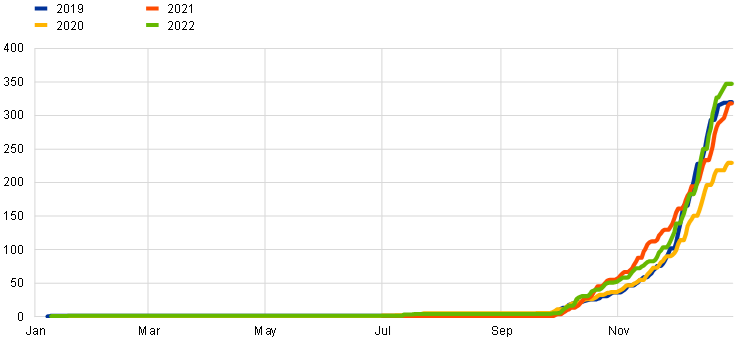

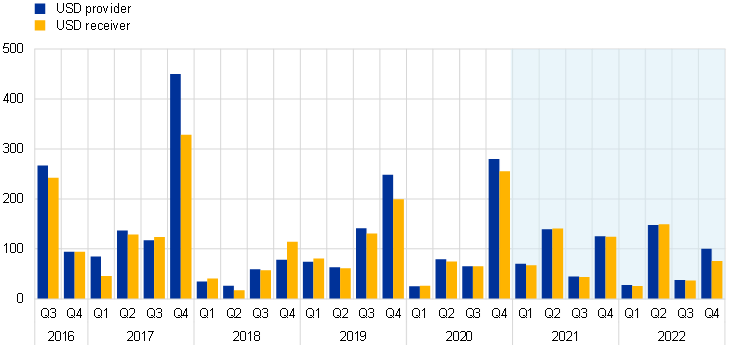

Counterparties intensified their prefunding activity ahead of the major balance sheet reporting dates over the years to avoid acquiring collateral at particularly punitive rates in the last days of each year (Charts 1.3.5 and 1.3.6). In recent years, market participants have hedged their liquidity (or collateral) needs beyond the reporting dates by stepping up their prefunding activity on repo transactions. Repo transactions that were settled in the second half of the year and mature at the beginning of the following year increased in 2022, reaching €347 billion at the end of 2022, similar to 2021 and significantly higher than in 2020. The spread between euro area repo and OIS rates for transactions maturing after the year-end widened, peaking by the end of September and then gradually narrowing down in response to measures taken during the fourth quarter aimed at alleviating collateral scarcity. By the end of the third quarter of 2022, markets had discounted particularly low rates at the end of the year and possible increases in fails following the Governing Council’s September 2022 decisions. As the end of the year approached, a series of measures had been taken by the Eurosystem and by governments in order to alleviate the scarcity of specific securities in the market.[5] As a result, conditions in the repo market slightly improved. These measures helped to stabilise rates and narrow the repo-OIS spread, ensuring a smoother end-of-year transition.

Chart 1.3.5

Prefunding rates

(basis points)

Sources: MMSR, Bloomberg.

Note: Collateral issuer locations: DE, IT, FR, ES. The prefunding rates refer to all transactions executed and settled throughout the year of the selected period and that mature in January of the following year. Transactions are considered that fit in the maturities buckets of 1W, 2W, 1M, 2M, 3M, 6M, 9M and 12M. Trades maturity dates are adjusted for open repo transactions without fixed maturity at origination, so they reflect the date of termination or the latest date if a still ongoing operation. The size of the bubble represents the size of the transaction. Confidential points are hidden.

Chart 1.3.6

Prefunding volumes

(EUR billions)

Source: MMSR.

Note: Collateral issuer locations: DE, IT, FR, ES. The prefunding volumes refer to all transactions executed and settled throughout the year of the selected period and that mature in January of the following year. Considering the transactions that fit in the maturities buckets of 1W, 2W, 1M, 2M, 3M, 6M, 9M and 12M. Trades maturity dates are adjusted for open repo transactions without fixed maturity at origination, so they reflect the date of termination or the latest date if a still ongoing operation. Confidential points are hidden.

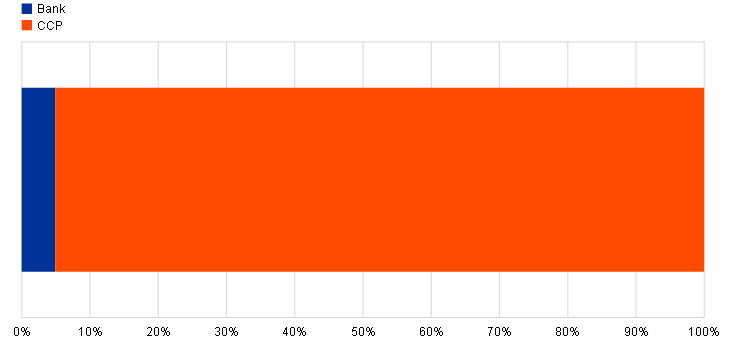

1.4 Counterparties

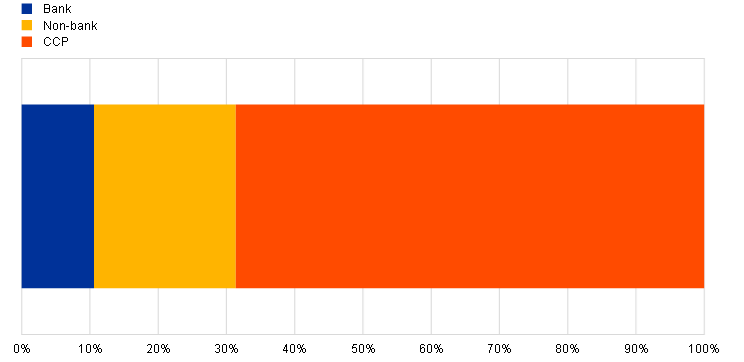

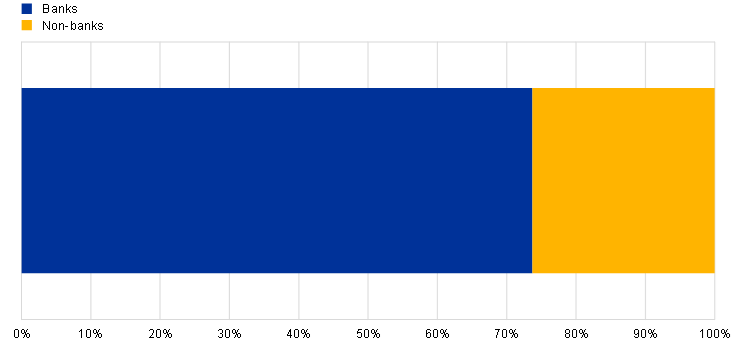

1.4.1 The importance of non-banks

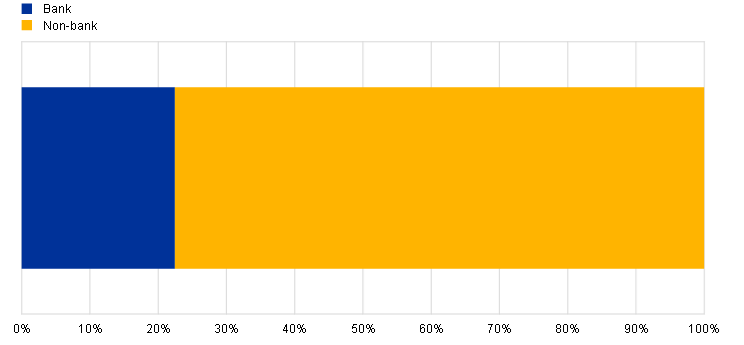

Around two-thirds of traded volumes in the euro repo market are centrally cleared (Chart 1.4.1). While some of the CCPs have a banking licence, they are considered as a third category, separate from banks and non-banks.

Chart 1.4.1

Percentage of trade with non-banks

(percentages)

Source: MMSR.

Note: Secured borrowing and lending volumes displayed. Some of the CCPs also have a banking licence. However, CCPs are displayed as a third category in this chart, separate from banks and non-banks.

The highest volumes of non-cleared transactions were conducted by MMSR reporting agents with other banks and with investment and money market funds (Chart 1.4.2). The non-cleared activity was distributed across banks, other types of financial institutions, general governments and, to a lesser extent, insurance companies. This trend has been ongoing since 2018. While banks borrow and lend in repo because of their market intermediation activity and their own portfolio management, MMFs tend to be net cash lenders and investment funds are generally net cash borrowers. Investment funds use repo transactions to increase their leverage for financing securities holdings.

Chart 1.4.2

Daily average non-cleared secured transaction volumes by sector

(EUR billions)

Source: MMSR.

