- 11 March 2019

- Press release

Euro area insurance corporation statistics: fourth quarter of 2018

- Total assets of euro area insurance corporations amounted to €7,878 billion in the fourth quarter of 2018, €109 billion lower than in third quarter of 2018

- Total insurance technical reserves of euro area insurance corporations dropped to €5,943 billion in fourth quarter, down €91 billion from third quarter

Total assets of euro area insurance corporations decreased to €7,878 billion in the fourth quarter of 2018, from €7,986 billion in the third quarter. Debt securities accounted for 42.0% of the sector's total assets in the fourth quarter. The second largest category of holdings was investment fund shares (25.7%), followed by equity (10.6%) and loans (7.3%).

Holdings of debt securities increased to €3,307 billion at the end of the fourth quarter from €3,298 billion at the end of the previous quarter. Net purchases of debt securities amounted to €13 billion in the fourth quarter; price and other changes amounted to -€4 billion. The year-on-year growth rate of debt securities held was 2.0%.

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was 2.3% in the fourth quarter of 2018, with net purchases in the quarter amounting to €8 billion. As regards debt securities issued by the private sector, the annual growth rate was 1.7%, and quarterly net purchases amounted to €5 billion. For debt securities issued by non-euro area residents, the annual growth rate was 1.7%.

Chart 1

Insurance corporations' holdings of debt securities by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

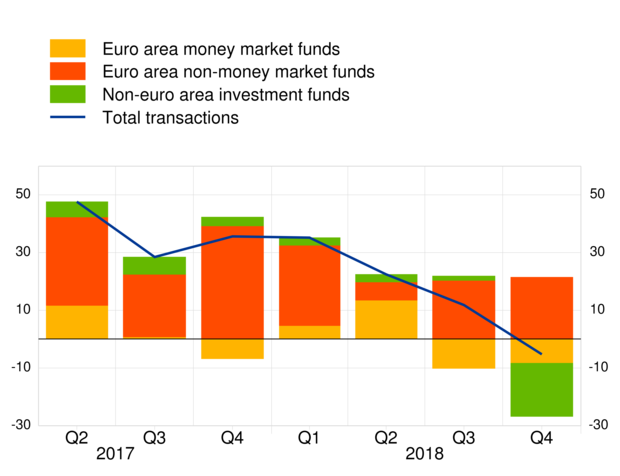

Turning to insurance corporations' holdings of investment fund shares, these decreased to €2,025 billion in the fourth quarter of 2018, from €2,120 billion in the previous quarter, with net sales of €5 billion and price and other changes of -€89 billion. The year-on-year growth rate in the fourth quarter was 3.1%.

The annual growth rate of euro area money market fund shares held by insurance corporations was -0.3% in the fourth quarter of 2018, with net sales in the quarter amounting to €8 billion. As regards holdings of euro area non-money market fund shares, the annual growth rate was 4.3%, with quarterly net purchases amounting to €21 billion. For investment fund shares issued by non-euro area residents, the annual growth rate was -6.9%, with quarterly net sales of €18 billion.

Chart 2

Insurance corporations' holdings of investment fund shares by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €5,943 billion in the fourth quarter of 2018, down from €6,035 billion in the third quarter. Life insurance technical reserves accounted for 91.0% of total insurance technical reserves in the fourth quarter. Unit-linked products amounted to €1,133 billion, accounting for 20.9% of total life insurance technical reserves.

Annex

Table: Annex to the table on euro area insurance corporations

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- "Other assets" includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- "Private sector" refers to euro area excluding general government.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the press release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts