- STATISTICAL RELEASE

Euro area investment fund statistics: second quarter of 2020

17 August 2020

- In the second quarter of 2020 the outstanding amount of shares/units issued by investment funds other than money market funds was €12,473 billion, €1,004 billion higher than in the first quarter of 2020. The increase was mainly accounted for by €817 billion in price and other changes.

- The outstanding amount of shares/units issued by exchange-traded funds (ETFs) was €815 billion, which was €109 billion higher than in the first quarter of 2020.

- The outstanding amount of shares/units issued by money market funds was €1,363 billion, €113 billion higher than in the first quarter of 2020.

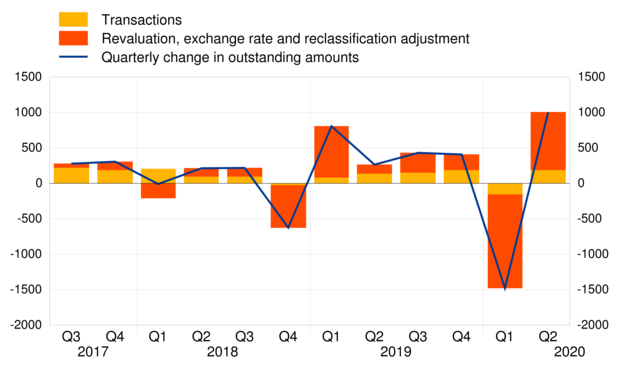

Chart 1

Investment fund shares/units issued

(EUR billions; not seasonally adjusted)

In the second quarter of 2020 the outstanding amount of shares/units issued by investment funds other than money market funds was €1,004 billion higher than in the first quarter of 2020 (see Chart 1). This development was accounted for by €187 billion in net issuance of shares/units and €817 billion in other changes (including price changes). The annual growth rate of shares/units issued by investment funds other than money market funds, calculated on the basis of transactions, was 3.2% in the second quarter of 2020.

Chart 2

Investment funds' holdings of debt securities

(quarterly transactions in EUR billions; not seasonally adjusted)

Chart 3

Investment funds' holdings of equity and investment fund shares/units

(quarterly transactions in EUR billions; not seasonally adjusted)

Within the assets of investment funds other than money market funds, the annual growth rate of debt securities was 3.3% in the second quarter of 2020, with transactions amounting to €156 billion during this period (see Chart 2). The annual growth rate of equity and investment fund shares/units was 1.7% in the second quarter of 2020, with transactions amounting to €74 billion during this period (see Chart 3). In the case of equity, the corresponding annual growth rate was 2.1%, with transactions totalling €47 billion. For holdings of investment fund shares/units, the annual growth rate was 0.7% and transactions amounted to €28 billion.

In terms of holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was -4.8% in the second quarter of 2020. In the same period, the net purchases of debt securities issued by the euro area general government amounted to €5 billion (see Chart 2). In the case of debt securities issued by the private sector, the annual growth rate was 6.9%, whereby the net purchases amounted to €48 billion. For debt securities issued by non-euro area residents, the corresponding annual growth rate was 4.2%, with net purchases of €103 billion.

Chart 4

Investment fund shares/units issued by type of investment fund

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of the type of investment fund, the annual growth rate of shares/units issued by bond funds was 4.3% in the second quarter of 2020. In the same period, transactions in shares/units issued by bond funds amounted to €87 billion (see Chart 4). In the case of equity funds, the corresponding annual growth rate was 1.4%, with transactions of €39 billion. For mixed funds, the corresponding figures were 2.2% and €14 billion.

Chart 5

Investment fund shares/units issued by ETFs and underlying assets

(quarterly transactions in EUR billions; not seasonally adjusted)

The shares/units issued by exchange-traded funds (ETFs), which are presented as a separate category within total investment funds, recorded an annual growth rate of 12.3% in the second quarter of 2020, with an outstanding amount of €815 billion (see Chart 5). In terms of assets held by ETFs, in the second quarter of 2020, 62% were equity, 29% were debt securities and 9% were other assets (including financial derivatives, deposit and loan claims and investment fund shares/units).

The outstanding amount of shares/units issued by money market funds was €113 billion higher than in the first quarter of 2020. This development was accounted for by €131 billion in net issuance of shares/units and -€19 billion in other changes (including price changes). The annual growth rate of shares/units issued by money market funds, calculated on the basis of transactions, was 18.0% in the second quarter of 2020.

Within the assets of money market funds, the annual growth rate of debt securities holdings was 15.7% in the second quarter of 2020, with transactions amounting to €146 billion, which reflected net purchases of €43 billion related to debt securities issued by euro area residents and net purchases of €103 billion in debt securities issued by non-euro area residents. For deposits and loan claims, the annual growth rate was 26.8% and transactions during the second quarter of 2020 amounted to -€22 billion.

Statistical Data Warehouse:

All money market funds time seriesAll investment funds other than money market funds time series

For queries, please use the Statistical information request form.

Notes:

- Money market funds are presented separately in this statistical release since they are classified in the monetary financial institutions sector within the European statistical framework.

- "Euro area private sector" refers to total euro area excluding general government.

- Hyperlinks in the main body of the statistical release and in annex tables lead to data that may change with subsequent releases as a result of revisions. Figures shown in annex table are a snapshot of the data as at the time of the current release.

- In addition to the data on net transactions presented in this statistical release, Statistical Data Warehouse also contains data on gross issues and redemptions of investment fund shares/units.

- 17 August 2020