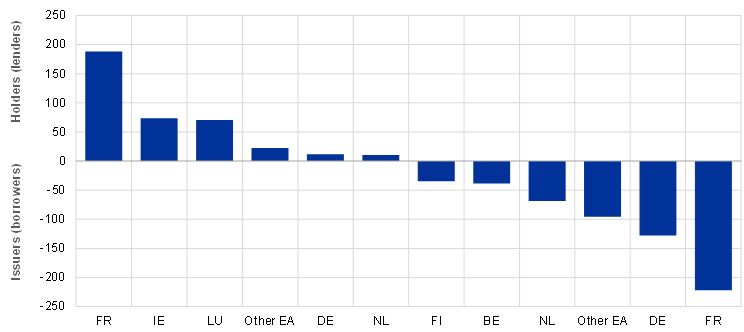

1.4.2 Direction of the trade by sector and by jurisdiction

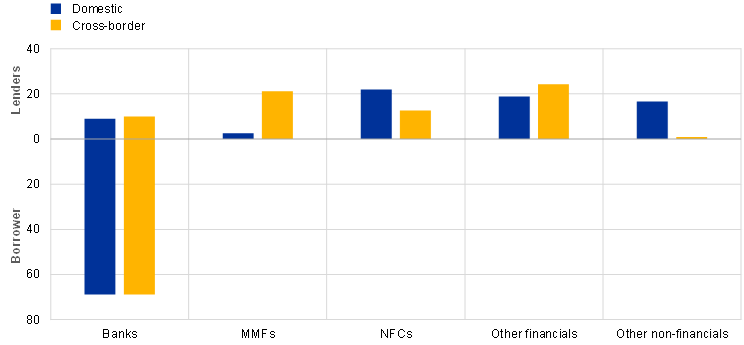

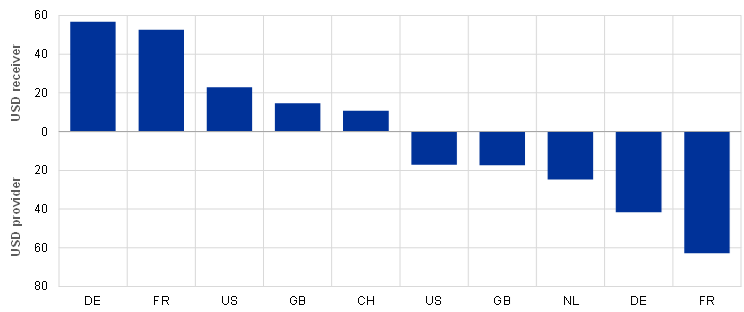

French institutions account for the largest volumes in borrowing and lending repo transactions, followed by German institutions (Chart 1.4.3). Institutions from the Cayman Islands make up the third-largest counterparty jurisdiction for both trading directions.

Chart 1.4.3

Top 5 lender and borrower jurisdictions

(EUR billions)

Source: MMSR.

Note: Only bilateral trades were considered. KY refers to the Cayman Islands.

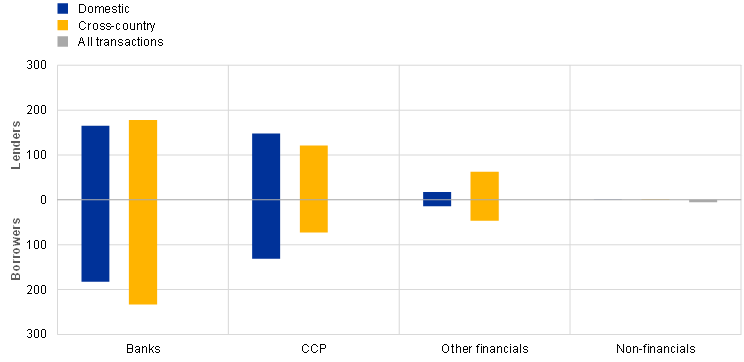

Traded volumes for different counterparty sectors and jurisdictions were evenly distributed across borrowing and lending transactions (Chart 1.4.4). Moreover, over half of the turnover with bank counterparties is cross-border, and MMSR reporting agents are net borrowers from other banks. On the other hand, over half of the turnover with CCPs is domestic, and MMSR reporting agents are net lenders in these transactions.

Chart 1.4.4

Direction of the trade by sector and by jurisdiction

(EUR billions)

Source: MMSR.

Notes: For compliance with confidentiality rules, euro area cross-border and international trades need to be displayed together under cross-country label.

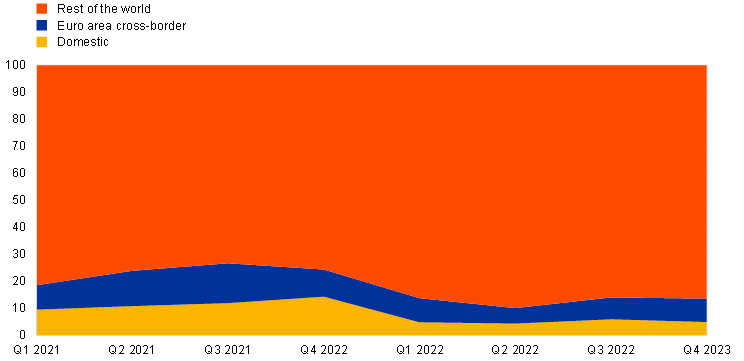

The share of non-euro area international counterparties increased over the course of 2022 (Chart 1.4.5). The share of trades with non-euro area international counterparties reached 20% of total turnover, compared to 15% at the end of 2020. However, the share of domestic trades remained the most sizeable with almost half of the total turnover.

Chart 1.4.5

Direction of the trade by sector and by jurisdiction

(percentages)

Source: MMSR.

Note: Domestic refers to trades with a counterparty located in the same jurisdiction than the MMSR reporting bank. Euro area cross-border refers to trades with a counterparty located in the different member state than the MMSR reporting bank. Rest of the world refers to trades with a counterparty located outside the Euro area.

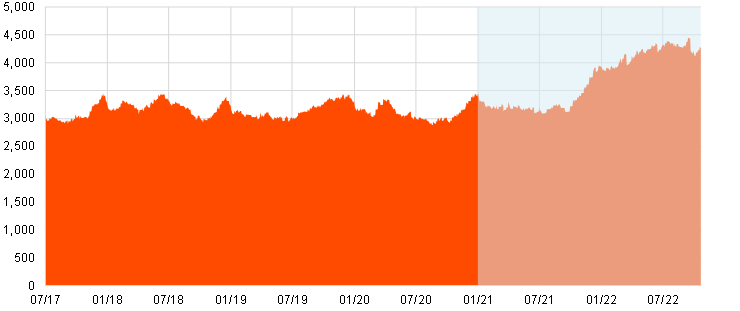

2 The unsecured cash segment

Activity in the unsecured cash segment remained subdued but showed signs of reactivation during the second half of 2022. With excess liquidity reaching a record high of €4.7 trillion in the period under review, activity in the European money markets was largely driven by transfers of funds from non-banks to banks that subsequently placed them in the deposit facility of the Eurosystem. While the amount of funds exchanged in the secured segment was almost three times larger than in the unsecured segment, the return to positive interest rates in 2022 unlocked some business that had remained dormant during the negative interest period. Moreover, rising policy rates triggered devaluations of the securities holdings, requiring account holders to deposit additional cash or securities to meet margin calls, thus increasing trading volumes. Both factors relaunched activity – mainly overnight – in the unsecured segment by about one-fifth.

The pass-through of four policy rate hikes to unsecured overnight rates was rapid and efficient, but somewhat slower for longer maturities. The €STR responded immediately and by 99.4% to the four rate hikes. The EURIBOR also reacted to the policy normalisation process, but a less immediate pass-through was noted.

The €STR-DFR spread reached 10 basis points by the end of 2022 compared with 6 basis points at the beginning of 2021. Downward pressures on borrowing rates came from a persistent imbalance between cash demand and supply. On the demand side, euro area banks discouraged short-term cash inflows as they worsen the banks’ regulatory ratios. On the supply side, depositors placing an increasing amount of excess liquidity favoured short money market maturities which, in the latter part of 2022, offered positive returns in an environment still dominated by large uncertainty surrounding the ECB terminal policy rate. This resulted in banks paying lower rates for deposits, which caused a wider €STR-DFR spread and negative one-month EURIBOR-OIS spreads, reflecting negative liquidity risk premia in shorter tenors. However, forward spreads (i.e. FRA-OIS spreads) remained positive, suggesting that the negative EURIBOR-OIS spreads were expected to be temporary.

Both overnight volumes and rates exhibited seasonality at quarter-ends, and this was more notable at year-ends. At these dates, both the usual volume of transactions and interest rates are reduced, as borrowing cash becomes particularly unwelcome for regulatory reasons. The rate effect exacerbated in 2021 and 2022, with the rate declining by 20 basis points on both year-ends compared with a decline of less than 7 basis points in previous years.

Almost 80% of the turnover reflected transactions between banks with access to the deposit facility and non-banks with no access to it. Non-bank counterparties domiciled in Germany, Luxembourg and Ireland showed the most active lending activity. Liquidity tended to accumulate in German, French and Belgian banks, independently of whether the liquidity had originally been distributed by the Eurosystem’s credit providing operations or its asset purchases.

2.1 Volumes

2.1.1 Flows

With an average daily trading volume of €138 billion, the unsecured segment was the third-largest segment of the euro money market in terms of volume (Chart 2.1.1), growing by approximately 21% over the last year. Unsecured transactions represented 12% of the total euro money market trading volume in the period under review, as measured in the MMSR data. The average daily trading volume stood at €125 billion in 2021 and increased to €151 billion in 2022.

Chart 2.1.1

Market size per segment in terms of daily transaction volumes, average in each quarter

(EUR billions)

Source: MMSR.

Note: The percentages refer to the weight of the unsecured cash segment on the total of the euro money market for 2018, 2020 and 2022.

2.1.2 Stock

Outstanding amounts increased with the monetary policy normalisation cycle in the second half of 2022, starting from the lower levels observed during the pandemic (Chart 2.1.2). The decline in volumes stopped in 2021 and stabilised at around €265 billion, approximately €80 billion lower than in the years before the COVID-19 crisis. Inflation pressures changed market expectations of ECB interest rates and triggered appetite for more active liquidity management in 2022. This reactivation of activity increased the outstanding volume to around €300 billion in the first half of 2022 and €400 billion in the second half of 2022. In November 2022, outstanding volume hovered close to €500 billion, the highest outstanding volume recorded in the unsecured segment since MMSR data collection started.

Chart 2.1.2

Borrowing and lending trading volumes, daily values

(EUR billions)

Source: MMSR.

Note: Confidential points are hidden.

2.1.3 Drivers of volume

Liquidity placements from non-banks, concentrated in overnight maturity

Money market activity in the unsecured segment remained dominated by financial institutions other than banks and corporates placing their liquidity with euro area banks at very short tenors (Chart 2.1.3). Almost 78% of banks’ unsecured transactions have a non-bank as counterparty. Non-banks without access to the Eurosystem standing facilities place cash of an overnight maturity via the money market with euro area banks. These banks subsequently deposit funds with the ECB at the DFR. While there has been an increased preference for secured trading in money markets since the global financial crisis, market participants’ daily liquidity management practices and the less onerous pricing of unsecured trades have always preserved daily borrowing activity above €100 billion.

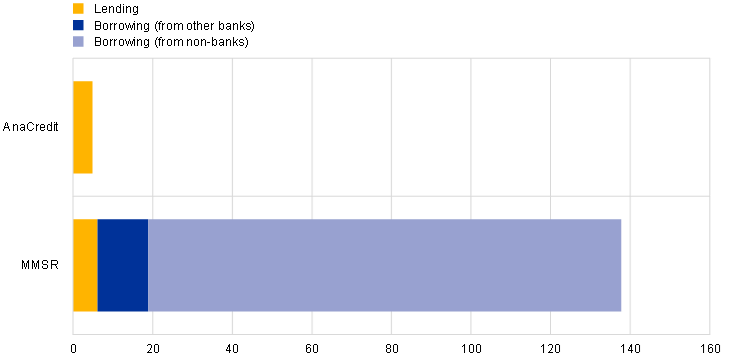

Chart 2.1.3

Market size per data source – average daily transaction volumes over the last two years

(EUR billions)

Sources: AnaCredit (bank loans below one year) and MMSR (borrowing and lending).

Note: While borrowing covers banks’ transactions vis-a-vis any counterparty, lending only covers interbank activity.

The overnight segment represented 83% of the total unsecured volume (Chart 2.1.4). The reactivation of the unsecured activity in the second half of 2022 remained largely concentrated in the overnight maturity bucket.

Chart 2.1.4

Quarterly daily average volume traded by maturity bucket

(EUR billions)

Source: MMSR.

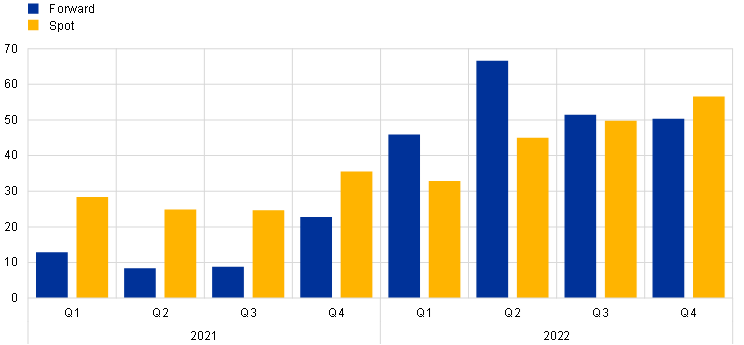

Return to positive interest rates

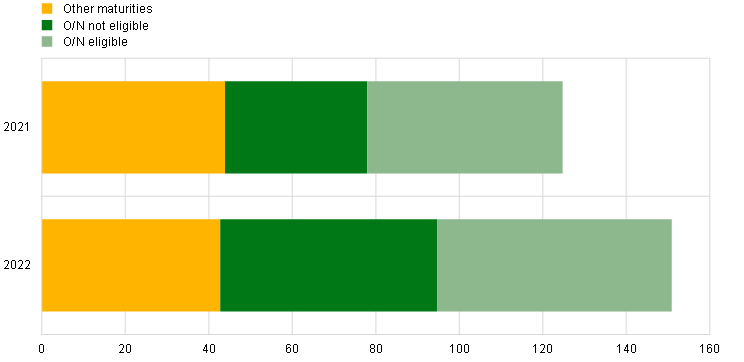

The return to positive interest rates in 2022 unlocked some business that had remained dormant during the negative interest period and triggered a decline in the value of securities holdings, requiring account holders to deposit additional cash to meet margin calls (Chart 2.1.5). Both factors contributed to a reactivation of activity in the unsecured segment by about one-fifth, mainly overnight and in the very short-term tenors. The daily average volume contribution to the €STR[6] increased from €46 billion in 2021 to €56 billion in 2022. The increase in €STR volumes was particularly strong during the second half of 2022, with an average daily volume of €60 billion and a peak of €80 billion on 14 September 2022.

Chart 2.1.5

Breakdown of borrowing transactions according to contribution to €STR

(EUR billions)

Source: MMSR.

Notes: The chart is calculated as the daily average of the borrowing transactions divided into different selected maturities: “O/N eligible” captures O/N transactions contributing to the €STR, including those affected by the trimming procedure; “O/N not eligible” captures O/N transactions outside the €STR calculation (call accounts transactions with governments and NFCs, as well as small trades below €1 million); and “Other maturities” captures the residual borrowing transactions with maturities of longer than overnight.

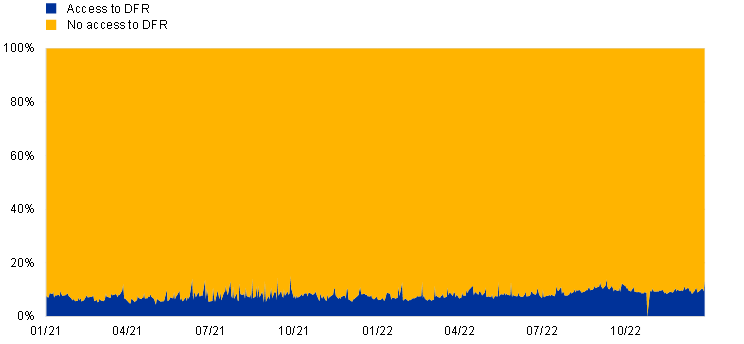

Interbank activity in the unsecured cash segment has also increased, albeit still at a low level (Chart 2.1.6). While interbank lending activity continues to be subdued, with daily flows between €4 billion and €7 billion, the share of unsecured interbank activity in MMSR for all maturities has slightly increased, from almost 7% at the beginning of 2021 to 10% at the end of 2022.

Chart 2.1.6

Percentage of unsecured lending and borrowing volumes across counterparties with and without access to the DFR

(percentages)

Source: MMSR.

Note: Borrowing and lending average daily transaction volumes over the last two years are shown. Confidential points are hidden.

2.2 Rates

2.2.1 2021-22 trends

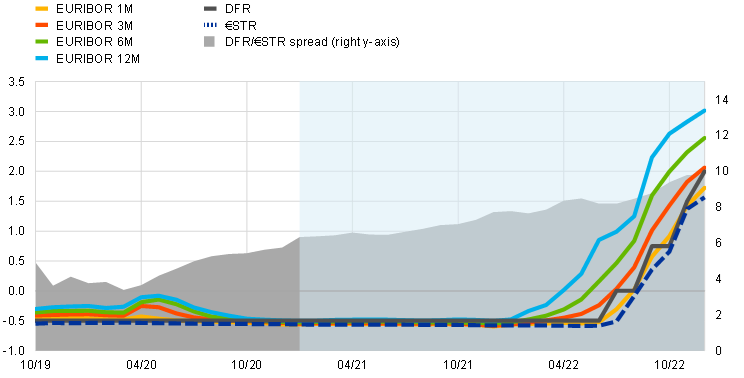

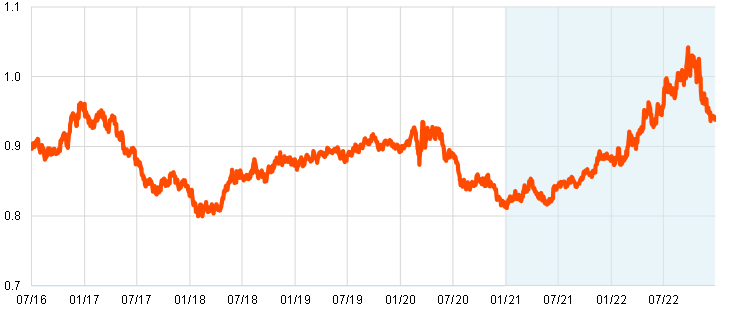

Unsecured rates increased for all tenors in 2022 after reaching a historical low at -0.60% in December 2021 (Chart 2.2.1). The €STR remained broadly stable in 2021 at an average of around -0.568%, while in the first half of 2022 the €STR fluctuated at a somewhat lower level, close to, but without reaching -0.6%. The EURIBOR also remained broadly stable in 2021, hovering below, but close to, the DFR in all maturities except for the 12-month tenor, which remained slightly above the DFR. All EURIBOR tenors reached historical lows in mid-December 2021, with the three-month EURIBOR at -0.605% and the six- and 12-month EURIBOR at -0.554% and -0.518%, respectively. In 2022, higher inflationary pressures changed market expectations regarding the ECB official interest rate hikes and led to a steady increase of all unsecured rates and to higher term risk premia. This had a more visible impact on the 12-month EURIBOR which discounted further ECB interest rate hikes. By the end of 2022 the €STR stood at 1.89% and the 12-month EURIBOR at 3.00%.

Chart 2.2.1

Evolution of unsecured rates and the DFR-€STR spread

(left y-axis: percentages; right y-axis: EUR billions)

Sources: MMSR, ECB, Bloomberg.

Notes: EURIBOR stands for euro interbank offered rate. The EURIBOR is based on the average interest rates at which a large panel of European banks borrow funds from one another. There are different maturities, ranging from one week to one year.

The pass-through of the four policy rate hikes to the unsecured rates in 2022 was rapid and effective (Chart 2.2.2). The increases in the ECB’s official interest rates were well transmitted to the unsecured segment. The €STR responded immediately with a 99.4% pass-through of the four rate hikes of +50 basis points, +75 basis points, +75 basis points and +50 basis points decided in the second half of 2022, increasing by 49.6 basis points on 27 July to -0.085%, by 74.5 basis points on 14 September to 0.662%, by 74.4 basis points on 2 November to 1.403%, and by 49.9 basis points on 21 December to 1.902%, respectively. The EURIBOR also reacted to the policy normalisation process, but a less immediate and less complete pass-through was noted.

Chart 2.2.2

Transmission of the rate hikes on the first two days after the change in the policy rate became effective

(basis points)

Sources: ECB and Bloomberg.

Notes: The €STR shows the one-day change for unsecured overnight trades that settled on the last day of the MP and the first day of the MP. The EURIBOR with one-week and one-month maturities reflects the change compared with one week and one month prior to the first day of the MP.

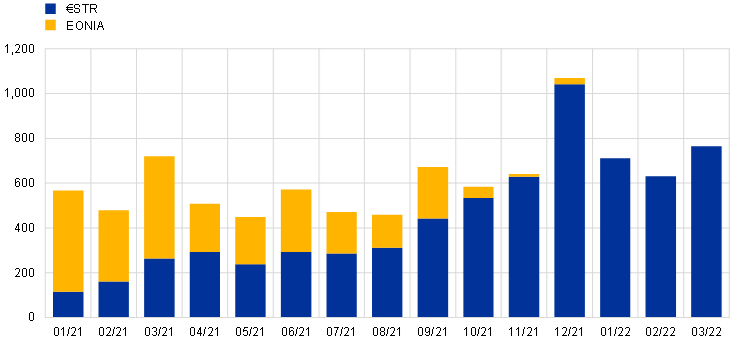

2.2.2 Drivers of rates

Negative liquidity premia in short tenors

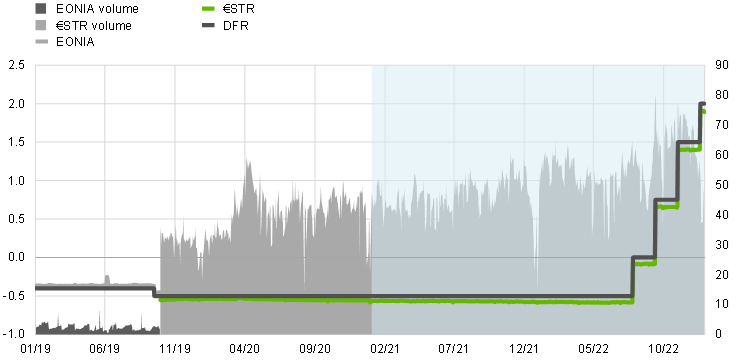

Overnight unsecured borrowing rates remained anchored to the DFR even if they drifted marginally away amid investors’ preferences for short-term investments (Chart 2.2.3). On 3 January 2022, the €STR successfully replaced the euro overnight index average (EONIA) as the overnight benchmark rate for the euro. The transition took place over several years, guided by a private sector working group on euro risk-free rates.[7] Users of the EONIA managed to switch to the new benchmark rate successfully within the required deadlines.[8] Overnight unsecured borrowing rates remained anchored to the DFR during the whole period under review, almost perfectly mirroring the official interest rates hikes, although the €STR spread with the DFR slightly widened.

Chart 2.2.3

EONIA/€STR rate and volume

(left y-axis: percentage; right y-axis: EUR billions)

Source: MMSR.

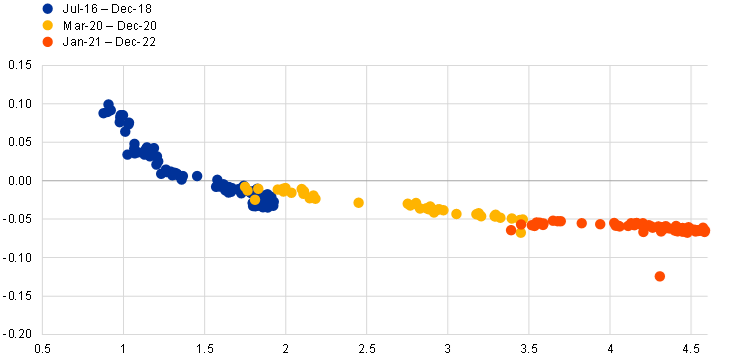

The negative relationship between excess liquidity and unsecured rates persisted in the review period (Chart 2.2.4). By the end of 2022 the €STR stood around 10 basis points below the DFR[9] compared with around 6 basis points at the beginning of 2021[10]. Until mid-2022 the spread increase was smooth and gradual, with the variation on the spread of 2 basis points at around 18 months, in line with the speed observed in 2020. However, the pace accelerated in the second half of 2022, increasing by another 2 basis points in about six months amid the four interest rates hikes. The negative relationship between excess liquidity and unsecured rates recently intensified, putting further downward pressure on unsecured overnight rates.

Chart 2.2.4

Relationship between excess liquidity and unsecured interest rates

(x-axis: EUR trillions; y-axis: percentages)

Sources: MMSR, Bloomberg.

Note: Unsecured borrowing, weekly average of volume-weighted average rate’s spread to DFR.

Banks’ market power in a positive interest rate environment

Banks had the market power to keep borrowing rates low as a result of access to the ECB’s deposit facility and the return to positive rates. Downward pressure on borrowing rates was also caused by a persistent imbalance between demand and supply for cash in the money market. On the supply side, market participants showed a preference for placing cash in the shortest tenors, given (i) the uncertainly stemming from the war in Ukraine, (ii) the uncertainty regarding ECB rate hikes, and (iii) the restricted counterparty risk limits for longer maturities. As a result, most of the supply of funds was concentrated in the overnight maturity bucket. On the demand side, banks had limited appetite for cash in such short maturities because it impacts their LCR[11] and does not have NSFR regulatory value. In addition, the cash also negatively impacts the LR[12] and, if kept at the central bank, leads to an increase in banks’ balance sheet size. This in turn leads to higher regulatory costs, such as supervisory fees[13] and contributions to the Single Resolution Fund[14]. Therefore, banks were only willing to accept liquidity below 30 days at rates further below the DFR to compensate for the impact of those new deposits on banks’ regulatory ratios and levies. Moreover, banks’ market power on rate negotiation with other non-bank economic agents seemed to increase with the transition to a positive rates environment. These factors explain the widening of the €STR-DFR spread which took place in the second half of 2022.

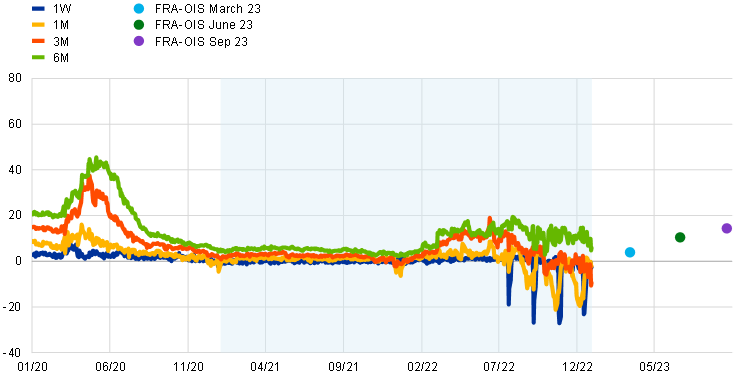

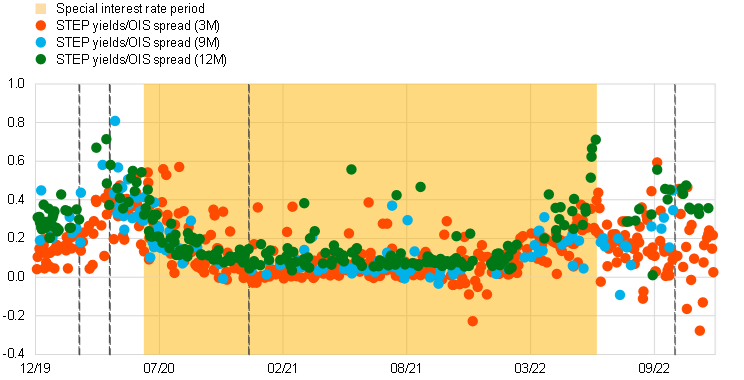

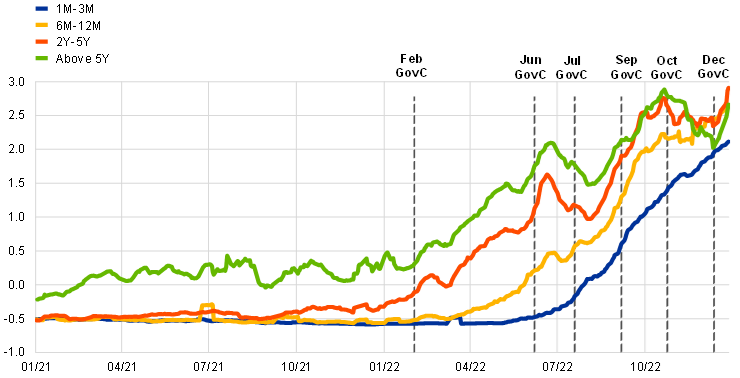

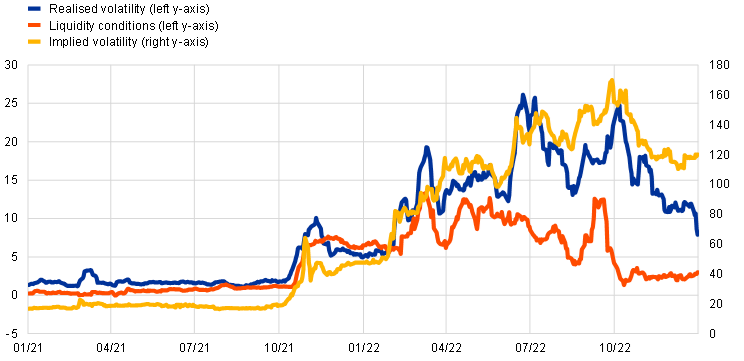

Positive risk premia visible on tenors above three months and FRA rates

Signs of credit risk were visible in forward rate agreement rates, but not in borrowing rates below the three-month tenor (Chart 2.2.5). The EURIBOR-OIS spread is generally seen as a good measure of credit and liquidity risk. The EURIBOR is (at least partly) built on actual unsecured borrowing transactions. It therefore contains a credit element between trade counterparties and a liquidity element in the form of funding availability. In contrast, the OIS reflects expectations of overnight and almost risk-free rates. Hence, the spread between the two is usually positive and a good measurement of credit and liquidity risk. However, EURIBOR-OIS spreads for the one-month tenor turned negative from August 2022 with brief episodes where it turned positive. It has been almost constantly inverted since the beginning of October 2022, together with the three-month EURIBOR-OIS spread. The downward pressure observed on term rates up to three months seems to be attributable to a negative liquidity premium and driven by cash supply-demand imbalances, equal to that observed in the €STR. The one-month EURIBOR also showed a more sluggish reaction to the repricing of ECB policy rates, suggesting that the downward pressure is largest for funds that fully weigh on the LCR denominator. However, the three-month FRA-OIS spread remained positive at 4 basis points for March 2023 and at 10 basis points for mid-2023. As FRAs reflect expectations on future unsecured interest rate levels, the persistence of a positive FRA-OIS spread in the tenors where the EURIBOR-OIS spread is negative suggests that the negative spreads are expected to be temporary. Therefore, it seems that the FRA-OIS spread was a better indicator for monitoring the development of credit risk perception across maturities in 2022 than the EURIBOR-OIS spread.

Chart 2.2.5

EURIBOR versus OIS spread developments

(basis points)

Source: Bloomberg.

Box 1

€STR-based fallbacks for EURIBOR

One of the benchmark rate reforms guided by the Financial Stability Board, the EU Benchmarks Regulation (BMR) and the International Organization of Securities Commissions (IOSCO), is the introduction of robust fallbacks in contracts referencing benchmark rates. These fallbacks would cover a scenario in which the benchmark was subject to the risk of disruption or discontinuation.

While there are no plans to discontinue EURIBOR, the EURIBOR fallback measures would make it possible for market participants to comply with Article 28(2) of the BMR.

On 11 May 2021, the working group on euro risk-free rates issued recommendations[15] supporting a homogeneous and consistent development of robust fallback measures for EURIBOR-linked contracts across market usage and segments. These recommendations put forward the use of compounded €STR rates and term €STR rates as components of EURIBOR fallback measures, depending on the different asset categories.

Compounded €STR average rates

On 15 April 2021 the ECB started publishing compounded €STR average rates and a compounded index based on the €STR in response to market feedback. The rates are backward-looking compounded averages of the €STR calculated over standardised tenors of one week, one month, three months, six months and twelve months. The compounded €STR index makes it possible to calculate a compounded €STR average rate over any other tenor of choice. Publication takes place each TARGET2 business day at 09:15 CET. The rules for the calculation and publication of the compounded €STR average rates and index are published on the ECB website[16] and their design was the result of a public consultation.

€STR term rates

On 14 November 2021, the European Money Markets Institute started publishing a euro forward-looking term rate (EFTERM) based on available market data on OIS and futures that reference the €STR, where the ICE Benchmark Administration acts as its calculation agent. EFTERM applies a waterfall methodology using dealer-to-client bid and offer prices and volumes obtained from Tradeweb’s institutional trading platform or end-of-day settlement prices for ICE one-month €STR futures contracts. Tradeable bid and offer prices and volumes from regulated electronic trading venues will also be used in the waterfall, when available. EFTERM is calculated for five tenors: one week, one month, three months, six months and twelve months. Publication takes place on every TARGET2 business day at or shortly after 11:15 CET.

On 26 October 2021, Refinitiv launched a prototype forward-looking fallback rate. The Refinitiv Term €STR adopts a waterfall methodology that uses dealer-to-client bids and offers quotes of €STR and OIS from Tradeweb’s institutional trading platform as the primary source. An integrated fallback based on the compounded €STR is used as the secondary source. Publication of the Refinitiv Term €STR is planned to take place on a daily basis for five tenors: one week, one month, three months, six months and twelve months.

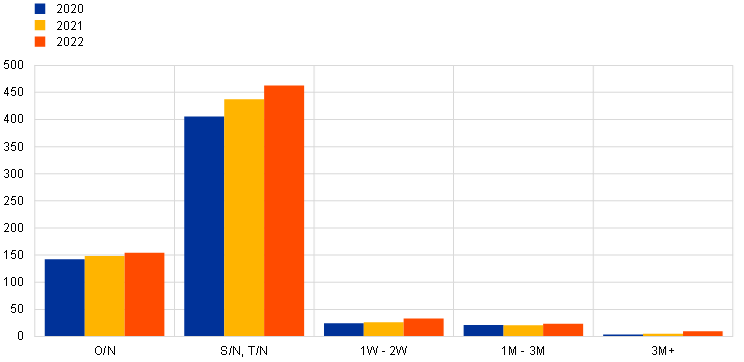

2.3 Maturities and calendar effects

2.3.1 Flows

The data show an increase in the overnight volume, to the detriment of the other maturity buckets (Chart 2.3.1). Between 2021 and 2022 the average overnight volume increased by €24 billion to €108 billion, representing 83% of the unsecured volume, while the rest of the maturity buckets experienced a decline in volume (for example, the three-month volume fell from €34 billion to €20 billion). This increase in overnight activity seemed to be the result of banks preferring to negotiate on the shorter maturities. The transfer of the unsecured activity from the longer maturity buckets to the overnight bucket occurred in two different stages. First, in 2021, an aggregate decline of the average daily transaction volume was mainly observable in the longer maturity buckets (for example, volumes with maturities of one to three months and above three months declined by €14 billion and €6 billion, respectively). Second, in 2022 the reactivation of the unsecured activity was largely concentrated in the overnight maturity bucket.

Chart 2.3.1

Volume (average daily transaction) per maturity bucket

(EUR billions)

Source: MMSR.

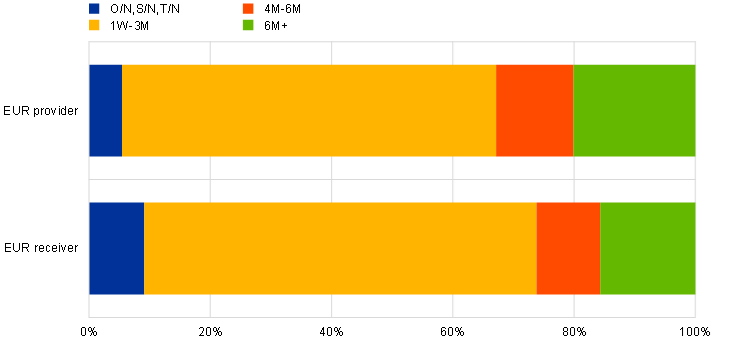

2.3.2 Stock

Outstanding amounts (stocks) accounted for a higher weight of longer maturities compared with overnight activity (Chart 2.3.2). One-day maturity trades only account for 28% of the total outstanding borrowing volume. The remaining 72% of borrowing outstanding amounts and almost all lending contracts have a maturity of over one week. Therefore, they appear more prominent than in the flow data. Specifically, both lending and borrowing activity have a similar concentration of around 35% in the one-week and three-month maturity tenors. However, lending outstanding volumes constitute a larger share of contracts with a maturity of 4 months and over.

Chart 2.3.2

Borrowing and lending volumes (outstanding at period end) per maturity bucket at 15 September

(percentages)

Source: MMSR.

Note: The middle of the month was chosen in order to avoid quarter-end differences in the composition of the maturity buckets in the outstanding amounts.

2.3.3 Calendar effects

Unsecured overnight volumes and rates exhibit seasonality at quarter-ends and more notably at year-ends. At these dates, both the usual volume of transactions and rates are reduced, as borrowing cash becomes particularly undesirable for regulatory reasons and therefore euro area banks only take it at lower rates.

On rates

Overnight borrowing rates fell substantially at quarter-ends (Chart 2.3.3). In order to reduce the borrowing activity on the reporting dates, banks lower prices for taking up overnight deposits. This effect has gradually increased over time and intensified for the last two year-ends, with an overnight rate decline of 7 basis points in the fourth quarter of 2020, compared with 20 basis points in the fourth quarter of 2021 and the fourth quarter of 2022. The stronger effect on rates despite the lower impact on volume in the period under review might be attributable to banks’ market power regarding rate negotiation.

Chart 2.3.3

Effect of reporting dates on unsecured interest rates

(basis points)

Source: MMSR.

Note: Rate difference between the last business day of the quarter and the first business day of following quarter.

On volume

Overnight borrowing volume fell significantly at reporting dates, showing approximately 20% lower volume at year-ends (Chart 2.3.4). On these reporting dates banks try to minimise their balance sheet size with the aim of improving their regulatory ratios, optimising their financial state at the reporting date and reducing their contributions to certain bank levies. Several factors put pressure on banks to avoid liquidity holdings from non-banks and to not rely heavily on central bank funding in their year-end balance sheet: (i) the entry into force of the liquidity ratio regulation on 28 June 2021, (ii) the increasing levels of excess liquidity recorded until mid-2022, and (iii) the re-inclusion of central bank exposures for the calculation of the leverage ratio as of April 2022. For these reasons, a volume decline at quarter-ends and especially at year-ends is observed, with a decline of €39 billion in the fourth quarter of 2020, and €29 billion in the fourth quarter of 2021 and the fourth quarter of 2022. The decrease in lending volume at reporting dates is more marginal than the decrease in borrowing activity.

Chart 2.3.4

Effect of reporting dates on trading volume

(EUR billions)

Source: MMSR.

Note: Volume difference between the last business day of the quarter and the first business day of following quarter.

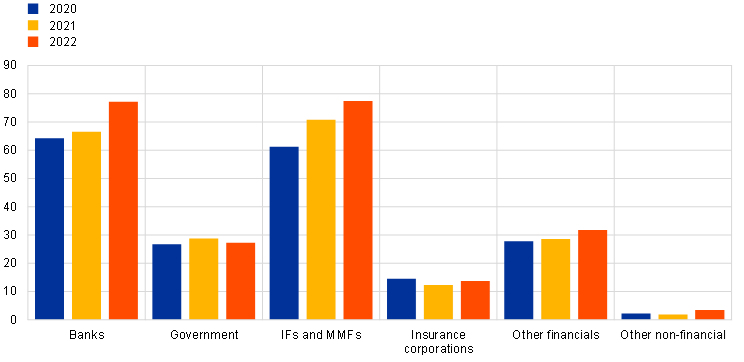

2.4 Counterparties

2.4.1 The role of non-banks

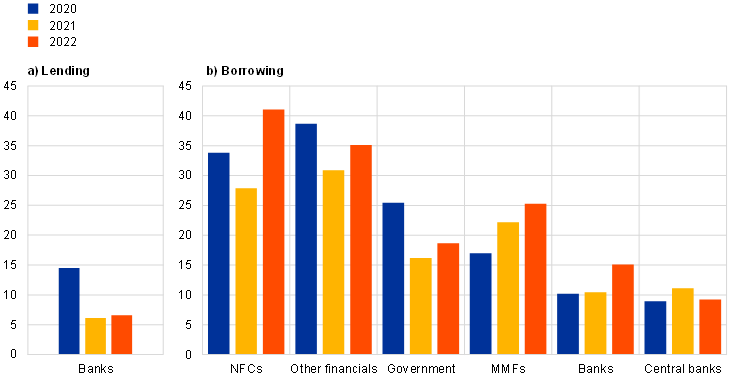

Almost 80% of euro area banks’ unsecured trades were conducted with non-bank counterparties (Charts 2.4.1 and 2.4.2). Roughly 78% of the unsecured activity in the MMSR was made up of banks receiving cash from other entities that do not have access to the ECB deposit facility. Of such entities, non-bank financial institutions – in particular MMFs – and NFCs registered the highest volumes, followed by governments. Interbank business accounted for the remaining 22%.

Chart 2.4.1

Percentage of trades per counterparty group (banks and non-banks)

(percentages)

Source: MMSR.

While non-bank financial institutions – including MMFs and other investment funds – were the largest cash depositors, trades with non-financial corporations grew considerably in 2022 (Chart 2.4.2). In relative terms, MMFs recorded the highest growth in cash deposits with banks – 44% since 2021 – continuing the upward trend observed since 2020, when the deterioration in risk sentiment led MMFs to maintain more liquidity in order to be able to meet potential outflows at any time. This trend was reinforced with the return of the positive interest rates environment. NFCs became the second-largest contributor to unsecured market activity in 2022, after having declined in volume in 2021. This decline was attributable to the release of part of the liquidity buffers built during the COVID-19 crisis. In 2022 NFCs rebuilt liquidity buffers in view of new macroeconomic uncertainties linked to inflation and commodity price volatility. This rebuilding led to a daily average volume of €35 billion. Other financial institutions and governments also increased their deposits during 2022, despite the fall observed in 2021. The ECB Governing Council’s September 2022 decision to remunerate government deposits held with the Eurosystem at market rates until April 2023 tempered abrupt shifts from Eurosystem accounts to the market in a positive rate environment. Finally, interbank lending volumes decreased from 2020 to 2021 and remained broadly stable in 2022 at around €7 billion.

Chart 2.4.2

Unsecured volumes for each counterparty sector, borrowing and lending

(EUR billions)

Source: MMSR.

Note: “Other financials” includes financial auxiliaries, captive financial institutions and money lenders, pension funds, insurance corporations, non-MMF investment funds and other financial intermediaries.

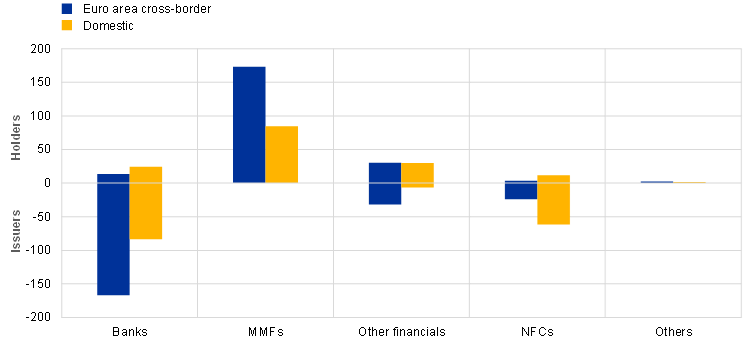

2.4.2 Direction of the trade by sector and jurisdiction

In terms of jurisdiction, German and French banks received cash predominantly from non-banks domiciled in Germany, Luxembourg and Ireland (Charts 2.4.3 and 2.4.4.). Over time, excess liquidity tended to accumulate in very large banks located in a few euro area countries (Germany, France or Belgium). Thus, high volumes were transacted among market counterparties across jurisdictions, independently of how the liquidity had originally been provided by the Eurosystem. Due to their status as financial hubs for the fund industry, Luxembourg and Ireland have a high concentration of MMFs. Germany also acts as a financial hub for corporations and other financials. These non-bank actors ultimately place their liquidity in euro area banks because they do not have access to the central bank deposit facility. Chart 2.4.4 shows that in the review period, almost 50% of the unsecured activity was domestic, and euro area cross-border flows accounted for 40% of unsecured activity. Around a half of the inflows to banks came from financials and corporations – and to a lesser extent from governments – from the same jurisdiction. Euro area cross-border activity predominantly reflected inflows from financial institutions. Finally, the international trades were limited, taking place on the interbank market and also reflecting inflows from financial institutions.

Chart 2.4.3

Direction of trade by jurisdiction (top five borrowers and lenders)

(EUR billions)

Source: MMSR.

Note: On the borrower side, the fifth jurisdiction was removed in compliance with MMSR confidentiality rules.

Chart 2.4.4

Direction of the trade by counterparty

(EUR billions)

Source: MMSR.

Notes: In the unsecured segment, the lending side does not mirror the borrowing one, as on the lending side the MMSR reporting agents are only providing information on trades concluded with counterparties belonging to ESA 2010 sector “S.122”. On the borrowing side the range of counterparties is much broader, covering other financial corporations, non-financial corporations and governments. In this chart we are considering both sides of the trade to show the current representation.

Despite higher levels of domestic activity, cross-border trading increased over the past two years (Chart 2.4.5). The share of volume traded between counterparties belonging to different countries in the euro area increased from 35% in 2021 to 40% in 2022, while domestic business remained at around 50%. The increase in domestic activity observed at the end of 2022 seemed to be related to the growth of interbank lending activity (Chart 2.1.6).

Chart 2.4.5

Evolution of international business in the unsecured money market

(percentages)

Source: MMSR.

Notes: Domestic refers to trades with a counterparty located in the same jurisdiction than the MMSR reporting bank. Euro area cross-border refers to trades with a counterparty located in the different member state than the MMSR reporting bank. Rest of the world refers to trades with a counterparty located outside the Euro area.

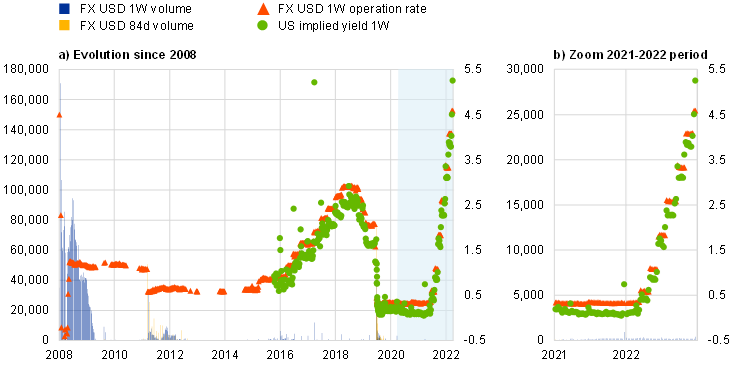

3 The short-term securities segment

The short-term securities (STS) segment of the euro money market encompasses several markets with their own legal basis, participants and dynamics. The international and multi-currency Euro Commercial Paper (ECP) market remains the largest market and is mainly governed by English law. The second most important market is the Negotiable European Commercial Paper (NEU CP) and medium-term notes (NEU MTN) market, which is governed by French law and was reformed in 2016 to comply with international standards and attract a larger number of issuers, especially non-domestic issuers. Other domestic markets in Belgium, Germany, Spain and Italy are smaller. The Short-Term European Paper (STEP) label was launched in 2006 and its aim is to foster the integration of European markets for short-term paper by harmonising standards and practices.

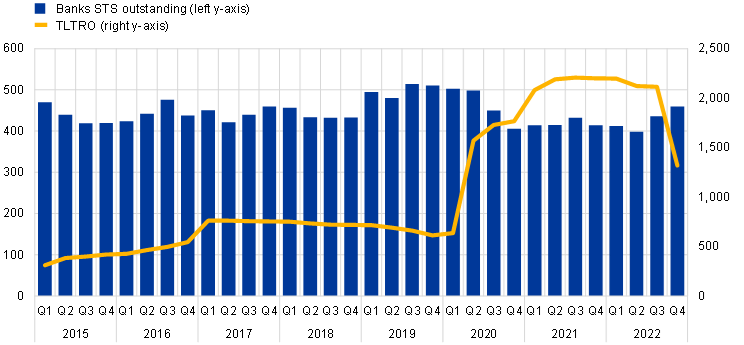

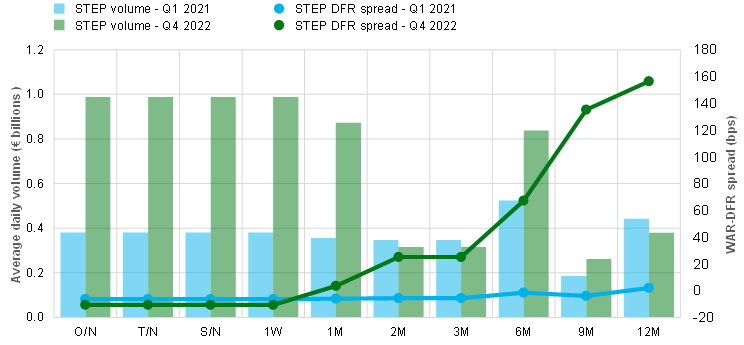

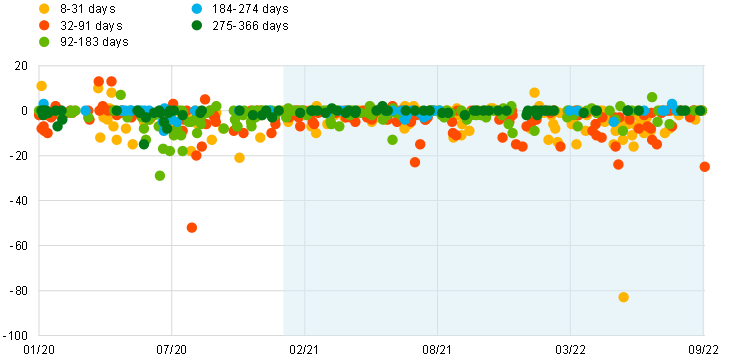

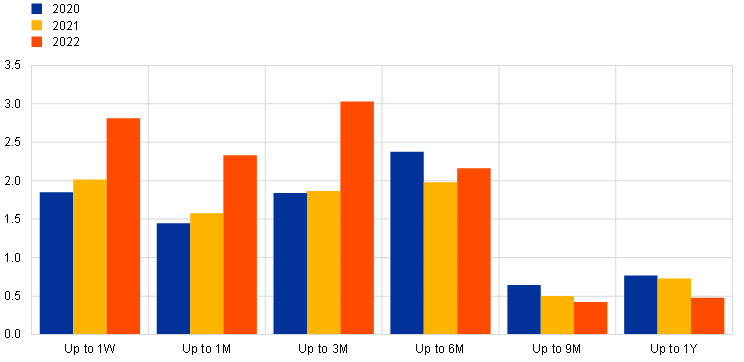

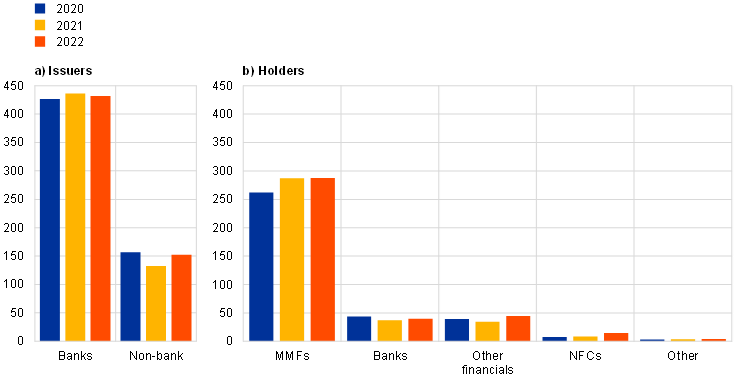

Issuances in the STS segment stabilised in 2021 below pre-pandemic levels and increased again during the latter half of 2022. Banks issued 75% of STS in the primary market, leading the increase observed in the second half of 2022. TLTRO take-up substituted banks’ STS issuance as a funding source in 2021. Conversely, TLTRO repayments in the second half of 2022 and a renewed appetite for investment opportunities at positive rates had a positive impact on banks’ STS issuances. However, pre-pandemic levels are yet to be achieved.

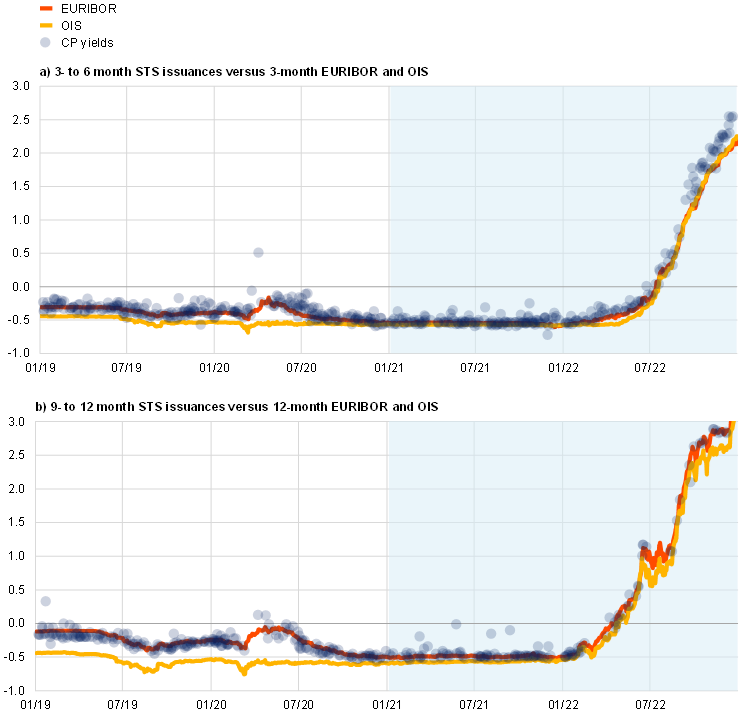

From 2021 to early 2022, the yield curve of euro-denominated STS remained flat and steepened thereafter following monetary policy normalisation. The pass-through of hikes in Eurosystem policy rates to rates in the STS segment was complete. The high degree of uncertainty in financial markets and the monetary policy normalisation accentuated investors’ preference for STS issuances up to three months. Issuances of STS with maturities above nine months continued to decrease for the whole period under review. MMFs remain the largest investors in short-term securities.

