T2S in 2017

The year in review

In 2017, one of the largest infrastructure projects ever launched by the Eurosystem came full circle with the conclusion of the TARGET2-Securities (T2S) migration phase. The final migration wave was rolled out on 18 September 2017 with Estonia, Latvia, Lithuania, Poland[1] and Spain all connecting to the T2S platform. By the end of 2017, 21 central securities depositories (CSDs) in 20 European markets were linked to T2S and able to carry out Europe-wide securities settlement in central bank money. Euroclear Finland aims to join T2S in September 2019. By December 2017, the platform was settling more than 570,000 securities transactions per day on average –the largest volumes that T2S had ever handled– reflecting high levels of harmonisation in the area of post-trade processes. Currently, T2S only carries out securities transactions in euro but the platform’s inherent multi-currency functionality will be set in motion when settlement in Danish kroner becomes available in October 2018.

The T2S platform is now grouped, together with TARGET2 and the forthcoming TARGET Instant Payment Settlement (TIPS) service under the TARGET Services umbrella. TARGET Services are the backbone of the euro area’s financial infrastructure, encompassing real-time gross settlement (RTGS) operations (TARGET2), securities settlement (T2S) and instant payments (TIPS). All three are key elements in the Eurosystem’s mission to harmonise Europe’s once highly fragmented financial market infrastructure landscape.

In December 2017, the Governing Council of the European Central Bank (ECB) approved the consolidation of TARGET2 and T2S in an effort to optimise and enhance TARGET Services. That project is expected to improve efficiency and reduce operational costs by facilitating access to services via the use of a harmonised interface. It will also help participants to optimise their liquidity management by introducing a centralised liquidity management function for TARGET Services. The consolidation of TARGET2 and T2S is scheduled to go live in November 2021.

2017 also saw the establishment of the Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo). That group was set up by the Eurosystem to facilitate active dialogue with market participants with the aim of fostering financial market integration. AMI-SeCo will be consulted on matters pertaining to T2S, the TARGET2-T2S consolidation project and the Eurosystem Collateral Management System (ECMS). It convened for the first time in March 2017, taking over responsibilities from the Contact Group on Euro Securities Infrastructures (COGESI) and the T2S Advisory Group.

T2S markets spearheaded the post-trade harmonisation agenda in 2017, significantly improving their compliance levels. As the Eighth T2S Harmonisation Progress Report indicates, levels of compliance with the endorsed and monitored standards exceeded 80%. These figures are a testament to the contribution that T2S has made in terms of furthering European economic integration and supporting the European Commission’s capital markets union initiative.

T2S migration completed

In 2017, the last two waves of countries migrated to T2S, rendering the system fully operational. The fourth migration wave took place over the weekend of 3-5 February 2017, with OeKB CSD (Austria), Clearstream (Germany), KELER (Hungary), LuxCSD (Luxembourg), CDCP (Slovakia) and KDD (Slovenia) joining T2S. The final migration wave on 18 September 2017 saw Iberclear (Spain) and Narodowy Bank Polski (Poland) migrate to T2S, alongside CSDs from Estonia, Latvia and Lithuania, which merged to form one single CSD following their migration. In addition to those migration waves, which had been planned from the outset, the newly-formed Slovak CSD NCDCP successfully joined T2S on 30 October 2017.

Although the T2S platform is a multi-currency system, settlement has only ever taken place in euro until now. However, with Danmarks Nationalbank deciding to make kroner available for securities settlement in T2S as of October 2018, users will soon have the chance to make full use of the platform’s functionalities.

Operational activity

Facts and figures

On account of the fourth migration wave, February saw a sharp increase in the average daily volume of settled and partially settled transactions, including liquidity transfers (see Chart 1). Those figures remained high in the months that followed, peaking in December at an average of 571,879 transactions per day. The average daily value of settled transactions rose proportionately, peaking in December at an average of €884,401,559,456 per day (see Chart 2). Settlement efficiency by volume remained stable, with levels in excess of 97.67% being maintained throughout the year.

Chart 1

Average daily volume of settled transactions and settlement efficiency by volume

Chart 2

Average daily value of settled transactions and settlement efficiency by value

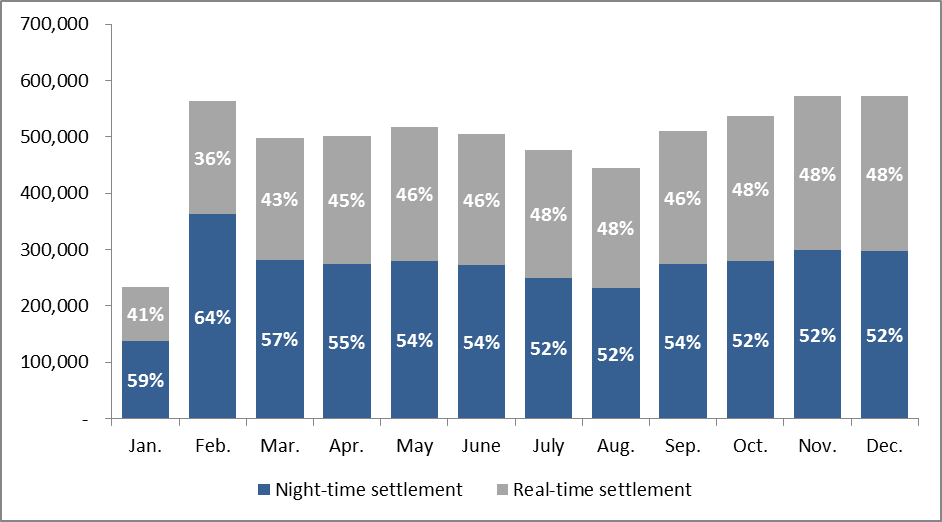

Settlement was more likely to be carried out at night-time, with real-time settlements accounting for a maximum of 48% of the average daily volume of transactions in any given month (see Chart 3). However, the value of transactions settled in real time far exceeded that of transactions settled at night-time (see Chart 4). Additionally, the auto-collateralisation feature was primarily used for real-time settlement (see Chart 5).

Chart 3

Comparison of real-time and night-time settlement volumes (daily averages)

Chart 4

Comparison of real-time and night-time settlement values (daily averages)

Chart 5

Comparison of real-time and night-time usage of auto-collateralisation (average daily values)

As in previous years, delivery-versus-payment (DVP) transactions accounted for the majority of average daily volumes, followed by free-of-payment (FOP) transactions. Liquidity transfers, cash and other transaction types (delivery with payment (DWP), settlement restrictions (SRSE) and payment free of delivery (PFOD)) made up a very small percentage (see Chart 6). In contrast, liquidity transfers accounted for a far larger percentage of average daily values than cash and other transaction types (PFOD and DWP; see Chart 7). The majority of average daily values were generated by DVP transactions.

As the waves of CSDs and their respective communities have migrated to T2S, there has been a steady increase in the amount of central bank liquidity dedicated to T2S accounts (see Chart 8). The largest increase took place after the final migration wave. In all cases, the liquidity intake rose between 15:00 and 16:00.

Chart 8

Average daily liquidity absorption across migration waves

Operational support and handling of incidents

In 2017, the T2S platform experienced eight incidents, which resulted in delays to scheduled times:

- five incidents relating to customer requests;

- two incidents relating to software issues;

- one incident relating to the TARGET2 system.

Given the magnitude and complexity of T2S, that number of incidents was considered normal and no measures were taken to improve the functioning of the platform. Relevant problems were addressed through the deployment of new software releases and/or hotfixes.

There were no major issues regarding the connection between T2S and TARGET2 in 2017. However, there were four minor complications relating to the functioning of T2S:

- on 28 February 2017 the closing of TARGET2 was delayed by 30 minutes;

- on 29 March 2017 the closing of TARGET2 was delayed by 1 hour;

- on 10 May 2017 the closing of TARGET2 was delayed by 30 minutes;

- on 28 June 2017 the closing of TARGET2 was delayed by 30 minutes.

Financial matters

T2S’s financial position is determined by trends regarding costs and revenues. The platform operates on a full cost recovery basis, meaning that all costs incurred are covered by the revenues generated. T2S revenues are driven by two factors:

- the transaction volumes that are settled in T2S during a predefined cost recovery period;

- the fees for using T2S, which are based on the fee structure announced in 2010 (see Schedule 7 in the T2S Framework Agreement) and may be adjusted to achieve full cost recovery.

In 2017, the revenue side was influenced by a decline in the volume of settled securities transactions. This was partly a result of market conditions that were significantly weaker than initially expected and partially due to the delayed migration of certain CSDs. Meanwhile, operational costs were higher than anticipated owing to the complexity of the migration and stabilisation phases.

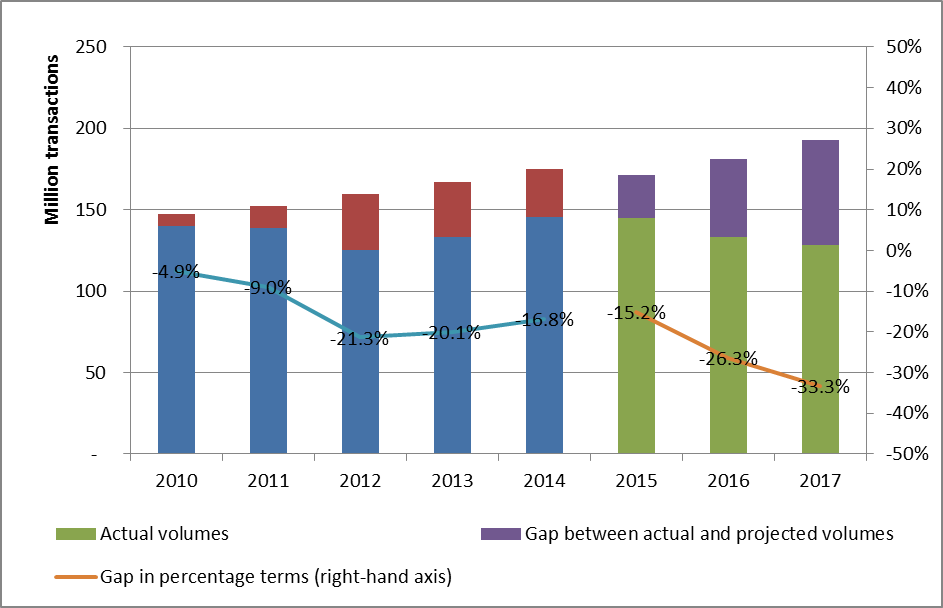

Throughout 2017, the Eurosystem continued to collect estimates of regular settlement volumes in order to produce realistic forecasts for future volumes and revenue streams. Following the completion of the final wave migration, T2S is now settling more than half a million transactions per day, which provides the basis for the platform’s revenues flow. However, the volumes settled by CSDs that have signed the T2S Framework Agreement are 33.3% lower than the initially projected levels (see Chart 9).

Chart 9

Annual evolution of T2S volumes

The pricing policy set out in the T2S Framework Agreement provides for the possibility of increasing T2S prices if:

- additional volumes derived from the settlement of transactions in currencies other than the euro are less than 20% of euro-denominated settlement volumes; or

- market volumes are more than 10% below the initial projections.

In March 2012, the T2S Programme Board clarified the platform’s pricing policy by emphasising that it did not intend to propose revising the benchmark price of €0.15 per DVP settlement instruction before 2019. This decision was made in order to foster stable volumes in T2S, with the intention of assessing the situation against the two above-mentioned conditions at a later date. With the volumes settled on the T2S platform in 2017 remaining below the projected levels, it will be necessary to review the price of €0.15 per DVP settlement instruction in 2019.

T2S’s overall financial position is summarised in the T2S financial statements, which are prepared in accordance with specific accounting policies established by the Market Infrastructure Board (MIB)[4]. In the interests of clarity, the T2S financial statements are prepared in a similar manner to a profit and loss report (T2S operating statement), and a balance sheet report (T2S financial situation report).

The T2S operating statement shows yearly accumulated revenues (collected on a monthly basis) and yearly operational costs (paid on a quarterly basis using fees that have been collected and additional financing provided by the Eurosystem). The T2S financial situation report provides a snapshot of relevant items in the asset and liability accounts. For more information on T2S’s financial position, see the financial statements for 2016[5].

The evolution of T2S

Change requests

In 2017, there were 25 approved changes to T2S functionalities (see Table 1):

- 16 change requests (CRs) were made by the market;

- 6 CRs stemmed from testing performed by T2S service providers;

- 3 CRs consisted of editorial changes with no cost impact.

The total cost of implementing those CRs was estimated at € 2.57 million and the average annual increase in maintenance and running costs was estimated at €0.25 million.

Further information can be found on the Change Review Group’s web page.

Table 1: CRs in 2017[6]

Type |

Description |

Number of CRs |

Project phase costs |

Average annual maintenance and running costs |

Market requests |

Changes requested by the market |

16 |

€2,403,301.00 |

€238,476.96 |

4CB requests[7] |

Changes stemming from 4CB testing activities |

6 |

€169,121.12 |

€15,374.12 |

Editorial changes |

Editorial changes to the T2S documentation |

3 |

||

Total |

25 |

€2,572,422.12 |

€253,851.08 |

|

Next steps

Cyber resilience

The Eurosystem is working on further improving the cyber resilience of TARGET Services, in line with the guidance issued by the Committee on Payments and Market Infrastructures (CPMI) and the Board of the International Organization of Securities Commissions (IOSCO). In the event of any operational disruption or cyberattack, T2S should be able to resume business processes in a timely manner, thereby minimising any adverse impact on T2S operations. For that reason, T2S’s security testing program is set to be improved and enhancements are due to be made to the platform’s recovery capabilities for software and data.

