Emerging market currencies: the role of global risk, the US dollar and domestic forces

Published as part of the ECB Economic Bulletin, Issue 3/2019.

Exchange rate movements against the US dollar are an important factor shaping the outlook in emerging market economies as a large share of their credit, trade and debt is priced in dollars. Abrupt swings in emerging market exchange rates are typically linked to capital outflows, tighter financing conditions and heightened financial instability. The drivers of those movements are, however, difficult to disentangle, as global and domestic forces jointly determine the relative strengths of these currencies. This box presents a methodology for separating out the four main drivers of emerging market exchange rate swings: spillovers from US shocks, global risk appetite, interest rate effects and idiosyncratic domestic shocks. It uses the methodology to analyse the factors behind the sharp depreciation and subsequent recovery of emerging market currencies over the course of 2018.

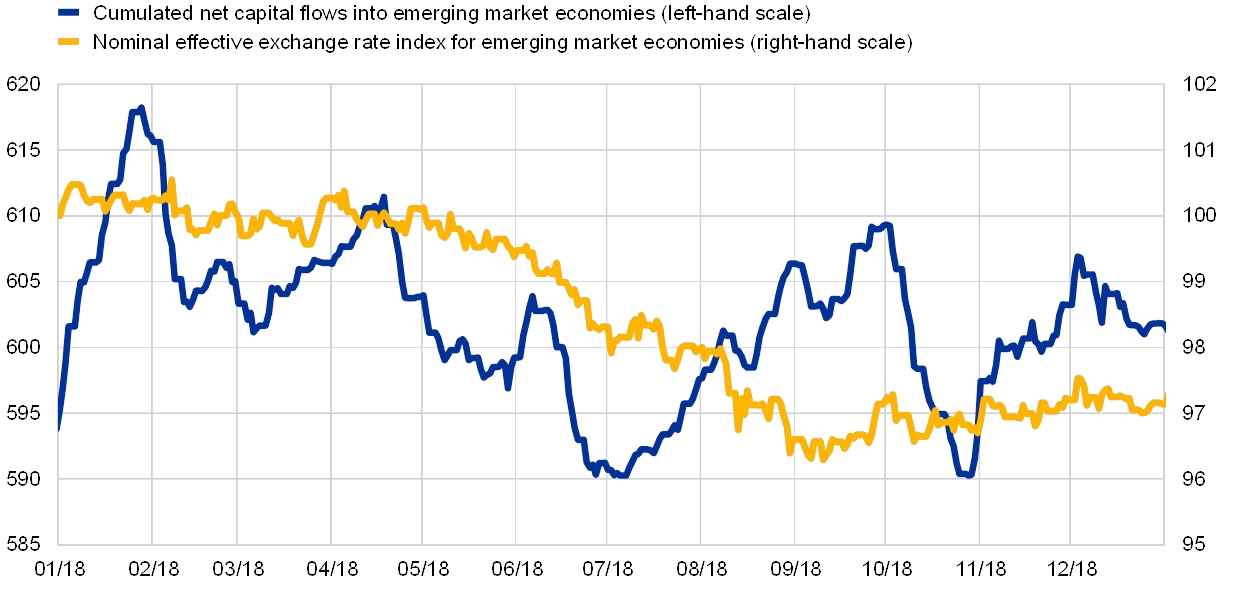

Chart A

Evolution of emerging market economies’ net capital inflows and exchange rates

(left-hand scale: USD billions; right-hand scale: index: 1 January 2018 = 100)

Sources: ECB, Institute of International Finance, JP Morgan and ECB calculations.

Notes: The emerging market exchange rate index is the JP Morgan nominal effective exchange rate for emerging markets, which is a weighted average of emerging markets exchange rates. The latest observation is for 31 December 2018.

Between January and August 2018 emerging market currencies depreciated markedly. Emerging market currencies experienced a sharp sell-off over the first eight months of 2018 coupled with capital outflows and rising financial market volatility (see Chart A). The composite index of the nominal effective exchange rates of emerging market currencies fell by 3.6% between January and August of that year, while bilateral exchange rates against the US dollar reacted much more strongly, weakening in some cases by more than 20%. The abrupt financial market swings in some countries have posed a threat to financial stability, with potential spillovers to advanced economies. Large currency depreciations also increase funding costs for emerging market economies, whose financial systems typically raise liquidity in US dollars, lowering economic growth prospects.

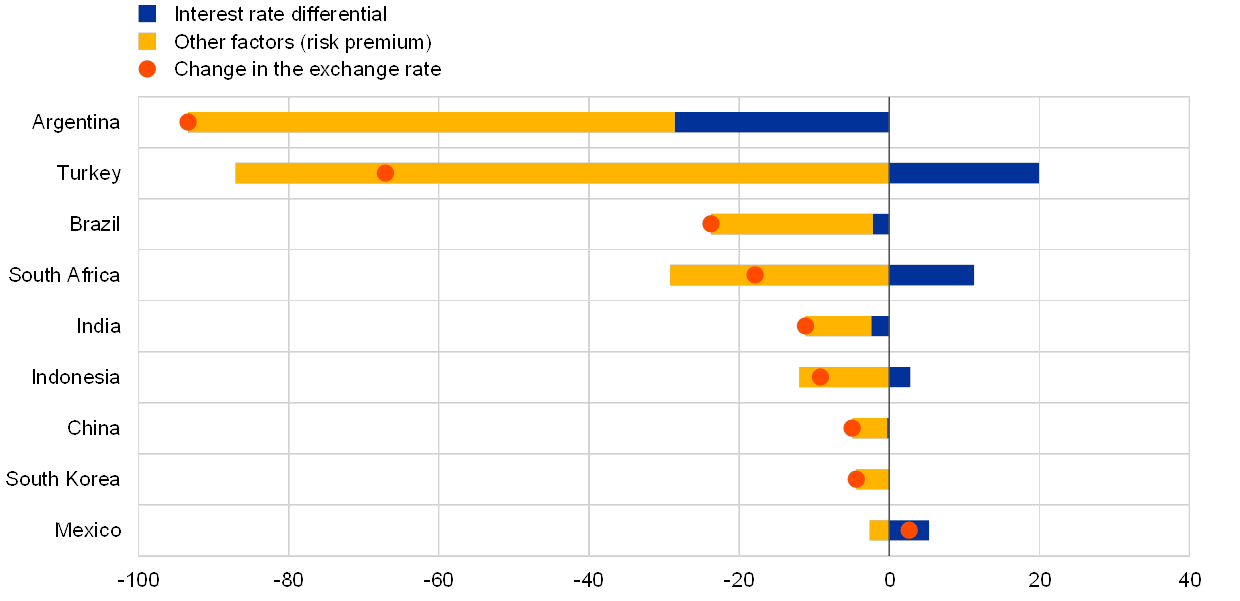

Interest rate differentials alone do not explain exchange rate movements. The theoretical concept of uncovered interest rate parity postulates that interest rate differentials determine exchange rate movements. It states that developments in the difference in interest rates between two countries should determine the change in the bilateral exchange rate, with the high-yielding currency depreciating vis-à-vis the low-yielding currency. In practice, however, a large part of exchange rate movements is not explained by interest rate differentials and is often attributed to changes in the risk premium.[1] The risk premium correlates with various economic forces which are not well captured by short-term interest rate differentials, including, for example, measures of investors’ risk appetite or market volatility. Interest rate differentials indeed explain very little of the changes in emerging market exchange rates against the US dollar in 2018 (see Chart B).

Chart B

Contribution of interest rate differentials and other factors to exchange rate movements against the US dollar

(percentage points)

Sources: Haver Analytics, Board of Governors of the Federal Reserve System, Global Financial Data and ECB calculations.

Notes: The blue bars show contributions of interest rate differentials to the change in the bilateral exchange rates against the US dollar (expressed as US dollars per unit of local currency) from January to August 2018. Contributions are computed from a regression of daily changes in the bilateral exchange rate on interest rate differentials between the country in question and the United States. The interest rate used is the short-term money market rate. The component “other factors” is the residual of this regression. The latest observation is for 31 August 2018.

A better understanding of the drivers of currency movements is provided by a model which augments the standard interest rate regression with measures of global risk appetite and US factors. Beyond interest rates, there are two main forces behind emerging market currency movements: changes in global risk appetite and the spillovers from developments in the United States. Global risk appetite affects currencies because a higher risk appetite among market participants tends to lead to inflows of capital into emerging markets, which results in an appreciation of their exchange rates. The unique position of the US dollar in the international monetary system also plays an important role. When the US dollar is strong, which happens in periods of positive economic growth momentum and high interest rates in the US economy, capital tends to flow from emerging markets to the United States, and emerging market currencies depreciate. This is a channel through which US shocks spread to emerging market economies.

Verdelhan (2018)[2] provides a simple framework to assess the relative significance of each of the two forces for movements in emerging market currencies.[3] The standard model in which exchange rate changes are related to interest rate differentials is augmented by two components. One, which can be called a “dollar factor”, aims to identify the effect of developments in the United States on emerging market currencies. It is added by inserting a component into the regression which measures the average change in emerging market exchange rates against the US dollar. Since a purely US-based shock might be expected to have a similar effect on all US dollar bilateral exchange rates, looking at changes that are common to a number of such exchange rates should reveal shocks that are specific to the US dollar.[4] The second component accounts for risk-driven movements in emerging market currencies which do not stem directly from US shocks and is generally labelled in the literature as the “carry factor”. It is defined as the difference between exchange rate changes of high-yielding currencies and those of low-yielding currencies. When investors engage in carry trades – i.e. sell assets in low-yielding currencies to buy assets in high-yielding currencies – they become exposed to global risks through the exchange rate. This is because high-interest rate currencies tend to depreciate during periods of economic downturn or adverse risk sentiment. Therefore, when global risk rises, the difference in exchange rate returns between the two portfolios widens, mechanically making this component highly correlated with global risk. Adding these two variables to the baseline model significantly increases the share of variation in emerging market currencies that can be explained.[5] The residual element that is not explained by these global or US factors reflects country-specific developments. It may include developments not entirely captured by short-term money market rates such as domestic political instability, changes in expectations of the future path of the domestic economy or market sentiment towards the currency.

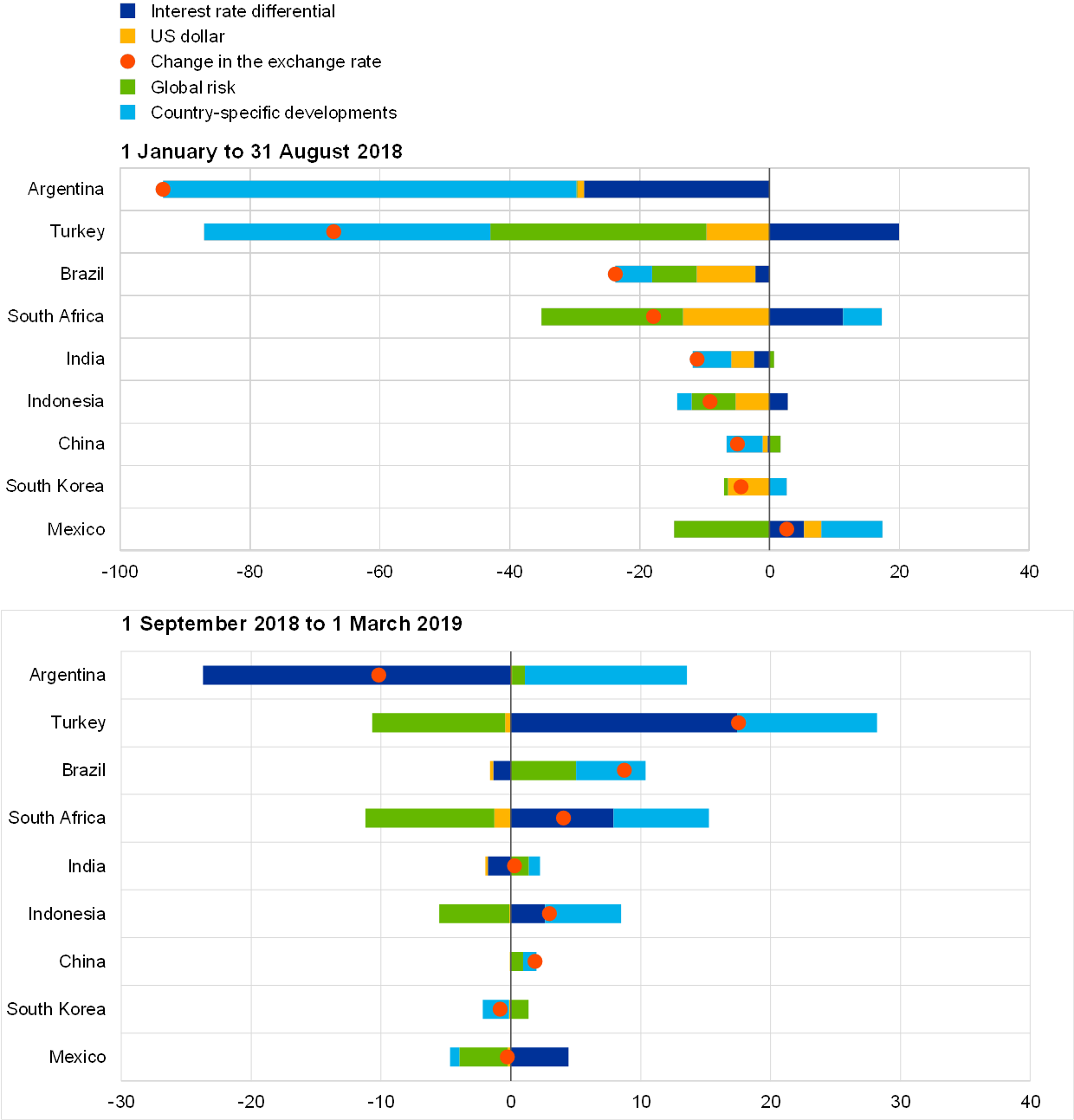

This model suggests that the sell-off during the first eight months of 2018 was mainly driven by spillovers from the United States and rising global risk aversion (see Chart C). In the period to August 2018, the decomposition highlights two main forces behind the depreciation of emerging market currencies against the US dollar: spillovers from US shocks and global risk. This is in line with the tightening of financial conditions in emerging markets and rising US yields observed over the same period. Notable outliers are Turkey and Argentina, where domestic political tensions are likely to have been the main drivers of exchange rate developments. The model also shows that domestic monetary policies – aimed at increasing interest rate differentials vis-à-vis the United States – were largely unable to cushion the effects of the global and US factors driving currencies downwards.

Chart C

Contributions to the depreciation and recovery of emerging market currencies against the US dollar

(percentage points)

Sources: Haver Analytics, Board of Governors of the Federal Reserve System, Global Financial Data and ECB calculations.

Notes: The bars show contributions to variance based on a regression of changes in the exchange rates against the US dollar (expressed as US dollars per unit of local currency) on interest rate differentials, the dollar factor and the carry factor at daily frequency. The interest rate used is the short-term money market rate. The latest observation is for 1 March 2019

The subsequent recovery, on the other hand, appears to have been driven mainly by domestic policy reactions in emerging market countries and positive idiosyncratic developments (see Chart C). The decomposition shows that global risk has continued to put downward pressure on emerging market currencies. However, the role of the US dollar factor has been more limited since August 2018, suggesting that developments in the United States have not generated additional spillovers to emerging market currencies since then. On the other hand, country-specific factors have tended to bolster emerging market currencies, suggesting that domestic conditions have become somewhat more positive and growth prospects have improved in emerging economies since the financial market turmoil during the summer of 2018.

- See for example Fama, E.F., “Forward and spot exchange rates”, Journal of Monetary Economics, Vol. 14, No 3, 1984, pp. 319-338; Evans, M., “Exchange-Rate Dark matter”, Working Papers, Georgetown University, 2012; or Engel, C., Nelson, M. and West, K., “Factor Model Forecasts of Exchange Rates”, Econometric Reviews, Vol. 34(1-2), 2015, pp. 32-55.

- Verdelhan, A., “The Share of Systemic Variation in Bilateral Exchange Rates”, Journal of Finance, Vol. 73, No 1, 2018.

- This model is design to analyse floating currencies of countries with free capital mobility. Clearly, if the exchange rate is controlled (for example it is pegged to the US dollar), its variations cannot be explained directly by macroeconomic developments.

- A simple average of bilateral exchange rates is preferred to the US dollar nominal effective exchange rate because the latter could be driven by shocks to the bilateral exchange rates of large trading partners of the United States.

- The additional regressors increase the in-sample fit of the model from 0.02% to 27% over the entire sample and to almost 40% for advanced economies.