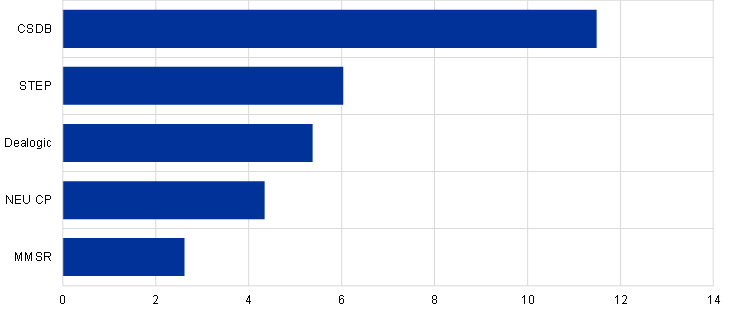

3.1 Volumes

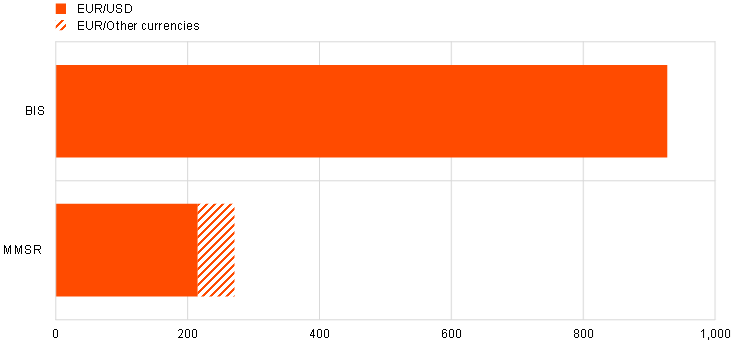

STS issuance and price activity are best measured in statistical datasets outside the MMSR dataset. MMSR data cover four out of the five segments of the euro money market. Information on the fifth segment – STS issuance – is provided by the statistics on the Centralised Securities Database (CSDB) for volumes and STEP for rates, as they both cover a broader range of short-term debt instruments compared with the MMSR.

Chart 3.1.1

Issuance volumes – average daily volumes by different databases

(EUR billions)

Notes: The CSDB contains data on “certificates of deposit”, “commercial paper” and “other money market instruments” with a maturity of up to 12 months for all currencies and all issuer types located in the euro area. The MMSR only covers euro-denominated issuances made by a sample of reporting agents. The STEP includes STS in all currencies and from all types of issuers, and with a STEP label. NEU CP covers STS issued under the NEU CP programme in France, which are largely euro denominated. Dealogic provides STS primary market issuances by euro area issuers in all currencies.

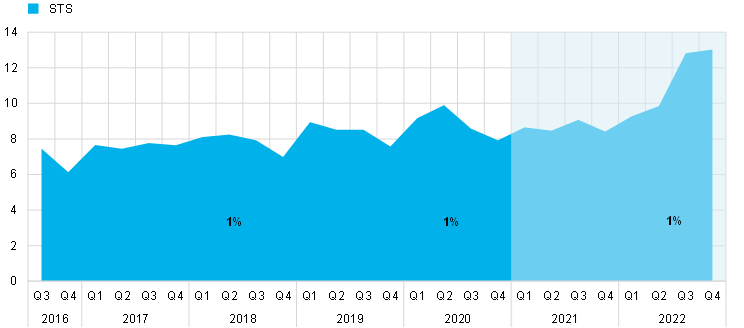

3.1.1 Flows

With an average daily issuance volume of €9.9 billion, the STS market remains the smallest segment of the euro money market in terms of volume (Chart 3.1.2). After reaching a low point at the end of 2020 (€8.3 billion), gross issuances of commercial paper (CP) and certificates of deposit (CD) gradually increased at the end of 2022. The average daily gross issuances have accelerated more sharply since the third quarter of 2022, reaching €12.4 billion by the end of 2022.

Chart 3.1.2

STS market size, average daily issuance volume per quarter

(EUR billions)

Source: CSDB.

Notes: The series consider only the borrowing side (issuance) by all counterparties sectors (except public entities), and all currencies. The percentages refer to the weight of the short-term securities segment on the total of the euro money market for 2018, 2020 and 2022.

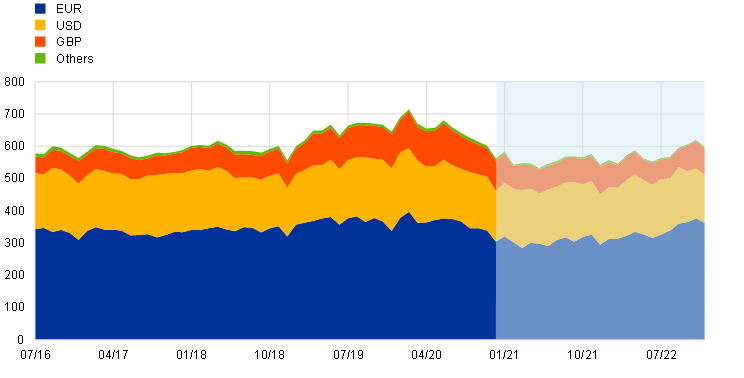

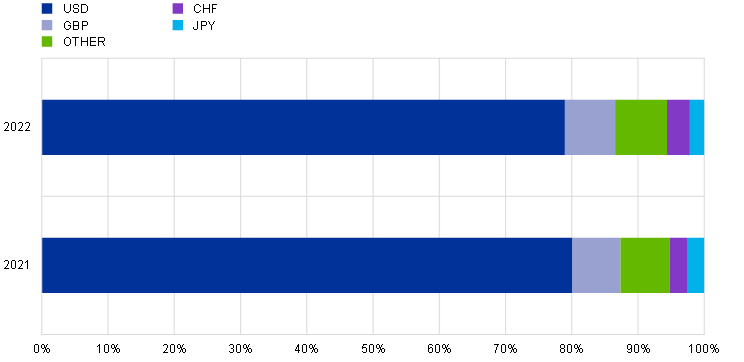

3.1.2 Stock

The outstanding stock of STS has remained broadly stable (Chart 3.1.3). This is because the share of EUR- and USD-denominated issuances grew in the second half of 2022 at the expense of GBP-denominated issuances After the annual average outstanding amount fell to €556 billion in 2021 from €648 billion in 2020, it recovered slightly to €586 billion in the second half of 2022. EUR-denominated STS remained dominant (61% in the second half of 2022 compared with 55% in January 2021), followed by USD-denominated STS (25% compared with 29% in January 2021). On the contrary, the weight of GBP-denominated STS slightly decreased from 15% to 14%. STS denominated in other currencies remained marginal (1%).

Chart 3.1.3

STS outstanding volumes per currency over time

(EUR billions)

Source: CSDB.

Notes: Outstanding amounts of securities with maturities of up to one year issued by all sectors, excluding general government issuance.

3.1.3 Drivers of volume

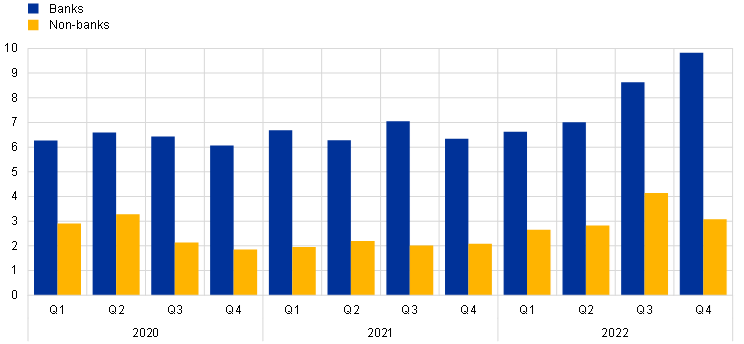

Dominance of bank issuance

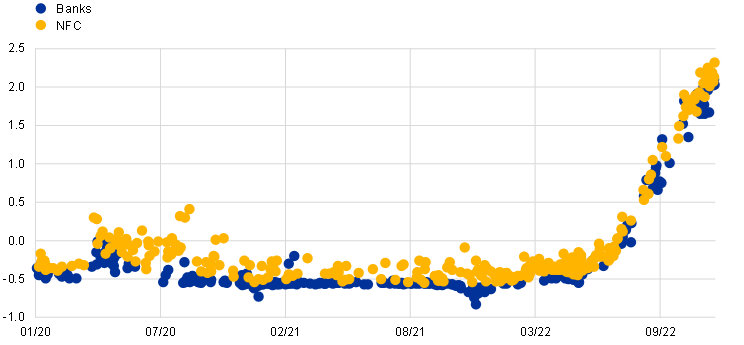

Banks led the recovery of STS issuance in the second half of 2022 (Chart 3.1.4). Banks issued 74% of STS in the primary market, leading the increase observed in the second half of 2022. The issuance of NFCs increased slightly on average over 2022 compared with previous years, without showing a consistent upward trend yet.

Chart 3.1.4

Development of daily average issuance split by issuer group (banks and non-banks)

(EUR billions)

Source: CSDB.

Note: Average daily issuance volume of securities with maturities of up to one year issued in all currencies, by all sectors, excluding general government issuance.