The CSD Regulation

Securities settlement systems operated by CSDs across the European Union are being monitored, reviewed and ultimately harmonised on the basis of the CSD Regulation[8]. Although that regulation first entered into force in 2014, a number of provisions are still gradually being implemented.

As regards T2S, the CSD Regulation mainly calls for the introduction of new requirements relating to settlement discipline. The timing of their delivery will depend on the publication date of the relevant regulatory technical standards (RTSs) by the European authorities, and on the publication date of related guidelines and Q&As by the European Securities and Markets Authority (ESMA). Those documents are expected to be published in the course of 2018, possibly resulting in the development of a penalty mechanism, which will calculate and report cash penalties for settlement fails in T2S on a daily basis. The CSD Regulation requires CSDs using common settlement infrastructure to jointly manage the calculation, application, collection and redistribution of cash penalties. The platform’s CSDs are due to provide the Eurosystem with a final decision regarding their intention to use a T2S penalty mechanism in April 2018. Pending that decision, all relevant requirements will have to be implemented in T2S within 24 months of the approval and publication of the RTSs in question.

Regular software releases

New software is regularly released for T2S, so that the system can maintain its high standards and meet the expectations of new and existing users. One major release, one minor release and two releases resolving production problems are scheduled each year. The Eurosystem conducts planning and organises testing for all new T2S software, thereby ensuring that T2S participants are ready for the forthcoming release and that the release delivers the expected results. Market participants can look forward to the following software releases in 2018, which should resolve production problems and ensure the efficient usage of T2S:

- fine-tuning of T2S’s multi-currency features in view of the Danish krone’s migration to the platform;

- functional improvements stemming from market requests.

Consolidation of TARGET2 and T2S

In November 2021, the consolidation of TARGET2 and T2S will go live, bringing about the technical and functional consolidation of the Eurosystem’s payment and securities settlement services. That project will improve the operational efficiency of TARGET Services by enhancing monitoring and increasing the level of automation in operational activities. Consequently, such consolidation will reduce T2S’s operational costs.

During the implementation phase, the Eurosystem will analyse the potential impact of project-related requirements/changes on T2S, particularly those affecting common technical components. Nonetheless, the functional impact is expected to be limited. All T2S CRs will continue to follow the existing procedures, as set out in the T2S Framework Agreement. In the meantime, the governance of T2S will be amended on a regular basis in line with changes and requirements resulting from the TARGET2-T2S consolidation project.

In order to keep up to date with developments regarding T2S, please refer to the dedicated page on the ECB’s website, follow the official TARGET Services Twitter account and join the ECB: Market Infrastructure and Payments group on LinkedIn.

- [1] In the case of Poland, the central bank (Narodowy Bank Polski) migrated to T2S, but the Polish CSD did not.

- [2] “Other transaction types” comprise DWP, SRSE and PFOD.

- [3] “Other transaction types” comprise DWP and PFOD.

- [4] The T2S Board took over the responsibilities of the T2S Programme Board in 2012. In 2016, the MIB was established. It convenes in different compositions, including that of the T2S Board, depending on the issues to be discussed.

- [5] The T2S financial statements for 2017 will be published by the end of June 2018.

- [6] As approved by the T2S Steering Level.

- [7] The 4CB CRs are:

- T2S-0645-SYS Character Set X: align discrepancies between UDFS, UHB, DMT and SWIFT handbook

- T2S-0648-SYS Enhancement of operational resilience in multi-currency context

- T2S-0649-SYS Handling of leading and trailing "blanks" and "/" in A2A and U2A names and identification attributes

- T2S-0660-SYS Long-term statistical information improvements and performance optimisation (phase 1)

- T2S-0663-SYS Treatment of change of fractional digit for cases of ISIN with settlement type nominal and change of settlement type

- T2S-0667-SYS The camt.019 final message after the night-time settlement file bundling shall report zero files

- [8] Regulation (EU) No 909/2014 of the European Parliament and of the Council of 23 July 2014 on improving securities settlement in the European Union and on central securities depositories and amending Directives 98/26/EC and 2014/65/EU and Regulation (EU) No 236/2012.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts